0001830029false0001830029grdi:RedeemableWarrantsExercisableForSharesOfCommonStockAtAnExercisePriceOf1150PerShareMember2024-04-182024-04-1800018300292024-04-182024-04-180001830029grdi:CommonStockParValue00001PerShareMember2024-04-182024-04-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): April 18, 2024 |

GRIID Infrastructure Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

333-251641 |

85-3477678 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2577 Duck Creek Road |

|

Cincinnati, Ohio |

|

45212 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 513 268-6185 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.0001 per share |

|

GRDI |

|

Nasdaq Global Market |

Redeemable warrants, exercisable for shares of common stock at an exercise price of $11.50 per share |

|

GRDI-W |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 (e) Compensatory Arrangements of Certain Officers.

On April 18, 2024 (the “Effective Date”), GRIID Infrastructure Inc. (the “Company”) entered into Employment Agreements (the “Executive Employment Agreements”) with James D. Kelly III, the Company’s Chief Executive Officer, Allan Wallander, the Company’s Chief Financial Officer, and Michael Hamilton, the Company’s Chief Research Officer, which have terms that commenced as of the Effective Date and will continue until terminated in accordance with the Executive Employment Agreements (or earlier termination of employment).

Under the Executive Employment Agreements, Mr. Kelly will receive an annual base salary of $500,000 and an annual target bonus opportunity equal to $500,000. Mr. Wallander will receive an annual base salary of $300,000 and an annual target bonus opportunity equal to $300,000. Mr. Hamilton will receive an annual base salary of $180,000 and an annual target bonus opportunity equal to $100,000. Messrs. Kelly and Wallander are also entitled to receive a special bonus (a “Special Bonus”), payable immediately, in the amounts of $200,000 and $300,000, respectively, for services provided prior to the Effective Date.

The Executive Employment Agreements each provide that in the event of the executive’s termination of employment by the Company without “Cause” or a termination of employment by the executive for “Good Reason” (each as defined in the Executive Employment Agreement), the executive will receive payment of: (i) a lump sum payment equal to two (2) times the sum of the executive’s base salary and target bonus for the year in which the date of termination occurs, which shall be paid within thirty (30) days following the date of termination; (ii) a lump sum payment equal to the Special Bonus (as applicable to Messrs. Kelly and Wallander), to the extent unpaid as of the date of termination, (iii) a payment equal to the product of (i) the annual bonus, if any, that the executive would have earned for the calendar year in which the date of termination occurs based on achievement of the applicable performance goals for such year and (ii) a fraction, the numerator of which is the number of days the executive was employed by the Company during the year of termination and the denominator of which is the number of days in such year (the “Pro-Rata Bonus”). This amount shall be paid on the date that annual bonuses are paid to similarly situated executives, but in no event later than two-and-a-half (2-1/2) months following the end of the calendar year in which the date of termination occurs. If the executive timely and properly elects continuation coverage under the Consolidated Omnibus Reconciliation Act of 1985 (“COBRA”), the Company shall reimburse the executive for the monthly COBRA premium paid by the executive for himself and his dependents. Such reimbursement shall be paid to the executive on the fifteenth (15th) of the month immediately following the month in which the executive timely remits the premium payment. The executive shall be eligible to receive such reimbursement until the earliest of: (A) the eighteen-month anniversary of the date of termination; (B) the date the executive is no longer eligible to receive COBRA continuation coverage; and (C) the date on which the executive becomes eligible to receive substantially similar coverage from another employer. Items (i) through (iv) above are referred to as the “Accrued Amounts.”

Notwithstanding the above, if employment is terminated by the executive for Good Reason or by the Company without Cause (other than on account of the executive’s death or Disability (as defined in the Executive Employment Agreement)), in each case within twelve (12) months following a “Change in Control” (as defined in the Executive Employment Agreement), then the executive shall be entitled to receive the Accrued Amounts and, subject to compliance with a restrictive covenant agreement and his execution of a release which becomes effective within sixty (60) days following the date of termination, the executive shall be entitled to receive (i) a lump sum payment equal to two (2) times the sum of the executive’s base salary and target bonus for the year in which the date of termination occurs (or if greater, the year immediately preceding the year in which the Change in Control occurs), which shall be paid within thirty (30) days following the date of termination; (ii) a lump sum payment equal to the Special Bonus (as applicable to Messrs. Kelly and Wallander), to the extent unpaid as of the date of termination, (iii) a lump sum payment equal to the executive’s target bonus for the calendar year in which the date of termination occurs (or if greater, the year in which the Change in Control occurs), which shall be paid within sixty (60) days following the date of termination; and (iv) if the executive timely and properly elects continuation coverage under COBRA, the Company shall reimburse the executive for the monthly COBRA premium paid by the executive for himself and his dependents. Such reimbursement shall be paid to the executive on the fifteenth (15th) of the month immediately following the month in which the Executive timely remits the premium payment. The Executive shall be eligible to receive such reimbursement until the earliest of: (A) the eighteen-month anniversary of the date of termination; (B) the date the executive is no longer eligible to receive COBRA continuation coverage; and (C) the date on which the executive becomes eligible to receive substantially similar coverage from another employer.

Payment of any severance benefits under the Executive Employment Agreements is conditioned on the executive officer’s execution and non-revocation of a release of claims in favor of the Company. In addition, under the Executive Employment Agreements, the executive officers are subject to restrictive covenants relating to non-competition, non-solicitation and confidentiality of information.

