0000032621

EMERSON RADIO CORP

false

--03-31

Q3

2023

10,000,000

10,000,000

3,677

3,677

3,677

3,677

3,677,000

3,677,000

0.01

0.01

75,000,000

75,000,000

52,965,797

52,965,797

21,042,652

21,042,652

31,923,145

31,923,145

1

0

0

0

2018 2019 2020 2021 2022 2023

2017 2018 2019 2020 2021 2022

0

2

3

2

3

3

3

3

2

4

2

6

60

0

0

0

false

false

false

false

00000326212023-04-012023-12-31

xbrli:shares

00000326212024-02-20

thunderdome:item

iso4217:USD

0000032621us-gaap:ProductMember2023-10-012023-12-31

0000032621us-gaap:ProductMember2022-10-012022-12-31

0000032621us-gaap:ProductMember2023-04-012023-12-31

0000032621us-gaap:ProductMember2022-04-012022-12-31

0000032621us-gaap:LicenseMember2023-10-012023-12-31

0000032621us-gaap:LicenseMember2022-10-012022-12-31

0000032621us-gaap:LicenseMember2023-04-012023-12-31

0000032621us-gaap:LicenseMember2022-04-012022-12-31

0000032621us-gaap:RoyaltyMember2023-10-012023-12-31

0000032621us-gaap:RoyaltyMember2022-10-012022-12-31

0000032621us-gaap:RoyaltyMember2023-04-012023-12-31

0000032621us-gaap:RoyaltyMember2022-04-012022-12-31

00000326212023-10-012023-12-31

00000326212022-10-012022-12-31

00000326212022-04-012022-12-31

iso4217:USDxbrli:shares

00000326212023-12-31

00000326212023-03-31

0000032621us-gaap:RelatedPartyMember2023-12-31

0000032621us-gaap:RelatedPartyMember2023-03-31

00000326212022-03-31

00000326212022-12-31

0000032621us-gaap:PreferredStockMember2023-03-31

0000032621us-gaap:CommonStockMember2023-03-31

0000032621us-gaap:AdditionalPaidInCapitalMember2023-03-31

0000032621us-gaap:RetainedEarningsMember2023-03-31

0000032621us-gaap:TreasuryStockCommonMember2023-03-31

0000032621us-gaap:PreferredStockMember2023-04-012023-12-31

0000032621us-gaap:CommonStockMember2023-04-012023-12-31

0000032621us-gaap:AdditionalPaidInCapitalMember2023-04-012023-12-31

0000032621us-gaap:RetainedEarningsMember2023-04-012023-12-31

0000032621us-gaap:TreasuryStockCommonMember2023-04-012023-12-31

0000032621us-gaap:PreferredStockMember2023-12-31

0000032621us-gaap:CommonStockMember2023-12-31

0000032621us-gaap:AdditionalPaidInCapitalMember2023-12-31

0000032621us-gaap:RetainedEarningsMember2023-12-31

0000032621us-gaap:TreasuryStockCommonMember2023-12-31

0000032621us-gaap:PreferredStockMember2022-03-31

0000032621us-gaap:CommonStockMember2022-03-31

0000032621us-gaap:AdditionalPaidInCapitalMember2022-03-31

0000032621us-gaap:RetainedEarningsMember2022-03-31

0000032621us-gaap:TreasuryStockCommonMember2022-03-31

0000032621us-gaap:PreferredStockMember2022-04-012022-12-31

0000032621us-gaap:CommonStockMember2022-04-012022-12-31

0000032621us-gaap:AdditionalPaidInCapitalMember2022-04-012022-12-31

0000032621us-gaap:RetainedEarningsMember2022-04-012022-12-31

0000032621us-gaap:TreasuryStockCommonMember2022-04-012022-12-31

0000032621us-gaap:PreferredStockMember2022-12-31

0000032621us-gaap:CommonStockMember2022-12-31

0000032621us-gaap:AdditionalPaidInCapitalMember2022-12-31

0000032621us-gaap:RetainedEarningsMember2022-12-31

0000032621us-gaap:TreasuryStockCommonMember2022-12-31

utr:Y

0000032621msn:MicrowaveOvensMember2023-04-012023-12-31

utr:D

0000032621msn:AudioProductsMember2023-04-012023-12-31

0000032621us-gaap:DomesticCountryMember2023-12-31

xbrli:pure

0000032621us-gaap:DomesticCountryMember2023-04-012023-12-31

0000032621us-gaap:StateAndLocalJurisdictionMember2023-12-31

0000032621us-gaap:StateAndLocalJurisdictionMember2023-04-012023-12-31

00000326212023-07-122023-07-12

0000032621us-gaap:MajorityShareholderMember2023-12-31

0000032621msn:VigersAppraisalAndConsultingLtdMember2023-10-012023-12-31

0000032621msn:VigersAppraisalAndConsultingLtdMember2023-04-012023-12-31

0000032621msn:VigersAppraisalAndConsultingLtdMember2023-12-31

0000032621us-gaap:CashEquivalentsMember2023-12-31

0000032621us-gaap:CashEquivalentsMember2023-03-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-10-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:TwoLargestCustomersMember2023-10-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:WalmartMember2023-10-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:AmazonMember2023-10-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-04-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:ThreeLargestCustomersMember2023-04-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:WalmartMember2023-04-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:AmazonMember2023-04-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:FredMeyerMember2023-04-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-10-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:TwoLargestCustomersMember2022-10-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:WalmartMember2022-10-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:AmazonMember2022-10-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-04-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:ThreeLargestCustomersMember2022-04-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:WalmartMember2022-04-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:AmazonMember2022-04-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermsn:FredMeyerMember2022-04-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembermsn:MicrowaveOvensMember2023-10-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembermsn:MicrowaveOvensMember2023-04-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembermsn:AudioProductsMember2023-10-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembermsn:AudioProductsMember2023-04-012023-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembermsn:MicrowaveOvensMember2022-10-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembermsn:MicrowaveOvensMember2022-04-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembermsn:AudioProductsMember2022-10-012022-12-31

