TIDMIHC

RNS Number : 1604B

Inspiration Healthcare Group PLC

06 October 2020

Inspiration Healthcare Group plc

("Inspiration Healthcare", the "Company" or the "Group")

6 October 2020

Interim Results

Inspiration Healthcare Group plc (AIM: IHC), the global medical

device company, today announces its unaudited interim results for

the six months ended 31 July 2020 ("H1 2020/21").

Highlights:

-- Total Group Revenue up 77% to GBP14.2m

-- Revenue on a like for like basis increased by 25% (excluding acquired / 'one time' revenue)

-- Gross Margin up to 51.4% (from 46.8%)

-- EBITDA(1) up 178% to GBP2.5m

-- Operating Profit up 122% to GBP1.1m (before exceptional items up 277% to GBP2.1m)

-- Strong net cash position, GBP5.2m, provides opportunity to

accelerate market development investments

-- Maiden interim dividend payment declared

-- Transformational acquisition of SLE Ltd for a total

consideration of GBP18m - integration on track

-- Oversubscribed placing and open offer raising GBP17m

-- Significant contribution to the UK Ventilator Challenge,

sourcing over 500 adult ventilators and delivering GBP7.3m of 'one

time' revenue, of which GBP2.9m was in the first half year

-- Patents granted for FirstBreath and Project Wave to maintain R&D momentum

-- Expect to materially exceed market expectations for the current financial year

(1) Earnings before interest, tax, depreciation, share based

payments and exceptional items

Neil Campbell, Chief Executive Officer, said today:

"I am delighted to be able to report on such a positive first

half of this financial year. Despite the operating challenges

caused by Covid-19, our underlying growth was strong, demonstrating

the robustness of our business model and our agility to be able to

adapt to new situations quickly. Acquiring SLE has transformed the

Group and, in the past few weeks we have confirmed our thinking

about the exciting opportunities it brings and its potential to

deliver more benefits. We have started the process to integrate it

into the Group as a major step on our journey to become a world

leader in Neonatal Intensive Care. We are pleased to declare our

maiden interim dividend and are confident of further strong growth

during the rest of the year and beyond."

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

Enquiries:

Inspiration Healthcare Group plc Tel: 01455 840555

Neil Campbell, Chief Executive Officer

Jon Ballard, Chief Financial Officer

Nominated Adviser & Broker Tel: 0207 397 8900

Cenkos Securities plc

Mark Connelly

Stephen Keys

Cameron MacRitchie

Cadogan PR Tel: 07771 713608

Alex Walters

alex.walters@cadoganpr.com

About Inspiration Healthcare

Inspiration Healthcare (AIM: IHC) is a global provider of

medical technology for use in neonatal intensive care &

operating theatres. The Company provides high quality innovative

products to patients around the world which help to improve patient

outcomes and it actively invests in innovative product

opportunities and disruptive technologies.

The Company has key own brand products that can be used within

the first days of life to help premature and sick babies; helping

resuscitation and stabilisation in the first moments of life

through to preventing brain damage and both invasive and

non-invasive respiratory support in terms of capital equipment and

disposable medical devices. Additionally, the Company has its own

range of products for maintaining normothermia pre, during and

post-surgery.

Since September 2019, the Company has acquired Vio Holdings a

designer, manufacturer and supplier of single use respiratory

products and sterile medical consumables and S.L.E., a leading

designer, manufacturer and global provider of neonatal ventilation

products. The Group generates approximately 60% of its revenues

from export markets and around two-thirds of its revenues come from

its own-branded products.

With product availability actively promoted to over 75 countries

through a distribution network, Inspiration Healthcare's success

has been built on continuous innovation, excellent customer service

and an inherent commitment to improving patient outcomes, working

in close collaboration with key opinion leaders across the

globe.

In the UK and Ireland, the Group has direct sales teams selling

Group Branded and complementary products from third parties, with

an additional range of home healthcare products. This is supported

by Technical Support for planned preventative maintenance and

emergency assistance.

The Group operates from various sites in the UK for R&D,

Marketing and operations with manufacturing based in Croydon (south

London) and Hailsham (East Sussex). The Group's Head Office is

located in Crawley, a short distance from London's Gatwick

Airport.

Further information on Inspiration Healthcare can be found at

www.inspiration-healthcare.com

Chairman's Statement

I am delighted to confirm that the Group has traded above our

expectations for the first half of this financial year ending 31

January 2021. Our revenue was up by 77% on the equivalent period

last year to GBP14.2 million.

