TIDMPHSC

PHSC plc

(the "Company" or the "Group")

Final Results for the year ended 31 March 2020 and Notice of Annual General

Meeting

Financial Highlights

* EBITDA of GBP0.255m, an increase of approximately 120% from GBP0.116m

last year (after adjustment for exceptional gain on property sale of GBP0.166m

last year)

* Statutory loss after tax of GBP0.015m compared with a profit of GBP

0.001m last year (which included gain on property sale of GBP0.166m last year)

* Group revenue of GBP4.438m compared with GBP5.215m last year

* Cash reserves of GBP0.756m at year end compared to GBP0.642m last year

* Write-down of GBP0.200m due to impaired goodwill, the same as last

year

* Group net assets at GBP4.978m after goodwill impairment compared to

GBP5.140m last year

* Loss per share of 0.11p compared to a profit per share of 0.005p

last year

* Final dividend of 0.5p proposed, making a total of 1.0p for the

year, matching the 1.0p paid last year

31.3.20 31.3.19

GBP GBP

Profit before tax 4,999 42,494

Less: interest received (1,990) (303)

Add: interest paid - 1,514

Add: depreciation 52,194 38,179

Add: impairment B2BSG Solutions Limited goodwill 200,000 200,000

Less: net gain on sale of property - (166,270)

Underlying EBITDA* 255,203 115,614

* Underlying EBITDA is calculated as earnings before interest, tax,

depreciation, impairment charges and non-recurring costs. This is used by the

board as a measure of underlying trading and has been provided to assist

shareholders in understanding the Group's trading activities.

Annual General Meeting

This year's annual general meeting (AGM) will be held at 10am on Wednesday 30

September 2020 at the Old Church, 31 Rochester Road, Aylesford, Kent ME20 7PR.

The report and accounts and notice of AGM are expected to be posted to

shareholders on or around 24 August 2020 and will shortly be available to view

on the Company's website at www.phsc.plc.uk.

Dividend

The Company confirms that, subject to shareholder approval at the AGM, the

final dividend of 0.5p will be payable on 16 October 2020 to shareholders on

the register on 2 October 2020.

For further information please contact:

PHSC plc (www.phsc.plc.uk)

Stephen King (stephen.king@phsc.co.uk) - 01622 717700

Strand Hanson Limited (Nominated Adviser)

Richard Tulloch/James Bellman - 020 7409 3494

Novum Securities Limited (Broker)

Colin Rowbury - 020 7399 9427

About PHSC

PHSC plc, through its trading subsidiaries Personnel Health & Safety

Consultants Limited, RSA Environmental Health Limited, QCS International

Limited, Inspection Services (UK) Limited, and Quality Leisure Management

Limited, provide a range of health, safety, hygiene, environmental and quality

systems consultancy and training services to organisations across the UK. B2BSG

Solutions Limited offers innovative security solutions including electronic

tagging, labelling and CCTV.

The information contained in this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulations

(EU) No 596/2014.

STRATEGIC REPORT

On behalf of the board, I present my review of the Group's activities and

performance during financial year 2019-20, along with a commentary about the

Group's plans and expectations for 2020-21.

General business review and outlook

Trading for the year ended 31 March 2020 showed consolidated Group revenue of GBP

4.438m (31 March 2019: GBP5.215m) and EBITDA of approximately GBP255,000 for the

period. In the previous year, the Group recorded EBITDA of GBP116,000 (excluding

an exceptional gain from the sale of an unused property).

Sales within B2BSG Solutions Limited, the Group's security division which

predominantly serves the high street retail sector, continued to decline during

the year, as a result of the ongoing struggles within the high street retail

sector impacting on the demand for our services. Revenues in the security

division fell to GBP1.9m (31 March 2019: GBP2.7m), accounting for 43% of Group

revenues compared with 52% in the previous year. As a result, the board

considered the carrying value of its security division and decided that a

further impairment of GBP0.2m (31 March 2019: GBP0.2m) was appropriate.

Revenues in the Group's health, safety and management systems businesses

remained stable at GBP2.5m (31 March 2019: GBP2.5m), though accounted for 57% of

the Group's overall revenue (31 March 2019: 48%).

Various actions were taken to mitigate the effect of lower sales across the

Group as a whole, which led to cost savings in a number of areas. In

particular, there were lower overheads and premises-related savings across the

Group. The security division, whilst still loss-making, saw an improvement

overall and further commentary regarding this subsidiary and the other

companies within the Group appear later in this report.

