Market Vectors-Global Alternative Energy ETF and Market Vectors-Russia ETF Declared Effective by Securities and Exchange Commiss

10 Abril 2007 - 10:46AM

PR Newswire (US)

NEW YORK, April 10 /PRNewswire/ -- New York-based investment

manager Van Eck Global today announced that the Securities and

Exchange Commission (SEC) has declared effective the prospectus for

Market Vectors-Global Alternative Energy ETF and Market

Vectors-Russia ETF as of April 9, 2007. The new Market Vectors ETFs

are expected to be launched on the New York Stock Exchange later in

the second quarter of 2007. Options are expected to be available on

both ETFs. Market Vectors-Global Alternative Energy ETF (NYSE:GEX)

will seek to replicate as closely as possible, before fees and

expenses, the price and yield performance of the Ardour Global

Index(SM) (Extra Liquid) (AGIXL). The index is published by Ardour

Global Indexes(SM), LLC, and is calculated by Dow Jones Indexes. It

includes the stocks of 30 publicly traded companies engaged in the

entire chain of alternative energy production, including

alternative energy fuels and resources (solar, wind, bio-fuels,

water and geothermal), environmental technologies, energy

efficiency and enabling technologies. Market Vectors-Russia ETF

(NYSE:RSX) is the first and only Russia ETF listed in the U.S. It

will seek to replicate as closely as possible, before fees and

expenses, the price and yield performance of the DAXglobal(R)

Russia+ Index (DXRPUSP). This index is calculated and maintained by

Deutsche Borse AG and is comprised of the stocks of 30 publicly

traded companies domiciled in Russia and traded on global

exchanges. Founded in 1955, Van Eck Global was among the first U.S.

money managers helping investors achieve greater diversification

through global investing. As of February 28, 2007, the company

managed over $4.8 billion in assets for individuals, insurers and

institutional investors. The two new ETFs will join three other Van

Eck Market Vectors ETFs already in the market: Environmental

Services (AMEX:EVX). Gold Miners (AMEX:GDX) and Steel (AMEX:SLX).

About Ardour Global Indexes(SM), LLC Ardour Global Indexes(SM), LLC

was founded in 2005 for the express purpose of developing

benchmarking tools for the global alternative energy industry. It

is a partnership between Ardour Capital Investments(SM), a premier

investment bank specializing in alternative energy finance, and

S-Network Energy Technologies(SM), LLC, a developer of indexes and

investment products focused on both traditional and alternative

energy. "Ardour Global Indexes(SM), LLC", "ARDOUR GLOBAL INDEX(SM)"

(Composite), ARDOUR COMPOSITE(SM)", "ARDOUR GLOBAL INDEX(SM) (Extra

Liquid)", "ARDOUR GLOBAL ALTERNATIVE ENERGY INDEXES(SM)", "ARDOUR

FAMILY(SM)", are service marks of Ardour Global Indexes(SM), LLC

and have been licensed for use by Van Eck Associates Corporation.

Market Vectors-Global Alternative Energy ETF is not sponsored,

endorsed, sold or promoted by Ardour Global Indexes(SM), LLC and

Ardour Global Indexes(SM), LLC makes no representation regarding

the advisability of investing in Market Vectors-Global Alternative

Energy ETF. The Ardour Global Alternative Energy Index(SM), is

calculated by Dow Jones Indexes. Van Eck's Market Vectors-Global

Alternative Energy ETF, based on the Ardour Global Index(SM) (Extra

Liquid), is not sponsored, endorsed, sold or promoted by Dow Jones

Indexes, and Dow Jones Indexes makes no representation regarding

the advisability of investing in such product(s). About Deutsche

Borse AG Deutsche Borse Group offers more than a marketplace for

trading shares and other securities. It is a transaction services

provider with advanced technology to afford companies and investors

access to global capital markets. Deutsche Borse has a broader

basis than any of its competitors. Its product and services mix

cover the entire process chain: securities and derivatives trading,

transaction settlement, provision of market information as well as

the development and operation of electronic trading systems. With

its process-oriented business model, Deutsche Borse increases

capital markets efficiency. Issuers benefit from low capital costs

and investors enjoy the advantages of high liquidity and low

transaction costs. The DAXglobal(R) Russia+ Index (DXRPUSP) is a

registered trademark of the Deutsche Borse AG which is licensed for

use by Van Eck Associates Corporation in connection with the Fund.

The ETF is not sponsored or endorsed by the Deutsche Borse and the

Deutsche Borse makes no warranty or representation as to the

accuracy and/or completeness of the Index or the results to be

obtained by any person from the use of the Index in connection with

the trading of the Fund. About Van Eck Global Founded in 1955, Van

Eck Associates Corporation was among the first U.S. money managers

helping investors achieve greater diversification through global

investing. Today, the firm continues its 50+ year tradition by

offering global investment choices in hard assets, emerging

markets, precious metals including gold, and other specialized

asset classes. Van Eck Global's investment products are designed

for investors seeking innovative choices for portfolio

diversification. They are often categorized in asset classes having

returns with low correlations to those of more traditional U.S.

equity and fixed income investments. Investors may call

1.888.MKT.VCTR or visit http://www.vaneck.com/etf for a free

prospectus or for the performance information current to the most

recent month end for each Market Vectors ETF. Investors should

consider the investment objective, risks and charges and expenses

carefully before investing. The prospectus contains this and other

information about each Market Vectors ETF. Please read the

prospectus carefully before investing. There are risks associated

with investing including the possible loss of principal.

DATASOURCE: Van Eck Global CONTACT: Mike MacMillan, , or Andrew

Schiff, of MacMillan Communications, +1-212-473-4442, for Van Eck

Global Web site: http://www.vaneck.com/etf

Copyright

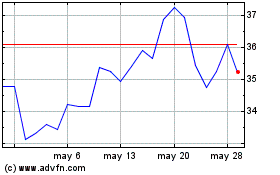

VanEck Gold Miners ETF (AMEX:GDX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

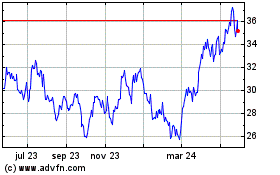

VanEck Gold Miners ETF (AMEX:GDX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024