0000032621us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembermsn:AudioProductsMember2022-04-012022-12-31

0000032621us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-04-012023-12-31

0000032621us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembermsn:CustomerOneMember2023-04-012023-12-31

0000032621us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembermsn:CustomerTwoMember2023-04-012023-12-31

0000032621us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembermsn:CustomerThreeMember2023-04-012023-12-31

0000032621us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2022-04-012023-03-31

0000032621us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembermsn:CustomerOneMember2022-04-012023-03-31

0000032621us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembermsn:CustomerTwoMember2022-04-012023-03-31

0000032621us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembermsn:CustomerThreeMember2022-04-012023-03-31

0000032621srt:MaximumMember2023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:ThreeLargestFactorySuppliersMember2023-10-012023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMember2023-10-012023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:LargestSupplierMember2023-10-012023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:SupplierOneMember2023-10-012023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:SupplierTwoMember2023-10-012023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:TwoLargestFactorySuppliersMember2022-10-012022-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMember2022-10-012022-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:LargestSupplierMember2022-10-012022-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:SupplierOneMember2022-10-012022-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:FourLargestFactorySuppliersMember2023-04-012023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMember2023-04-012023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:LargestSupplierMember2023-04-012023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:SupplierOneMember2023-04-012023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:SupplierTwoMember2023-04-012023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:SupplierThreeMember2023-04-012023-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:TwoLargestFactorySuppliersMember2022-04-012022-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMember2022-04-012022-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:LargestSupplierMember2022-04-012022-12-31

0000032621msn:ProductsForResaleMemberus-gaap:SupplierConcentrationRiskMembermsn:SupplierOneMember2022-04-012022-12-31

0000032621srt:MinimumMember2023-12-31

utr:M

0000032621msn:EmploymentSupportSchemeMember2023-10-012023-12-31

0000032621msn:EmploymentSupportSchemeMember2022-10-012022-12-31

0000032621msn:EmploymentSupportSchemeMember2023-04-012023-12-31

0000032621msn:EmploymentSupportSchemeMember2022-04-012022-12-31

00000326212022-04-192022-04-19

00000326212022-04-012023-03-31

00000326212023-09-292023-09-29

00000326212023-07-012023-09-30

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 31, 2023

Or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-07731

EMERSON RADIO CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 22-3285224 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 959 Route 46 East, Suite 210, Parsippany, NJ | 07054 |

| (Address of principal executive offices) | (Zip code) |

(973) 428-2000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

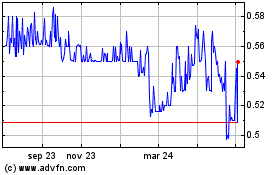

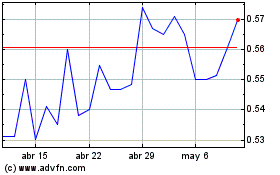

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, par value $.01 per share | MSN | NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | | |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Indicate the number of shares outstanding of common stock as of February 20, 2024: 21,042,652.

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements.

The Company recently engaged a new independent registered public accounting firm and such firm has not yet completed its review of the unaudited interim consolidated financial statements as of, and for the three and nine months ended December 31, 2023 presented in this Quarterly Report on Form 10-Q, in accordance with Public Company Accounting Oversight Board Auditing Standard 4105, Reviews of Interim Financial Information. Accordingly, this Quarterly Report on Form 10-Q is considered substantially deficient and the Company is no longer considered to be timely or current in its filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Once the registered public accounting firm has completed its review of the financial statements in this Quarterly Report on Form 10-Q, the Company plans to remediate the deficiency by filing an appropriate amendment to this Quarterly Report on Form 10-Q with the Securities and Exchange Commission (“SEC”).

While this Quarterly Report on Form 10-Q does not comply with the requirements of Regulation S-X, and should not be interpreted to be a substitute for the review that would normally occur by the Company’s independent registered public accounting firm, the Company’s management believes that the interim financial information presented herein fairly presents, in all material respects, the financial condition and results of operations of the Company as of the end of and for the referenced periods. Except for the absence of this review of the unaudited interim financial information discussed above, this Quarterly Report on Form 10-Q fully complies with the requirements of the Exchange Act and the Company believes it is prudent to file this Quarterly Report on Form 10-Q with the SEC in spite of the current circumstances to provide the financial and other information set forth therein to its stockholders and other interested parties.

