false

0001120970

0001120970

2024-12-18

2024-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 18, 2024

COMSTOCK INC.

(Exact Name of Registrant as Specified in its Charter)

| |

|

|

|

Nevada

(State or Other

Jurisdiction of Incorporation)

|

001-35200

(Commission File Number)

|

65-0955118

(I.R.S. Employer

Identification Number)

|

117 American Flat Road, Virginia City, Nevada 89440

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: (775) 847-5272

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

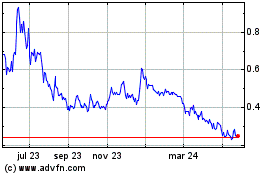

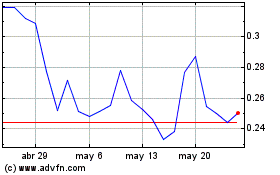

Common Stock, par value $0.000666 per share

|

LODE

|

NYSE AMERICAN

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 18, 2024, Comstock Inc. (the “Company”) executed a binding membership interest purchase agreement (the “Purchase Agreement”) with Mackay Precious Metals Inc. (“Mackay”) pursuant to which the Company sold all of Comstock’s right, title, and interest in and to Comstock Northern Exploration LLC, a Nevada limited liability company, and the Company’s 25% interest in and to Pelen Limited-Liability Company, a Nevada limited liability company, to Mackay, for an aggregate purchase price of $2,750,000, of which $1,300,000 was paid in cash, with another $450,000 due on or before February 15, 2025 and $1,000,000 to be paid in either cash or stock; plus a 1.5% royalty of Net Smelter Returns, pursuant to and as defined in the NSR Royalty Agreement by and between the Company and Mackay, also dated December 18, 2024 (the “Royalty Agreement”).

The foregoing summary of the terms of the Purchase Agreement and Royalty Agreement are not intended to be exhaustive and are qualified in their entirety by the terms of the Purchase Agreement and Royalty Agreement, as applicable, copies of which are attached hereto as Exhibits 10.1 and 10.2 respectively and are incorporated by reference herein.

A copy of the press release announcing the transactions contemplated by the Purchase Agreement and Royalty Agreement is attached as Exhibit 99.1 to the Form 8-K.

Item 1.02 Termination of a Material Definitive Agreement.

As previously disclosed, on June 30, 2023, the Company entered into a binding Mineral Exploration and Mining Lease Agreement (the “Lease Agreement”), with Mackay for certain owned or controlled fee tracts, patented mining claims, and unpatented mining claims located in Nevada and described in the Lease.

On December 18, 2024, the Company and Mackay mutually agreed to terminate the Lease Agreement subject to the terms of a lease termination agreement establishing their relative rights, duties, and obligation under the Lease Agreement up through and including the effective date of the lease termination agreement; and establishing their relative rights, duties, and obligations following the effective date of the lease termination agreement. An additional $500,000 in pro-rata lease expenses are also due on or before February 15, 2025.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits.

| |

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

COMSTOCK INC.

|

| |

|

|

|

Date: December 20, 2024

|

By:

|

/s/ Corrado De Gasperis

|

| |

|

Corrado De Gasperis

Executive Chairman and Chief Executive Officer

|

Exhibit 10.1

MEMBERSHIP INTEREST PURCHASE AGREEMENT

This Membership Interest Purchase Agreement (this “Agreement”), dated as of December 18, 2024 (the “Effective Date”), is entered into between Comstock Inc., a Nevada corporation (“Seller”), Mackay Precious Metals Inc., a Delaware corporation (“Buyer”).

RECITALS

WHEREAS, Seller owns all of the issued and outstanding membership interests, in Comstock Northern Exploration LLC, a Nevada limited liability company (“CNEL”), and 25% of the issued and outstanding membership interest in Pelen Limited-Liability Company, a Nevada limited liability company (“Pelen”) (such membership interests of CNEL and Pelen, the “Membership Interests”);

WHEREAS, CNEL owns or controls the property listed in Schedule A attached hereto and shown on Figure A1 (the “Properties”) and holds the third-party leases listed in Schedule B attached hereto (the “Leased Properties”);

WHEREAS, Pelen owns the Sutro Tunnel Company, the entity that owns or controls the Sutro Tunnel, which is a drainage tunnel connected to the Comstock Lode in Northern Nevada, beginning at Dayton, Nevada, and connecting 3.88 miles Northwest to the Savage mine in Virginia City, Nevada;

WHEREAS, for the sake of clarity, the Properties and Leased Properties exclude mining and non- mining properties owned by Comstock Mining LLC, Comstock Processing LLC, Northern Comstock LLC, Comstock Exploration and Development LLC, and Comstock Real Estate Inc., and personal property held by Comstock Inc.;

WHEREAS the Buyer intends to complete an initial public offering of its common shares or a reverse takeover or any other similar going public transaction such that its common shares, or securities exchanged for such common shares, become listed on a Canadian stock exchange (the “Public Listing”);

AND WHEREAS, Seller wishes to sell to Buyer, and Buyer wishes to purchase from Seller, the Membership Interests, subject to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS

The following terms have the meanings specified or referred to in this Article I:

“Affiliate” of a Person means any other Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such Person. The term “control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Additional Properties” has the meaning set forth in Section 5.07.

“Agreement” has the meaning set forth in the preamble.

“Ancillary Documents” means the Assignment; assignments of third-party leases relating to the Leased Properties set forth in Schedule C from Seller to CNEL, as necessary, including all work commitments and other obligations associated with the Leased Properties (specifically, these are the leases with Fred Garrett, James Obester, Railroad and Gold, Renegade and Sutro); estoppel certificates on all third-party leases that are to be assigned to CNEL (as detailed in Table C.2) relating to the Leased Properties; title and survey studies relating to the Properties, satisfactory to Buyer; the Royalty Agreement; and the Termination Agreement.

“Area of Interest” has the meaning set forth in Section 5.07.

“Assignment” has the meaning set forth in Section 2.03(b)(i).

“Business Day” means any day except Saturday, Sunday or any other day on which commercial banks located in Reno, Nevada are authorized or required by Law to be closed for business.

“Buyer” has the meaning set forth in the preamble.

“Buyer’s Notice” has the meaning set forth in Section 5.01(b).

“Closing” has the meaning set forth in Section 2.04.

“Closing Date” has the meaning set forth in Section 2.04.

“CNEL” has the meaning set forth in the recitals.

“Code” means the Internal Revenue Code of 1986, as amended.

“Conveyance Properties” has the meaning set forth in Section 5.09(d).

“CRMSS” has the meaning as set forth in Section 5.11

“Deductible” has the meaning set forth in Section 7.04(a).

“Direct Claim” has the meaning set forth in Section 7.05(c).

“Disclosure Schedules” means the Disclosure Schedules delivered by Seller and Buyer concurrently with the execution and delivery of this Agreement.

“Dollars or $” means the lawful currency of the United States.

“Drop Dead Date” has the meaning set forth in Section 8.01(b)(i).

“Effective Date” has the meaning set forth in the Preamble.

“Encumbrance” means means any lein, pledge, mortgage, deed of trust, security interest, charge, or other similar encumbrance.

“Escrow Agent” has the meaning set forth in Section 2.05.

“Fraud” means, with respect to a party, common law fraud involving an actual and intentional misrepresentation of a material existing fact with respect to any representation or warranty in Article III or Article IV, made by such party with actual knowledge of its falsity and made for the purpose of inducing the other party to act, and upon which the other party justifiably relies with resulting Losses. For the avoidance of doubt, “Fraud” shall not include any claim for equitable fraud, constructive fraud, promissory fraud, unfair dealings fraud, fraud by reckless or negligent misrepresentation or any tort based on negligence or recklessness.