Impact of COVID-19

The specific impacts of COVID-19 on each subsidiary is provided later in this

report, though from a Group-wide perspective the pandemic had a marginally

adverse impact on the year ended 31 March 2020. The financial consequences of

COVID-19 will largely be seen in 2020-21, though are at this stage very

difficult to quantify due to the uncertainty of how the UK economy will respond

to the on-going COVID-19 pandemic. The trading update below provides figures

for Q1 of 2020-21.

Cash at bank stood at GBP756,000 at year end. Due to concerns about cash flow

during the COVID-19 pandemic, the Group exercised an option to defer payment of

VAT due for Q4 of 2019-20 but has recently made these payments in full (GBP

162,410) to HMRC.

The Group continues to enjoy a strong cash position and has an undrawn facility

with HSBC plc, renewed in October each year and currently agreed at GBP50,000,

having been reduced from GBP150,000.

Since the start of the pandemic, the Group has reviewed staffing levels and has

made five posts redundant, including three at the security division. In

addition, the Group furloughed a number of staff under the Government's Job

Retention Scheme. All except one subsidiary has taken advantage of the

furlough arrangements, with up to half of the Group's staff furloughed at the

peak of the crisis.

Our priority has been the health, safety and wellbeing of customers and staff,

and our expertise in the field of health and safety has enabled us to continue

to provide various services to existing clients. We have also been able to

acquire new clients who commissioned us to assist with enabling them to provide

COVID-Secure environments so that they could return to work.

All Group directors elected to take a 20% reduction in pay from 1 May 2020 for

the duration of the furlough scheme.

Net asset value

As at 31 March 2020, the Group's consolidated net assets stood at GBP4.98m (2019:

GBP5.14m). There were 14,677,257 ordinary shares in issue at that date which

equates to a net asset value per share of 34p.

As we have previously stated, the Company's ordinary shares continue to trade

at a substantial discount to the net asset value. We recognise that there is a

value of goodwill on the balance sheet and we review this each year to ensure

that the value is fairly stated. In each of the past two years, the board has

taken the decision to reduce the carrying value of our security division by GBP

200,000, and we have done the same thing in 2019-20 in line with good

accounting practice. The write-down represents a reduction of approximately 4%

in the consolidated net assets of the Group. The board remains satisfied that

all other goodwill valuations can presently be justified.

Outlook

Whilst the effect of COVID-19 on the economy is the greatest concern for the

Group, this does not reduce the potentially negative effects of the lack of

specific terms on which the UK will trade with the EU at the end of the

transition period this year. That matter was causing some clients to delay

certain investment decisions, and this is exacerbated by the uncertainly

brought about by the pandemic. We may also be affected positively or

negatively by future Government fiscal measures to assist the recovery of the

UK economy and we will pay close attention to such decisions as they are

announced. In the context of our security division, an important general

economic factor is the purchasing power of sterling as a weaker pound erodes

our gross margins. The closure of many retail premises is also a critical

factor as the move to online shopping accelerates.

Trading update

Unaudited management accounts for the first quarter of 2020-21 indicate that

Group revenues were GBP0.82m and generated an EBITDA of GBP108,300. This compares

with total revenues of GBP1.08m for the first quarter of 2019-20 and an EBITDA of

GBP84,600.

Dividends

A total dividend of 1.0p per ordinary share, (GBP146,772) was paid in respect of

the year ended 31 March 2019. An interim dividend of 0.5p in respect of the

year ended 31 March 2020 was paid in February 2020 and, subject to shareholder

approval, a final dividend of 0.5p, to be paid from earnings from the year

ended 31 March 2020, is proposed for payment in October 2020, matching the

total of 1.0p paid last year.

Pre-tax profit/(loss) per subsidiary before Group management charges

Profits before tax and management charges are reviewed by each subsidiary and

by the board every month to establish whether each subsidiary is trading

profitably and to determine whether intervention is necessary. To provide a

more accurate picture of the performance of each subsidiary, the cross-charging

of consultants between subsidiaries has been introduced so that the cost of

labour is met by the invoicing company rather than the subsidiary providing

that labour.

A review of the activities of each trading subsidiary is provided below. The

profit figures stated are before tax, central management charges and impairment

charges. The management charges are the individual subsidiary's contribution

to Group overheads and are not directly attributable costs.