Despite issues and concerns around Covid-19 during the first

half, revenues on a true like for like basis increased to GBP10.1

million as the Group benefitted from some capital equipment orders

from the NHS being brought forward and some pent up demand in our

order book from the end of the previous financial year being

released, along with our expected growth in the underlying

business.

Additionally, the Group benefited from a contribution of 4 weeks

of sales from the recently acquired SLE Ltd. This additional

acquired revenue along with the contribution of Viomedex accounted

for GBP1.2 million (excluding 'one time' adult ventilator sales)

compared to the same period last year. Finally, the Group

(including SLE) benefited from several 'one time' orders from the

NHS in the UK for ventilators and ancillary products and support

associated with Covid-19. In the first half of the year, the total

revenue for these contracts was GBP2.9 million and I am pleased to

say that a further GBP4.4 million of revenue has been delivered

since 1 August 2020. These orders are now complete.

At a Glance

Inspiration Acquired Revenue* Covid-19 Revenue Total

Revenue GBPmillion GBPmillion GBPmillion

GBPmillion

H1 YE Jan 21 GBP10.1 GBP1.2 GBP2.9 GBP14.2

------------ ------------------ ----------------- ------------

H1 YE Jan 20 GBP8.1 n/a n/a GBP8.1

------------ ------------------ ----------------- ------------

Growth Year-on-Year 25% n/a n/a 77%

------------ ------------------ ----------------- ------------

*Excluding inter-company revenues

As could be expected with the unknown impact of Covid-19, the

mix of products sold is different from that we had anticipated at

the beginning of the year. Needless to say, we are delighted at how

robust our product portfolio is and how well our margins stood up

over this period with Gross Margins (increasing) to 51.4% from

46.8% in the equivalent period. It is understandable that our

operating theatre sector suffered a downturn in revenues with much

planned surgery being postponed but pleasing that this was made up

by a strong performance in our Critical Care and Homecare sectors.

We look forward to a recovery in performance in the Operating

Theatre sector when hospitals return to routine work.

It pays testament to the staff across the Group as a whole that

during the height of the pandemic in the UK, we not only remained

open and delivered products and service support to our customers,

but we continued our important work in the background and have now

submitted Project Wave through the UK's IRAS portal to be assessed

for clinical trials. We hope that we will get clearance at the

earliest opportunity and can start clinical trials early in

2021.

The recent acquisition of the SLE business was underpinned by

expectations of synergistic growth opportunities through a stronger

product portfolio and greater geographic reach. Having only owned

the business for a few weeks we are very confident that the

acquisition will transform the Group quickly and deliver long term

synergistic value. With the additional cash and profit from the

one-time Covid-19 related activity along with a strong first half

performance in the underlying business I am excited about the next

chapter in the Group's development. We will use the additional

profit from the Covid-19 activity to further invest in our business

and fast track our growth.

Financial Review

Revenue for the six months to 31 July 2020 totalled GBP14.2

million (H1 2019/20: GBP8.1 million), an increase of 77% over the

equivalent period for the previous year with the inclusion of SLE,

Viomedex and the 'one time' UK NHS ventilator and ancillary product

orders. Like for like revenue growth was at 25% reflecting some

large contracts and certain specific opportunities being brought

forward resulting in revenue being weighted towards the first half.

EBITDA(1) improved by 178% to GBP2.5 million as a result of

improved gross margins, additional revenues and the impact of

Covid-19 on the timing of some cash-based overheads now expected to

be incurred during H2.

Operating profit before exceptional items for the period was

GBP2.1 million, an increase of 277% over the equivalent period of

the previous year.

Revenue from our Own Brand Products decreased 17% year on year

to GBP3.0 million (H1 2019/20: GBP3.6 million) and accounted for

30% of underlying revenue on a like for like basis, compared with

45% in the equivalent period. This is reflective of both a deferral

of operating theatre revenue as a result of Covid-19 and the large

Polish Alpha Core(5) Patient Warming System order received during

H1 of the prior period. Revenue from our Distributed Products was

up by 83% to GBP6.1 million on a like for like basis. The growth

was mainly as a result of strong performance in the Micrel product

range and unwinding back orders of products that could not be

shipped last year along with the NHS bringing forward orders that

were planned for later in the year due to Covid-19. Interest in the

Group's products remain strong.