“GAAP” means United States generally accepted accounting principles in effect from time to time.

“Governmental Authority” means any federal, state, local or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority (to the extent that the rules, regulations or orders of such organization or authority have the force of Law), or any arbitrator, court, or tribunal of competent jurisdiction.

“Governmental Order” means any order, writ, judgment, injunction, decree, stipulation, determination, or award entered by or with any Governmental Authority.

“Hazardous Materials” has the meaning set forth in Section 3.26.

“Ida Properties” has the meaning set forth in Section 5.09(d).

“Indemnified Party” has the meaning set forth in Section 7.04.

“Indemnifying Party” has the meaning set forth in Section 7.04.

“Insured Exception” has the meaning set forth in Section 5.01(b).

“Law” means any statute, law, ordinance, regulation, rule, code, order, constitution, treaty, common law, judgment, decree, other requirement, or rule of law of any Governmental Authority.

“Lease” means that certain Mineral Exploration and Mining Lease Agreement by and between Seller, as lessor, and Buyer, as lessee, dated June 30, 2023, a memorandum of which is recorded in the official records of Lyon County, Nevada as document number 671630 and in the official records of Storey County, Nevada as document number 137950.

“Leased Properties” has the meaning set forth in the recitals.

“Listed Issuer” means the publicly-listed company resulting from the Public Listing;

“Listed Issuer Shares” means the common shares or other listed securities of the Listed Issuer following the completion of the Public Listing;

“Losses” means actual out-of-pocket losses, damages, liabilities, costs, or expenses, including reasonable attorneys’ fees.

“Material Adverse Effect” means any event, occurrence, fact, condition or change that is materially adverse to (a) the business, results of operations, financial condition or assets of CNEL, or (b) the ability of Seller to consummate the transactions contemplated hereby; provided, however, that “Material Adverse Effect” shall not include any event, occurrence, fact, condition or change, directly or indirectly, arising out of or attributable to: (i) general economic or political conditions; (ii) conditions generally affecting the industries in which CNEL operates; (iii) any changes in financial, banking or securities markets in general, including any disruption thereof and any decline in the price of any security or any market index or any change in prevailing interest rates; (iv) acts of war (whether or not declared), armed hostilities or terrorism, or the escalation or worsening thereof; (v) any action required or permitted by this Agreement or any action taken (or omitted to be taken) with the written consent of or at the written request of Buyer; (vi) any matter of which Buyer is aware on the date hereof; (vii) any changes in applicable Laws or accounting rules (including GAAP) or the enforcement, implementation or interpretation thereof; (viii) the announcement, pendency or completion of the transactions contemplated by this Agreement, including losses or threatened losses of employees, customers, suppliers, distributors or others having relationships with CNEL; (ix) any natural or man-made disaster or acts of God; or (x) any epidemics, pandemics, disease outbreaks, or other public health emergencies.

“Material Agreements” has the meaning set forth in Section 3.15

“Membership Interests” has the meaning set forth in the recitals.

“Non-Compete Area” has the meaning set forth in Section 5.07.

“Non-Party Affiliates” has the meaning set forth in Section 9.15.

“Organizational Documents” means (a) in the case of a Person that is a corporation, its articles or certificate of incorporation and its by-laws, regulations or similar governing instruments required by the laws of its jurisdiction of formation or organization; (b) in the case of a Person that is a partnership, its articles or certificate of partnership, formation or association, and its partnership agreement (in each case, limited, limited liability, general or otherwise); (c) in the case of a Person that is a limited liability company, its articles or certificate of formation or organization, and its limited liability company agreement or operating agreement; and (d) in the case of a Person that is none of a corporation, partnership (limited, limited liability, general or otherwise), limited liability company or natural person, its governing instruments as required or contemplated by the laws of its jurisdiction of organization.

“Pelen” has the meaning as set forth in the recitals

“Permitted Exceptions” has the meaning set forth in Section 5.01(b).

“Permits” means all permits, licenses, franchises, approvals, authorizations, and consents required to be obtained from Governmental Authorities.

“Person” means an individual, corporation, partnership, joint venture, limited liability company, Governmental Authority, unincorporated organization, trust, association, or other entity.

“Privileged Communications” has the meaning set forth in Section 9.14(b).

“Properties” has the meaning set forth in the recitals.

“Public Listing” has the meaning set forth in the recitals to this Agreement;

“Purchase Price” has the meaning set forth in Section 2.02.

“Recorded Documents” has the meaning set forth in Section 5.01(b).

“Representative” means, with respect to any Person, any and all managers, officers, employees, consultants, financial advisors, counsel, accountants and other agents of such Person.

“Royalty Agreement” means a mutually acceptable 1.5% net smelter returns royalty agreement for the benefit of Seller. Such Royalty Agreement to cover all mineral production of any kind from the Properties, including properties controlled by the third-party leases, on a net smelter returns basis, and in addition to any other royalties recorded with the property titles or due to the third-party lessors.

“Royalty Interests” has the meaning set forth in Section 5.10.

“Schedule Supplement” has the meaning set forth in Section 5.02.

“Seller” has the meaning set forth in the preamble.

“Seller Group” has the meaning set forth in Section 9.14(a)(i).

“Seller Group Law Firm” has the meaning set forth in Section 9.14(a)(i).

“Title Commitment” has the meaning set forth in Section 5.01(b).

“Title Insurer” has the meaning set forth in Section 5.01(b).

“Title Objections” has the meaning as set forth in Section 5.01(b)

“Taxes” means all federal, state, local, foreign and other income, gross receipts, sales, use, production, ad valorem, transfer, franchise, registration, profits, license, lease, service, service use, withholding, payroll, employment, unemployment, estimated, excise, severance, environmental, stamp, occupation, premium, property (real or personal), real property gains, windfall profits, customs, duties or other taxes, fees, assessments or charges of any kind whatsoever, together with any interest, additions or penalties with respect thereto and any interest in respect of such additions or penalties.

“Tax Return” means any return, declaration, report, claim for refund, information return, or statement or other document required to be filed with respect to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

“Termination Agreement” means a mutually acceptable agreement entered into for the purpose of terminating the Lease.

“Third-Party Claim” has the meaning set forth in Section 7.05(a).

“Wilson Parties” has the meaning set forth in Section 5.09(d).

ARTICLE II

PURCHASE AND SALE

Section 2.01 Purchase and Sale. Subject to the terms and conditions set forth herein, at the Closing, Seller shall sell to Buyer, and Buyer shall purchase from Seller, all of Seller’s right, title and interest in and to the Membership Interests for the consideration specified in Section 2.02.

Section 2.02 Purchase Price. The aggregate purchase price for the CNEL Membership Interests shall be $2,750,000 (the “Purchase Price”), of which $1,300,000 will be paid in cash by wire transfer(s) (the “Cash Amount”), $450,000 will be paid subsequent to Closing (the “Residual Payment”) and $1,000,000 will be paid within 45 days of the completion of the Public Listing, at the election of Buyer, either in cash or in Listed Issuer Shares issued at a deemed price per share equal to the volume-weighted average trading price of the Listed Issuer Shares for the 20 trading day period ending three trading days before issuance, subject to any minimum pricing requirements of the stock exchange upon which the Listed Issuer Shares are trading. Additionally, the Buyer shall remit to the Seller a minimum of 80% of available funds until such time the full amounts previously due under the Lease, pro-rated through October 31, 2024 being $500,000 and the Residual Payment has been remitted to the Seller, but no later than February 15, 2025.