B2BSG Solutions Limited (B2BSG)

* 2020: revenues of GBP1,915,200 yielding a loss of GBP90,800

* 2019: revenues of GBP2,724,000 yielding a loss of GBP137,400

The fall in revenue reflects the reduced demand from B2BSG's primary sphere of

operation which remains the retail sector which has continued to suffer as a

result of weaker consumer demand on the high street and the move towards

on-line purchasing which has accelerated during the COVID-19 pandemic. Over GBP

165,000 was saved in lower staff salaries and associated expenditure through

restructuring and non-replacement of leavers. There were no redundancy

payments necessary in this process.

There are bad debts of GBP18,730 provided for in the accounts. These stem mainly

from a second period of administration by a large client, Debenhams, who have

proposed a Company Voluntary Arrangement for their UK businesses and have

closed their estate in Ireland entirely.

Selling into the retail sector remains challenging and the COVID-19 pandemic

will have a large effect on our client base. Any further material

deterioration in the retail sector and specifically in B2BSG's client base may

have a significant negative effect on B2BSG's and hence the Group's prospects.

In the meantime, B2BSG is making use of available business grants and the

Government's Job Retention Scheme and looks forward to an increase in demand

once high streets are able to recover.

Inspection Services (UK) Limited (ISL)

* 2020: revenues of GBP230,800 yielding a profit of GBP37,400

* 2019: revenues of GBP232,600 yielding a profit of GBP43,500

ISL ended the year with marginally lower sales and a slight increase in total

costs compared with the prior year. ISL offers a fairly narrow range of

specialised services directly to clients and, for the most part, through

insurance brokers. The work involves the statutory examination and inspection

of workplace plant and equipment where plant failure may lead to a serious risk

of injury. This includes lifting plant and equipment, pressure vessels, power

presses and bailing machines.

Early in the COVID-19 pandemic, the Health and Safety Executive (HSE) notified

duty holders across the UK that the obligation to have plant and equipment

examined in line with statutory frequencies was not being relaxed. Our

professional association, the Safety Assessment Federation, in consultation

with the HSE, deemed us to be "key workers". This enabled ISL to carry on

trading as normal, subject to complying with appropriate safety protocols to

safeguard staff and those they may encounter in their work and as a result,

demand has remained stable during since the financial year end.

Personnel Health & Safety Consultants Limited (PHSCL)

* 2020: revenues of GBP763,600 yielding a profit of GBP302,500

* 2019: revenues of GBP657,100 yielding a profit of GBP278,000

Income from PHSCL's flagship product, the Appointed Safety Advisor Service was

around 10% down year on year. However, consultancy income from non-retained

clients more than doubled to around GBP225,000. In addition, revenue from

training courses was up by GBP20,000.

Despite the reduction in revenue from the Appointed Safety Advisor Service,

PHSCL derives most of its income from this product. There was some client

churn, though generally client retention is good and has not been unduly

affected by the COVID-19 pandemic.

PHSCL continues to meet the accreditation requirements for the ISO 9001 quality

management standard, having held this "kitemark" for 23 years since becoming

the first organisation of its kind to achieve the standard.

Since the financial year-end, COVID-19 has had an effect both on PHSCL and the

clients we serve. There has been demand for consultancy advice in relation to

preparing COVID-Secure workplaces and this has introduced us to a number of

clients for whom we have not worked before. Once a degree of normality

returns, we would hope to build on those relationships by offering other

services.

QCS International Limited (QCS)

* 2020: revenues of GBP756,700 yielding a profit of GBP220,900

* 2019: revenues of GBP759,500 yielding a profit of GBP242,300

QCS maintained a good level of both sales and profits and performed as expected

over the year. The introduction of management standard ISO 45001 (for health

and safety) and work assisting clients on ISO 27001 (information security) more

than offset the loss of work in the previous year relating to the transition to

new quality and environmental standards.

Sales in public training and consultancy services remained strong. Full

advantage was made of the investment in new training facilities that are now

able to accommodate additional delegates. However, in-house training sales

weakened, and this caused total sales for the year to end marginally below

those for 2018-19. An internal target to increase public training sales by 12%

over the period was achieved. Efforts will continue to promote in-house

services and reduce the decline in that area. Consultancy sales remained

consistently strong throughout the year, posting growth of 7%. QCS continues

to enjoy exceptionally high levels of repeat business and has developed a loyal

customer base across many economic sectors.

Departure from the EU has not yet directly affected sales, though a significant

proportion of medical device work is linked to an ability to offer services

linked to EU regulation. QCS now offers a 'UK Responsible Person' service in

the event of a no-deal conclusion to the transition period which may present

some opportunities, acting as a UK address for manufacturers of medical devices

within the remaining EU. To date there have been an encouraging number of

enquiries regarding the service. The weakness of sterling has the potential to

work in QCS's favour.