The foregoing description of the Executive Employment Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the form of Executive Employment Agreement, a copy of which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are being filed herewith:

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

GRIID INFRASTRUCTURE INC. |

|

|

|

|

Date: |

April 24, 2024 |

By: |

/s/ Allan J. Wallander |

|

|

|

Allan J. Wallander

Chief Financial Officer |

EMPLOYMENT AGREEMENT

This Employment Agreement (the “Agreement”) is made on , 2024 by and between GRIID INFRASTRUCTURE, INC. (the “Company”) and (the “Executive”).

Introduction

The Company desires to retain the services of the Executive pursuant to the terms and conditions set forth herein, and the Executive wishes to be employed by the Company on such terms and conditions. The Executive will be a key employee of the Company, with significant access to information concerning the Company and its business. The disclosure or misuse of such information or the engaging in competitive activities would cause substantial harm to the Company.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1.Term. The Company agrees to employ Executive, and Executive accepts employment with the Company, on the terms and subject to the conditions of this Agreement. The term of this Agreement shall commence as of the date hereof and will continue until terminated in accordance with this Agreement.

2.Duties. The Executive will serve as Chief Executive Officer and President and shall have such duties of an executive nature as the Board of Directors of the Company (the “Board”) shall determine from time to time. [The Executive will report to the Company’s Chief Executive Officer.]

3.Full Time; Best Efforts. The Executive shall devote Executive’ s full business time and best efforts to the performance of Executive’s duties hereunder and to the promotion of the business and affairs of the Company. The Executive shall not engage in any other commercial activity; provided however, that the Executive may, with the approval of the Chief Executive Officer, serve on a board of directors of a company, so long as such service does not represent a potential conflict of interest or interfere with the performance of the Executive’ s duties and responsibilities hereunder or violate the terms of this Agreement or the Restrictive Covenant Agreement. Similarly, the Executive may engage in charitable or civic endeavors so long as they do not interfere with the performance of the Executive’ s duties and responsibilities hereunder or violate the terms of this Agreement or the Restrictive Covenant Agreement. The Executive shall not engage in any other activity which could reasonably be expected to interfere with the performance of the Executive’s duties, services and responsibilities hereunder or violate the terms of this Agreement or the Restrictive Covenant Agreement.

4.Compensation and Benefits. During the Executive’s employment with the Company under this Agreement, the Executive shall be entitled to compensation and benefits as follows:

(a)Base Salary. The Executive will receive a salary at the rate of $500,000 annually, in periodic installments in accordance with the Company's customary payroll practices, but no less frequently than monthly in arrears. The Executive’s rate of base salary, as in effect from time to time, (the “Base Salary”) will be reviewed at least annually by the Compensation Committee of the Board (the “Committee”) and may not be decreased, except in connection with a proportionate reduction of the salaries of all the Company’s other executive officers.

(b)Bonus. [The Executive shall be entitled to a bonus equal to $ for performances of services prior to the date hereof (the “Special Bonus”), to be paid when the Company has sufficient cash on hand to pay such bonus.] For each calendar year ending hereafter during his employment, the Executive will have the opportunity to earn an annual bonus (the “Annual Bonus”) in a targeted amount of $ (the “Target Bonus”). The actual Bonus payable to the Executive, if any, may be more or less than the Target Bonus and will be determined by the Committee, in its sole discretion, based on the achievement of corporate and/or personal objectives established by the Committee. Except as otherwise provided herein or determined by the Committee, payment of any otherwise earned Bonus will be conditioned on Executive’s continued service through the date that annual bonuses are paid to the Company’s executive officers generally with respect to the applicable year.

(c)Benefits. The Executive shall be entitled to participate in Company benefit plans that are generally available to the Company’ s executive employees in accordance with and subject to the terms and conditions of such plans, as in effect from time to time.

(d)Vacation. The Executive will be entitled to paid time off in accordance with the Company’s policies, as in effect from time to time.

(e)Expenses. The Executive will be entitled to reimbursement of all reasonable expenses incurred in the ordinary course of business on behalf of the Company in accordance with Company expense reimbursement policies.

(f)Withholding. The Company may withhold from compensation payable to the Executive all applicable federal, state and local withholding taxes.

5.Restrictive Covenant Agreement. In consideration of the good and valuable consideration received hereunder, the Executive will promptly execute the Confidentiality, Intellectual Property Assignment and Restrictive Covenant Agreement attached hereto as Appendix A (the “Restrictive Covenant Agreement”).

(a)General. The Executive’ s employment with the Company may be terminated by the Company at any time, for any reason. The Executive’ s employment with the Company may also be terminated by the Executive for Good Reason or, after at least thirty (30) days prior written notice thereof from the Executive to the Company, without Good Reason (provided that upon notice by the Executive of a resignation without Good Reason, the Company may without

any liability accept such resignation with an earlier effective date than proposed by the Executive).

(b)Definitions. As used herein, the following terms shall have the following meanings:

“Cause” shall mean: (i) the Executive’s willful failure to perform his reasonably assigned duties for the Company (other than any such failure resulting from incapacity due to physical or mental illness); (ii) the Executive’s willful engagement in dishonesty, illegal conduct or gross misconduct, which is, in each case, materially injurious to the Company or its affiliates; (iii) the Executive’s embezzlement, misappropriation or fraud, whether or not related to the Executive’s employment with the Company; (iv) the Executive’s conviction of or plea of guilty or nolo contendere to a crime that constitutes a felony (or state law equivalent) or a crime that constitutes a misdemeanor involving moral turpitude, if such felony or other crime is work-related, materially impairs the Executive’s ability to perform services for the Company or results in material or financial harm to the Company or its affiliates; (v) the Executive’s violation of a material policy of the Company; (vi) the Executive’s willful unauthorized disclosure of Confidential Information (as defined below); (vii) the Executive’s material breach of any material obligation under this Agreement or any other written agreement between the Executive and the Company; or (viii) any material failure by the Executive to comply with the Company’s written policies or rules, as they may be in effect from time to time during the Employment Term, if such failure causes material reputational or financial harm to the Company. For purposes of this provision, no act or failure to act on the part of the Executive shall be considered “willful” unless it is done, or omitted to be done, by the Executive in bad faith or without reasonable belief that the Executive’s action or omission was in the best interests of the Company. Any act, or failure to act, based upon authority given pursuant to a resolution duly adopted by the Board or upon the advice of counsel for the Company shall be conclusively presumed to be done, or omitted to be done, by the Executive in good faith and in the best interests of the Company. Termination of the Executive’s employment shall not be deemed to be for Cause unless and until the Company delivers to the Executive a copy of a resolution duly adopted by the affirmative vote of not less than a majority of the Board (after reasonable written notice is provided to the Executive and the Executive is given an opportunity, together with counsel, to be heard before the Board), finding that the Executive has engaged in the conduct described in any of (i)-(viii) above. Except for a failure, breach or refusal which, by its nature, cannot reasonably be expected to be cured, the Executive shall have ten (10) business days from the delivery of written notice by the Company within which to cure any acts constituting Cause; provided however, that, if the Company reasonably expects irreparable injury from a delay of ten (10) business days, the Company may give the Executive notice of such shorter period within which to cure as is reasonable under the circumstances, which may include the termination of the Executive’s employment without notice and with immediate effect. The Company may place the Executive on paid leave for up to 60 days while it is determining whether there is a basis to terminate the Executive’s employment for Cause. This will not constitute Good Reason.

“Change in Control” shall mean the occurrence of any of the following after the Effective Date:

(i) one person (or more than one person acting as a group) acquires ownership of stock of the Company that, together with the stock held by such person or group, constitutes more than 50% of the total fair market value or total voting power of the stock of the Company;

(iii) a majority of the members of the Board are replaced during any twelve-month period by directors whose appointment or election is not endorsed by a majority of the Board before the date of appointment or election;

(iv) the sale of all or substantially all of the Company’s assets; or

(v) any other event that constitutes a “change in control event,” as that term is used in Treas. Reg. § 1.409A-3(i)(5)(i).

Notwithstanding the foregoing, a Change in Control shall not occur unless such transaction constitutes a change in the ownership of the Company, a change in effective control of the Company, or a change in the ownership of a substantial portion of the Company’s assets under Section 409A.

“Disability” means Executive’s inability to substantially perform his duties to the Company as a result of incapacity by reason of any medically determinable physical or mental impairment that can be expected to result in death or to last for a period of at least twelve (12) months.

“Good Reason” for resignation shall exist upon, without the Executive’s written consent: (a) an adverse change by the Company in the location at which the Executive performs his principal duties for the Company of more than 25 miles from the location at which the Executive was performing his principal duties for the Company prior to such change; (b) a material reduction of the Executive’s Base Salary (other than a reduction permitted by Section 4(a)); (c) a material reduction of the Executive’s Target Bonus below that specified in Section 4(b); (d) any material breach by the Company of any material provision of this Agreement; (e) the Company’s failure to obtain an agreement from any successor to the Company to assume and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform if no succession had taken place, except where such assumption occurs by operation of law; or (f) a material adverse change in the Executive’s title, authority or duties; provided that no such event or condition in clauses (a) through (f) shall constitute Good Reason unless (x) the Executive gives the Company a written notice of termination not more than thirty (30) days after the initial existence of the condition, (y) the grounds for termination (if susceptible to correction) are not corrected by the Company within thirty (30) days of its receipt of such notice, and (z) the Executive’s termination occurs within sixty (60) days following the Company’s receipt of such notice. Notwithstanding the foregoing, in the event that a Change in Control (as defined below) occurs during the Employment Term, the Executive may terminate his employment for any reason during the thirty-day period following the Change in Control and such termination shall be deemed to be for Good Reason.

“Termination Date” with respect to the Executive’s employment shall mean (a) if the Executive’s employment hereunder terminates on account of the Executive’s death, the date of the Executive’s death; (b) if the Executive’s employment hereunder is terminated on account of the Executive’s Disability, the date that it is determined that the Executive has a Disability; (c) if the Company terminates the Executive’s employment hereunder for Cause, the date the Notice of Termination is delivered to the Executive; (d) if the Company terminates the Executive’s employment hereunder without Cause, the date specified in the Notice of Termination, which shall be no less than thirty (30) days following the date on which the Notice of Termination is delivered; and (e) if the Executive terminates his employment hereunder with or without Good Reason, the date specified in the Executive’s Notice of Termination, which shall be no less than sixty (60) days following the date on which the Notice of Termination is delivered. Notwithstanding anything contained herein, the Termination Date shall not occur until the date on which the Executive incurs a “separation from service” within the meaning of Section 409A.

(c)Termination For Cause or By the Executive without Good Reason. The Executive’s employment hereunder may be terminated by the Company for Cause or by the Executive without Good Reason. If the Executive's employment is terminated by the Company for Cause or by the Executive without Good Reason, the Executive shall be entitled to receive:

(i)any accrued but unpaid Base Salary and accrued but unused vacation which shall be paid on the pay date immediately following the Termination Date (as defined below) in accordance with the Company’s customary payroll procedures;

(ii)[the Special Bonus, to the extent unpaid as of the Termination Date, and] any earned but unpaid Annual Bonus with respect to any completed calendar immediately preceding the Termination Date, which shall be paid on the otherwise applicable payment date; provided that, if the Executive's employment is terminated by the Company for Cause, then any such accrued but unpaid Annual Bonus shall be forfeited;

(iii)reimbursement for unreimbursed business expenses properly incurred by the Executive, which shall be subject to and paid in accordance with the Company's expense reimbursement policy; and

(iv)such employee benefits (including equity compensation), if any, to which the Executive may be entitled under the Company's employee benefit plans as of the Termination Date; provided that, in no event shall the Executive be entitled to any payments in the nature of severance or termination payments except as specifically provided herein.