Gross margin of 51.4% increased from 46.8% in the equivalent

period due to improved Distributed Product margins and the

consolidation of manufacturer margins on a number of Group products

resulting from the acquisition of Viomedex.

Operating expenses pre-exceptional items increased by 62%. These

increases included 6 months of overheads associated with Viomedex,

4 weeks from SLE and additional one-time Covid-19 related expenses,

along with our planned continued investment in personnel to

maintain our growth. Investment in R&D amounted to

approximately 2% of underlying revenue in the first half, however,

we expect total spend on R&D to increase in the second

half.

Exceptional items of GBP1.0 million (H1 2019/20: GBP0.07

million) of which GBP0.4 million relates to the issue of 671,296

new ordinary shares in the Company to the vendors of Vio Holdings

in full and final settlement of the deferred consideration

arrangements relating to the acquisition. The remaining GBP0.6

million represent expenses incurred to 31 July 2020 in relation to

the acquisition of SLE Limited which completed on 7 July 2020.

Profit after tax of GBP0.8 million was up 95% on last year.

Adjusting for exceptional items and amortisation of intangible

assets acquired through business combinations, underlying earnings

per share was 4.3p (H1 2019/20: 1.3p).

Cash at 31 July 2020 was GBP6.7 million. A revolving credit

facility was put in place to help facilitate the acquisition of SLE

of which GBP1.5 million was due resulting in a net cash position of

GBP5.2 million as at 31 July 2020. It is pleasing to note that the

Group has generated enough cash to have paid off the loan early in

H2.

Operational Review

Sales in the UK (without sales of 'one time' orders for

Covid-19) were up 60% resulting from a previous strong order book,

also a greater installed base of products requiring consumables and

a small contribution from Viomedex (acquired September 2019).

Additionally, some sales for capital equipment that were expected

to have been realised in the second half have been brought forward

which will result in a change to the usual second half weighting of

sales activity. Internationally sales were down 28% primarily due

to a change of buying patterns of overseas critical care providers

focusing their resources on Covid-19. We expect international sales

to improve in the second half and domestic sales to maintain a more

normal level of activity over the next few months.

The Group continues to plan for Brexit and having acquired SLE

we are integrating their plans into the Group to ensure that we

continue to serve all our customers around the world. We have been

working alongside the Dept of Health contingency planning group and

ensuring that our regulatory compliance in the EU will not be

affected.

Jonathan Ballard was promoted from Group Financial Controller to

Chief Financial Officer due to the retirement of Mike Briant. We

have also appointed Brook Nolson as Chief Operating Officer, adding

considerable expertise to the Group's executive team and an

important resource as we integrate SLE and re-structure the Group

for further growth. In addition, we are currently seeking to fill

the non-executive role that was held by Brook Nelson prior to him

being appointed as COO and are making good progress in this regard.

Furthermore, we have recently strengthened our senior team with the

appointment of Dr Peter Reynolds, a Consultant Neonatologist, as

our VP Clinical, Research and Innovation.

Acquisition of SLE Ltd

The Group has acquired the entire share capital of SLE Ltd, a

well-known UK based manufacturer and supplier of Neonatal

ventilators for a total consideration of GBP18m. SLE offers great

commercial synergies to the Group with products that can be sold

alongside the Group's main product lines and opens opportunities in

overseas markets where SLE has a broader geographic reach than the

existing Group, especially in Asia-Pacific. The acquisition

transforms the size of the Group, almost doubling the size in every

metric. Although the acquisition only completed on 7 July 2020, SLE

has already shown potential to deliver more opportunities than

originally anticipated as we integrate the business into the

Group.

Dividend Declaration

The Board believes that the growth and profitability of the

Group now support implementation of a progressive dividend policy.

Our cash generation further confirms our ability to commence

dividend payments. The initial interim payment will be 0.2p per

share payable to shareholders on the register on 27th November

payable on 29th December 2020. It is the Board's intention to

announce approximately one third of the annual dividend at the

interim stage.

Outlook

The Group has made great progress in the first half of the

financial year despite the uncertainty and stress caused by

Covid-19. To have delivered such strong growth in our underlying

business, along with the acquisition of SLE and one-time orders due

to Covid-19 is a credit to the strength of our product portfolio,

reputation, partners and, of course, our people.

The cash generated by this growth will allow us to invest

further in H2 and over the forthcoming year. We intend to invest in

our marketing and accelerate our plans for product development to

ensure that our exciting new products reach the widest customer

base as quickly as possible.