Quality Leisure Management Limited (QLM)

* 2020: revenues of GBP353,400 yielding a profit of GBP75,700

* 2019: revenues of GBP437,600 yielding a profit of GBP106,500

QLM made a profit before tax and central management charges of GBP75,711,

compared to GBP106,576 in the previous year.

Retained client renewals remained largely the same in comparison to the

previous period. Small deviations are seen as contracts between local

authorities and QLM clients change, or smaller clients are absorbed by larger

operators though there remains a strong need for QLM's expertise with clients

placing significant reliance on its services.

Although the support service remains a stable source of income, audit income

fell significantly compared to the same period last year. Savings and cost

cutting exercises across many local authorities has seen a knock-on effect to

the resources of leisure trusts and other QLM clients. In addition, auditing

functions are more frequently tackled internally by clients leading to less

need for external verification and auditing. The impact of COVID-19 remains to

be seen and will depend on what support is given to the sector by local

authorities and central government.

Training is a core income stream and remained generally consistent with

previous years. The most popular courses were IOSH Managing Safely and QLM's

own (CIMSPA Endorsed) Health and Safety Management in Leisure and Culture

Facilities.

One full-time consultant left the business in October 2019 and was not replaced

which led to greater use of sub-contractors.

RSA Environmental Health Limited (RSA)

* 2020: revenues of GBP418,100 yielding a profit of GBP83,500

* 2019: revenues of GBP404,300 yielding a profit of GBP66,700

Revenue for the year was up by 3.4% to GBP418,100. Costs were effectively

controlled, and this led to gross profit margin of 53% (2019: 52%).

Integration of the Envex brand into RSA has brought in some much-needed skills

which have aided service delivery to our existing clients, reducing the need to

rely on contractors and associates.

Whereas in previous years the focus of RSA has been on the SafetyMARK brand,

providing safety services to the school's sector, this year has seen the

revenues fall into four main categories; training, health and safety

consultancy, food safety consultancy and SafetyMARK. This has widened the focus

and spread some of the risk, leaving RSA potentially less exposed in the

future.

SafetyMARK, whilst remaining the main focus, saw revenues fall within the

financial year to around GBP90,000. This can be partially accounted for by a

number of postponed audits at short notice within the last quarter. This

happened due to a combination of staffing changes at key schools and the start

of the COVID-19 pandemic. There was also an impact on this sector by RSA

diverting its attention to fulfilling a large contract in the hospitality

sector. However, demand for safety services in schools remains strong and is

expected to pick up when schools are fully open in September 2020.

Training has seen an increase due to the numbers of courses being provided to

clients compared to the previous year. There continues to be demand for some

of our public courses within the schools' sector and for our IOSH accredited

school courses. Training was not unduly affected by COVID-19 in March, with

only a couple of courses having to be postponed to the next financial year

Health and safety consultancy saw the biggest change in demand for the year

2019-20 as a result of the large contract in the hospitality sector previously

mentioned. This generated significant revenues for RSA but was very heavy in

administrative terms.

Food safety consultancy saw strong demand, but the impact of COVID-19 saw an

end to the ability to continue with auditing of our regular clients. All

clients have stated that they will restore the audit programmes as soon as the

various sectors are allowed to open.

PHSC plc

* 2020: net loss of GBP424,100 before management charges, exceptional costs and

dividends received

* 2019: net loss of GBP523,700 before management charges, exceptional costs and

dividends received

The Company incurs costs on behalf of the Group and does not generate any

income. The costs incurred by the Company represent the costs of running an AIM

quoted Group. The reduction in costs is due to changes in staffing arrangements

between the Company and the subsidiaries. Costs in all other respects are

consistent with the previous year.

PRINCIPAL RISKS AND UNCERTAINITIES

Pandemic

The coronavirus pandemic involving the spread of COVID-19 has presented several

different risks to the business. The spread was rapid and the global

repercussions unprecedented.

As Government guidance evolved, a comprehensive plan was developed and updated

by the directors to minimise the risk to staff, customers and business

continuity. This was circulated to all staff and contained measures to maintain

business productivity whilst protecting the health of employees, customers, and

other stakeholders. The plan was monitored and revised in response to new

information published by Public Health England. Guidance was also published on

the website for staff, customers, and prospects to access.