EMERSON RADIO CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share data)

| |

|

Three Months Ended December 31, |

|

|

Nine Months Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

(Not Reviewed) |

|

|

|

|

|

|

|

(Not Reviewed) |

|

|

|

|

|

| Net revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net product sales |

|

$ |

2,599 |

|

|

$ |

1,704 |

|

|

$ |

6,745 |

|

|

$ |

4,335 |

|

| Licensing revenue |

|

|

23 |

|

|

|

123 |

|

|

|

124 |

|

|

|

271 |

|

| Royalty income |

|

|

— |

|

|

|

105 |

|

|

|

— |

|

|

|

700 |

|

| Net revenues |

|

|

2,622 |

|

|

|

1,932 |

|

|

|

6,869 |

|

|

|

5,306 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

2,144 |

|

|

|

1,361 |

|

|

|

5,654 |

|

|

|

3,549 |

|

| Selling, general and administrative expenses |

|

|

1,202 |

|

|

|

1,051 |

|

|

|

3,464 |

|

|

|

3,686 |

|

| Total costs and expenses |

|

|

3,346 |

|

|

|

2,412 |

|

|

|

9,118 |

|

|

|

7,235 |

|

| Operating loss |

|

|

(724 |

) |

|

|

(480 |

) |

|

|

(2,249 |

) |

|

|

(1,929 |

) |

| Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Settlement of litigation |

|

|

— |

|

|

|

— |

|

|

|

3,100 |

|

|

|

— |

|

| Interest income, net |

|

|

289 |

|

|

|

235 |

|

|

|

872 |

|

|

|

424 |

|

| Income from governmental assistance programs |

|

|

— |

|

|

|

4 |

|

|

|

— |

|

|

|

34 |

|

| Income (loss) before income taxes |

|

|

(435 |

) |

|

|

(241 |

) |

|

|

1,723 |

|

|

|

(1,471 |

) |

| Provision for income tax expense |

|

|

(14 |

) |

|

|

— |

|

|

|

74 |

|

|

|

— |

|

| Net income (loss) |

|

|

(421 |

) |

|

|

(241 |

) |

|

|

1,649 |

|

|

|

(1,471 |

) |

| Basic income (loss) per share |

|

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

|

$ |

0.08 |

|

|

$ |

(0.07 |

) |

| Diluted income (loss) per share |

|

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

|

$ |

0.08 |

|

|

$ |

(0.07 |

) |

| Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

21,042,652 |

|

|

|

21,042,652 |

|

|

|

21,042,652 |

|

|

|

21,042,652 |

|

| Diluted |

|

|

21,042,652 |

|

|

|

21,042,652 |

|

|

|

21,042,652 |

|

|

|

21,042,652 |

|

The accompanying notes are an integral part of the consolidated financial statements.

EMERSON RADIO CORP. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands except share data)

| | | December 31, 2023 | | | March 31, 2023 | |

| | | | (Not Reviewed) | | | | | |

| ASSETS | | | | | | | | |

| Current Assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 3,637 | | | $ | 25,268 | |

| Short term investments | | | 18,505 | | | | — | |

| Accounts receivable, net | | | 1,087 | | | | 1,165 | |

| Licensing receivable | | | 228 | | | | 245 | |

| Inventory | | | 5,761 | | | | 3,813 | |

| Prepaid purchases | | | 137 | | | | 247 | |

| Prepaid expenses and other current assets | | | 364 | | | | 357 | |

| Total Current Assets | | | 29,719 | | | | 31,095 | |

| Non-Current Assets: | | | | | | | | |

| Property and equipment, net | | | 91 | | | | 1 | |

| Right-of-use asset-operating leases | | | 327 | | | | 200 | |

| Right-of-use asset-finance leases | | | 1 | | | | 1 | |

| Other assets | | | 84 | | | | 74 | |

| Total Non-Current Assets | | | 503 | | | | 276 | |

| Total Assets | | $ | 30,222 | | | $ | 31,371 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | |

| Current Liabilities: | | | | | | | | |

| Accounts payable and other current liabilities | | | 1,287 | | | | 641 | |

| Due to affiliate | | | 1 | | | | 1 | |

| Short-term operating lease liability | | | 128 | | | | 139 | |

| Short-term finance lease liability | | | 1 | | | | 1 | |

| Income tax payable, current portion | | | 609 | | | | 401 | |

| Advanced deposits | | | — | | | | 3,316 | |

| Deferred revenue | | | 212 | | | | 149 | |

| Total Current Liabilities | | | 2,238 | | | | 4,648 | |

| Non-Current Liabilities: | | | | | | | | |

| Long-term operating lease liability | | | 208 | | | | 62 | |

| Long-term finance lease liability | | | — | | | | — | |

| Income tax payable | | | 668 | | | | 1,202 | |

| Total Non-Current Liabilities | | | 876 | | | | 1,264 | |

| Total Liabilities | | $ | 3,114 | | | $ | 5,912 | |

| Shareholders’ Equity: | | | | | | | | |

| Series A Preferred shares — 10,000,000 shares authorized; 3,677 shares issued and outstanding; liquidation preference of $3,677,000 | | | 3,310 | | | | 3,310 | |

