TIDMPRIM

RNS Number : 9169V

Primorus Investments PLC

12 August 2020

Primorus Investments plc

("Primorus" or the "Company")

Quarterly Investor Update

Primorus Investments plc (AIM: PRIM, AQSE: PRIM) is pleased to

provide the quarter ending 30 June 2020 ("Q2" or the "Quarter")

investor update regarding its current holdings as per its investing

policy.

Executive Director's Quarterly Comment - Alastair Clayton

We still find ourselves in unprecedented times with the effects

of COVID-19 reverberating around the globe and the long-term

effects on the economies of the world are still unclear. We have,

however, seen the gold price breach US$2,000/oz in the post-Quarter

period and a continued surge in values of many of the large

technology companies, as global consumer and work practices react

and evolve to the changing social and business environment.

Against this backdrop, the Company has once again had a

successful Quarter in terms of both growing its portfolio and

realising some significant gains. We continue to believe there is a

great amount of unrecognised value in the portfolio and see

significant short, and medium, term opportunities to realise

further gains from our investments.

Highlights

-- Greatland Gold Plc share price up over 155% for the Quarter

and 640% year to end Q2 (618% since investment). Further positive

drill results from Havieron reported by Newcrest Mining

("Newcrest").

-- Completed a programme of sales of a total of 10,500,000

Greatland shares for gross proceeds of approximately GBP1,030,000

and retains a holding of 26,000,000 Greatland shares with a cost of

carry of zero pence per share and a mark-to-market value of circa

GBP3.5 million.

-- TruSpine Technologies ("TruSpine") releases its Intention to

Float announcement for its upcoming IPO on the Aquis Stock Exchange

Growth Market ("Aquis"). TruSpine will, upon admission, trade under

the ticker TSP and intends to raise up to GBP1.5 million by way of

a subscription and is expected to have a market capitalisation on

admission of approximately GBP31.5 million.

-- Fresho, at request of suppliers, launched "Fresho for home

delivery" and signed up over 60,000 customers in first few months.

An exciting new B2C business is evolving to complement current B2B

business.

-- SOA Energy advises that drill plan permits and contracts for

the Ofek drilling are in place. Actual drilling commencement is now

reliant on a re-opening of the international borders, such that

contractors and suppliers can enter Israel to undertake the work.

Best estimation of revised well spud is therefore September, but

this is subject to Government policy in light of the current

COVID-19 pandemic.

-- Potential further investment of GBP250,000 into Engage via a

provisionally approved Government-matched Convertible Loan Note as

part of wider circa GBP4.3 million fundraise to accelerate growth

and carry the business through to a cashflow positive position.

-- The Company finished the Quarter debt-free and the Board

still foresees no short to medium term need or intention to raise

capital.

Update on Investments

Greatland Gold Plc ("Greatland") (AIM: GGP)

Greatland began the Quarter at 4.7p and closed on June 30 at 12p

representing a Quarterly increase of approximately 155%. At the

time of writing the share price was 1 3.6p representing an

investment gain to date of over 714%.

Since our last Quarterly update, the Havieron Joint Venture has

reported further positive drill results (refer to announcements

released by Greatland on 30 April 2020 and 11 June 2020).

Furthermore, (post-period) a mining licence has been applied for,

covering the Joint Venture Area, and Newcrest drilling has begun to

extend the bounds of known mineralisation by some 220m to the north

west and remains open in several directions. This success in

growing the mineralised footprint at Havieron chimes well with our

earlier interpretation of the overall potential of a wider Havieron

area to host additional significant mineralised areas.

As announced on 16 June 2020, the Company completed a staged

sale programme of some of our holdings in Greatland. Overall this

comprised some 10,500,000 shares and grossed circa GBP1,030,000 in

proceeds. This represents a significant pre-tax gross return on our

total investment outlay of circa GBP625,000 made back in 2018.

We retain 26,000,000 shares in Greatland Gold that, as a result

of the share sale, have a cost of carry of zero pence per share and

mark-to-market value at the time of writing of circa GBP3. 5

million which equates to approximately 73% of our current market

capitalisation.

TruSpine Technologies ("TruSpine")

The news from TruSpine Technologies ("TruSpine") is also very

encouraging, with a recent Intention to Float announcement

regarding the company's move to list on the Aquis Stock Exchange

Growth Market announced on 31 July 2020. Shareholders may recall

that, despite significant interest over the past few years, a

natural strategic investor had not materialised until recently.

Following her investment, Ms Annabel Schild has agreed to be

appointed to the board as a non-executive director as part of the

TruSpine IPO. The Schild family sold Huntleigh PLC (a healthcare

business) for GBP409 million in 2006.

Primorus invested some GBP500,000 in TruSpine at a price of

GBP0.30 per share. We understand that IPO capital is expected to be

raised at GBP0.36 per share, which would be a very welcome 20%

premium to our investment price. Whilst this may not represent a

multiple on investment that we have been able to generate

elsewhere, we still believe this is a great result given recent

global events and time taken to secure a cornerstone investor.

Pleasingly, TruSpine is seeking to obtain regulatory clearance

from the US Food and Drug Administration ("FDA") for its Cervi-LOK

product in Q1 2021 and will subsequently seek clearance for

Faci-LOK and GRASP Laminoplasty.