The risk of employees contracting the virus, resulting in loss of key staff to

illness was mitigated by working from home being encouraged wherever

appropriate. Vulnerable workers were identified and asked to shield, and

employees contacted regularly to monitor welfare. A skeleton staff remained in

the head office to minimise numbers present whilst at the same time maintaining

business continuity. Social distancing was exercised, and hand sanitiser

provided.

Where consultants were required to visit clients' premises, mainly to advise on

COVID-19 related topics, face masks and disposable gloves were issued.

Consultants were asked to use their own vehicles to commute rather than take

public transport. A focus was to protect PHSC's reputational risk by ensuring

staff adhered to government guidelines. In the short term, all classroom

training was ceased.

The risk of poor communication during the pandemic was mitigated using

Microsoft Teams and Zoom to keep in touch with staff and clients. The

operational directors met via Zoom each week for a business update and to share

knowledge and best practice. Board meetings were also undertaken as scheduled

via Zoom.

In terms of lost revenue and profit, the impact in the year ended 31 March 2020

was immaterial though the full effect will be felt in the new financial year.

The UK lockdown has inevitably led to a loss of business and revenue, as

schools, leisure facilities, shops and pubs/restaurants make up a significant

portion of the Group's customer base. An exception to this is ISL, where the

Health and Safety Executive did not relax the obligation to have plant and

equipment examined in line with statutory frequencies. The engineers were

deemed key workers and ISL was able to carry on trading as normal, subject to

complying with appropriate safety protocols to safeguard staff. Another

mitigating factor is the uninterrupted subscription income received by some of

the subsidiaries which provides a base of ongoing revenue. It is also fortunate

that the expertise within the Group in the field of health and safety has

enabled various services to continue to be provided to existing clients and new

clients have been secured who commissioned assistance with the provision of

COVID-Secure environments. Income from the Government Job Retention Scheme and

Business Grants have also played a key role in maintaining cash flow.

In terms of liquidity risk, the Group had a strong cash position at the year

end and the start of lockdown. Good credit control has been maintained by the

head office staff and with the income from the Government's schemes, the Group

has remained cash generative. Payment of VAT for Q4 was initially delayed in

line with an HMRC concession but was subsequently settled in full.

Although the economic outlook remains uncertain, the discipline of forecasting

has been maintained, though initially with a reduced horizon. Expectations for

first half of 2020-21 are that with the continued use of Government funding

assistance, the Group should do no worse than break even and will maintain a

strong cash position.

Regulatory/Marketplace

Approximately 50% of the Group's work involves assisting organisations with the

implementation of measures to meet regulatory requirements relating to health

and safety at work. If the regulatory burden was to be substantially lightened,

for example if the government embarked upon a programme of radical

deregulation, there could be less demand for the Group's services. Changes to

the operation of the employer's liability insurance system, as proposed in some

quarters, could reduce the incentive for organisations to buy in

claims-preventive services such as health and safety advice. In mitigation of

these risks, the board has diversified the Group's range of offerings for

example, through investing in its security businesses and is exploring

non-regulatory areas of environmental work to add to the current portfolio of

services.

In the event of a "no deal" end to the post-Brexit transition period, the

Group's security division will take appropriate steps to ensure that sufficient

supplies are held of relevant products to meet the predicted needs of

customers. In doing so, customers can expect more frequent requests to

forecast their likely requirements over longer time horizons than usual. The

security division is already dealing extensively with a wide range of imported

goods, some from within the EU and others from countries beyond the EU. It is

therefore well-versed in customs processes and expects to be able to apply the

same or similar processes to imports from within the EU (albeit at potentially

different tariff rates) should that prove necessary under a "no deal" Brexit.

Matters outside the Group's control would include delays caused at customs if

administrative demands on border officials are suddenly increased, resulting in

slower clearance times for imported goods.

There are predictions by economists that the value of sterling may deteriorate

if the UK and EU cannot reach a trade deal by the end of the transition

period. Whilst the Group will take reasonable steps to hedge against the

effects of a weaker pound, customers are being advised to consider pre-ordering

and/or increasing their stock levels of those products supplied by the Group's

security division which they see as critical to their business. Higher stock

levels would have the double benefit of reducing the risk of an interruption to

supply, and mitigating the impact of price rises that would ultimately work

their way through to all imported goods if there is a materially weaker

exchange rate. The warehouse at B2BSG has the capacity for storage of

additional products and close partnership with logistics providers will allow

access to further warehousing space should that prove necessary.

The Group's security division works almost exclusively in the retail sector and

this has continued to suffer as a result of weaker consumer demand on the high

street and the move towards on-line purchasing which has accelerated during the

COVID-19 pandemic. Any further material deterioration in the retail sector and

specifically in B2BSG's client base may have a significant negative effect on

the company's and hence the Group's prospects.