| Common shares — $0.01 par value, 75,000,000 shares authorized; 52,965,797 shares issued at December 31, 2023 and March 31, 2023, respectively; 21,042,652 shares outstanding at December 31, 2023 and March 31, 2023, respectively | | | 529 | | | | 529 | |

| Additional paid-in capital | | | 79,792 | | | | 79,792 | |

| Accumulated deficit | | | (23,322 | ) | | | (24,971 | ) |

| Treasury stock, at cost (31,923,145 shares at December 31, 2023 and March 31, 2023, respectively) | | | (33,201 | ) | | | (33,201 | ) |

| Total Shareholders’ Equity | | | 27,108 | | | | 25,459 | |

| Total Liabilities and Shareholders’ Equity | | $ | 30,222 | | | $ | 31,371 | |

The accompanying notes are an integral part of the consolidated financial statements.

EMERSON RADIO CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

| |

|

Nine Months Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Cash Flows from Operating Activities: |

|

|

(Not Reviewed) |

|

|

|

|

|

| Net income (loss) |

|

$ |

1,649 |

|

|

$ |

(1,471 |

) |

| Adjustments to reconcile net income (loss) to net cash (used) by operating activities: |

|

|

|

|

|

|

|

|

| Amortization of right-of-use assets |

|

|

121 |

|

|

|

159 |

|

| Depreciation and amortization |

|

|

17 |

|

|

|

— |

|

| Asset valuation allowance |

|

|

64 |

|

|

|

39 |

|

| Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

14 |

|

|

|

328 |

|

| Licensing receivable |

|

|

17 |

|

|

|

(191 |

) |

| Inventory |

|

|

(1,948 |

) |

|

|

(233 |

) |

| Prepaid purchases |

|

|

110 |

|

|

|

(503 |

) |

| Prepaid expenses and other current assets |

|

|

(7 |

) |

|

|

136 |

|

| Other assets |

|

|

(10 |

) |

|

|

— |

|

| Accounts payable and other current liabilities |

|

|

646 |

|

|

|

(244 |

) |

| Right of use assets-operating |

|

|

(248 |

) |

|

|

— |

|

| Short term lease liabilities |

|

|

(11 |

) |

|

|

(66 |

) |

| Long term lease liabilities |

|

|

146 |

|

|

|

(104 |

) |

| Due to affiliate |

|

|

— |

|

|

|

1 |

|

| Income taxes payable |

|

|

(326 |

) |

|

|

(205 |

) |

| Advanced deposits |

|

|

(3,316 |

) |

|

|

4,100 |

|

| Deferred revenue |

|

|

63 |

|

|

|

(28 |

) |

| Net cash (used) provided by operating activities |

|

|

(3,019 |

) |

|

|

1,718 |

|

| Cash Flows From Investing Activities: |

|

|

|

|

|

|

|

|

| Purchases of investments |

|

|

(18,505 |

) |

|

|

— |

|

| Additions to property and equipment |

|

|

(107 |

) |

|

|

— |

|

| Disposals of property and equipment |

|

|

— |

|

|

|

— |

|

| Net cash (used) by investing activities |

|

|

(18,612 |

) |

|

|

— |

|

| Cash Flows from Financing Activities: |

|

|

|

|

|

|

|

|

| |

|

|

— |

|

|

|

— |

|

| Net cash provided by financing activities |

|

|

— |

|

|

|

— |

|

| Net (decrease) increase in cash and cash equivalents |

|

|

(21,631 |

) |

|

|

1,718 |

|

| Cash and cash equivalents at beginning of the year |

|

|

25,268 |

|

|

|

25,576 |

|

| Cash and cash equivalents at end of the year |

|

$ |

3,637 |

|

|

$ |

27,294 |

|

| Supplemental disclosures: |

|

|

|

|

|

|

|

|

| Cash paid for: |

|

|

|

|

|

|

|

|

| Interest |

|

$ |

4 |

|

|

$ |

8 |

|

| Income taxes |

|

$ |

401 |

|

|

$ |

205 |

|

The accompanying notes are an integral part of the consolidated financial statements.

EMERSON RADIO CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(Unaudited)

(In thousands)

| |

|

|

|

|

|

Common Stock |

|

|

Additional |

|

|

|

|

|

|

|

|

|

|

Total |

|

| |

|

Preferred |

|

|

Number |

|

|

Par |

|

|

Paid-In |

|

|

Accumulated |

|

|

Treasury |

|

|

Shareholders’ |

|

| |

|

Stock |

|

|

of Shares |

|

|

Value |

|

|

Capital |

|

|

Deficit |

|

|

Stock |

|

|

Equity |

|

| Balance — March 31, 2023 |

|

$ |

3,310 |

|

|

|

52,965,797 |

|

|

$ |

529 |

|

|

$ |

79,792 |

|

|

$ |

(24,971 |

) |

|

$ |

(33,201 |

) |

|

$ |

25,459 |

|

| Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,649 |

|

|

|

— |

|

|

|

1,649 |

|

| Balance — December 31, 2023 |

|

$ |

3,310 |

|

|

|

52,965,797 |

|

|

$ |

529 |

|

|

$ |

79,792 |

|

|

$ |

(23,322 |

) |

|

$ |

(33,201 |

) |

|

$ |

27,108 |

|

(Not Reviewed)