Section 2.03 Transactions to be Effected at the Closing.

| |

(a)

|

At the Closing, Buyer shall deliver to Seller:

|

(i) The Cash Amount, by wire transfer of immediately available funds to an account designated in writing by Seller to Buyer; and

(ii) Subject to Section 2.02, all amounts then owed by Buyer to Seller under the terms of the Lease, i.e., all lease fees and carrying costs described in Exhibit A2 of the Lease, pro-rated through October 31, 2024;

(iii) all other Ancillary Documents required to be delivered by Buyer at or prior to the Closing pursuant to Section 6.03 of this Agreement.

| |

(b)

|

At the Closing, Seller shall deliver to Buyer:

|

(i) an assignment of the Membership Interests to Buyer in form and substance reasonably satisfactory to Buyer (the “Assignment”), duly executed by Seller; and

(ii) all other Ancillary Documents required to be delivered by Seller at or prior to the Closing pursuant to Section 6.02 of this Agreement.

Section 2.04 Closing. Subject to the terms and conditions of this Agreement, the purchase and sale of the Membership Interests contemplated hereby shall take place at a closing (the “Closing”) to be held at 9:00 a.m., Pacific standard time, on or before December 16, 2024, provided that the conditions to Closing set forth in ARTICLE VI have either been satisfied or waived (other than conditions which, by their nature, are to be satisfied on the Closing Date), by exchange of documents and signatures (or their electronic counterparts), or at such other time or on such other date or at such other place as Seller and Buyer may mutually agree upon in writing (the day on which the Closing takes place being the “Closing Date”). The Closing shall occur through an escrow administered by First American Title Insurance Company (the “Escrow Agent”).

Section 2.05 Post Closing. Provided that the Listed Issuer is a “foreign issuer” as defined in Rule 901(e) of Regulation S (“Regulation S”) under the Securities Act of 1933, as amended (the “Securities Act”), and the Listed Issuer Shares are being sold in compliance with the requirements of Rule 904 of Regulation S and in compliance with local laws and regulations, and the Seller provides a declaration to the Listed Issuer and its transfer agent reasonably acceptable to the Listed Issuer and its transfer agent, acting reasonably, regarding compliance with Rule 904 of Regulation S, the Buyer will ensure that the Listed Issuer removes the restricted legend from the Listed Issuer Shares in connection with any planned sales of Listed Issuer Shares by the Seller. The Seller covenants with the Buyer that it shall limit sales of the Listed Issuer Shares in each trading day to an amount that does not exceed 20% of the average daily trading volume for the 20 trading day period predating such trading day, provided that if the Seller arranges block trades with purchasers identified with the Buyer, such restriction shall not apply in respect of such trades. As used herein, the “Value Test Date” means October 31, 2025. Seller covenants and agrees to promptly advise the Buyer on the Value Test Date of the number of Listed Issuer Shares that Seller continues to own and the cash proceeds of any Listed Issuer Shares sold by Seller prior to the Value Test Date. If the sum of (i) the value of the Listed Issuer Shares owned by Seller as of Value Test Date (calculated using the volume-weighted average trading price of the Listed Issuer Shares for the 20 trading day period ending prior to the Value Test Date) plus (ii) the aggregate cash proceeds received by Seller from the sale of Listed Issuer Shares, is less than $1,000,000 (such amount less than $1,000,000, the “Shortfall”), then Buyer shall pay Seller cash equal to the Shortfall no later than ten (10) calendar days after the Value Test Date.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF SELLER

Seller represents and warrants to Buyer that the statements contained in this ARTICLE III are true and correct as of the date hereof.

Section 3.01 Organization and Authority of Seller. Seller is a corporation duly organized, validly existing and in good standing under the Laws of the State of Nevada. Seller has all necessary corporate power and authority to enter into this Agreement and the Ancillary Documents to which it is or will be a party, to carry out its obligations hereunder and thereunder and to consummate the transactions contemplated hereby and thereby. The execution and delivery by Seller of this Agreement and the Ancillary Documents to which Seller is or will be a party, the performance by Seller of its obligations hereunder and thereunder and the consummation by Seller of the transactions contemplated hereby and thereby have been duly authorized by all requisite corporate action on the part of Seller. This Agreement has been duly executed and delivered by Seller, and (assuming due authorization, execution and delivery by Buyer) constitutes, and each Ancillary Document to which Seller is or will be a party when duly executed and delivered by Seller (assuming due authorization, execution and delivery by each other party thereto) will constitute, a legal, valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws affecting creditors’ rights generally and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

Section 3.02 Organization, Authority and Qualification of CNEL. CNEL is a limited liability company duly organized, validly existing and in good standing under the Laws of the state of Nevada and has all necessary limited liability company power and authority to own, operate or lease the properties and assets now owned, operated or leased by it and to carry on its business as it is currently conducted. CNEL is duly licensed or qualified to do business and is in good standing in each jurisdiction in which the properties owned or leased by it or the operation of its business as currently conducted makes such licensing or qualification necessary, except where the failure to be so licensed, qualified or in good standing would not have a Material Adverse Effect and subject to environmental laws and regulations that can impose civil or criminal sanctions and that may restrict or limit certain business activities or require it to mitigate the effects of contamination caused by the release or disposal of Hazardous Materials by Persons other than CNEL into the environment. All limited liability company actions taken by CNEL in connection with this Agreement and the Ancillary Documents will be duly authorized on or prior to the Closing.

Section 3.03 Capitalization.

(a) Seller is the record owner of and has good and valid title to the Membership Interests, free and clear of all Encumbrances. The Membership Interests constitute 100% of the total issued and outstanding membership interests in CNEL. The Membership Interests have been duly authorized and are validly issued, fully-paid and non-assessable.

(b) There are no outstanding or authorized options, warrants, convertible securities or other rights, agreements, arrangements or commitments of any character relating to any membership interests in CNEL or obligating Seller or CNEL to issue or sell any membership interests (including the Membership Interests), or any other interest in, CNEL. Other than the Organizational Documents, there are no voting trusts, proxies or other agreements or understandings in effect with respect to the voting or transfer of any of the Membership Interests.

Section 3.04 No Subsidiaries. CNEL does not own or have any capital stock or other equity interests in any other Person.

Section 3.05 No Conflicts; Consents. The execution, delivery and performance by Seller of this Agreement and the Ancillary Documents to which it is or will be a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) result in a violation or breach of any provision of the Organizational Documents of Seller or CNEL; (b) result in a violation or breach of any provision of any Law or Governmental Order applicable to Seller or CNEL; or (c) require the consent, notice or other action by any Person under, conflict with, result in a violation or breach of, constitute a default under any contract, except in the cases of clauses (b) and (c), where the violation, breach, conflict, default, acceleration or failure to give notice or obtain consent would not have a Material Adverse Effect. No consent, approval, Permit, Governmental Order, declaration or filing with, or notice to, any Governmental Authority is required by or with respect to Seller or CNEL in connection with the execution and delivery of this Agreement and the Ancillary Documents to which Seller is or will be a party and the consummation of the transactions contemplated hereby and thereby, except where the failure to obtain or make such consents, approvals, Permits, Governmental Orders, declarations, filings or notices would not have, in the aggregate, a Material Adverse Effect.

Section 3.06 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Seller.

Section 3.07 No Adverse Proceedings. As of the Effective Date, there are no actions, suits, arbitrations, orders, decrees, claims, writs, injunctions, government investigations, proceedings pending or, to a Seller’s knowledge, threatened in writing against Seller or CNEL which, if determined adversely to such entity, would: (a) adversely affect the ability of any Seller to perform its material obligations hereunder; (b) result in the imposition of a lien or other encumbrance on the Membership Interests, the Properties, Leased Properties or assets of CNEL; or (c) that would be expected to have a Material Adverse Effect on the business or assets of CNEL.

