false

0001230992

0001230992

dei:BusinessContactMember

2022-01-01

2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

--12-31 FY 2022

|

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year endedDecember 31, 2022.

|

Commission File Number 001-33574.

|

| |

|

|

MAG SILVER CORP.

|

|

(Exact name of Registrant as specified in its charter)

|

| |

|

British Columbia

|

|

(Province or other jurisdiction of incorporation or organization)

|

| |

|

1040

|

|

(Primary Standard Industrial Classification Code Number (if applicable))

|

| |

|

Not Applicable

|

|

(I.R.S. Employer Identification Number (if applicable))

|

| |

|

800 West Pender Street, Suite 770

Vancouver, British Columbia V6C 2V6

Tel: (604) 630-1399

|

|

(Address and telephone number of Registrant's principal executive offices)

|

| |

|

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

Tel: (302) 738-6680

|

|

(Name, address (including zip code) and telephone number (including area code)

Of agent for service in the United States)

|

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares, without par value

|

MAG

|

NYSE American

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

For annual reports, indicate by check mark the information filed with this Form:

|

☒ Annual information form

|

☒ Audited annual consolidated financial statements

|

Indicate the number of outstanding shares of each of the Registrant’s classes of capital or common stock as of the close of the period covered by the annual report.

98,956,808 outstanding shares of the Registrant’s common stock as of the fiscal year ended December 31, 2022.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interac‐tive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preced‐ing 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

EXPLANATORY COMMENT

MAG Silver Corp. (the “Company” or the “Registrant”) is a British Columbia corporation and a “foreign private issuer” as defined in Rule 3b-4 promulgated under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) by the U.S. Securities and Exchange Commission (the “SEC”). Under the SEC’s rules, the Company is eligible to prepare and file this Annual Report on Form 40-F, and to present the disclosures herein primarily in accordance with Canadian disclosure requirements, which differ in certain material respects from those which the SEC requires of United States companies.

For example, the Company has prepared its financial statements, which are included as Exhibit 99.2 to this Annual Report on Form 40-F, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”), and such statements are not in many respects directly comparable to financial statements of United States companies.

Similarly, and as discussed in greater detail below in “ESTIMATES OF RESOURCES AND RESERVES,” the resource and reserve estimates included in the accompanying Annual Information Form (including the Schedules thereto), found at Exhibit 99.1 of this Form 40-F Annual Report, and management’s discussion and analysis for the fiscal year ended December 31, 2022 filed as Exhibit 99.2 to this Annual Report on Form 40-F, have been prepared in accordance with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), which differ from the practices used to estimate resources and reserves in reports and other materials filed with the SEC by United States companies.

As a “foreign private issuer”, the Company is exempt from certain proxy-related requirements found in Sections 14(a), 14(b), 14(c), and 14(f) of the Exchange Act, and the insider reporting, “short swing profit” and short sale provisions found in Section 16 thereof are not applicable to the Company’s common shares.

PRINCIPAL DOCUMENTS

The following documents have been filed by the Company with this Annual Report on Form 40-F, and are incorporated herein by reference:

A. Annual Information Form

The Company’s Annual Information Form (“AIF”) for the fiscal year ended December 31, 2022: see Exhibit 99.1 of this Annual Report on Form 40-F.

B. Audited Annual Consolidated Financial Statements and accompanying Management’s Discussion and Analysis

The Company’s Audited Annual Consolidated Financial Statements including the reports of the Independent Registered Public Accounting Firm with respect thereto and accompanying Management’s Discussion and Analysis for fiscal year ended December 31, 2022: see Exhibit 99.2 of this Annual Report on Form 40-F. The Company’s Audited Annual Consolidated Financial Statements have been prepared in accordance with IFRS.