Given the success in the first half, we expect to materially

exceed market expectations in the full year and will maintain

momentum into next year.

Mark Abrahams

Chairman

6 October 2020

(1) Earnings before interest, tax, depreciation, share based

payments and exceptional items

Unaudited Consolidated Income Statement

For the six months ended 31 July 2020

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31-Jul 31-Jul 31-Jan

2020 2019 2020

Notes GBP'000 GBP'000 GBP'000

------------------------------------- ------ ---------------- ------------------ -------------------

Revenue 14,218 8,057 17,775

Cost of sales (6,916) (4,288) (9,203)

Gross profit 7,302 3,769 8,572

Operating expenses (6,220) (3,281) (7,434)

Operating profit 1,082 488 1,138

Analysed as:

Operating profit before exceptional

items 2,122 563 1,521

Exceptional items (1,040) (75) (383)

------------------------------------- ------ ---------------- ------------------ -------------------

Finance income 2 4 9

Finance cost (10) (9) (21)

Profit before tax 1,074 483 1,126

Income tax expense 4 (287) (79) (393)

Profit attributable to the owners

of the parent company 787 404 733

Earnings per share, attributable

to owners of the parent company

Basic expressed in pence per share 6 1.84p 1.32p 2.19p

Diluted expressed in pence per

share 6 1.82p 1.29p 2.15p

------------------------------------- ------ ---------------- ------------------ -------------------

Unaudited Consolidated Statement of Comprehensive Income

For the six months ended 31 July 2020

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31-Jul 31-Jul 31-Jan

2020 2019 2020

Notes GBP'000 GBP'000 GBP'000

-------------------------------------------- ------- ---------- ---------- -------------------

Profit for the period/year 787 404 733

Other comprehensive income/(expense)

Items that may be reclassified

to profit or loss

Cash flow hedges 65 13 (31)

Total other comprehensive income/(expense)

for the period/year 65 13 (31)

----------------------------------------------------- ---------- ---------- -------------------

Total comprehensive income for

the period/year 852 702

----------------------------------------------------- ---------- ---------- -------------------

Unaudited Consolidated Statement of Financial Position

As at 31 July 2020

(Registered Number: 03587944)

Unaudited Unaudited Audited

As at As at As at

31-Jul 31-Jul 31-Jan

2020 2019 2020

Notes GBP'000 GBP'000 GBP'000

-------------------------------------------------------------------------------- -------------------- ----------------------- ------------------------

ASSETS

Non-current assets

Intangible assets 15,818 1,212 3,655

Property, plant and equipment 811 397 496

Right of use asset 482 448 553

Investments - 111 -

--------------------

17,111 2,168 4,704

-------------------------------------------------------------------------------- -------------------- ----------------------- ------------------------

Current assets

Inventories 9,118 1,225 3,091

Trade and other receivables 9,547 3,111 4,205

Cash and cash equivalents 7,663 2,646 4,480

-------------------------------------------------------------------------------- -------------------- ----------------------- ------------------------

26,328 6,982 11,776

Total assets 43,439 9,150 16,480

-------------------------------------------------------------------------------- -------------------- ----------------------- ------------------------

Liabilities

Current liabilities

Trade and other payables (8,627) (2,059) (3,988)

Lease liabilities (97) (86) (132)

Financial liability - - (40)

Contract liabilities (2,624) (505) (376)

(11,348) (2,650) (4,536)

Non-current liabilities

Trade and other payables (248) - (742)

Lease liabilities (376) (367) (426)

Borrowings (1,500) - -

Deferred tax liability (227) (105) (227)

-------------------------------------------------------------------------------- -------------------- ----------------------- ------------------------

(2,351) (472) (1,395)

-------------------------------------------------------------------------------- -------------------- ----------------------- ------------------------

Total liabilities (13,699) (3,122) (5,931)

-------------------------------------------------------------------------------- -------------------- ----------------------- ------------------------

Net assets 29,740 6,028 10,549

-------------------------------------------------------------------------------- -------------------- ----------------------- ------------------------

Shareholders' equity

Called up share capital 6,797 3,067 3,838

Share premium account 18,761 - 3,475

Reverse acquisition reserve (16,164) (16,164) (16,164)

Share based payment reserve 247 169 153

Other reserves 31 4 (34)