Section 3.08 Taxes. CNEL is a wholly-owned subsidiary and disregarded entity for federal income tax purposes and, accordingly, has been consolidated with all Tax Returns filed by Seller. CNEL has no employees. There are no Tax Liens on the Membership Interests or any assets of a CNEL, other than for current real property Taxes not yet due and payable.

Section 3.09 Bankruptcy. Neither Seller nor CNEL has: (a) made a general assignment for the benefit of creditors; (b) filed any voluntary petition in bankruptcy or suffered the filing of any involuntary petition by any of its creditors; (c) suffered the appointment of a receiver to take possession of all, or substantially all, of a its assets, which remains pending; or (d) suffered the attachment or other judicial seizure of all, or substantially all of its assets, which remains pending.

Section 3.10 Accounts Receivable. All of the accounts receivable of CNEL are set forth on the Disclosure Schedules and are valid receivables and arose in the ordinary course of business from bona fide transactions.

Section 3.11 Undisclosed Liabilities. Except as set forth in the Disclosure Schedules or as would not otherwise constitute a Material Adverse Effect, CNEL has no indebtedness, obligation or other liability (contingent or otherwise), subject to environmental laws and regulations that can impose civil or criminal sanctions and that may restrict or limit certain business activities or require CNEL to mitigate the effects of contamination caused by the release or disposal of Hazardous Materials by Persons other than CNEL into the environment.

Section 3.12 Real Property Leases. Seller has delivered to Buyer true, accurate and complete copies of all leases (and any amendments thereto) of real property to which CNEL is a party. CNEL has a valid leasehold interest in all of the Leased Properties, free and clear of all Encumbrances. Each Lease is in full force and effect and is the legal, valid and binding obligation of CNEL and of the landlord, enforceable in accordance with its terms, except that enforcement of the leases may be subject to applicable bankruptcy, insolvency, reorganization, moratorium or other similar Law, now or hereafter in effect, affecting creditor’s rights generally, except for the Railroad and Gold lease which technically expired as of October 1, 2024. However, Railroad and Gold continues accepting lease payments on a month to month basis, and on this basis, we remain in good standing, and is receptive to renewals and extensions, although we cannot guarantee that they will agree to a lease renewal on commercially acceptable terms. Additionally, and for purposes of clarity, The Virginia City Ventures lease resides and remains with Northern Comstock LLC. Seller agrees to assign the Virginia City Ventures lease after the Northern Comstock LLC transaction has concluded with a transfer of its assets to Seller. Until such time, Seller will assign the exploration rights and obligations under that lease. Buyer will make all required payments and agrees to take all actions required to keep the Virginia City Ventures lease in good standing. To Seller’s knowledge, except as set forth on the Disclosure Schedules, no Person is in default or breach in the observance or performance of any term or obligation to be performed by it under any lease, except for defaults or breaches involving a de minimis amount or of an incidental nature.

Section 3.13 Land Use. To Seller’s knowledge: (a) the Properties and the Leased Properties comprise all of the real property used in CNEL’s business; (b) the current use and occupancy of the Properties and the Leased Properties and the operation of CNEL’s business: (i) complies in all material respects with all Laws including the local zoning Laws, subject to environmental laws and regulations that can impose civil or criminal sanctions and that may restrict or limit certain business activities or require CNEL to mitigate the effects of contamination caused by the release or disposal of Hazardous Materials by Persons other than CNEL into the environment; and (ii) does not violate any easement, covenant, condition, restriction or similar provision in any instrument of record or other unrecorded agreement or instrument affecting such property, subject to environmental laws and regulations that can impose civil or criminal sanctions and that may restrict or limit certain business activities or require CNEL to mitigate the effects of contamination caused by the release or disposal of Hazardous Materials by Persons other than CNEL into the environment; (c) CNEL has not subleased, licensed or otherwise granted any Person the right to use or occupy all or any portion of such property; (d) CNEL has not collaterally assigned or granted any other Encumbrance in any such lease or any interest therein; and (e) to the knowledge of Seller, there are no condemnation or eminent domain proceedings pending or, to the knowledge of Seller, threatened against any of the Properties or the Leased Properties.

Section 3.14 Material Agreements. The Disclosure Schedules contain a true and complete list of the following contracts or agreements (other than leases of the Leased Properties) to which CNEL is a party, to the extent applicable (“Material Agreements”): (a) any agreement creating a partnership or joint venture; (b) any agreement under which CNEL has created, incurred, assumed or guaranteed any indebtedness for borrowed money or any capitalized lease obligation in excess of $5,000 or under which it has imposed a lien on any of its material assets; (c) contracts for the future acquisition or sale of any assets involving $5,000 or more individually (or in the aggregate, in the case of any related series of contracts), other than acquisitions or sales in the ordinary course of business; (d) contracts containing covenants of CNEL prohibiting or limiting the right to compete in any line of business or prohibiting or restricting its ability to conduct business with any Person or in any geographical area; (e) contracts relating to the acquisition by CNEL of any operating business, the capital of any other Person; (f) contracts requiring the payment by or to CNEL of a royalty, “finders’ fee,” brokerage commission, override or similar commission or fee; (g) contracts with third party administrators or other persons for the provision of any management, administrative or claims processing service; (h) any contract that is a power of attorney, proxy or similar instrument; (i) any stock option agreement, restricted stock agreement, phantom stock agreement, stock appreciation rights, plan of equity compensation, or similar agreement, arrangement or understanding; (j) any contract under which CNEL has been prepaid in an amount in excess of $1,000 for goods and services not delivered or requiring the delivery of services or products in the future; (k) any other contract the performance of the executory portion of which involves consideration in excess of $5,000; (l) any contract under which CNEL employs a Person or Persons or contracts for the services of a Person or Persons in the operation of business of CNEL; and (m) any contract that cannot be terminated by CNEL upon not more than thirty (30) days’ notice. All such Material Agreements are in full force and effect and are the valid and binding obligations of CNEL and to Seller’s knowledge, of its respective counterparties, enforceable in accordance with their respective terms. Neither CNEL nor, to Seller’s knowledge, any other Person is in default or breach in the observance or the performance of any term or obligation to be performed by it under any Material Agreement, except for defaults or breaches involving a de minimis amount or of an incidental nature.

Section 3.15 Insurance. The Disclosure Schedules contain a true and complete list of all liability, property, workers’ compensation, directors’ and officers’ liability, errors and omissions, fidelity bond, reinsurance, medical malpractice and other material insurance policies (including all self-insurance policies) maintained by or for the benefit of CNEL or any landlords. Each policy listed in the Disclosure Schedules is valid and binding and in full force and effect, all premiums due thereunder have been paid in full, and CNEL has not received any written notice of cancellation or termination in respect of any such policy. To Sellers’ knowledge, no event has occurred which constitutes, or with notice or lapse of time or both, would constitute, a material breach or a default, or permit the termination, material modification or acceleration under, any such policy. The Disclosure Schedules further list and describe all material claims for payment made by CNEL against its insurance policies since January 1, 2020.

Section 3.16 Employees; Labor Relations. CNEL has no employees. CNEL is not a party to or bound by any collective bargaining agreement, and has not experienced any strike, slowdown, work stoppage, lockout or other collective bargaining dispute. There is no unfair labor practice charge or complaint against CNEL pending before the National Labor Relations Board or similar governmental authority in the State of Nevada or any other jurisdiction where CNEL is engaged in business and there has been no charge of discrimination filed against CNEL with the Equal Employment Opportunity Commission or similar governmental authority in the State of Nevada or any other jurisdiction where CNEL is engaged in business. CNEL is not a party to any employment agreement, independent contractor agreement, consulting agreement, advisory or service agreement, deferred compensation agreement, bonus agreement (including all agreements that require a payment to any Person upon the consummation of the transaction contemplated by this agreement), or severance contract. CNEL has not made any loans or advance to any officer or director of CNEL.