Technological

The Group's website is a primary source of new business. If the website became

inaccessible for protracted periods, or was subject to "hacking", this may

prejudice the opportunity to obtain new business. Additionally, the increase

in the use of the internet for satisfying business requirements may lead to a

reduction in demand for face-to-face consultancy services and the number of

training courses commissioned may be affected by moves towards screen-based

interactive learning. The subject of IT security is regularly reviewed by the

board to ensure that appropriate strategies are in place.

Personnel

Generally, there is an excess of demand over supply for health and safety

professionals. Those with sufficient qualifications and experience to be

suitable for consultancy roles are in the minority. This has the combined

effect of making it difficult for the Group to source suitable personnel and

having to offer higher remuneration packages to attract them. The Group is

dependent upon its current executive management team. Whilst it has entered

into contractual arrangements with the aim of securing the services of these

personnel, the retention of their services cannot be guaranteed. Accordingly,

the loss of any key member of management of the Group may have an adverse

effect on the future of the Group's business. The Group and each subsidiary

have contingency plans in place in the event of incapacity of key personnel.

Geographical

The Group offers a nationwide service, but a number of organisations see

benefit in using consultancies that are local to them and internet search

engines favour local providers. With offices in Kent, Berkshire,

Northamptonshire and Scotland, the Group has a good geographical spread.

Licences

The Group is reliant on licences and accreditations to be able to carry on its

business. The temporary loss of, or failure to maintain, any single licence or

accreditation would be unlikely to be materially detrimental to the Group, as

the directors believe that this could be remedied. However, if the Group fails

to remedy any loss of, or does not maintain, any licence or accreditation, this

will have a material adverse effect on the business of the Group. The Group

has internal processes in place to ensure that the licences and accreditations

are maintained.

SECTION 172 STATEMENT

The Companies (Miscellaneous Reporting) Regulations require large companies to

publish a statement describing how the directors have had regard to the matters

set out in section 172 (1) (a) to (f) of the Companies Act 2006. These sections

require directors to act in a way most likely to promote the success of the

Group for the benefit of its stakeholders and with regard to the following

matters.

The likely consequences of any decision in the long-term.

The board receives an annual business plan from the director of each subsidiary

company, which forms the basis of the Group's strategic plan. The board

requires that the plans include financial forecasts, KPI's, marketing strategy

and an analysis of strengths, weaknesses, opportunities, and threats.

Subsidiary directors, via the Groups operational board of which they are

members, consider the implications of their own plans in the context of what

others within the Group are intending to do and the opportunities for synergies

are explored. Any proposed actions that may adversely affect another subsidiary

are flagged at operational board level and are resolved. Subsidiary directors

are challenged on the content of their plans and the assumptions they have

made, to ensure that the plans are realistic and achievable. Once agreed by the

board, this plan, at Group and subsidiary level, is used as the benchmark

against which to assess performance.

The interests of the Group's employees

As the Group is mainly involved in the supply of services, the board considers

the staff to be the greatest asset and the interests of employees are taken

into consideration in all decisions made. Each subsidiary company within the

Group has in place the necessary structures to ensure effective communication

with its employees. The subsidiary directors meet once a quarter and relevant

information is shared with employees via team meetings held at subsidiary

level. The views of employees are heard in a similar fashion, initially at

team meetings, and ascending to the operational board and the main board if

appropriate. Each subsidiary has its own bonus scheme, based on results for the

financial year and/or tailor-made targets. There is an annual budget for staff

training in recognition that the performance of the Group can be improved by

the development of its employees.

The Group is committed to equality of employment and its policies reflect a

disregard of factors such as disability in the selection and development of

employees. During the year, a review was conducted to identify any

gender-related pay anomalies across the Group and as at the date of this

report, there are no known anomalies in any subsidiary that would fall into

this category.

The need to foster the Group's business relationships with suppliers,

customers, and others.

The Group seeks to treat suppliers fairly and adhere to contractual payment

terms. The Group works with its suppliers to help drive change through

innovation, promoting new ideas and ways of working. The Group has

zero-tolerance to modern slavery and is committed to acting ethically and with

integrity in all business dealings and relationships. The Group policy for

Modern Slavery and Human Trafficking contains systems and controls to ensure

that these activities are not taking place anywhere in the subsidiaries or

throughout the Groups supply chains.

