false

0001464790

0001464790

2024-10-13

2024-10-13

0001464790

RILY:CommonStockParValue0.0001PerShareMember

2024-10-13

2024-10-13

0001464790

RILY:DepositarySharesEachRepresenting11000thInterestIn6.875SeriesCumulativePerpetualPreferredShareParValue0.0001PerShareMember

2024-10-13

2024-10-13

0001464790

RILY:DepositarySharesEachRepresenting11000thFractionalInterestIn7.375ShareOfSeriesBCumulativePerpetualPreferredStockMember

2024-10-13

2024-10-13

0001464790

RILY:Sec6.375SeniorNotesDue2025Member

2024-10-13

2024-10-13

0001464790

RILY:Sec5.00SeniorNotesDue2026Member

2024-10-13

2024-10-13

0001464790

RILY:Sec5.50SeniorNotesDue2026Member

2024-10-13

2024-10-13

0001464790

RILY:Sec6.50SeniorNotesDue2026Member

2024-10-13

2024-10-13

0001464790

RILY:Sec5.25SeniorNotesDue2028Member

2024-10-13

2024-10-13

0001464790

RILY:Sec6.00SeniorNotesDue2028Member

2024-10-13

2024-10-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 13, 2024

B. Riley FinanCIAl,

Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-37503 |

|

27-0223495 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

11100 Santa Monica Blvd., Suite 800

Los Angeles, CA 90025

(310) 966-1444

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

RILY |

|

Nasdaq Global Market |

| Depositary Shares (each representing a 1/1000th interest in a 6.875% Series A Cumulative Perpetual Preferred Share, par value $0.0001 per share) |

|

RILYP |

|

Nasdaq Global Market |

| Depositary Shares, each representing a 1/1000th fractional interest in a 7.375% share of Series B Cumulative Perpetual Preferred Stock |

|

RILYL |

|

Nasdaq Global Market |

| 6.375% Senior Notes due 2025 |

|

RILYM |

|

Nasdaq Global Market |

| 5.00% Senior Notes due 2026 |

|

RILYG |

|

Nasdaq Global Market |

| 5.50% Senior Notes due 2026 |

|

RILYK |

|

Nasdaq Global Market |

| 6.50% Senior Notes due 2026 |

|

RILYN |

|

Nasdaq Global Market |

| 5.25% Senior Notes due 2028 |

|

RILYZ |

|

Nasdaq Global Market |

| 6.00% Senior Notes due 2028 |

|

RILYT |

|

Nasdaq Global Market |

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On October 14, 2024, B. Riley Financial, Inc.,

a Delaware corporation (the “Company”), announced that the Company and BR Financial Holdings, LLC, a Delaware limited

liability company and a wholly owned subsidiary of the Company (“BR Financial”), entered into an equity purchase agreement,

dated October 13, 2024 (the “Equity Purchase Agreement”), by and among OCM SSF III Great American PT, L.P.,

a Delaware limited partnership (“Investor 1”), Opps XII Great American Holdings, LLC, a Delaware limited liability

company (“Investor 2”), and VOF Great American Holdings, L.P., a Delaware limited partnership (“Investor 3,”

and, together with Investor 1 and Investor 2, the “Investors”), Great American Holdings, LLC, a Delaware limited liability

company and a wholly owned subsidiary of the Company (“Great American NewCo”), and certain other parties identified

therein, with respect to the ownership of Great American NewCo by the Investors and the Company. The Investors are affiliates of Oaktree

Capital Management, L.P.

Pursuant to, and subject to the terms and conditions

set forth in, the Equity Purchase Agreement, prior to the closing (the “Closing”) of the transactions contemplated

by the Equity Purchase Agreement (the “Transactions”) BR Financial and its Affiliates will conduct an internal reorganization

and will contribute all of the interests in the Company’s Appraisal and Valuation Services, Retail, Wholesale & Industrial Solutions

and Real Estate businesses (collectively, the “Great American Group”) to Great American NewCo. At the Closing, (i) the

Investors will receive (a) all of the outstanding class A preferred limited liability units of Great American NewCo (which will have a

7.5% cash coupon and a 7.5% payment-in-kind coupon) (the “Class A Preferred Units”) and (b) common limited liability

units of Great American NewCo (the “Common Units”) representing 52.591% of the issued and outstanding common limited

liability units in Great American NewCo for a purchase price of approximately $203 million (which will have an initial liquidation preference

of approximately $203 million). BR Financial will retain (a) 93.182% of the issued and outstanding class B preferred limited liability

company units of Great American NewCo (which will have a 2.3% payment-in-kind coupon and an initial aggregate liquidation preference of

approximately $183 million) (the “Class B Preferred Units”) and (b) 44.177% of the issued and outstanding Common

Units. The remaining 6.818% of issued and outstanding Class B Preferred Units and 3.232% of issued and outstanding Common Units will be

held by certain minority investors. The investors in Great American NewCo will also be entitled to certain quarterly tax distributions

pursuant to the Great American NewCo LLCA (defined below).