Section 3.17 Absence of Certain Changes or Events. Except as set forth in the Disclosure Schedules, CNEL has conducted its business in the ordinary course and has not: (a) suffered any Material Adverse Effect; (b) incurred any indebtedness, obligation or other liability (contingent or otherwise), subject to environmental laws and regulations that can impose civil or criminal sanctions and that may restrict or limit certain business activities or require CNEL to mitigate the effects of contamination caused by the release or disposal of Hazardous Materials by Persons other than CNEL into the environment; (c) created, permitted or allowed any lien with respect to CNEL assets; (d) executed, materially amended, or terminated any Material Agreement to which it is or was a party or by which any of CNEL assets are bound or affected; amended, terminated or waived any of its material rights thereunder; or received notice of termination, amendment, or waiver of any Material Agreement or any material rights thereunder; (e) instituted, settled, or agreed to settle, any litigation, action, or proceeding before any governmental authority, court or arbitrators; (f) sold, assigned or transferred any assets; (g) made any capital commitments therefore in excess of $1,000 in the aggregate; (h) suffered any theft, damage, destruction or casualty loss to its property in excess of $1,000 not covered by insurance; (i) declared or paid any dividend or made any distribution on its Membership Interests, or redeemed or purchased any Membership Interests; (j) made any loan or any investment in or capital contribution to, or extended any credit to, any Person; (k) made any material election with respect to Taxes, agreed to make any material claim or assessment in respect of Taxes, agreed to an extension or waiver of the limitation period to any claim or assessment in respect of Taxes, or filed any claim for a Tax refund or amended any income or other Tax Return; (l) waived or released any debts, claims or rights of value, or written down the value of any assets or written down or off any receivable in excess of $1,000 for any single occurrence or $5,000 in the aggregate; or (m) entered into any agreement or made any commitment to take any of the types of action described herein.

Section 3.18 Employee Benefit Plans; CNEL does not provide, nor has any liability for, health or welfare benefits, retirement, pension deferred compensation, defined benefit plan or other benefit plan with respect to any current, retired or former employees of CNEL.

Section 3.19 Certain Business Relationships; Managers and Officers. Except as set forth in the Disclosure Schedules no manager or officer of CNEL or any affiliate of CNEL or Seller CNEL, nor any family member of any of the foregoing: (a) owns, directly or indirectly, in whole or in part, any property, assets or rights, which are associated with or necessary for the use, operation or conduct of any of CNEL business, or (b) has a contract to furnish material services or goods to CNEL. The Disclosure Schedules identify all managers and officers of CNEL, all of whom shall resign as of the Closing.

Section 3.20 Licenses and Governmental Authorizations; General Compliance With Laws. CNEL currently holds all licenses, permits or other certifications issued by each governmental authority necessary for the current operation of its business, and said licenses are and shall through the Closing Date be unrestricted, unconditional, in good standing and in full force and effect and subject to no waivers or limitation, subject to environmental laws and regulations that can impose civil or criminal sanctions and that may restrict or limit certain business activities or require CNEL to mitigate the effects of contamination caused by the release or disposal of Hazardous Materials by Persons other than CNEL into the environment. Such licenses, permits, and authorizations are listed in the Disclosure Schedules. CNEL and its operations are in compliance in all material respects with all applicable Laws in all jurisdictions where CNEL is conducting business, subject to environmental laws and regulations that can impose civil or criminal sanctions and that may restrict or limit certain business activities or require CNEL to mitigate the effects of contamination caused by the release or disposal of Hazardous Materials by Persons other than CNEL into the environment. CNEL has not been charged with, or given notice of, and to Seller’s knowledge, CNEL is not under investigation with respect to, any violation of, or any obligation to take remedial action under, any applicable Law.

Section 3.21 Guarantees. CNEL is not a guarantor or otherwise contractually responsible for any liability or obligation (including indebtedness) of any other Person.

Section 3.22 Banks and Depositories. The Disclosure Schedules set forth a list of the name and address of each bank or other financial institution in which CNEL has an account or safe deposit box, the identity of each such account or safe deposit box (including account number), and the names of all Persons authorized to draw on each account and to have access to each safe deposit box;

Section 3.23 Title to the Property. Except as set forth in the Disclosure Schedules or in the Title Commitment, CNEL has, and shall have as of the Closing, good and marketable indefeasible fee simple title to the surface and mineral estates of the Properties, free and clear of all Encumbrances other than Permitted Exceptions and subject to environmental laws and regulations that can impose civil or criminal sanctions and that may restrict or limit certain business activities or require CNEL to mitigate the effects of contamination caused by the release or disposal of Hazardous Materials by Persons other than CNEL into the environment, and there are no outstanding leases, licenses, contracts to sell, options, rights of first offer or rights of first refusal to purchase such Properties or any portion thereof or interest therein.

Section 3.24 Compliance with Laws. Neither Seller nor CNEL has received any notice or notices in writing, from any Governmental Authority, of any material violation of any applicable Law, where any such violation would be expected to have a Material Adverse Effect, subject to environmental laws and regulations that can impose civil or criminal sanctions and that may restrict or limit certain business activities or require CNEL to mitigate the effects of contamination caused by the release or disposal of Hazardous Materials by Persons other than CNEL into the environment.

Section 3.25 Environmental Matters. Except as set forth on the Disclosure Schedules, to Sellers’ knowledge, there have been no disposals, releases or threatened releases of Hazardous Materials on, from or under the Properties or the Leased Properties by or on behalf of Seller, CNEL or any of their Affiliates in violation of applicable Laws. Neither Seller nor CNEL, nor, to their knowledge, any other Person, has used, generated, manufactured or stored on, under or about, or transported to or from the Properties or the Leased Properties any Hazardous Materials in violation of applicable Laws. For purposes of this Agreement: (a) the terms “disposal,” “release,” and “threatened release” shall have the definitions assigned thereto by the Comprehensive Environmental Response, Compensation and Liability Act of 1980, 42 U.S.C. Section 9601 et seq., as amended (“CERCLA”), and (b) “Hazardous Materials” shall mean any hazardous, corrosive, ignitable, explosive, infectious, radioactive, carcinogenic, petroleum- derived, or toxic substance, material or waste that is regulated under, or defined as a “hazardous substance,” “hazardous waste,” “carcinogen,” “toxic substance,” “pollutant,” “contaminant,” “toxic chemical,” “hazardous materials” or “hazardous chemical” under: (1) CERCLA; (2) the Resource Conservation and Recovery Act, 42 U.S.C. Section 6901 et seq.; (3) the Clean Water Act, 33 U.S.C. Section 1251, et seq.; (4) the Clean Air Act, 42 U.S.C. Section 7401 et seq.; (5) the Emergency Planning and Community Right-to-Know Act, 42 U.S.C. Section 1101 et seq.; (6) the Hazardous Materials Transportation Act, 49 U.S.C. Section 1801, et seq.; (7) the Toxic Substances Control Act, 15 U.S.C. Section 2601 et seq.; (8) the Occupational Safety and Health Act of 1970, 29 U.S.C. Section 651 et seq.; (9) regulations promulgated under any of the above statutes; or (10) any applicable state or local Law that has a scope or purpose similar to those statutes identified above.