The Group also has zero-tolerance with regards to bribery, made explicit

through its Anti-Bribery and Corruption Policy. This covers the acceptance of

gifts and hospitality and any form of unethical inducement or payment including

facilitation payments and "kickbacks". The policy sets out the responsibilities

of directors, employees and contractors and details the procedures in place to

prevent bribery and corruption.

Each subsidiary is focussed on its customers. Communication takes many forms

and is structured according to how each subsidiary interacts with its client

base. Channels of communication include quarterly newsletters in hard copy and/

or sent electronically, customer roadshows, various social media platforms and

regular client meetings. An ongoing dialogue is held electronically, with most

clients subscribing to email updates that are sent out periodically. There is

also interaction through social media platforms such as Twitter, LinkedIn and

Facebook where appropriate.

Stephen King is the principal contact between the Company and its investors,

with whom he maintains a regular dialogue. The Company is committed to

listening to and communicating openly with its shareholders to ensure that its

business model and performance are understood. Regular announcements are made

to the market and the AGM provides a forum for information dissemination,

discussion, and feedback.

The impact of the Group's operations on the community and the environment

The board's intention is to behave responsibly and ensure that management

operates the business in a responsible manner, complying with high standards of

business conduct and good governance. The Group has a long tradition of

supporting local causes through sponsorship and community involvement, details

of which can be found on the PHSC plc website (www.phsc.plc.uk). The directors

are aware of the impact of the Group's business on the environment but believe

this to be minimal due to the nature of its operations.

GOING CONCERN

Company law require the directors to consider the appropriateness of the going

concern basis when preparing the financial statements. COVID-19 and the

Government-imposed lockdowns and restrictions are inevitably having an impact

on the Group's ability to trade normally. In terms of lost profit, a relatively

small impact was felt in the year ended 31 March 2020 though the board's

expectations for the new financial year have had to be significantly revised.

Mitigating factors are the strong cash position at the start of lockdown,

income from statutory examination of equipment (a requirement not relaxed

during the pandemic), continuation of subscription income, demand for COVID-19

Secure risk assessments, and income from the Government job retention and

business grant schemes. The Group's expectations and current banking facilities

indicate that the Group has adequate resources to continue in operational

existence for the foreseeable future. Consequently, the directors continue to

adopt the going concern basis of accounting in preparing the annual financial

statements.

In closing, I would like to extend thanks to all our shareholders for their

continued support and to everyone employed across the Group for their hard work

and effort during these unprecedented times. The board acknowledges the

valuable work carried out by every employee and recognises that it is reliant

upon each individual member of staff and management if it is to succeed and

prosper.

On behalf of the board

Stephen King,

Group Chief Executive

19 August 2020

GROUP STATEMENT OF FINANCIAL POSITION

as at 31 March 2020

31.3.20 31.3.19

GBP GBP

Non-Current Assets

Property, plant and equipment 592,539 488,585

Goodwill 3,278,463 3,478,463

Deferred tax asset 19,582 17,627

3,890,584 3,984,675

Current Assets

Stock 264,301 316,556

Trade and other receivables 885,947 973,130

Cash and cash equivalents 755,919 642,466

1,906,167 1,932,152

Total Assets 5,796,751 5,916,827

Current Liabilities

Trade and other payables 622,938 675,162

Right of use liabilities 34,071 -

Current corporation tax payable 40,250 54,707

697,259 729,869

Non-Current Liabilities

Right of use liabilities 69,912 -

Deferred tax liabilities 51,256 46,313

121,168 46,313

Total Liabilities 818,427 776,182

Net Assets 4,978,324 5,140,645

Capital and reserves attributable to equity

holders of the Group

Called up share capital 1,467,726 1,467,726

Share premium account 1,916,017 1,916,017

Capital redemption reserve 143,628 143,628

Merger relief reserve 133,836 133,836

Retained earnings 1,317,117 1,479,438

4,978,324 5,140,645

GROUP STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31 March 2020

31.3.20 31.3.19

GBP GBP

Continuing operations:

Revenue 4,437,922 5,215,341

Cost of sales (2,251,867) (2,719,724)

Gross profit 2,186,055 2,495,617

Administrative expenses (1,983,046) (2,418,182)

Goodwill impairment (200,000) (200,000)

Other income - 166,270

Profit/ from operations 3,009 43,705

Finance income 1,990 303

Finance costs - (1,514)

Profit before taxation 4,999 42,494

Corporation tax expense (20,548) (41,795)