| |

|

|

|

|

|

Common Stock |

|

|

Additional |

|

|

|

|

|

|

|

|

|

|

Total |

|

| |

|

Preferred |

|

|

Number |

|

|

Par |

|

|

Paid-In |

|

|

Accumulated |

|

|

Treasury |

|

|

Shareholders’ |

|

| |

|

Stock |

|

|

of Shares |

|

|

Value |

|

|

Capital |

|

|

Deficit |

|

|

Stock |

|

|

Equity |

|

| Balance — March 31, 2022 |

|

$ |

3,310 |

|

|

|

52,965,797 |

|

|

$ |

529 |

|

|

$ |

79,792 |

|

|

$ |

(23,611 |

) |

|

$ |

(33,201 |

) |

|

$ |

26,819 |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,471 |

) |

|

|

— |

|

|

|

(1,471 |

) |

| Balance — December 31, 2022 |

|

$ |

3,310 |

|

|

|

52,965,797 |

|

|

$ |

529 |

|

|

$ |

79,792 |

|

|

$ |

(25,082 |

) |

|

$ |

(33,201 |

) |

|

$ |

25,348 |

|

(Not Reviewed)

The accompanying notes are an integral part of the consolidated financial statements.

EMERSON RADIO CORP. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited and Not Reviewed)

NOTE 1 — BACKGROUND AND BASIS OF PRESENTATION

The consolidated financial statements include the accounts of Emerson Radio Corp. and its subsidiaries (“Emerson” or the “Company”). The Company designs, sources, imports and markets certain houseware and consumer electronic products, and licenses the Company’s trademarks for a variety of products.

The unaudited interim consolidated financial statements reflect all normal and recurring adjustments that are, in the opinion of management, necessary to present a fair statement of the Company’s consolidated financial position as of December 31, 2023 and the results of operations for the three and nine month periods ended December 31, 2023 and December 31, 2022. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary in order to make the financial statements not misleading have been included. All significant intercompany accounts and transactions have been eliminated in consolidation. The preparation of the unaudited interim consolidated financial statements requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes; actual results could materially differ from those estimates. The unaudited interim consolidated financial statements have been prepared pursuant to the rules and regulations of the SEC and accordingly do not include all of the disclosures normally made in the Company’s annual consolidated financial statements. Accordingly, these unaudited interim consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto for the fiscal year ended March 31, 2023 (“fiscal 2023”), included in the Company’s Annual Report on Form 10-K, as amended, for fiscal 2023.

The results of operations for the three and nine month periods ended December 31, 2023 are not necessarily indicative of the results of operations that may be expected for any other interim period or for the full year ending March 31, 2024 (“fiscal 2024”).

Whenever necessary, reclassifications are made to conform the prior year’s consolidated financial statements to the current year’s presentation.

Recently Issued Accounting Pronouncements

The following Accounting Standards Updates (“ASUs”) were issued by the Financial Accounting Standards Board (“FASB”) which relate to or could relate to the Company as concerns the Company’s normal ongoing operations or the industry in which the Company operates.

Accounting Standards Update 2019-12 “Income Taxes (Topic 740) – Simplifying the Accounting for Income Taxes” (Issued December 2019)

In December 2019, the FASB issued ASU 2019-12, “Income Taxes (Topic 740) - Simplifying the Accounting for Income Taxes,” which is intended to simplify various aspects related to accounting for income taxes. ASU 2019-12 removes certain exceptions to the general principles in Topic 740 and also clarifies and amends existing guidance to improve consistent application. ASU 2019-12 is effective for fiscal years beginning after December 15, 2020. This standard took effect in the first quarter ( June 2021) of the Company’s fiscal year ending March 31, 2022. The adoption of ASU 2019-12 had no material impact on the Company’s consolidated financial statements and related disclosures.

Accounting Standards Update 2016-13 “Financial Instruments – Credit Losses” (Issued June 2016)

In June 2016, the FASB issued ASU 2016-13 “Financial Instruments - Credit Losses” to introduce new guidance for the accounting for credit losses on instruments within its scope. ASU 2016-13 requires among other things, the measurement of all expected credit losses for financial assets held at the reporting date based on historical experience, current conditions, and reasonable supportable forecasts. Many of the loss estimation techniques applied today will still be permitted, although the inputs to those techniques will change to reflect the full amount of expected credit losses. In addition, ASU 2016-13 amends the accounting for credit losses on available-for-sale debt securities and purchased financial assets with credit deterioration. ASU 2016-13 is effective for fiscal years and interim periods beginning after December 15, 2022. The adoption of ASU 2016-13 had no material impacts on the Company's financial statements.

Revenue recognition: Sales to customers and related cost of sales are primarily recognized at the point in time when control of goods transfers to the customer. Control is considered to be transferred when the customer has the ability to direct the use of and obtain substantially all of the remaining benefits of that good. Under the Direct Import Program, title passes in the country of origin when the goods are passed over the rail of the customer’s vessel. Under the Domestic Program, title passes primarily at the time of shipment. Estimates for future expected returns are based upon historical return rates and netted against revenues.