The Equity Purchase Agreement contains representations,

warranties and covenants that are customary for a transaction of this type, including, among others, covenants by BR Financial to use

reasonable best efforts to conduct the business of the Great American Group in the ordinary course between execution of the Equity Purchase

Agreement and closing of the Transactions.

The Transactions are subject to the satisfaction

of customary closing conditions, including (i) the receipt of required regulatory approvals, (ii) the absence of any law or

order prohibiting the consummation of the Transactions, (iii) the accuracy of the representations and warranties of each party, and

(iv) performance and compliance by each party with the covenants, agreements and other obligations of such party pursuant to the

Equity Purchase Agreement, subject to certain materiality thresholds.

The Equity Purchase Agreement contains certain

customary termination rights, including the right of either BR Financial or the Investors to terminate the Equity Purchase Agreement if

the transaction is not consummated on or prior to February 10, 2025, subject to an automatic extension of 60 days in the event that the

required regulatory approvals have not yet been obtained.

In connection with the Equity Purchase Agreement,

at the Closing, (i) BR Financial, the Investors and the other minority investors will enter into an Amended and Restated Limited Liability

Company Agreement of Great American NewCo (the “Great American NewCo LLCA”), (ii) BR Financial and Great American NewCo

will enter into a Transition Services Agreement, pursuant to which BR Financial will provide certain transition services to Great American

NewCo relating for the Great American Group for a period of up to one year from the Closing, subject to certain exceptions, and (iii) an

affiliate of the Company, Great American NewCo and certain subsidiary guarantors of Great American NewCo will enter into a credit agreement,

pursuant to which an affiliate of the Company, as lender, will provide to Great American NewCo, as borrower, a first lien secured revolving

credit facility of up to $25 million for general corporate purposes, subject to the terms and conditions set forth therein.

The foregoing summary of the Equity Purchase

Agreement and the Transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by,

the full text of the Equity Purchase Agreement, which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2024.

Under the Great American NewCo LLCA, Great

American NewCo will initially have a five-member board of directors that will oversee the day-to-day management of Great American NewCo,

subject to certain approval rights reserved for the Investors and/or BR Financial, as applicable. The Investors will be entitled to appoint

a majority of the directors of the board for so long as they collectively hold at least 25% of their combined amount of Common Units owned

immediately following the Closing. The Great American NewCo LLCA will also contain certain protections for BR Financial, including, but

not limited to, requiring BR Financial approval for certain fundamental actions. The Investors will have certain drag-along rights following

the second-year anniversary of the Closing Date and certain call rights exercisable starting on the fifth-year anniversary of the Closing

Date. The Great American NewCo LLCA sets forth distribution mechanics pursuant to which Great American NewCo will make distributions in

cash and payment-in-kind at any time the board of directors may authorize, with the Class A Preferred Units having priority in any such

distribution over Class B Preferred Units. In addition, the Great American NewCo LLCA will contain certain transfer restrictions and other

transfer rights and obligations that apply to BR Financial, the Investors and other unitholders, as applicable, in certain circumstances.

Item 7.01 Regulation FD Disclosure.

On October 14, 2024, the Company issued a press

release announcing the execution of the Equity Purchase Agreement and the Transactions contemplated thereby. A copy of such press release

is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 7.01 shall not

be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any registration statement

or other filing under the Securities Act of 1933, as amended, or the Exchange Act, except in the event that the Company expressly states

that such information is to be considered filed under the Exchange Act or incorporates it by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Cautionary Language Regarding Forward-looking

statements

This Current Report on Form 8-K contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical

fact are forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors

which may cause Company’s performance or achievements to be materially different from any expected future results, performance,

or achievements. Forward-looking statements speak only as of the date they are made and the Company assumes no duty to update forward

looking statements, except as required by law. Actual future results, performance or achievements may differ materially from historical

results or those anticipated depending on a variety of factors, some of which are beyond the control of the Company, including, but not

limited to, the occurrence of any event, change or other circumstances that could give rise to the termination of the Equity Purchase

Agreement; the inability to consummate the Transactions contemplated therein or the failure to satisfy other conditions to completion

of the proposed Transactions; potential litigation relating to the Transactions that could be instituted in connection with the Equity

Purchase Agreement; and the risk that the Transactions will not be consummated in a timely manner, if at all. In addition to these

factors, investors should review the “Risk Factors” set forth in B. Riley’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023 and other filings with the United States Securities and Exchange Commission, which identify important factors,

though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in the forward-looking

statements in this communication.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