CAUTIONARY COMMENT ON FORWARD-LOOKING STATEMENTS

Forward Looking Statements

Certain information contained in this Annual Report on Form 40-F and the documents incorporated by reference herein, including any information relating to the Company’s future oriented financial information are forward-looking statements within the meaning of the US Private Securities Litigation Reform Act of 1995 and constitute forward-looking information within the meaning of applicable Canadian securities laws (collectively “forward-looking statements”). All statements in this Annual Report on Form 40-F and the documents incorporated by reference herein, other than statements of historical facts, are forward-looking statements. Such forward-looking statements and information include, but are not limited to, statements regarding: the future price of silver, gold, lead, zinc and copper; the estimation of mineral resources; preliminary economic estimates relating to the Minera Juanicipio Project (the “Juanicipio Project”); estimates of the time and amount of future silver, gold, lead, zinc and copper production for specific operations; estimated future exploration and development expenditures and other expenses for specific operations; permitting timelines; the Company’s expectations regarding impairments of mineral properties; the expected timeline to commercial production at the Juanicipio Project, including expectations regarding the timing of the operator services agreement between the Company and Fresnillo plc (“Fresnillo”) taking effect; the expected extended timeline for the processing plant at the Juanicipio Project to be fully commissioned and the related impacts on production for the current financial year; expectations regarding the Company’s and Fresnillo’s ability to secure several positive outcomes for the Juanicipio Project, including but not limited to, generating sufficient cash-flow from production to offset cash requirements of initial and sustaining capital; the intended use of proceeds from the Company’s February 2023 public offering and flow-through private placement; the amount of mineralized development material to be processed through the Fresnillo plants; the annual exploration expenditures to be paid by the Company on the Company’s 100% interest in the Deer Trail project, the Company’s 100% interest in the Larder project and other exploration projects; the expected capital and sustaining capital requirements to achieve commercial production at the Juanicipio Project; amendments to the Mexican federal labour law on labour subcontracting in Mexico and their potential impacts; the Company’s expectations regarding the sufficiency of its capital resources and requirements for additional capital; the Company’s expectations regarding the payment of dividends and use of available funds; the expected completion of the Company’s comprehensive climate and sustainability risk assessment and scenario planning on the timing contemplated, if at all; the continuation of the Company’s amended shareholder rights plan; the Company’s planned initiatives with respect to its health and safety, environmental, social responsibility, human rights, diversity and other environmental social governance related commitments; the Company’s continued engagement of certain related party service providers (Minera Cascabel S.A. de C.V. (“Cascabel”) and IMDEX Inc. (“IMDEX”)); expectations regarding the impact of certain taxes on the viability of the Juanicipio Project; litigation risks; currency and interest rate fluctuations; surface rights and title risk; environmental risks and reclamation cost; the Company’s commitment to corporate social responsibility; and changes to governmental laws and regulations.

Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. Forward-looking statements are necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control and many of which, regarding future business decisions, are subject to change. Assumptions and other factors underlying the Company’s expectations regarding forward-looking statements or information contained in this Annual Report on Form 40-F include, among others: the Company’s ability to manage growth effectively; the absence of material adverse changes in the mining industry or the global economy; trends in the mining industry and markets; the Company’s ability to maintain good business relationships; the Company’s ability to manage and integrate acquisitions; the Company’s mineral resource estimates, and the assumptions upon which they are based; the Company’s ability to comply with current and future environmental, safety and other regulatory requirements and to obtain and maintain required regulatory approvals; the Company’s expectation that its operations will not be significantly disrupted as a result of political instability, pandemics and communicable diseases, nationalization, terrorism, sabotage, social or political activism, breakdown, natural disasters, governmental or political actions, litigation or arbitration proceedings, equipment or infrastructure failure, labour shortages, transportation disruptions or accidents, or other development or exploration risks; the Company and Fresnillo will agree on the manner in which Minera Juanicipio S.A. de C.V. (“Minera Juanicipio”) and Equipos Chaparral, S.A. de C.V. (together with Minera Juanicipio, the “Juanicipio Entities”) will operate, including agreement on development plans, exploration plans and capital expenditures; the Company’s ability to meet the expected timelines to production; the Company’s ability to retain key personnel; the Company’s ability to raise sufficient debt or equity financing to support the Company’s continued growth; the timely receipt of required approvals and permits; that the Company will continue to have sufficient working capital to fund its operations; that the price of silver, gold, lead, zinc and copper will not decline significantly or for a protracted period of time; the global financial markets and general economic conditions (including monetary policies and rates of inflation) will be stable and conducive to business in the future; and preliminary economic estimates and the assumptions upon which they are based relating to the Juanicipio Project.