We intend to be patient and longer-term investors in TruSpine as

we have a fundamental belief in the team and the products.

We also note this is the first of our private investments to

float on the public markets and we hope that more will follow suit

in the future.

Fresho

Fresho reported that it is returning to "business as usual" with

B2B volumes picking up significantly. The B2C business continues to

grow with 60,000 consumers onboard. The two businesses complement

each other well and open up a database of over 100,000 users. Given

it is well funded, having raised $7m towards the end of last year,

we hope that opportunities may start to present themselves as

competitors struggle for sustaining capital. Fresho continues to

build out its technology to improve its fresh food technology

services. Fresho reports that wholesale customer sales continue

apace with many businesses taking advantage of this change in

consumer behaviour to make the move online.

Whilst the overall business has no doubt been impacted by venue

closures associated with COVID-19, the development of a B2C

business has been very welcome. Given its strong cash balance, we

view Fresho as being well positioned to press home technological

advantages and capture customers as alternative offerings

falter.

Engage Technology Partners ("Engage")

Engage is a key investment for us and we are delighted to report

that, subject to final Government confirmation, we have agreed to

invest GBP250,000 in Engage. Primorus will make the investment via

a Convertible Loan Note ("CLN") yielding a coupon of 10% p.a. and

providing for repayment and / or conversion at a 20% discount to

the next funding round or IPO. Along with other investors, and a

pound for pound matching investment by the UK Government's Future

Funding Programme (that has been provisionally approved already by

the Government and is in the process of financially closing) just

under GBP3.89 million in loan notes will be issued. Alongside this

an additional GBP408,000 in straight equity at GBP22 per share has

been raised by Engage.

The total of this funding round at circa GBP4.3 million should

provide Engage with not only adequate funds to reach projected

breakeven but will allow for accelerated workstreams to potentially

bring this forward and pursue other complimentary opportunities on

top of the core business.

We expect the CLN issue to close soon and once this has

occurred, we will provide a further operational update but, given

the COVID-19 impacts upon physical business operations and

processes, we remain very excited on the outlook for Engage as the

need for its zero-contact, end to end industry solutions becomes

more apparent.

SOA Energy ("SOA")

We previously reported that SOA Energy advised shareholders that

drill plans at the Ofek oil discovery remained on time, with the

spud date originally expected to be in May 2020. With the Israeli

Government closing borders to combat COVID-19, we now have been

informed that despite all elements being in place (rig, contractor,

permits etc.) to commence operations, they cannot start until the

boarder is opened to foreign operators. SOA remains hopeful that

key staff will be allowed to enter the country to complete the

drill programme in September 2020. We will monitor updates as they

occur.

Elsewhere across our portfolio, we are expecting a business

update from Zuuse soon, WeShop has yet to report movement on their

funding solution and Sport:80 reported a good financial performance

(as evidenced by their latest filings) over the past 6 months but

is no closer to a liquidity event for us as shareholders. Nomad

Energy remains in dispute with the Ivorian Government and the

recent death of the Prime Minister has, according to the Nomad

management, only made an opaque situation less transparent. We

welcome any outcome that could lead to us recouping our

investment.

Summary

The message to our shareholders remains essentially the same as

last quarter and is that, despite the tumultuous events of recent

months, our principal listed investment has had an excellent

performance and this has continued into the current period. Most

notably, our decision to position the portfolio meaningfully toward

gold exposure has so far delivered pleasing rewards. Many of our

core investments in the technology space, whilst losing some

ground, are, we believe, well-placed to benefit in a post-COVID-19

world. We consider that these companies are at the forefront of

business process change and expect that, following on from recent

capital raising activities, they require little or no additional

capital. We feel that Primorus is in a strong position and we look

forward to another successful quarter ahead. The Board still sees

no requirement to raise any capital in the short to medium term and

would like to thank shareholders for their continued support.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Forward Looking Statements

This announcement contains forward-looking statements relating

to expected or anticipated future events and anticipated results

that are forward-looking in nature and, as a result, are subject to

certain risks and uncertainties, such as general economic, market

and business conditions, competition for qualified staff, the

regulatory process and actions, technical issues, new legislation,

uncertainties resulting from potential delays or changes in plans,

uncertainties resulting from working in a new political

jurisdiction, uncertainties regarding the results of exploration,

uncertainties regarding the timing and granting of prospecting

rights, uncertainties regarding the Company's ability to execute

and implement future plans, and the occurrence of unexpected

events. Actual results achieved may vary from the information

provided herein as a result of numerous known and unknown risks and

uncertainties and other factors.

For further information, please contact:

Primorus Investments plc: +44 (0) 20 7440 0640

Alastair Clayton

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

Broker: +44 (0) 20 3657 0050

Turner Pope Investments

Andy Thacker / Zoe Alexander

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDMZGMRRZKGGZG

(END) Dow Jones Newswires

August 12, 2020 04:19 ET (08:19 GMT)

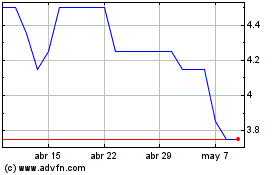

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024