Revenue is measured as the amount of consideration the Company expects to receive in exchange for transferring goods. Revenue is recorded net of customer discounts, promotional allowances, volume rebates and similar charges. When the Company offers the right to return product, historical experience is utilized to establish a liability for the estimate of expected returns. Sales and other tax amounts collected from customers for remittance to governmental authorities are excluded from revenue.

Management must make estimates of potential future product returns related to current period product revenue. Management analyzes historical returns, current economic trends and changes in customer demand for the Company’s products when evaluating the adequacy of the reserve for sales returns. Management judgments and estimates must be made and used in connection with establishing the sales return reserves in any accounting period. Additional reserves may be required if actual sales returns increase above the historical return rates. Conversely, the sales return reserve could be decreased if the actual return rates are less than the historical return rates, which were used to establish the reserve.

Sales allowances, marketing support programs, promotions and other volume-based incentives which are provided to retailers and distributors are accounted for on an accrual basis as a reduction to net revenues in the period in which the related sales are recognized in accordance with ASC topic 606, “Revenue from Contracts with Customers” (“ASC 606”).

At the time of sale, the Company reduces recognized gross revenue by allowances to cover, in addition to estimated sales returns as required by ASC 606, (i) sales incentives offered to customers that meet the criteria for accrual and (ii) an estimated amount to recognize additional non-offered deductions it anticipates and can reasonably estimate will be taken by customers, which it does not expect to recover. Accruals for the estimated amount of future non-offered deductions are required to be made as contra-revenue items, because that percentage of shipped revenue fails to meet the collectability criteria within ASC 606.

If additional marketing support programs, promotions and other volume-based incentives are required to promote the Company’s products subsequent to the initial sale, then additional reserves may be required and are accrued for when such support is offered.

The Company offers limited warranties for its consumer electronics, comparable to those offered to consumers by the Company’s competitors in the United States. Such warranties typically consist of a one year period for microwaves and a 90 day period for audio products, under which the Company pays for labor and parts, or offers a new or similar unit in exchange for a non-performing unit.

Licensing: In addition to the distribution of products, the Company grants licenses for the right to access the Company’s intellectual property, specifically the Company’s trademarks, for a stated term for the manufacture and/or sale of consumer electronics and other products under agreements which require payment of either (i) a non-refundable minimum guaranteed royalty or, (ii) the greater of (a) the actual royalties due (based on a contractual calculation, normally comprised of actual product sales by the licensee multiplied by a stated royalty rate, or “Sales Royalties”) or (b) a minimum guaranteed royalty amount. In the case of the foregoing clause (i), such amounts are recognized as revenue on a straight-line basis over the term of the license agreement. In the case of the foregoing clause (ii), Sales Royalties in excess of guaranteed minimums are accounted for as variable fees and are not recognized as revenue until the Company has ascertained that the licensee’s sales of products have exceeded the guaranteed minimum. In effect, the Company recognizes the greater of Sales Royalties earned to date or the straight-line amount of minimum guaranteed royalties to date. In the case where a royalty is paid to the Company in advance, the royalty payment is initially recorded as a liability and recognized as revenue as the royalties are deemed to be earned according to the principles outlined above.

NOTE 2 — EARNINGS PER SHARE

The following table sets forth the computation of basic and diluted earnings per share (in thousands, except per share amounts). Weighted average shares includes the impact of shares held in treasury.

| | | Three Months Ended December 31, | | | Nine Months Ended December 31, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | | | | | | | | | | | | | | | |

| Numerator: | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | (421 | ) | | $ | (241 | ) | | $ | 1,649 | | | $ | (1,471 | ) |

| Denominator: | | | | | | | | | | | | | | | | |

| Denominator for basic and diluted income (loss) per share — weighted average shares | | | 21,042,652 | | | | 21,042,652 | | | | 21,042,652 | | | | 21,042,652 | |

| Net income (loss) per share: | | | | | | | | | | | | | | | | |

| Basic and diluted income (loss) per share | | $ | (0.02 | ) | | $ | (0.01 | ) | | $ | 0.08 | | | $ | (0.07 | ) |

NOTE 3 — SHAREHOLDERS’ EQUITY

Outstanding capital stock at December 31, 2023 consisted of common stock and Series A preferred stock. The Series A preferred stock is non-voting, has no dividend preferences and has not been convertible since March 31, 2002; however, it retains a liquidation preference.

At December 31, 2023, the Company had no options, warrants or other potentially dilutive securities outstanding.

NOTE 4 — INVENTORY

Inventories, which consist primarily of finished goods, are stated at the lower of cost or net realizable value. Cost is determined using the first-in, first-out method. As of December 31, 2023 and March 31, 2023, inventories consisted of the following (in thousands):

| | | December 31, 2023 | | | March 31, 2023 | |

| Finished goods | | $ | 5,761 | | | $ | 3,813 | |

NOTE 5 — INCOME TAXES

At December 31, 2023, the Company had $14.0 million of U.S. federal net operating loss (“NOL”) carry forwards. These losses do not expire but are limited to utilization of 80% of taxable income in any one year. At December 31, 2023, the Company had approximately $16.1 million of U.S. state NOL carry forwards. The tax benefits related to these state NOL carry forwards and future deductible temporary differences are recorded to the extent management believes it is more likely than not that such benefits will be realized.