Accumulated profit 20,068 18,952 19,281

Total equity attributable to owners

of the parent company 29,740 6,028 10,549

-------------------------------------------------------------------------------- -------------------- ----------------------- ------------------------

Unaudited Consolidated Statement of Changes in Shareholders'

Equity

For the six months ended 31 July 2020

Share

Called Reverse based

up Share Share acquisition payment Other Retained Total

Notes Capital Premium reserve reserve reserves earnings equity

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

At 31 January 2019 3,067 - (16,164) 91 (9) 18,548 5,533

Profit for the period

1 February 2019 to

31 July 2019 - - - - - 404 404

Other comprehensive

income - - - - 13 - 13

Total comprehensive

income for the period - - - - 13 404 417

---------------------------- --------- --------- ------------ --------- ------------ ---------------- ---------

Transactions with

owners in their

capacity

of owners

Employee share scheme

expense - - - 78 - - 78

---------------------------- --------- --------- ------------ --------- ------------ ---------------- ---------

Total transactions

with owners - - - 78 - - 78

---------------------------- --------- --------- ------------ --------- ------------ ---------------- ---------

At 31 July 2019 3,067 - (16,164) 169 4 18,952 6,028

Profit for the period

1 August 2019 to

31 January 2020 - - - - - 329 329

Other comprehensive

income - - - - (44) - (44)

---------------------------- --------- --------- ------------ --------- ------------ ---------------- ---------

Total comprehensive

income/(expense)

for the period - - - - (44) 329 285

---------------------------- --------- --------- ------------ --------- ------------ ---------------- ---------

Transactions with

owners in their

capacity

of owners

Employee share scheme

expense - - - (16) - - (16)

Issue of ordinary

shares as consideration

for a business

combination,

net of transaction

cost and tax 771 - - - - - 771

Proceeds from shares

issued, net of transaction

costs and tax - 3,475 - - - - 3,475

Deferred tax - - - - 6 - 6

Total transactions

with owners 771 3,475 - (16) 6 - 4,236

---------------------------- --------- --------- ------------ --------- ------------ ---------------- ---------

At 31 January 2020 3,838 3,475 (16,164) 153 (34) 19,281 10,549

Profit for the period

1 February 2020 to

31 July 2020 - - - - - 787 787

Other comprehensive

income - - - - 65 - 65

---------------------------- --------- --------- ------------ --------- ------------ ---------------- ---------

Total comprehensive

income for the period - - - - 65 787 852

---------------------------- --------- --------- ------------ --------- ------------ ---------------- ---------

Transactions with

owners in their

capacity

of owners

Employee share scheme

expense - - - 94 - - 94

Issue of ordinary

shares as consideration

for a business

combination,

net of transaction

cost and tax 2,959 - - - - - 2,959

Proceeds from shares

issued, net of transaction

costs and tax - 15,286 - - - - 15,286

---------------------------- --------- --------- ------------ --------- ------------ ---------------- ---------

Total transactions

with owners 2,959 15,286 - 94 - - 18,339

---------------------------- --------- --------- ------------ --------- ------------ ---------------- ---------

At 31 July 2020 6,797 18,761 (16,164) 247 31 20,068 29,740

---------------------------- --------- --------- ------------ --------- ------------ ---------------- ---------

Unaudited Consolidated Statements of Cash flows

For the six months ended 31 July 2020

Unaudited Unaudited Audited

6 months 6 months Year

ended Ended ended

31-Jul 31-Jul 31-Jan

2020 2019 2020

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 7 2,242 261 1,616

Interest paid (10) (9) (21)

Taxation received - 105 104

Taxation paid (114) (75) (235)

------------------- ------------------ ----------------------

Net cash inflow from operating activities 2,118 282 1,464

-------------------------------------------- ------------------- ------------------ ----------------------

Cash flow from investing activities

Payment for acquisition of subsidiary,

net of cash acquired (16,200) - (3,000)

Interest received 2 4 9

Purchase of property, plant and equipment (59) (71) (163)

Purchase of intangible assets (16) (12) (24)

Capitalised development costs (87) (33) (192)

-------------------------------------------- ------------------- ------------------ ----------------------

Net cash used in investing activities (16,360) (112) (3,370)

-------------------------------------------- ------------------- ------------------ ----------------------

Cash flow from financing activities

Proceeds from issue of shares 16,967 - 4,246

Share issue costs (957) - (250)

Proceeds from borrowings 1,500 - -

Principle elements of lease payments (85) (63) (149)