Section 3.26 Securities Law Matters. Seller is an "accredited investor" as defined in Rule 501(a) under the Securities Act. Seller is acquiring the Listed Issuer Shares solely for the Seller’s own beneficial account, for investment purposes, and not with a view to, or for resale in connection with, any distribution of the Listed Issuer Shares. The Seller understands that the Listed Issuer Shares have not been and will not be registered under the Securities Act or any state securities laws by reason of specific exemptions under the provisions thereof which depend in part upon the investment intent of the Seller and of the other representations made by the Seller in this Agreement. The Seller understands that the Listed Issuer Shares will be "restricted securities" under applicable federal securities laws and that the Securities Act and the rules of the U.S. Securities and Exchange Commission provide in substance that the Seller may dispose of the Listed Issuer Shares only pursuant to an effective registration statement under the Securities Act or an exemption from the registration requirements of the Securities Act, and the Seller understands that the Listed Issuer has no obligation to register any of the Listed Issuer Shares or the offering or sale thereof, or to take action so as to permit offers or sales pursuant to the Securities Act or an exemption from registration thereunder (including pursuant to Rule 144 thereunder). Consequently, the Seller understands that it must bear the economic risks of the investment in the Listed Issuer Shares for an indefinite period of time. Seller represents and warrants that neither it, nor any of its Rule 506(b) Related Partis is a “bad actor” within the meaning of Rule 506(d) promulgated under the Securities Act (for purposes of this Agreement, “Rule 506(d) Related Parties” means Seller’s officers and directors and beneficial owners of Seller’s voting securities as provided under Rule 13d-3 under the Securities and Exchange Act of 1934, as amended).

Section 3.27 No Other Representations and Warranties. Except for the representations and warranties contained in this ARTICLE III (including the related portions of the Disclosure Schedules), none of Seller, CNEL or any other Person has made or makes any other express or implied representation or warranty, either written or oral, on behalf of Seller or CNEL, including any representation or warranty as to the accuracy or completeness of any information regarding CNEL furnished or made available to Buyer and its Representatives (including any information, documents or material delivered or made available to Buyer, management presentations or in any other form in expectation of the transactions contemplated hereby) or as to the future revenue, profitability or success of CNEL, or any representation or warranty arising from statute or otherwise in law.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants to Seller that the statements contained in this ARTICLE IV are true and correct as of the date hereof.

Section 4.01 Organization and Authority of Buyer. Buyer is a corporation duly organized, validly existing and in good standing under the Laws of the state of Delaware. Buyer has all necessary corporate power and authority to enter into this Agreement and the Ancillary Documents to which Buyer is or will be a party, to carry out its obligations hereunder and thereunder and to consummate the transactions contemplated hereby and thereby. The execution and delivery by Buyer of this Agreement and any Ancillary Documents to which Buyer is or will be a party, the performance by Buyer of its obligations hereunder and thereunder and the consummation by Buyer of the transactions contemplated hereby and thereby have been duly authorized by all requisite corporate action on the part of Buyer. This Agreement has been duly executed and delivered by Buyer, and (assuming due authorization, execution and delivery by Seller) constitutes, and each Ancillary Document to which Buyer is or will be a party when duly executed and delivered by Buyer (assuming due authorization, execution and delivery by each other party thereto) will constitute, a legal, valid and binding obligation of Buyer, enforceable against Buyer in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws affecting creditors’ rights generally and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

Section 4.02 No Conflicts; Consents. The execution, delivery and performance by Buyer of this Agreement and the Ancillary Documents to which it is or will be a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) result in a violation or breach of any provision of the Organizational Documents of Buyer; (b) result in a violation or breach of any provision of any Law or Governmental Order applicable to Buyer; or (c) require the consent, notice or other action by any Person under, conflict with, result in a violation or breach of, constitute a default under any agreement to which Buyer is a party, except in the cases of clauses (b) and (c), where the violation, breach, conflict, default, acceleration or failure to give notice or obtain consent would not have a material adverse effect on Buyer’s ability to consummate the transactions contemplated hereby. No consent, approval, Permit, Governmental Order, declaration or filing with, or notice to, any Governmental Authority is required by or with respect to Buyer in connection with the execution and delivery of this Agreement and the Ancillary Documents to which it is or will be party and the consummation of the transactions contemplated hereby and thereby, except where the failure to obtain or make such consents, approvals, Permits, Governmental Orders, declarations, filings or notices would not have a material adverse effect on Buyer’s ability to consummate the transactions contemplated hereby and thereby.

Section 4.03 Investment Purpose. Buyer is acquiring the Membership Interests solely for its own account for investment purposes and not with a view to, or for offer or sale in connection with, any distribution thereof. Buyer acknowledges that the Membership Interests are not registered under the Securities Act of 1933, as amended, or any state securities laws, and that the Membership Interests may not be transferred or sold except pursuant to the registration provisions of the Securities Act of 1933, as amended or pursuant to an applicable exemption therefrom and subject to state securities laws and regulations, as applicable. Buyer is able to bear the economic risk of holding the Membership Interests for an indefinite period (including total loss of its investment) and has sufficient knowledge and experience in financial and business matters so as to be capable of evaluating the merits and risk of its investment. Buyer has had the opportunity to visit with CNEL and meet with the officers of CNEL and other representatives to discuss the business, assets, liabilities, financial condition and operations of CNEL, has received all materials, documents and other information that Buyer deems necessary or advisable to evaluate CNEL and the Membership Interests and has made its own independent examination, investigation, analysis and evaluation of CNEL and the Membership Interests, including its own estimate of the value of the Membership Interests. Buyer has undertaken such due diligence (including a review of the properties, liabilities, books, records, and contracts of CNEL) as Buyer deems adequate.

Section 4.04 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement or any Ancillary Document based upon arrangements made by or on behalf of Buyer.

Section 4.05 Independent Investigation. Buyer has conducted its own independent investigation, review and analysis of the business, results of operations, prospects, condition (financial or otherwise) or assets of CNEL, and acknowledges that it has been provided adequate access to the personnel, properties, assets, premises, books and records, and other documents and data of Seller and CNEL for such purpose. Buyer acknowledges and agrees that: (a) in making its decision to enter into this Agreement and the Ancillary Documents to which it is or will be a party and to consummate the transactions contemplated hereby and thereby, Buyer has relied solely upon its own investigation and the express representations and warranties of Seller set forth in ARTICLE III of this Agreement (including the related portions of the Disclosure Schedules); and (b) none of Seller, CNEL or any other Person has made any representation or warranty as to Seller, CNEL or this Agreement, or to the accuracy or completeness of any information regarding Seller or CNEL furnished or made available to Buyer and its Representatives, except as expressly set forth in Article III of this Agreement (including the related portions of the Disclosure Schedules).

ARTICLE V

COVENANTS

Section 5.01 Access to Information: Title to Properties.

(a) From the date hereof until the Closing, Seller shall, and shall cause CNEL to: (i) afford Buyer and its Representatives reasonable access to and the right to inspect all of the Properties, Leased Properties, assets, premises, books and records, contracts, agreements and other documents and data related to CNEL; (ii) furnish Buyer and its Representatives with such financial, operating and other data and information related to CNEL as Buyer or any of its Representatives may reasonably request; and (iii) instruct the Representatives of Seller and CNEL to cooperate with Buyer in its investigation of CNEL; provided, however, that any such investigation shall be conducted during normal business hours upon reasonable advance notice to Seller, under the supervision of Seller’s personnel and in such a manner as not to interfere with the normal operations of CNEL. All requests by Buyer for access pursuant to this Section 5.01(a) shall be submitted or directed exclusively to Corrado De Gasperis or such other individuals as Seller may designate in writing from time to time.