Items 6(c)(i) through 6(c)(iv) are referred to herein collectively as the “Accrued Amounts”.

(d)Termination Without Cause or for Good Reason. If the Executive’s employment ceases due to a resignation by the Executive for Good Reason or a termination by the Company without Cause, the Executive shall be entitled to receive the Accrued Amounts and,

subject to the Executive’s compliance with the Restrictive Covenant Agreement and his execution of a release of claims in favor of the Company, its affiliates and their respective officers and directors in a form provided by the Company (the “Release”) and such Release becoming effective within sixty (60) days following the Termination Date (such sixty-day period, the “Release Execution Period”), the Executive shall be entitled to receive the following:

(i)a lump sum payment equal to two (2) times the sum of the Executive’s Base Salary and Target Bonus for the year in which the Termination Date occurs, which shall be paid within thirty (30) days following the Termination Date; provided that, if the Release Execution Period begins in one taxable year and ends in another taxable year, payment shall not be made until the beginning of the second taxable year;

(ii)[a lump sum payment equal to the Special Bonus, to the extent unpaid as of the Termination Date;]

(iii)a payment equal to the product of (i) the Annual Bonus, if any, that the Executive would have earned for the calendar year in which the Termination Date occurs based on achievement of the applicable performance goals for such year and (ii) a fraction, the numerator of which is the number of days the Executive was employed by the Company during the year of termination and the denominator of which is the number of days in such year (the “Pro-Rata Bonus’). This amount shall be paid on the date that annual bonuses are paid to similarly situated executives, but in no event later than two-and-a-half (2-1/2) months following the end of the calendar year in which the Termination Date occurs; and

(iv)if the Executive timely and properly elects continuation coverage under the Consolidated Omnibus Reconciliation Act of 1985 (“COBRA"), the Company shall reimburse the Executive for the monthly COBRA premium paid by the Executive for himself and his dependents. Such reimbursement shall be paid to the Executive on the fifteenth (15th) of the month immediately following the month in which the Executive timely remits the premium payment. The Executive shall be eligible to receive such reimbursement until the earliest of: (A) the eighteen-month anniversary of the Termination Date; (B) the date the Executive is no longer eligible to receive COBRA continuation coverage; and (C) the date on which the Executive becomes eligible to receive substantially similar coverage from another employer.

The treatment of any outstanding equity awards shall be determined in accordance with the terms of the GRIID Infrastructure Inc. 2023 Omnibus Incentive Compensation Plan (the “Plan”) and the applicable award agreements. Notwithstanding the terms of the Plan or any applicable award agreements: (A) all outstanding unvested stock options granted to the Executive during the Employment Term shall become fully vested and exercisable for the remainder of their full term; (B) all outstanding

equity-based compensation awards other than stock options that are not intended to qualify as performance-based compensation under Section 162(m)(4)(C) of the Internal Revenue Code of 1986, as amended (the “Code”), shall become fully vested and the restrictions thereon shall lapse; provided that, any delays in the settlement or payment of such awards that are set forth in the applicable award agreement and that are required under Section 409A of the Code (“Section 409A”) shall remain in effect; and (C) all outstanding equity-based compensation awards other than stock options that are intended to constitute performance-based compensation under Section 162(m)(4)(C) of the Code shall remain outstanding and shall vest or be forfeited in accordance with the terms of the applicable award agreements, if the applicable performance goals are satisfied.

(e)Involuntary Termination Proximate to a Change in Control. Notwithstanding any other provision contained herein, if the Executive’s employment hereunder is terminated by the Executive for Good Reason or by the Company without Cause (other than on account of the Executive’s death or Disability), in each case within twelve (12) months following a Change in Control, then the Executive shall be entitled to receive the Accrued Amounts and, subject to compliance with the Restrictive Covenant Agreement and his execution of a Release which becomes effective within sixty (60) days following the Termination Date, the Executive shall be entitled to receive the following:

(i)a lump sum payment equal to two (2) times the sum of the Executive’s Base Salary and Target Bonus for the year in which the Termination Date occurs (or if greater, the year immediately preceding the year in which the Change in Control occurs), which shall be paid within thirty (30) days following the Termination Date: provided that, if the Release Execution Period begins in one taxable year and ends in another taxable year, payment shall not be made until the beginning of the second taxable year; and

(ii)[a lump sum payment equal to the Special Bonus, to the extent unpaid as of the Termination Date,]

(iii)a lump sum payment equal to the Executive’s Target Bonus for the calendar year in which the Termination Date occurs (or if greater, the year in which the Change in Control occurs), which shall be paid within sixty (60) days following the Termination Date; provided that, if the Release Execution Period begins in one taxable year and ends in another taxable year, payment shall not be made until the beginning of the second taxable year; and

(iv)if the Executive timely and properly elects continuation coverage under COBRA, the Company shall reimburse the Executive for the monthly COBRA premium paid by the Executive for himself and his dependents. Such reimbursement shall be paid to the Executive on the fifteenth (15th) of the month immediately following the month in which the Executive timely remits the premium payment. The Executive shall be eligible to receive such reimbursement until the earliest of: (A) the eighteen-month anniversary of the Termination Date; (B) the date the Executive is no longer eligible to receive COBRA continuation

coverage; and (C) the date on which the Executive becomes eligible to receive substantially similar coverage from another employer.