Many factors could cause actual results to differ materially from those in forward-looking statements, including, but not limited to: the potential for no commercially mineable deposits due to the speculative nature of the Company’s business; none of the properties in which the Company has an interest having any mineral reserves; estimates of mineral resources being based on interpretation and assumptions which are inherently imprecise; no guarantee of surface rights for the Company’s mineral properties or those it has an interest in; no guarantee of the Company’s ability to obtain all necessary licenses and permits that may be required to carry out exploration and development of its mineral properties or those it has an interest in and business activities; risks related to the properties in which the Company has an interest being primarily located in foreign jurisdictions, including Mexico, which may be subject to political instability, governmental relations and increased police and military enforcement action against criminal activities; the effect of global economic and political instability on the Company’s business; risks related to supply chain disruptions; the Company’s liquidity and long term ability to raise the capital required to execute its business plans may be affected by market volatilities; the effect of virus outbreaks, including the COVID-19 outbreak as a global pandemic on world markets and the Company’s business; emerging climate change regulations could result in significant costs and climate change may result in physical risks to a mining company’s operations; risks related to maintaining a positive relationship with the communities in which the Company operates; risks related to the Company’s ability to finance substantial expenditures required for commercial operations on its mineral properties or those it has an interest in; the Company’s history of losses and, prior to 2020, no revenues from operations; risks related to the negative cash flow from operating activities; risks related to the Company’s ability to arrange additional financing, and possible dilution in or loss of the Company’s interests in its properties or those it has an interest in due to a lack of adequate funding; risks related to the Company’s decision to participate in the development of the Juanicipio Project; uncertainties and risks relating to the start-up of the Juanicipio Project; risks related to construction; the Company’s material property is in the development stage and many such projects experience cost overruns or delays; risks related to limited operating history at Juanicipio in addition to risks associated with establishing new mining operations; geotechnical risks associated with the design and operation of a mine and related civil structures; the Company’s capital and operating costs, production schedules and economic returns are based on certain assumptions which may prove to be inaccurate; risks of cost inflation or decreased availability of commodities consumed by or otherwise used by Juanicipio adversely affecting the Company; risks related to access and availability of infrastructure, power and water; risks related to ground water levels at the Juanicipio Project; risks related to a lack of access to a skilled workforce; labour risks; risks related to amendments to the Federal labour law on labour subcontracting; risks related to the Juanicipio Project mine plan and mine design and the development timeline to production; risks related to the Juanicipio Project not achieving the financial results and the development timeline consistent with the 2017 PEA (as defined herein); risks related to the capital requirements for the Juanicipio Project and the timeline to production; risks related to the mine plan and mine design; risks related to title, challenge to title, or potential title disputes regarding the Company’s mineral properties or those it has an interest in; risks related to potential Indigenous rights claims made against the Company’s mineral properties and the complex nature of such claims; risks related to the Company being a minority shareholder and non-operator of Minera Juanicipio; risks related to the control of Juanicipio cashflows and operation through a joint venture; risks related to the Company’s primary asset being held through a joint venture, which exposes the Company to risks inherent to joint ventures, including disagreements with joint venture partners and similar risks; risks related to disputes with shareholders of the Juanicipio Entities; risks related to the influence of the Company’s significant shareholders over the direction of the Company’s business; the potential for legal proceedings to be brought against the Company; risks related to environmental regulations; the highly competitive nature of the mineral exploration industry; the Company may experience difficulties managing and integrating acquisitions; risks related to equipment shortages, access restrictions and lack of infrastructure on the Company’s mineral properties or those it has an interest in; the Company’s dependence upon key personnel; the Company’s dependence on certain related party service providers (Cascabel and IMDEX) to conduct some of its operations in Mexico; the Company’s dependence on Fresnillo to attract, train and retain qualified personnel; the Company’s dependence on Fresnillo, as the Juanicipio Project operator, to supervise and operate the Juanicipio Project; risks related to directors or officers being, or becoming, associated with other natural resource companies which may give rise to conflicts of interest; currency fluctuations (particularly the C$/U.S.$ and U.S.$/Mexican Peso exchange rates) and inflationary pressures; cyber security risks may impact the Company’s business; risks related to mining operations generally; risks related to natural disasters; tailing/permit risks; risks related to fluctuation of mineral and metal prices and their marketability; the Company may be subject to reputational risk; risks related to the adverse application of new or existing laws, including without limitation anti-corruption laws, human rights laws and Mexican foreign investment, income tax laws and Mexican laws; the Company being subject to Canadian disclosure practices concerning its Mineral Resources which allow for different disclosure than is required for domestic U.S. reporting companies; risks related to the Company’s internal controls over financial reporting and compliance with applicable accounting regulations and securities laws; any enforcement proceedings under Canada’s Extractive Sector Transparency Measures Act against the Company could adversely affect the Company; risks relating to funding and property commitments and future sales or issuances of equity securities that may result in dilution to the Company’s shareholders; the volatility of the price of the Company’s Common Shares; risks related to changes in taxation laws applicable to the Company which may affect the Company’s profitability and ability to repatriate funds from foreign jurisdictions; risks related to uninsured or partially insured losses; the uncertainty of maintaining a liquid trading market for the Company’s Common Shares; the Company could in the future be classified as a “passive foreign investment company” which could have adverse U.S. federal income tax consequences for U.S. shareholders; the difficulty of U.S. litigants effecting service of process or enforcing any judgments against the Company, as the Company, its principals and assets are located outside of the United States; most of the Company’s mineral property assets being located outside of Canada; risks related to dilution to existing shareholders if stock options are exercised; risks related to dilution to existing shareholders if deferred share units, restricted share units or performance share units are converted into Common Shares of the Company; and the history of the Company with respect to not paying dividends and anticipation of not paying dividends in the immediate future. The reader is referred to the Company’s filings with the SEC and Canadian securities regulators for disclosure regarding these and other risk factors. There is no certainty that any forward-looking statement will come to pass and investors should not place undue reliance upon forward-looking statements. The Company does not undertake to provide updates to any of the forward-looking statements in this Annual Report on Form 40-F, except as required by law.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. The foregoing list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements and information. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements and information due to a variety of risks, uncertainties and other factors, including without limitation, those referred to in the AIF under the heading “Risk Factors” and documents incorporated by reference herein.