B. Riley Financial, Inc. |

| |

|

|

| |

By |

/s/ Bryant Riley |

| |

Name: |

Bryant Riley |

| |

Title: |

Chairman and Co-Chief Executive Officer |

Date: October 15, 2024

Exhibit 99.1

B. Riley Financial to Establish Partnership with

Oaktree in the Great American Group Businesses

Concludes Previously Announced Review of Strategic

Alternatives for the Great American Group Businesses

LOS ANGELES, Oct. 14, 2024 – B. Riley

Financial, Inc. (Nasdaq: RILY) (“B. Riley” and the "Company"), a diversified financial services platform, and funds

managed by Oaktree Capital Management, L.P. (“Oaktree”), have signed a definitive agreement (the “Agreement”)

to establish a partnership in Great American Holdings, LLC, a newly formed holding company (“Great American NewCo”).

Prior to the closing of the transactions contemplated

by the Agreement, B. Riley will undertake a pre-closing internal reorganization and will contribute all of the interests in B. Riley’s

Appraisal and Valuation Services, Retail, Wholesale & Industrial Solutions and Real Estate businesses (collectively known as the “Great

American Group”) to Great American NewCo.

At the closing of the transaction, B. Riley will receive

total consideration consisting of approximately $203 million in cash, subject to certain purchase price adjustments, Class B Preferred

Units of Great American NewCo with an initial aggregate liquidation preference of approximately $183 million, and Class A Common Units

of NewCo representing approximately 47% of the total outstanding common units. Oaktree will acquire Class A Preferred Units of Great American

NewCo with an initial liquidation preference of approximately $203 million, as well as Class A Common Units representing approximately

53% of the aggregate amount of the issued and outstanding Class A Common Units of Great American NewCo, in exchange for cash consideration

of approximately $203 million (the “Proposed Transaction”), implying a total enterprise value for the Great American NewCo

of $386 million. The transaction has been approved by the Board of Directors of the Company and is subject to the receipt of required

regulatory approvals and other customary closing conditions. It is expected to close in the fourth quarter of 2024.

Bryant Riley, Chairman and Co-Chief Executive Officer

of B. Riley, said, “I am pleased to be partnering with Oaktree given its stellar track record and reputation as one of the world’s

leading asset managers. We believe Oaktree’s scale and expertise in alternative investments and their strength as a capital provider,

combined with the Great American Group’s leading position as a provider of asset disposition, financial advisory and real estate

advisory services, will prove complementary as we join forces to deliver financial products and services to better serve our clients.”

Mr. Riley continued, “As we communicated last

month, this transaction is an important step in our plan to reduce our debt while reinvesting in our core financial services businesses. We

are very excited about this new partnership we established with Oaktree in the Great American Group as it will enable meaningful debt

reduction while retaining significant equity upside in the business with a highly capable new partner that will increase its future growth

prospects."

“Great American offers an exciting investment

opportunity for Oaktree in a leading valuation appraisal, asset disposition and real estate advisory platform. We are eager to provide

both capital and our extensive operating expertise to support the future growth of the business,” said Nick Basso, Managing Director

at Oaktree.

“As an experienced capital provider to the financial

services sector, we are thrilled to partner with B. Riley and Great American’s talented leadership team. We look forward to bringing

our resources and relationships to support Great American’s growth as an independent platform,” said Thomas Casarella, Managing

Director at Oaktree.

Advisors

Moelis & Company LLC served as the exclusive financial

advisor to B. Riley, and Sullivan & Cromwell LLP served as legal advisor to B. Riley. Wachtell, Lipton, Rosen & Katz served

as legal advisor to Oaktree.

About B. Riley Financial

B. Riley Financial is a diversified financial services

platform that delivers tailored solutions to meet the strategic, operational, and capital needs of its clients and partners. B. Riley

leverages cross-platform expertise to provide clients with full service, collaborative solutions at every stage of the business life cycle.

Through its affiliated subsidiaries, B. Riley provides end-to-end financial services across investment banking, institutional brokerage,

private wealth and investment management, financial consulting, corporate restructuring, operations management, risk and compliance, due

diligence, forensic accounting, litigation support, appraisal and valuation, auction, and liquidation services. B. Riley opportunistically

invests to benefit its shareholders, and certain affiliates originate and underwrite senior secured loans for asset-rich companies. B.

Riley refers to B. Riley Financial, Inc. and/or one or more of its subsidiaries or affiliates. For more information, please visit www.brileyfin.com.