Notwithstanding the terms of any equity incentive plan or award agreements, as applicable: (A) all outstanding unvested stock options granted to the Executive shall become fully vested and exercisable for the remainder of their full term; (B) all outstanding equity-based compensation awards other than stock options that are not intended to qualify as performance-based compensation under Section 162(m)(4)(C) of the Code shall become fully vested and the restrictions thereon shall lapse; provided that, any delays in the settlement or payment of such awards that are set forth in the applicable award agreement and that are required under Section 409A shall remain in effect; and (C) all outstanding equity-based compensation awards other than stock options that are intended to constitute performance-based compensation under Section 162(m)(4)(C) of the Code shall remain outstanding and shall vest or be forfeited in accordance with the terms of the applicable award agreements, if the applicable performance goals are satisfied.

(f)Death or Disability. The Executive's employment hereunder shall terminate automatically upon the Executive's death during the Employment Term, and the Company may terminate the Executive's employment on account of the Executive's Disability. If the Executive's employment is terminated during the Employment Term on account of the Executive's death or Disability, the Executive (or the Executive's estate and/or beneficiaries, as the case may be) shall be entitled to receive the following:

(i)the Accrued Amounts; and

(ii)a lump sum payment equal to the product of: (A) the Executive’s Target Bonus for the year in which the Termination Date occurs and (B) a fraction, the numerator of which is the number of days the Executive was employed by the Company during the year in which the Termination Date occurs and the denominator of which is the number of days in such year, which shall be paid within 30 days following the Termination Date.

Notwithstanding any other provision contained herein, all payments made in connection with the Executive’s Disability shall be provided in a manner which is consistent with federal and state law.

(g)Resignation of All Other Positions. Upon termination of the Executive’s employment hereunder for any reason, the Executive shall be deemed to have resigned from all positions that the Executive holds as an officer or member of the board of directors (or a committee thereof) of the Company or any of its affiliates.

7.Notices. All notices, demands or other communications hereunder shall be in writing and shall be deemed to have been duly given if delivered in person, by e-mail or fax, by United States mail, certified or registered with return receipt requested, or by a nationally recognized overnight courier service, or otherwise actually delivered: (a) if to the Executive, at the most recent address contained in the Company’s personnel files; (b) if to the Company, to the attention of its Legal Department at the address of its principal executive office; or (c) or at such

other address as may have been furnished by such person in writing to the other party. Any such notice, demand or communication shall be deemed given on the date given, if delivered in person, e-mailed or faxed, on the date received, if given by registered or certified mail, return receipt requested or by overnight delivery service, or three days after the date mailed, if otherwise given by first class mail, postage prepaid.

8.Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Delaware, without regard to its choice of law provisions.

9.Arbitration. In the event of any dispute under the provisions of this Agreement or otherwise regarding the Executive’s employment or compensation (other than a dispute in which the primary relief sought is an injunction or other equitable remedy, such as an action to enforce compliance with the Restrictive Covenant Agreement), the parties shall be required to have the dispute, controversy or claim settled by arbitration in [CITY], [STATE] in accordance with the National Rules for the Resolution of Employment Disputes then in effect of the American Arbitration Association (“AAA”), by one arbitrator mutually agreed upon by the parties (or, if no agreement can be reached within 30 days after names of potential arbitrators have been proposed by the AAA, then by one arbitrator having relevant experience who is chosen by the AAA). Any award or finding will be confidential. The arbitrator may not award attorneys’ fees to either party unless a statute or contract at issue specifically authorizes such an award. Any award entered by the arbitrators will be final, binding and non-appealable and judgment may be entered thereon by either party in accordance with applicable law in any court of competent jurisdiction. This arbitration provision will be specifically enforceable. Each party will be responsible for its own expenses relating to the conduct of the arbitration (including reasonable attorneys’ fees and expenses) and will share equally the fees of the arbitrator.

10.Amendments. This Agreement may be amended or modified only by a written instrument signed by a duly authorized officer of the Company and the Executive.

11.No Waivers. No waiver of this Agreement or any provision hereof shall be binding upon the party against whom enforcement of such waiver is sought unless it is made in writing and signed by or on behalf of such party. The waiver of a breach of any provision of this Agreement shall not be construed as a waiver or a continuing waiver of the same or any subsequent breach of any provision of this Agreement. No delay or omission in exercising any right under this Agreement shall operate as a waiver of that or any other right.

12.Binding Effect. This Agreement shall be binding on and inure to the benefit of the parties hereto and their respective heirs, executors and administrators, successors and assigns, except that the rights and obligations of the Executive hereunder are personal and may not be assigned without the Company’ s prior written consent. Any assignment of this Agreement by the Company shall not be considered a termination of the Executive’s employment.

13.Entire Agreement. This Agreement, together with the Restrictive Covenant Agreement, constitutes the final and entire agreement of the parties with respect to the matters covered hereby and replaces and supersedes all other agreements and understandings relating hereto and to the Executive’s employment.

14.Counterparts. This Agreement may be executed in any number of counterparts, including counterpart signature pages or counterpart facsimile signature pages, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

15.No Conflicting Agreements. The Executive represents and warrants that he is not a party to or otherwise bound by any agreement or restriction that could conflict with, or be violated by, the performance of his duties to the Company or his obligations under this Agreement. Executive will not use or misappropriate any intellectual property, trade secrets or confidential information belonging to any third party.

16.Interpretation. The captions of the sections of this Agreement are for convenience of reference only and in no way define, limit or affect the scope or substance of any section of this Agreement. The parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises under any provision of this Agreement, this Agreement shall be construed as if drafted jointly by the parties thereto, and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of authoring any of the provisions of this Agreement.