The income of foreign subsidiaries before taxes was $293,000 for the three month period ended December 31, 2023 as compared to income of foreign subsidiaries before taxes of $247,000 for the three month period ended December 31, 2022. The income of foreign subsidiaries before taxes was $892,000 for the nine month period ended December 31, 2023 as compared to income of foreign subsidiaries before taxes of $489,000 for the nine month period ended December 31, 2022.

The Company analyzed the future reasonability of recognizing its deferred tax assets at December 31, 2023. As a result, the Company concluded that a 100% valuation allowance of approximately $4,287,000 would be recorded against the assets.

The Company recorded an income tax benefit of $14,000 and income tax expense of $74,000, respectively, during the three and nine month periods ended December 31, 2023. During the three and nine month periods ended December 31, 2022, the Company recorded income tax expense of nil and $10,950, respectively, primarily resulting from state income taxes. After the adoption of ASU 2019-12 “Income Taxes (Topic 740) – Simplifying the Accounting for Income Taxes”during fiscal 2022, these non-income based state taxes are now reported within selling, general and administrative expenses.

The Company is subject to examination and assessment by tax authorities in numerous jurisdictions. As of December 31, 2023, the Company’s open tax years for examination for U.S. federal tax are 2018-2023, and for U.S. states’ tax are 2017-2023. Based on the outcome of tax examinations or due to the expiration of statutes of limitations, it is reasonably possible that the unrecognized tax benefits related to uncertain tax positions taken in previously filed returns may be different from the liabilities that have been recorded for these unrecognized tax benefits. As a result, the Company may be subject to additional tax expense.

As of December 31, 2023, the Company is asserting under ASC 740-30 that all of the unremitted earnings of its foreign subsidiaries are indefinitely invested. The Company evaluates this assertion each period based on a number of factors, including the operating plans, budgets, and forecasts for both the Company and its foreign subsidiaries; the long-term and short-term financial requirements in the U.S. and in each foreign jurisdiction; and the tax consequences of any decision to repatriate earnings of foreign subsidiaries to the U.S.

As of December 31, 2023 and March 31, 2023, the Company had a federal tax liability of approximately $1,202,000 and $1,603,000, respectively, related to the repatriation of the Company’s undistributed earnings of its foreign subsidiaries as required by the Tax Cuts and Jobs Act of 2017 (the “Tax Act”). As of December 31, 2023 and March 31, 2023, the Company’s short term portion was approximately $534,000 and $401,000, respectively, and the long term portion was approximately $668,000 and $1,202,000, respectively.

The liability is payable over 8 years. The first five installments are each equal to 8%, the sixth is equal to 15%, the seventh is equal to 20% and the final installment is equal to 25% of the liability. As of December 31, 2023, the Company has paid six of the eight installments. Each installment must be remitted on or before July 15th of the year in which such installment is due. On July 12, 2023, the Company paid its sixth installment of approximately $401,000.

In addition to the federal tax liabilities recorded under the Tax Act mentioned above, the Company incurred approximately $74,000 of additional federal tax liabilities resulting from the net income generated during the nine months ended December 31, 2023. Under the Tax Act, the Company was limited to 80% utilization of NOLs against taxable income in any one year. This limitation generated the additional $74,000 of federal tax liabilities as of December 31, 2023.

NOTE 6 — RELATED PARTY TRANSACTIONS

From time to time, Emerson engages in business transactions with its controlling shareholder, Nimble Holdings Company Limited (“Nimble”), formerly known as The Grande Holdings Limited (“Grande”), and one or more of Nimble’s direct and indirect subsidiaries, or with entities related to the Company’s Chief Executive Officer. Set forth below is a summary of such transactions.

Controlling Shareholder

S&T International Distribution Limited (“S&T”), which is a wholly owned subsidiary of Grande N.A.K.S. Ltd., which is a wholly owned subsidiary of Nimble, collectively have, based on a Schedule 13D/A filed with the SEC on February 15, 2019, the shared power to vote and direct the disposition of 15,243,283 shares, or approximately 72.4%, of the Company’s outstanding common stock as of December 31, 2023. Accordingly, the Company is a “controlled company” as defined in Section 801(a) of the NYSE American Company Guide.

Related Party Transactions

Charges of rental and utility fees on office space in Hong Kong

During the three and nine month periods ended December 31, 2023, the Company was billed approximately $40,000 and $119,000, respectively, for rental and utility fees from Vigers Appraisal and Consulting Ltd (“VACL”), which is a company related to the Company’s Chairman of the Board of Directors. As of December 31, 2023 the Company owed approximately $1,000 to VACL related to these charges.

NOTE 7 — SHORT TERM DEPOSITS AND INVESTMENTS

As of December 31, 2023 and March 31, 2023, the Company held $2.7 million and $23.1 million, respectively, in term deposits. Such term deposits had maturity dates of 90 days or less and, as a result, were classified as cash equivalents. As of December 31, 2023 and March 31, 2023, the Company held $18.5 million and nil, respectively, in short term investments which had maturity dates greater than 90 days.