The Company’s forward-looking statements and information are based on the reasonable beliefs, expectations and opinions of management on the date the statements are made and, other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s beliefs, expectations or opinions should change. For the reasons set forth above, investors should not attribute undue certainty to or place undue reliance on forward-looking statements and information.

Adjacent Property Disclosure

The AIF filed as Exhibit 99.1 to this Annual Report on Form 40-F contains information regarding adjacent properties on which we have no right to explore or mine, and is considered by management to be of material importance to the Company and its land holdings in the area. Investors are cautioned that mineral deposits on adjacent properties are not necessarily probative of the existence, nature or extent of mineral deposits on our properties.

ESTIMATES OF MINERAL RESOURCES

The Company’s AIF filed as Exhibit 99.1 to this Annual Report on Form 40-F and Management’s Discussion and Analysis for the fiscal year ended December 31, 2022 filed as Exhibit 99.2 to this Annual Report on Form 40-F have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Counsel, as amended (the “CIM Definition Standards”). NI 43-101 is an instrument developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the disclosure requirements of the SEC under subpart 1300 of Regulation S-K (the “SEC Modernization Rules”). The Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and provides disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, information contained in the Company’s AIF for the fiscal year ended December 31, 2022 and Management’s Discussion and Analysis for the fiscal year ended December 31, 2022 may differ significantly from the information that would be disclosed had the Company prepared its mineral resource estimates under the standards adopted under the SEC Modernization Rules.