(a)The parties intend for this Agreement to comply with or be exempt from Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and all provisions of this Agreement will be interpreted and applied accordingly. Nonetheless, the Company does not guaranty the tax treatment of any compensation payable to the Executive and, notwithstanding anything to the contrary herein or otherwise, the Company shall have no liability to the Executive or to any other person if the payments and benefits provided in this Agreement that are intended to be exempt from or compliant with Section 409A of the Code are not so exempt or compliant.

(b)If the cessation of employment giving rise to the payments described in Section 6(d) (as modified by Section 6(e), if applicable) is not a “Separation from Service” within the meaning of Treas. Reg. § 1.409A‑1(h)(1) (or any successor provision), then to the extent the amounts otherwise payable pursuant to that section constitute nonqualified deferred compensation subject to Section 409A of the Code, they will instead be deferred without interest and will not be paid until the Executive experiences a Separation from Service. In addition, to the extent compliance with the requirements of Treas. Reg. § 1.409A‑3(i)(2) (or any successor provision) is necessary to avoid the application of an additional tax under Section 409A of the Code to payments due to the Executive upon or following his Separation from Service, then notwithstanding any other provision of this Agreement (or any otherwise applicable plan, policy, agreement or arrangement), any such payments that are otherwise due within six months following the Executive’s Separation from Service (taking into account the preceding sentence of this paragraph) will be deferred without interest and paid to Executive in a lump sum within 10 days following the first to occur of (i) the day immediately following that six-month period and (ii) the date of Executive’s death. This paragraph should not be construed to prevent the application of Treas. Reg. § 1.409A‑1(b)(9)(iii)(or any successor provision) to amounts payable

hereunder. For purposes of Section 409A of the Code , each payment in a series of payments will be deemed a separate payment.

(c)Notwithstanding anything in this Agreement to the contrary, to the extent an expense, reimbursement or in-kind benefit provided to the Executive pursuant to this Agreement or otherwise constitutes a “deferral of compensation” within the meaning of Section 409A of the Code (a) the amount of expenses eligible for reimbursement or in-kind benefits provided to the Executive during any calendar year will not affect the amount of expenses eligible for reimbursement or in-kind benefits provided to the Executive in any other calendar year, (b) the reimbursements for expenses for which the Executive is entitled to be reimbursed shall be made on or before the last day of the calendar year following the calendar year in which the applicable expense is incurred, and (c) the right to payment or reimbursement or in-kind benefits hereunder may not be liquidated or exchanged for any other benefit.

18.Section 280G. Notwithstanding any other provision of this Agreement or the terms of any other agreement, award or plan, if any payment to or for the benefit of the Executive, whether paid or payable pursuant to the terms of this Agreement or otherwise (each, a “Payment,” and collectively, the “Total Payments”), would be subject (in whole or in part) to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then the Total Payments shall be reduced to the minimum extent necessary to avoid the imposition of the Excise Tax on the Total Payments, but only if (i) the net amount of such Total Payments, as so reduced, is greater than or equal to (ii) the net amount of such Total Payments without such reduction (in each case, after subtracting the expected federal, state and local taxes on such Total Payments and after taking into account the phase out of itemized deductions and personal exemptions attributable to such Total Payments). The reduction of the Total Payments contemplated in this paragraph will be implemented by determining the Parachute Payment Ratio (as defined below), as determined in good faith by the Company, for each Payment and then reducing the Total Payments in order beginning with the Payment with the highest Parachute Payment Ratio. For Payments with the same Parachute Payment Ratio, such Payments will be reduced based on the time of payment of such Payments, with the latest Payments reduced first. For Payments with the same Parachute Ratio and the same time of payment, each such Payment will be reduced proportionately. For purposes hereof, the term “Parachute Payment Ratio” shall mean a fraction, (x) the numerator of which is the value of the applicable Total Payment (as calculated for purposes of Section 280G of the Code), and (y) the denominator of which is the intrinsic (i.e., economic) value of such Total Payment. For the avoidance of doubt, to the extent any payments or benefits covered by this Section 18 constitute “nonqualified deferred compensation” subject to Section 409A of the Code, any reduction contemplated under this Section 18 will be effected in a manner intended to comply with Section 409A of the Code.

This Agreement has been executed and delivered on the date first above written.

GRIID INFRASTRUCTURE INC.

By:

Name:

Title:

EXECUTIVE

Appendix A

GRIID INFRASTRUCTURE, INC.

Confidentiality, Intellectual Property Assignment and

Restrictive Covenant Agreement (the “Agreement”)

In consideration and as a condition of my service relationship, whether as an employee, consultant, advisor or otherwise (collectively, “Service Relationship”) with GRIID Infrastructure, Inc. or any of its current or future parents, subsidiaries or affiliates (collectively, the “Company”), I agree as follows:

1. Confidential Information.

(a) I agree that all information, whether or not in writing, concerning the Company’s business, technology, business relationships or financial affairs which the Company has not released to the general public (collectively, “Confidential Information”) is and will be the exclusive property of the Company. Confidential Information also includes information received in confidence by the Company from its customers or suppliers or other third parties. Confidential Information may include, without limitation, information on finance, structure, business plans, employee performance, staffing, compensation of others, research and development, operations, manufacturing and marketing, strategies, customers, files, keys, certificates, passwords and other computer information, as well as information that the Company receives from others under an obligation of confidentiality.