About Oaktree

Oaktree is a leader among global investment managers specializing in alternative

investments, with $193 billion in assets under management as of June 30, 2024. The firm emphasizes an opportunistic, value-oriented and

risk-controlled approach to investments in credit, private equity, real estate and listed equities. The firm has over 1,200 employees

and offices in 23 cities worldwide. For additional information, please visit Oaktree’s website at http://www.oaktreecapital.com/.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical

fact are forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors

which may cause the Company’s performance or achievements to be materially different from any expected future results, performance,

or achievements. Forward-looking statements speak only as of the date they are made and the Company assumes no duty to update forward

looking statements, except as required by law. Actual future results, performance or achievements may differ materially from historical

results or those anticipated depending on a variety of factors, some of which are beyond the control of the Company, including, but not

limited to, the occurrence of any event, change or other circumstances that could give rise to the termination of the Agreement;

the inability to consummate the transactions contemplated therein or the failure to satisfy other conditions to completion of the Proposed

Transaction; potential litigation relating to the Proposed Transaction that could be instituted in connection with the Agreement;

and the risk that the Proposed Transaction will not be consummated in a timely manner, if at all. In addition to these factors, we encourage

you to review the “Risk Factors” set forth in B. Riley’s Annual Report on Form 10-K for the fiscal year ended December

31, 2023 and other filings with the United States Securities and Exchange Commission, which identify important factors, though not necessarily

all such factors, that could cause future outcomes to differ materially from those set forth in the forward-looking statements in this

communication.

Contacts

B. Riley

Investors

ir@brileyfin.com

Media

press@briley.com

v3.24.3

Cover

|

Oct. 13, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 13, 2024

|

| Entity File Number |

001-37503

|

| Entity Registrant Name |

B. Riley FinanCIAl,

Inc.

|

| Entity Central Index Key |

0001464790

|

| Entity Tax Identification Number |

27-0223495

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

11100 Santa Monica Blvd.

|

| Entity Address, Address Line Two |

Suite 800

|

| Entity Address, City or Town |

Los Angeles

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90025

|

| City Area Code |

310

|

| Local Phone Number |

966-1444

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

RILY

|

| Security Exchange Name |

NASDAQ

|

| Depositary Shares (each representing a 1/1000th interest in a 6.875% Series A Cumulative Perpetual Preferred Share, par value $0.0001 per share) |

|

| Title of 12(b) Security |

Depositary Shares (each representing a 1/1000th interest in a 6.875% Series A Cumulative Perpetual Preferred Share, par value $0.0001 per share)

|

| Trading Symbol |

RILYP

|

| Security Exchange Name |

NASDAQ

|

| Depositary Shares, each representing a 1/1000th fractional interest in a 7.375% share of Series B Cumulative Perpetual Preferred Stock |

|

| Title of 12(b) Security |

Depositary Shares, each representing a 1/1000th fractional interest in a 7.375% share of Series B Cumulative Perpetual Preferred Stock

|

| Trading Symbol |

RILYL

|

| Security Exchange Name |

NASDAQ

|

| 6.375% Senior Notes due 2025 |

|

| Title of 12(b) Security |

6.375% Senior Notes due 2025

|

| Trading Symbol |

RILYM

|

| Security Exchange Name |

NASDAQ

|

| 5.00% Senior Notes due 2026 |

|

| Title of 12(b) Security |

5.00% Senior Notes due 2026

|

| Trading Symbol |

RILYG

|

| Security Exchange Name |

NASDAQ

|

| 5.50% Senior Notes due 2026 |

|

| Title of 12(b) Security |

5.50% Senior Notes due 2026

|

| Trading Symbol |

RILYK

|

| Security Exchange Name |

NASDAQ

|

| 6.50% Senior Notes due 2026 |

|

| Title of 12(b) Security |

6.50% Senior Notes due 2026

|

| Trading Symbol |

RILYN

|

| Security Exchange Name |

NASDAQ

|

| 5.25% Senior Notes due 2028 |

|

| Title of 12(b) Security |

5.25% Senior Notes due 2028

|

| Trading Symbol |

RILYZ

|

| Security Exchange Name |

NASDAQ

|

| 6.00% Senior Notes due 2028 |

|

| Title of 12(b) Security |

6.00% Senior Notes due 2028

|

| Trading Symbol |

RILYT

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_DepositarySharesEachRepresenting11000thInterestIn6.875SeriesCumulativePerpetualPreferredShareParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_DepositarySharesEachRepresenting11000thFractionalInterestIn7.375ShareOfSeriesBCumulativePerpetualPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec6.375SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec5.00SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec5.50SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec6.50SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec5.25SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RILY_Sec6.00SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

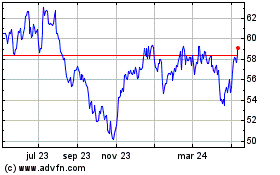

Amplify Video Game Tech ... (AMEX:GAMR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

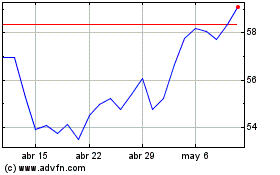

Amplify Video Game Tech ... (AMEX:GAMR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024