(b) As soon as is reasonably possible, and in no event later than three (3) Business Days after the date of this Agreement, Escrow shall furnish to Buyer for any Properties or Leased Properties consisting of patented claims or fee interests from First American Title Insurance Company (the “Title Insurer”): (i) title commitments issued by the Title Insurer to insure title to such properties (including the mineral estate of such properties), in the amount of that portion of the Purchase Price allocated to such properties, naming Buyer as the proposed insured (each a “Title Commitment”); and (ii) complete and legible copies of all recorded documents listed in the Title Commitment or as Schedule B 2 exceptions (the “Recorded Documents”). Buyer shall notify Seller in writing (“Buyer's Notice”) of any items in the Title Commitment to which it objects within ten (10) Business Days after receiving all of the Title Commitment and copies of Recorded Documents, other than customary exceptions and exclusions (the “Title Objections”). Seller shall use commercially reasonable efforts, at the sole cost and expense of Buyer, to cure each Title Objection and take all steps required by the Title Insurer to eliminate each Title Objection as an exception to the Title Commitment. Notwithstanding the foregoing Seller shall, at its sole cost and expense, cause to be removed any Encumbrances on the Properties caused, incurred or suffered to exist by Seller or its Affiliates and securing obligations of Seller or its Affiliates. Any Title Objection that the Title Insurer is willing to insure over on terms acceptable to Buyer is herein referred to as an “Insured Exception.” The Insured Exceptions, together with any title exception or matters disclosed not objected to by Buyer in the manner aforesaid shall be deemed to be acceptable to Buyer (the “Permitted Exceptions”).

Section 5.02 Supplement to Disclosure Schedules. From time to time prior to the Closing, Seller shall supplement or amend the Disclosure Schedules with respect to any material matter hereafter arising or of which it becomes aware after the date hereof (each a “Schedule Supplement”). Any disclosure in any such Schedule Supplement shall not be deemed to have cured any inaccuracy in or breach of any representation or warranty contained in this Agreement, including for purposes of the indemnification or termination rights contained in this Agreement or of determining whether or not the conditions set forth in Section 6.02 have been satisfied; provided, however, that if as a result of matters disclosed in a Schedule Supplement, Buyer has the right to, but does not elect to, terminate this Agreement within five (5) Business Days of its receipt of such Schedule Supplement, then Buyer shall be deemed to have irrevocably waived any right to terminate this Agreement with respect to such matter and, further, shall have irrevocably waived its right to indemnification under Section 7.02 with respect to such matter.

Section 5.03 Closing Conditions. From the date hereof until the Closing, each party hereto shall, and Seller shall cause CNEL to, use commercially reasonable efforts to take such actions as are necessary to expeditiously satisfy the closing conditions set forth in ARTICLE VI hereof.

Section 5.04 Public Announcements. Unless otherwise required by applicable Law or stock exchange requirements (based upon the reasonable advice of counsel), no party to this Agreement shall make any public announcements in respect of this Agreement or the transactions contemplated hereby or otherwise communicate with any news media without the prior written consent of the other party (which consent shall not be unreasonably withheld, conditioned or delayed), and the parties shall cooperate as to the timing and contents of any such announcement.

Section 5.05 Further Assurances. Following the Closing, each of the parties hereto shall, and shall cause their respective Affiliates to, execute, and deliver such additional documents, instruments, conveyances and assurances, and take such further actions as may be reasonably required to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement.

Section 5.06 Transfer Taxes. All transfer, documentary, sales, use, stamp, registration, value added, and other such Taxes and fees (including any penalties and interest) incurred in connection with this Agreement and the Ancillary Documents (including any real property transfer Tax and any other similar Tax) shall be borne and paid by Buyer when due. Buyer shall, at its own expense, timely file any Tax Return or other document with respect to such Taxes or fees (and Seller shall cooperate with respect thereto as necessary).

Section 5.07 Operation of the Business of CNEL. Between the date of this Agreement and the Closing Date, unless otherwise agreed in writing by the Buyer, the Seller shall observe and shall cause CNEL to observe, the following covenants:

(a) except as otherwise allowed or required pursuant to the terms of this Agreement, CNEL shall conduct its business in the ordinary course, consistent with past practices;

(b) Seller and CNEL shall use commercially reasonable efforts to preserve intact the CNEL business and their current business organization, maintain the relations and goodwill with all material suppliers, customers, landlords and others having material business relationships with CNEL;

(c) Seller shall use commercially reasonable efforts to cause CNEL to maintain all of its assets and properties that are material to the operation of the business in their current condition, ordinary wear and tear excepted, and maintain in full force and effect the insurance described in Section 4.2.8 or insurance providing comparable coverage;

(d) Seller and CNEL shall not amend any Material Agreement or terminate any Material Agreement prior to the expiration of the term thereof;

(e) Seller and CNEL shall maintain their books, accounts and records in the usual, regular and ordinary manner, on a basis consistent with prior years; and

(f) Seller and CNEL shall not take any affirmative action, or fail to take any commercially reasonable action within their control, which would result in any of the representations and warranties of the Seller in this Agreement not being true and correct in all material respects on and as of the Closing Date with the same force and effect as if such representations and warranties had been made on and as of the Closing Date.

Section 5.08 Divestment or Addition of Certain Assets of CNEL. Prior to or on the Closing Date, Seller will cause CNEL to convey or acquire any assets or contracts such that the Properties and Leased Properties shall consist of those set forth in the Disclosure Schedules or the Schedules or Exhibits hereto.

Section 5.09 Non-Compete. For a period of five (5) years after the Closing Date:

(a) Buyer may, in its discretion, decide to stake, lease, option, purchase or otherwise acquire properties (the “Additional Properties”) within an area surrounding the Properties; and extending to include Sections 20, 21, 27, 28, 29, and 34, Twp 17N, Rng 21E, MDM and portions of Sections 3 and 4, Twp 16N, Rng 21E, MDM; but only within Storey County (excluding the area adjacent to Silver City) and excluding the area within the Storey County Special Use Permit held by Comstock Mining LLC (the “Area of Interest”), as shown on Figure A1. Any Additional Properties acquired by Buyer shall not be subject to the Royalty Agreement.

(b) Buyer shall not, without the prior written approval of Seller (such approval shall be at Seller’s absolute discretion), directly or indirectly, either individually or on behalf of or through any Person, (i) locate, stake, lease, option, purchase or otherwise acquire or become entitled to acquire any interest, directly or indirectly, in any property, mineral rights, land rights, surface rights, water rights or other mining-related assets, or (ii) own, manage, stake, control, advise, operate, provide services to, consult with, receive remuneration from, be employed by any person engaged or proposing to engage in, or otherwise engage in any manner in the mining business in any location that is both (i) outside the Area of Interest and within two miles of any of the property currently owned or leased by Seller in Lyon or Storey Counties, Nevada as at Closing, and (ii) within Lyon or Storey Counties, Nevada (the “Non-Compete Area”), as shown on Figure A2. Any such property acquired with the prior written approval of Seller shall not be subject to the Royalty Agreement.

(c) Seller shall not, without the prior written approval of Buyer (such approval shall be at Buyer’s absolute discretion), directly or indirectly, either individually or on behalf of or through any Person, (i) locate, stake, lease, option, purchase or otherwise acquire or become entitled to acquire any interest, directly or indirectly, in any property, mineral rights, land rights, surface rights, water rights or other mining-related assets within the Area of Interest, except for properties adjacent to (and within 500 feet of the existing boundaries of) the current Lucerne or American Flat (Comstock Mining LLC or Comstock Processing LLC) properties described in Schedule D attached hereto and that reasonably enhance the potential for commercial mine production of the Lucerne or American Flat properties.

(d) Notwithstanding the foregoing. in the event Buyer desires to acquire any of the mining claims or other properties set forth on Schedule D-1 and located in the Non-Compete Area (the “Ida Properties”) currently owned by the estate of Art Wilson, Wilson Mining LLC., Ida Consolidated Mines, Southern Comstock Tailings Disposal Company, or Art Wilson Co. (collectively the “Wilson Parties”), such acquisition shall not be prohibited so long as Buyer conveys to Seller the patented and unpatented mining claims south of Silver City and west of Spring Valley, and the properties in the Gold Canyon area, all of which are identified in Schedule D-2 attached hereto (the “Conveyance Properties”), for no additional consideration, concurrently with the acquisition of the Ida Properties. In the event that Buyer does not acquire all Conveyance Properties from the Wilson Parties, then Buyer shall inform Seller and collaborate in the securing of the properties by Seller.