(b) I will not, at any time, without the Company’s prior written permission, either during or after my Service Relationship, disclose any Confidential Information to anyone outside of the Company, or use or permit to be used any Confidential Information for any purpose other than the performance of my duties as a service provider of the Company. I will cooperate with the Company and use my best efforts to prevent the unauthorized disclosure of all Confidential Information. I will deliver to the Company all copies of Confidential Information in my possession or control upon the earlier of a request by the Company or termination of my Service Relationship.

(c) Notwithstanding the foregoing, pursuant to 18 U.S.C. Section 1833(b), I shall not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that: (1) is made in confidence to a Federal, State, or local government official, either directly or indirectly, or to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law; or (2) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal.

(d) Notwithstanding anything herein to the contrary, I understand that this Agreement will not (1) prohibit me from making reports of possible violations of federal law or regulation to any governmental agency or entity in accordance with the provisions of and rules promulgated under Section 21F of the Securities Exchange Act of 1934, as amended, or Section 806 of the Sarbanes-Oxley Act of 2002, or of any other whistleblower protection provisions of federal law or regulation, or (2) require notification or prior approval by the Company of any such report; provided that, I am not authorized to disclose communications with counsel that were made for the purpose of receiving legal advice or that contain legal advice or that are protected by the attorney work product or similar privilege.

2. Developments.

(a) All inventions, know-how, knowledge, discoveries, data, technology, designs, innovations and improvements (whether or not patentable and whether or not copyrightable), which are created, invented, developed, conceived, discovered or reduced to practice by me, solely or jointly with others, in the course

of my Service Relationship with the Company (the “Inventions”) are the sole property of the Company, and the Company has the right to use any Inventions to develop products, to effect its development, marketing and sales activities and to otherwise freely use such Inventions in the conduct of its business operations. I agree to assign and hereby assign to the Company all of my rights, title and interest in any Inventions and any and all related patents, copyrights, trademarks, trade names, and other industrial and intellectual property rights and applications therefor, in the United States and elsewhere, and appoints any officer of the Company as my duly authorized attorney to execute, file, prosecute and protect the same before any government agency, court or authority. Upon the request of the Company and at the Company’ s expense, I will execute such further assignments, documents and other instruments as may be necessary or desirable to fully and completely assign all Inventions to the Company and to assist the Company in applying for, obtaining and enforcing patents or copyrights or other rights in the United States and in any foreign country with respect to any Invention.

(b) I will promptly disclose to the Company all Inventions and will maintain adequate and current written records (in the form of notes, sketches, drawings or in such form as may be specified by the Company) to document the conception and/or first actual reduction to practice of any Invention. Such written records are and remain the sole property of the Company at all times.

(c) If any Invention is not the property of the Company by operation of law, this Agreement or otherwise, I will, and I hereby do, assign to the Company all right, title and interest in such Invention, without further consideration, and will assist the Company and its nominees in every way, at the Company’ s expense, to secure, maintain and defend the Company’ s rights in such Invention. I will sign all instruments necessary for the filing and prosecution of any applications for, or extension or renewals of, letters patent (or other intellectual property registrations or filings) of the United States or any foreign country which the Company desires to file and relates to any Invention. I hereby irrevocably designate and appoint the Company and its duly authorized officers and agents as my agent and attorney-in-fact (which designation and appointment shall be deemed coupled with an interest and shall survive my death or incapacity), to act on my behalf to execute and file any such applications, extensions or renewals and to do all other lawfully permitted acts to further the prosecution and issuance of such letters patent, other intellectual property registrations or filings or such other similar documents with the same legal force and effect as if executed by me.

(d) I further acknowledge that all original works of authorship which are made by me (solely or jointly with others) in the course of the performance of my Service Relationship and which are protectable by copyright are "works made for hire," as that term is defined in the United States Copyright Act. To the extent any such works of authorship do not qualify as “works made for hire,” as that term is defined in the United States Copyright Act, then I will, and I hereby do, assign to the Company all right, title and interest, including copyrights, in such works of authorship.

(e) Attached hereto as Exhibit I is a list of all inventions, modifications, discoveries, designs, developments, improvements, processes, software programs, works of authorship, documentation, formulae, data, techniques, know-how, secrets or intellectual property rights or any interest therein made by me prior to the commencement of my Service Relationship (collectively, the “Prior Inventions”), which belong to me and which relate directly to the business of the Company and which are not assigned to the Company hereunder; (or if no such list is attached, I represent that there are no such Prior Inventions that relate to the business of the Company). If, in the course of my Service Relationship, I incorporate into a Company product, process or machine a Prior Invention owned by me or in which I have an interest, the Company is hereby granted and has a non-exclusive, royalty-free, irrevocable, perpetual, transferable, worldwide license to make, have made, modify, use, sell and otherwise exploit such Prior Invention as part of or in connection with such product, process or machine, or any enhancements or extensions thereof.

3. Nondisparagement and Cooperation. During my Service Relationship and at all times thereafter:

(a) I will not, directly or indirectly, disparage or otherwise take any action that could reasonably be expected to harm the reputation of the Company or any of its products or practices, directors, officers, employees, stockholders, partners or agents. This Section shall not, however, prohibit the Executive from testifying truthfully as a witness in any court proceeding or governmental investigation.

(b) I will cooperate with the Company and its counsel with respect to litigation, investigations, audits, governmental proceedings and all similar matters that relate to events occurring, in whole or in part, during my Service Relationship. The Executive will render such cooperation in a timely manner on reasonable notice from the Company. Following my Service Relationship, the Company will exercise reasonable efforts to limit and schedule the need for my cooperation so as not to materially interfere with my other professional obligations.