Net cash used in financing activities 17,425 (63) 3,847

-------------------------------------------- ------------------- ------------------ ----------------------

Net increase in cash and cash equivalents 3,183 107 1,941

Cash and cash equivalents at the beginning

of the period 4,480 2,539 2,539

Cash and cash equivalents at the end

of the period/year 7,663 2,646 4,480

-------------------------------------------- ------------------- ------------------ ----------------------

Notes to the Unaudited Interim Financial Statements

For the six months ended 31 July 2020

1. Basis of Preparation

This condensed consolidated interim financial information for

the six months ended 31 July 2020 have been prepared in accordance

with AIM rule 18 in relation to half year reports. This information

should be read in conjunction with the annual financial statements

for the year ended 31 January 2020, which have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union.

2. Going concern basis

The Group meets its day-to-day working capital requirements

through its cash resources. After making enquiries, the directors

have a reasonable expectation that the Group has adequate resources

to continue in operational existence for the foreseeable future.

The Group therefore continues to adopt the going concern basis in

preparing its consolidated interim financial statements.

3. Interim financial information

The interim financial information for the period ended 31 July

2020 is unaudited and does not constitute statutory accounts within

the meaning of Section 434 of the Companies Act 2006. The interim

financial information for the period ended 31 July 2019 is also

unaudited. The audited accounts for the year ended 31 January 2020

for Inspiration Healthcare Group plc were approved by its Board of

Directors on 24 April 2020 and have been delivered to the Registrar

of Companies with an unqualified audit report.

The Company's annual report and financial statements for the

year ended 31 January 2020 were prepared under International

Financial Reporting Standards (IFRS) as adopted by the European

Union, International Financial Reporting Interpretations Committee

(IFRIC) interpretations and with those parts of the Companies Act

2006 applicable to companies reporting under IFRS. The standards

used are those published by the International Accounting Standards

Board (IASB) and endorsed by the EU at the time of preparing those

statements.

4. Taxation

A provision has been made for corporation tax at the rate of 19%

on the estimated taxable profits for the period.

5. Dividends Paid

No dividends were paid or declared in the currect period.

The Board has declared an interim dividend of 0.2p per share to

be paid on 29 December 2020.

6. Earnings per ordinary share

Basic earnings per share for the period is calculated by

dividing the profit attributable to ordinary shareholders for the

year after tax by the weighted average number of shares in

issue.

Basic diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares in issue to assume

conversion of all potential dilutive ordinary shares.

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31-Jul 31-Jul 31-Jan

2020 2019 2020

GBP'000 GBP'000 GBP'000

------------------------------------------------ ---------- ---------- --------

Profit

Profit attributable to equity holders

of the Company 787 404 733

Add back exceptional items 1,040 75 383

Add back amortisation of intangible

assets acquired through business combinations 31 - -

Add back deferred tax charge on intangible

assets acquired from the acquisition

of Vio Holdings Limited - - 117

------------------------------------------------ ---------- ---------- --------

Numerator for underlying earnings per

share calculation 1,858 479 1,233

------------------------------------------------ ---------- ---------- --------

The weighted average number of shares in issue and the diluted

weighted average number of shares in issue were as follows:

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31-Jul 31-Jul 31-Jan

2020 2019 2020

-------------------------------------------- ----------- ----------- -----------

Shares

Weighted average number of ordinary

shares in issue for the purpose of

basic earnings per share 38,380,850 30,667,548 30,667,548

Weighted average number of shares issued

during the period/year 4,485,115 - 2,747,203

-------------------------------------------- ----------- ----------- -----------

Weighted average number of ordinary

shares in issue during the period/year

for the purposes of basic earnings

per share 42,865,965 30,667,548 33,414,751

Dilutive effect of potential Ordinary

shares:

Share options 474,675 583,941 583,941

-------------------------------------------- ----------- ----------- -----------

Diluted weighted number of shares in

issue for the purpose of diluted earnings

per share 43,340,640 31,251,489 33,998,692

-------------------------------------------- ----------- ----------- -----------

GBP16.2 million of the GBP17.0 million proceeds from the

28,921,463 shares issued during the period was used to fund the

acquisition of SLE Limited, see note 8. These have been prorated

for the time they have been in place.

A further 671,296 shares were issued during the period in

relation to deferred consideration shares for the acquisition of

Vio Holdings Limited and its subsidiary company amounting to

GBP435,000.