(Loss)/profit for the year after tax

attributable to owners

of the parent (15,549) 699

Other comprehensive income - -

Total comprehensive (loss)/income

attributable to owners

of the parent (15,549) 699

Basic and diluted (loss)/earnings per share

from continuing operations (0.11)p 0.005p

GROUP STATEMENT OF CHANGES IN EQUITY

for the year ended 31 March 2020

Capital

Share Share Merger Redemption Retained

Capital Premium Relief Reserve Earnings Total

GBP GBP Reserve GBP GBP GBP

GBP

Balance at 1 April 2018 1,467,726 1,916,017 133,836 143,628 1,625,511 5,286,718

Profit for year

attributable to equity - - - - 699 699

holders

Dividends - - - - (146,772) (146,772)

Balance at 31 March 2019 1,467,726 1,916,017 133,836 143,628 1,479,438 5,140,645

Balance at 1 April 2019 1,467,726 1,916,017 133,836 143,628 1,479,438 5,140,645

Loss for year

attributable to equity - - - - (15,549) (15,549)

holders

Dividends - - - - (146,772) (146,772)

Balance at 31 March 2020 1,467,726 1,916,017 133,836 143,628 1,317,117 4,978,324

GROUP STATEMENT OF CASH FLOWS

for the year ended 31 March 2020

31.3.20 31.3.19

Note GBP GBP

Cash flows from operating activities:

Cash generated from operations I 346,847 325,587

Interest paid - (1,514)

Tax paid (32,017) (9,345)

Net cash generated from operating activities 314,830 314,728

Cash flows (used in)/from investing

activities

Purchase of property, plant and equipment (39,529) (69,578)

Disposal of fixed assets 2,250 299,495

Interest received 1,990 303

Net cash (used in)/from investing activities (35,289) 230,220

Cash flows used in financing activities

Payments on right of use assets (19,316) -

Dividends paid to shareholders (146,772) (146,772)

Net cash used in financing activities (166,088) (146,772)

Net increase in cash and cash equivalents 113,453 398,176

Cash and cash equivalents at beginning of 642,466 244,290

year

Cash and cash equivalents at end of year 755,919 642,466

All changes in liabilities arising from financing relate entirely to cash

movements.

NOTES TO THE GROUP STATEMENT OF CASH FLOWS

for the year ended 31 March 2020

31.3.20 31.3.19

GBP GBP

I. CASH GENERATED FROM OPERATIONS

Operating profit - continuing operations 3,009 43,705

Depreciation charge 52,194 38,179

Goodwill impairment 200,000 200,000

Loss/(profit) on sale of fixed assets 4,430 (162,338)

Decrease in stock 52,255 72,478

Decrease/(increase) in trade and other 87,183 595,495

receivables

(Decrease)/increase trade and other payables (52,224) (461,932)

Cash generated from operations 346,847 325,587

Notes to the results announcement of PHSC plc

The financial information set out above does not constitute the Group's

financial statements for the years ended 31 March 2020 or 31 March 2019 but is

derived from those financial statements. Statutory financial statements for

2019 have been delivered to the Registrar of Companies and those for 2020 have

been approved by the board and will be delivered after dispatch to

shareholders. The auditors have reported on the 2019 and 2020 financial

statements which carried an unqualified audit report, did not include a

reference to any matters to which the auditor drew attention by way of emphasis

and did not contain a statement under section 498(2) or 498(3) of the Companies

Act 2006.

While the financial information included in this announcement has been computed

in accordance with International Financial Reporting Standards (IFRS), this

announcement does not in itself contain sufficient information to comply with

IFRS. The accounting policies used in preparation of this announcement are

consistent with those in the full financial statements that have yet to be

published.

Dividend

An interim dividend of GBP73,368 representing 0.5p per ordinary share was paid in

February 2020 in respect of the year ended 31 March 2020. The board is

proposing, subject to shareholder approval at the AGM, a final dividend of GBP

73,386, representing 0.5p per ordinary share, to be paid on 16 October 2020,

making a total dividend for the year of 1.0p.

END

(END) Dow Jones Newswires

August 20, 2020 02:00 ET (06:00 GMT)

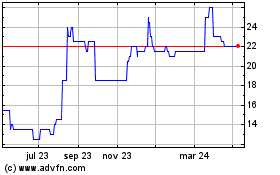

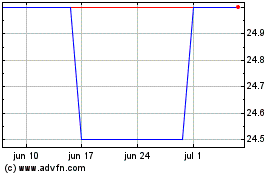

Phsc (LSE:PHSC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Phsc (LSE:PHSC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024