4. Survival and Assignment by the Company.

(a) I understand that my obligations under this Agreement will continue in accordance with its express terms regardless of any changes in my title, position, duties, salary, compensation or benefits or other terms and conditions of my Service Relationship. I further understand that my obligations under this Agreement will continue following the termination of my Service Relationship regardless of the manner of such termination and will be binding upon my heirs, executors and administrators.

(b) I acknowledge that the current and future parents, subsidiaries or affiliates of the Company are intended third party beneficiaries of this Agreement. I agree that the Company may assign this Agreement to a successor to or acquirer of any portion of its business or assets, without my consent.

5. Severability. This Agreement shall be interpreted in such a manner as to be effective and valid under applicable law, but if any provision hereof shall be prohibited or invalid under any such law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating or nullifying the remainder of such provision or any other provisions of this Agreement. If any one or more of the provisions contained in this Agreement shall for any reason be held to be excessively broad as to duration, geographical scope, activity or subject, such provision(s) shall be construed by limiting and reducing it so as to be enforceable to the maximum extent permitted by applicable law.

6. No Service Relationship Obligation. I understand that this Agreement does not create an obligation on the Company or any other person to continue my Service Relationship. I acknowledge that my Service Relationship with the Company is at-will and therefore may be terminated by the Company or me at any time and for any reason, with or without cause.

7. Non-Solicitation and Non-Competition.

(a) I agree that during the period of my Service Relationship and for six months after my Service Relationship ends for any reason (whether the relationship is terminated by me or the Company, with or without cause), I will not do any of the following, either directly or indirectly, except on behalf of the Company:

(1) solicit, induce, encourage, or participate in soliciting, inducing, or encouraging any employee, contractor, investor, lender, partner or supplier of the Company to terminate or alter his, her or its relationship with the Company;

(2) hire, employ, or engage, or attempt to hire, employ, or engage any person employed or engaged by the Company (or who was employed or engaged by the Company within the preceding 12 months) or discuss any potential employment or engagement with such person, even if I did not initiate the discussion or seek out the contact;

(3) solicit, perform, provide or attempt to perform or provide Competitive Services to any Customer or Potential Customer (as those terms are defined below); or

(4) establish, invest in, promote or perform services for another enterprise engaged in Competitive Services in any state where the Company currently mines bitcoin; provided, however, that my ownership of one percent or less of the outstanding publicly traded capital stock of any company will not violate this paragraph, provided that I have no other relationship with such company. I acknowledge that the Company’s business and the market for its products is global in scope.

(b) For purposes of this Agreement:

(1) “Competitive Services” means services that are competitive with or similar to services of the Company, or services that the Company has under development or that are the subject of active planning during my Service Relationship.

(2) “Customer or Potential Customer” means any person or entity who or which, at any time during the preceding two years (while I am still employed or engaged by the Company) or during the two years preceding the end of my Service Relationship (once I am no longer employed or engaged by the Company): (i) contracted for, was billed for or received from the Company any product, service or process; or (ii) was solicited by the Company in an effort in which I was involved, or of which I was or should have been aware, concerning any product, service or process of the Company.

8. Legal and Equitable Remedies.

(a) I agree that it may be impossible to assess the damages caused by my violation of this Agreement or any of its terms. I agree that any threatened or actual violation of this Agreement or any of its terms will constitute immediate and irreparable injury to the Company for which there would be no adequate remedy at law and the Company shall have the right to enforce this Agreement and any of its provisions by injunction, specific performance or other equitable relief, without bond and without prejudice to any other rights and remedies that the Company may have for a breach or threatened breach of this Agreement.

(b) I agree that if the Company is successful in whole or in part in any legal or equitable action against me under this Agreement, the Company shall be entitled to payment of all costs, including reasonable attorney’s fees, from me.

(c) If I am found to have been in breach of Section 7 of this Agreement, the restrictions described in that section will be extended by the period equal to the length of time I was in breach of that section.

9. Reasonableness of Restrictions. I have read this entire Agreement, understand it and have had the opportunity to review it with counsel. I agree that this Agreement does not prevent me from earning a living or pursuing my career and that I have the ability to secure other non-competitive employment using my marketable skills. I agree that the restrictions contained in this Agreement, including the duration and scope thereof, are reasonable, proper and necessary to protect the Company’s legitimate business interests, including without limitation the Company’s intellectual property rights, Confidential Information and goodwill. I represent and agree that I am entering into this Agreement freely and with knowledge of its contents with the intent to be bound by the Agreement and the restrictions contained in it.

10. Notification of New Employer. In the event that I leave the employ of the Company, I authorize the Company to provide notice of my obligations under this Agreement to my subsequent employer and to any other entity or person to whom I provide or propose to provide services.

11. Governing Law. This Agreement and actions taken hereunder shall be governed by and construed in accordance with the laws of the State of Delaware, applied without regard to conflict of law principles.

[The remainder of this page is intentionally left blank]

IN WITNESS WHEREOF, the undersigned has executed this Confidentiality, Intellectual Property Assignment and Restrictive Covenant Agreement as of the date set forth below.

Signed: Date:

(sign name above)

Print Name:

Exhibit I

Prior Inventions

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=grdi_RedeemableWarrantsExercisableForSharesOfCommonStockAtAnExercisePriceOf1150PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=grdi_CommonStockParValue00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

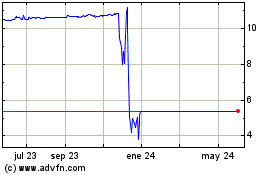

Adit EdTech Acquisition (AMEX:ADEX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

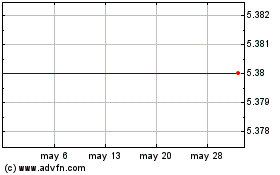

Adit EdTech Acquisition (AMEX:ADEX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024