The basic and diluted earnings per share are as follows:

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31-Jul 31-Jul 31-Jan

2020 2019 2020

Pence Pence pence

-------------------------------------------- ---------- ---------- --------

Basic earnings per share 1.84 1.32 2.19

Adjust for:

Exceptional items 2.43 0.24 1.15

Intangible assets acquired though business

combinations 0.07

Tax charge on intangible assets acquired

from the acquisition of Vio Holdings

Limited - - 0.36

-------------------------------------------- ---------- ---------- --------

Underlying basic earnings per share 4.34 1.56 3.69

-------------------------------------------- ---------- ---------- --------

Diluted earnings per share 1.82 1.29 2.15

-------------------------------------------- ---------- ---------- --------

Adjusted for:

Exceptional items 2.40 0.24 1.13

Intangible assets acquired through

business combinations 0.07

Tax charge on intangible assets acquired

from the acquisition of Vio Holdings

Limited - - 0.34

-------------------------------------------- ---------- ---------- --------

Underlying diluted earnings per share 4.29 1.53 3.62

-------------------------------------------- ---------- ---------- --------

7. Note to the Consolidated Statement of Cash flows

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31-Jul 31-Jul 31-Jan

2020 2019 2020

GBP'000 GBP'000 GBP'000

Profit before taxation 1,074 483 1,126

Adjustments for:

Net finance cost 8 5 12

Depreciation and amortisation 331 273 617

Impairment of investment - - 111

Impairment of intangible assets - - 72

Employee share scheme expense 94 78 62

Deferred consideration share issue 435 - -

Loss on disposal of tangible asset - 3 3

Increase in inventories (1,653) (507) (1,696)

Decrease/(increase) in trade and other

receivables 995 (30) (889)

Increase/(decrease) in trade and other

payables 1,101 (230) 2,141

Increase / (decrease) in contract liabilities (143) 186 57

--------------- ----------- -----------------

Net cash inflow from operating activities 2,242 261 1,616

----------------------------------------------- --------------- ----------- -----------------

8. Business combinations

On 7 July 2020, the Group acquired 100% of the share capital of

SLE Limited for GBP18.0 million on a cash free debt free basis. SLE

Limited designs, manufactures and supplies neonatal ventilators

worldwide.

As a result of the acqusition, the Group is expected to benefit

from both revenue and cost synergies, additional routes to

international markets whilst the acquired manufacturing capability

is expected to allow the Group to further improve gross

margins.

Details of the purchase consideration is as follows:

Unaudited

GBP'000

Purchase consideration

Cash paid 16,200

Ordinary shares issued 1,800

Total purchase consideration 18,000

-------------------------------- ----------

The cash consideration was raised via the issue of new ordinary

shares.

A GBP5m revolving credit facility was also put in place of which

GBP1.5 million was utilised in order to fund acquistion related

expenses.

Issue costs of GBP957,000 which were directly attributable to

the issue of the shares have been netted off against share

premium.

Both the purchase price allocation and fair value exersice of

the assets and liabilities recognised as a result of the

acquisition are ongoing as at the period end. As such the total

amount acquired above the draft assesment of net identiiable assets

acquired has been allocated to Goodwill totalling GBP12.2 million

in the first intance. Therefore all amounts in relation to the

Business Combination are provisional.

The purchase price allocation and fair value exercise are

expected to be completed by the year ended 31 January 2021.

9. Related party transactions

-- Lease of Leicestershire facility

The Leicestershire facility at Earl Shilton is rented on an arms

length basis from a self-invested pension plan controlled by Neil

Campbell, Toby Foster and others. The lease was renewed on an arms

length basis in April 2018.

-- Key management

Directors control 7% of the voting shares of the Company as at

31 July 2020.

Registere d Office:

2 Satellite Business Village

Fleming Way

Crawley RH10 9NE

T elephone : +44 (0) 1455 840555

Fax : +44 (0) 1455 841464

website www.Inspiration-healthcare.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFFTIALEIII

(END) Dow Jones Newswires

October 06, 2020 02:00 ET (06:00 GMT)

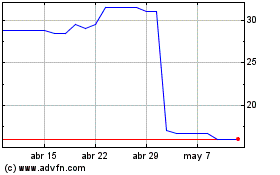

Inspiration Healthcare (LSE:IHC)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Inspiration Healthcare (LSE:IHC)

Gráfica de Acción Histórica

De May 2023 a May 2024