(e) Contemporaneously with the conveyance of the Conveyance Properties to Seller, Seller shall convey to Buyer, for no consideration, the Niger Ravine patent and the Three Brothers unpatented claim, identified in Schedule D-3 attached hereto, for no additional consideration.

Section 5.10 Royalty Interests. If the royalty interests of the Wilson Parties in Lyon County are also acquired by the Buyer inclusive of the Metropolitan patent and Peach and Wedge unpatented claims identified on Schedule D-4 attached hereto (“Royalty Interests"), Buyer shall also convey to Seller Buyer’s ownership of the Royalty Interests, for no additional consideration.

Section 5.11 CRMSS. Buyer acknowledges that the Leased Properties and the Properties are located within and/or in close proximity to the Carson River Mercury Superfund Site (the “CRMSS”). In 1990, the CRMSS became part of the National Priorities List. The CRMSS covers five counties, about 330 square miles and more than 130 river miles in Northwestern Nevada. Historic mill sites in Carson City, Virginia City, Dayton, Washoe Valley and Pleasant Valley have mercury contamination. Waterways located next to mill sites spread mercury from the 100-year floodplain of Carson River to its ends where it dries up. EPA’s site investigation found mercury in soil, sediments (earthen materials that settle to the bottom of a water body), fish and wildlife. Buyer acknowledges and agrees that notwithstanding anything to the contrary in this Agreement, Seller shall not be responsible for any Losses incurred by Buyer that are related to, or arise from, the CRMSS, including without limitation any and all costs of remediation or actions associated with operating in the CRMSS. Accordingly, Buyer hereby releases and forever discharges Seller and its Affiliates and their past and present officers, directors, agents, servants, employees and attorneys, from any and all claims, debts, accounts reckonings, obligations, costs, and causes of action, of every kind and nature whatsoever, whether known or unknown, suspected or unsuspected, arising out of, or related to, the CRMSS; provide that the foregoing release shall not apply to any claims, debts, accounts, reckonings, obligations, costs, or causes of action arising out of any inaccuracy in, or breach of, any of the express representations or warranties of Seller set forth in this Agreement.

ARTICLE VI

CONDITIONS TO CLOSING

Section 6.01 Conditions to Obligations of All Parties. The obligations of each party to consummate the transactions contemplated by this Agreement shall be subject to the fulfillment, at or prior to the Closing, of each of the following conditions:

(a) No Governmental Authority shall have enacted, issued, promulgated, enforced, or entered any Governmental Order which is in effect and has the effect of making the transactions contemplated by this Agreement illegal, otherwise restraining or prohibiting consummation of such transactions or causing any of the transactions contemplated hereunder to be rescinded following completion thereof.

Section 6.02 Conditions to Obligations of Buyer. The obligations of Buyer to consummate the transactions contemplated by this Agreement shall be subject to the fulfillment or Buyer’s waiver, at or prior to the Closing, of each of the following conditions:

(a) The representations and warranties of Seller contained in ARTICLE III shall be true and correct in all respects as of the Closing Date with the same effect as though made at and as of such date (except those representations and warranties that address matters only as of a specified date, which shall be true and correct in all respects as of that specified date), except where the failure of such representations and warranties to be true and correct would not have a Material Adverse Effect.

(b) Seller shall have duly performed and complied in all material respects with all agreements, covenants and conditions required by this Agreement and each of the Ancillary Documents to be performed or complied with by it prior to or on the Closing Date.

(c) Seller shall have delivered, or caused to be delivered, the Assignment.

(d) Seller shall have delivered to Buyer a certificate pursuant to Treasury Regulations Section 1.1445-2(b) that Seller is not a foreign person within the meaning of Section 1445 of the Code or a valid executed IRS Form W-9, Request for Taxpayer Identification Number and Certification.

(e) Buyer shall have received a certificate, dated the Closing Date and signed by a duly authorized officer of Seller, certifying that each of the conditions set forth in Section 6.02(a) and Section 6.02(b) have been satisfied.

(f) Buyer shall have received a certificate of the Secretary or an Assistant Secretary (or equivalent officer) of Seller certifying that attached thereto are true and complete copies of all resolutions adopted by the manager of Seller authorizing the execution, delivery and performance of this Agreement and the Ancillary Documents to which Seller is a party and the consummation of the transactions contemplated hereby and thereby, and that all such resolutions are in full force and effect and are all the resolutions adopted in connection with the transactions contemplated hereby and thereby.

(g) Buyer shall have received a certificate of the Secretary or an Assistant Secretary (or equivalent officer) of Seller certifying the names and signatures of the officers of Seller authorized to sign this Agreement and the Ancillary Documents to which Seller is a party.

(h) As of the Closing Date Seller shall have good and valid title to the Membership Interests free of any Encumbrances, and CNEL shall have good and valid title to the Properties and a valid and enforceable leasehold interest in the Leased Properties, free and clear of any Encumbrances other than the Permitted Exceptions.

(i) The Title Insurer has issued an ALTA Title Policy for the any Properties or Leased Properties consisting of patented claims or fee interests in the amount of the Purchase Price allocated to such properties, subject only to the Permitted Exceptions.

(j) The Ancillary Documents shall have been executed and delivered by the parties thereto and true and complete copies thereof shall have been delivered to Buyer.

(k) There have been no events or circumstances that have, or with the passage of time would have, a Material Adverse Effect.

Section 6.03 Conditions to Obligations of Seller. The obligations of Seller to consummate the transactions contemplated by this Agreement shall be subject to the fulfillment or Seller’s waiver, at or prior to the Closing, of each of the following conditions:

(a) The representations and warranties of Buyer contained in ARTICLE IV shall be true and correct in all respects as of the Closing Date with the same effect as though made at and as of such date (except those representations and warranties that address matters only as of a specified date, which shall be true and correct in all respects as of that specified date), except where the failure of such representations and warranties to be true and correct would not have a Material Adverse Effect on Buyer’s ability to consummate the transactions contemplated hereby.

(b) Buyer shall have duly performed and complied in all material respects with all agreements, covenants and conditions required by this Agreement and each of the Ancillary Documents to be performed or complied with by it prior to or on the Closing Date.

(c) Seller shall have received a certificate, dated the Closing Date and signed by a duly authorized officer of Buyer, certifying that each of the conditions set forth in Section 6.03(a) and Section 6.03(b) have been satisfied.

(d) Seller shall have received a certificate of the Secretary or an Assistant Secretary (or equivalent officer) of Buyer certifying that attached thereto are true and complete copies of all resolutions adopted by the board of directors of Buyer authorizing the execution, delivery and performance of this Agreement and the Ancillary Documents to which it is a party and the consummation of the transactions contemplated hereby and thereby, and that all such resolutions are in full force and effect and are all the resolutions adopted in connection with the transactions contemplated hereby and thereby.

(e) Seller shall have received a certificate of the Secretary or an Assistant Secretary (or equivalent officer) of Buyer certifying the names and signatures of the officers of Buyer authorized to sign this Agreement and Ancillary Documents to which it is a party.

(f) Ancillary Documents shall have been executed and delivered by the parties thereto and true and complete copies thereof shall have been delivered to Seller.

(g) Buyer shall have delivered the amount equal to the Cash Amount plus amounts payable by Buyer under the Lease by wire transfer of immediately available funds to an account designated in writing by Seller to Buyer

ARTICLE VII

INDEMNIFICATION