DISCLOSURE CONTROLS AND PROCEDURES

After evaluating the effectiveness of the Company’s disclosure controls and procedures as required by paragraph (b) of Exchange Act Rule 13a-15, the Chief Executive Officer and Chief Financial Officer of the Company have concluded that, as of the end of the period covered by this Annual Report on Form 40-F, the Company’s disclosure controls and procedures were effective to ensure that information required to be disclosed by the Company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and accumulated and communicated to the Company’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure.

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)) is a process designed by, or caused to be designed under the supervision of the President and Chief Executive Officer, and the Chief Financial Officer, and effected by the Board of Directors, management and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with IFRS. It includes those policies and procedures that:

| |

i.

|

pertain to the maintenance of records that accurately and fairly reflect, in reasonable detail, the transactions and dispositions of assets of the Company;

|

| |

ii.

|

provide reasonable assurance that transactions are recorded as necessary to permit preparation of consolidated financial statements in accordance with IFRS, and that the Company’s receipts and expenditures are made only in accordance with authorizations of management and the Company’s directors; and

|

| |

iii.

|

provided reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the Company’s consolidated financial statements.

|

Due to its inherent limitations, internal control over financial reporting may not prevent or detect misstatements on a timely basis. Also, projections of any evaluation of the effectiveness of internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2022, based on the criteria set forth in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this assessment, management concluded that, as of December 31, 2022, the Company’s internal control over financial reporting was effective.

The effectiveness of MAG’s internal control over financial reporting, as of December 31, 2022, has been audited by Deloitte LLP, Independent Registered Public Accounting Firm, who also audited the Company’s consolidated financial statements as at and for the year ended December 31, 2022, as stated in their reports.

ATTESTATION REPORT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Company’s internal control over financial reporting as of December 31, 2022 has been audited by Deloitte LLP, Independent Registered Public Accounting Firm, who also audited the Registrant’s Consolidated Financial Statements for the years ended December 31, 2022 and 2021. Deloitte LLP expressed an unqualified opinion on the effectiveness of the Registrant’s internal control over financial reporting. The reports of Deloitte LLP are found under the heading “Report of Independent Registered Public Accounting Firm” in the Registrant’s Audited Annual Consolidated Financial Statements for fiscal year ended December 31, 2022, included as Exhibit 99.2 to this Annual Report on Form 40-F.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

During the period covered by this Annual Report on Form 40-F, no changes occurred in the Company’s internal control over financial reporting that were identified in connection with the evaluation required by paragraph (d) of Exchange Act Rule 13a-15 that materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

Not applicable.

AUDIT COMMITTEE FINANCIAL EXPERT

As at December 31, 2022, the Audit Committee was comprised of Dale Peniuk, Peter Barnes and Jill Leversage. The Company’s Board of Directors has determined that each of the members of the Audit Committee is an “audit committee financial expert” as that term is defined in paragraph (8) of General Instruction B of Form 40-F, and each is an “independent director” as that term is defined under the listing standards applicable to the Company contained in Section 803A of the NYSE American Company Guide. A description of the relevant experience of each of such director can be found in the AIF. The SEC has indicated that the designation of a director as an audit committee financial expert does not make that director an “expert” for any purpose, impose any duties, obligations or liability on him or her that are greater than those imposed on members of the Audit Committee and Board of Directors who do not carry this designation, or affect the duties, obligations or liability of any other member of the Audit Committee or Board of Directors.

CODE OF ETHICS FOR CHIEF EXECUTIVE OFFICER, CHIEF FINANCIAL OFFICER,

AND OFFICERS AND DIRECTORS

The Company has adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) for its Chief Executive Officer, Chief Financial Officer, directors and officers. The Company furnished the latest version of the Code of Conduct with the SEC on March 28, 2022, as Exhibit 99.1 to its Form 6-K. Individuals may obtain a copy upon request, addressed to the Corporate Secretary, MAG Silver Corp., #770-800 West Pender Street, Vancouver, British Columbia, V6C 2V6. The Company has also posted the Code of Conduct on its internet website at www.magsilver.com. The Code of Conduct is reviewed annually, most recently on March 24, 2023. No waivers were granted from the Code of Conduct during the fiscal year ended December 31, 2022.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The aggregate fees billed by the Company’s current external auditor, Deloitte LLP, Vancouver, British Columbia, Canada, PCAOB ID No. 1208, in each of the last two fiscal years are as follows:

| |

|

Year ended

December 31, 2022

Canadian $

|

|

|

Year ended

December 31, 2021

Canadian $

|

|

|

Audit Fees

|

|

|

389,000 |

|

|

|

333,882 |

|

|

Audit-Related Fees

|

|

|

4,073 |

|

|

|

0 |

|

|

Tax Fees

|

|

|

93,787 |

|

|

|

100,870 |

|

|

All Other Fees

|

|

|

0 |

|

|

|

0 |

|

|

Total

|

|

|

486,860 |

|

|

|

434,752 |

|

The nature of the services provided by Deloitte LLP under each of the categories indicated in the table is described below.

Audit Fees

Audit fees are those incurred for professional services rendered by Deloitte LLP for the audit of the Company’s annual consolidated financial statements, for the quarterly interim reviews of the Company’s unaudited consolidated financial statements, and for services that are normally provided by Deloitte LLP in connection with regulatory filings.

Audit-Related Fees

The fees in 2022 include amounts with respect to the Company’s Canadian Public Accountability Board fees that are remitted by Deloitte LLP on behalf of the Company.

Tax Fees

Tax fees are those incurred for professional services rendered by Deloitte LLP for tax compliance, including the review of tax returns, tax planning and advisory services relating to common forms of domestic and international taxation, continued tax planning and advisory services on potential restructuring and spin-out projects, and services related to the Company’s transfer pricing report.

All Other Fees

There are no other fees to report under this category for professional services rendered by Deloitte LLP for the Company.

PRE-APPROVAL POLICIES AND PROCEDURES

It is within the mandate of the Company’s Audit Committee to pre-approve all audit and non-audit related fees. The Audit Committee is informed routinely as to the non-audit services actually provided by the auditor pursuant to this pre-approval process. The auditors also present the estimate for the annual audit related services to the Audit Committee for approval prior to undertaking the annual audit of the financial statements. No audit-related services or other services were approved by the Audit Committee pursuant to the de minimis exception provided by Section (c)(7)(i)(C) of Rule 2-01 or Regulation S-X.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet arrangements required to be disclosed in this Annual Report on Form 40-F.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Company has a separately designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act. As at December 31, 2022, the Audit Committee was comprised of the following members:

|

|

Chair:

|

Dale Peniuk

|

|

|

Members:

|

Peter Barnes

|

|

|

|

Jill Leversage

|

MINE SAFETY DISCLOSURE

Not applicable.

CORPORATE GOVERNANCE PRACTICES

There are certain differences between the corporate governance practices applicable to the Company and those applicable to U.S. companies under the NYSE American Company Guide. Any significant differences will be described on the Company’s website at www.magsilver.com. Information contained in or otherwise accessible through the Company’s website does not form part of this Form 40-F and is not incorporated into this Form 40-F by reference.

UNDERTAKING

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company has filed an Appointment of Agent for Service of Process and Undertaking on Form F-X with respect to the class of securities in relation to which the obligation to file this Form 40-F arises.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report on Form 40-F to be signed on its behalf by the undersigned, thereto duly authorized.

Registrant: MAG SILVER CORP.

| By: |

/s/ George Paspalas |

|

| Name: |

George Paspalas |

|

| Title: |

President and Chief Executive Officer |

|

| Dated: |

March 27, 2023 |

|

| |

|

|

| |

|

|

EXHIBITS

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

101

|

Interactive Data File (formatted as Inline XBRL).

|

| |

|

| 104 |

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

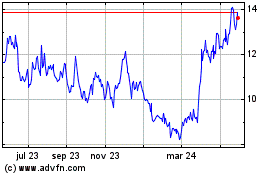

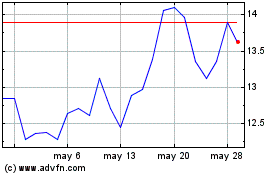

MAG Silver (AMEX:MAG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

MAG Silver (AMEX:MAG)

Gráfica de Acción Histórica

De May 2023 a May 2024