NOTE 8 — CONCENTRATION RISK

Customer Concentration

For the three month period ended December 31, 2023, the Company’s two largest customers accounted for approximately 84% of the Company’s net revenues, of which Walmart accounted for approximately 65% and Amazon accounted for approximately 19%. No other customer accounted for greater than 10% of the Company's net revenues during the period.

For the nine month period ended December 31, 2023, the Company’s three largest customers accounted for approximately 89% of the Company’s net revenues, of which Walmart accounted for approximately 58%, Amazon accounted for approximately 21% and Fred Meyer accounted for approximately 10%. No other customer accounted for greater than 10% of the Company's net revenues during the period.

For the three month period ended December 31, 2022, the Company’s two largest customers accounted for approximately 84% of the Company’s net revenues, of which Walmart accounted for approximately 50% and Amazon accounted for approximately 34%. No other customer accounted for greater than 10% of the Company's net revenues during the period.

For the nine month period ended December 31, 2022, the Company’s three largest customers accounted for approximately 74% of the Company’s net revenues, of which Walmart accounted for approximately 42%, Amazon accounted for approximately 21% and Fred Meyer accounted for approximately 11%. No other customer accounted for greater than 10% of the Company's net revenues during the period.

A significant decline in net sales to any of the Company’s key customers would have a material adverse effect on the Company’s business, financial condition and results of operation.

Product Concentration

For the three and nine month periods ended December 31, 2023, the Company’s gross product sales included microwave ovens, which generated approximately 22% and 28%, respectively, of the Company’s gross product sales and audio products, which generated approximately 76% and 70%, respectively, of the Company’s gross product sales. No other products accounted for greater than 10% of the Company's gross product sales during the period.

For the three and nine month periods ended December 31, 2022, the Company’s gross product sales included microwave ovens, which generated approximately 9% and 24%, respectively, of the Company’s gross product sales and audio products, which generated approximately 91% and 75%, respectively, of the Company’s gross product sales. No other products accounted for greater than 10% of the Company's gross product sales during the period.

Concentrations of Credit Risk

As a percentage of the Company’s total trade accounts receivable, net of specific reserves, the Company’s top three customers accounted for approximately 48%, 20% and 15%, respectively, as of December 31, 2023. No other customers accounted for greater than 10% of the Company's total trade accounts receivable, net of specific reserves, as of such date. As a percentage of the Company’s total trade accounts receivable, net of specific reserves, the Company’s top three customers accounted for approximately 43%, 35% and 11%, respectively, as of March 31, 2023. No other customers accounted for greater than 10% of the Company's total trade accounts receivable, net of specific reserves, as of such date. The Company periodically performs credit evaluations of its customers but generally does not require collateral, and the Company provides for any anticipated credit losses in the financial statements based upon management’s estimates and ongoing reviews of recorded allowances. Due to the high concentration of the Company’s net trade accounts receivables among just two customers, any significant failure by one of these customers to pay the Company the amounts owing against these receivables would result in a material adverse effect on the Company’s business, financial condition and results of operations.

The Company maintains its cash accounts with major U.S. and foreign financial institutions. The Company’s cash and restricted cash balances on deposit in the U.S. as of December 31, 2023 and March 31, 2023 were insured by the Federal Deposit Insurance Corporation (“FDIC”) up to $250,000 per qualifying bank account in accordance with FDIC rules. The Company’s cash, cash equivalents and restricted cash balances in excess of these FDIC-insured limits were approximately $3.4 million and approximately $25.0 million at December 31, 2023 and March 31, 2023, respectively.

Supplier Concentration

During the three month period ended December 31, 2023, the Company procured approximately 86% of its products for resale from its three largest factory suppliers, of which approximately 37% was supplied by its largest supplier and approximately 28% and 21%, respectively, by the other two suppliers. During the three month period ended December 31, 2022, the Company procured approximately 95% of its products for resale from its two largest factory suppliers, of which approximately 74% was supplied by its largest supplier and approximately 21% by another supplier. No other suppliers accounted for greater than 10% for either three month periods ended December 31, 2023 or December 31, 2022.

During the nine month period ended December 31, 2023, the Company procured approximately 93% of its products for resale from its four largest factory suppliers, of which approximately 29% was supplied by its largest supplier and approximately 26%, 23% and 15%, respectively, by the other three suppliers. During the nine month period ended December 31, 2022, the Company procured approximately 99% of its products for resale from its two largest factory suppliers, of which approximately 71% was supplied by its largest supplier and approximately 28% by another supplier. No other suppliers accounted for greater than 10% for either nine month periods ended December 31, 2023 or December 31, 2022.

11

NOTE 9 — LEASES

The Company leases office space in the U.S. and in Hong Kong as well as a copier in the U.S. These leases have remaining non-cancellable lease terms of six to sixty months. The Company has elected not to separate lease and non-lease components for all leased assets. The Company did not identify any events or conditions during the quarter ended December 31, 2023 to indicate that a reassessment or re-measurement of the Company’s existing leases was required.

As of December 31, 2023, the Company’s current operating lease liabilities and finance lease liabilities were $128,000 and $1,000, respectively and its non-current operating lease liabilities and finance lease liabilities were $208,000 and nil, respectively. The Company’s operating and finance lease right-of-use asset balances are presented in non-current assets. The net balance of the Company’s operating and finance lease right-of-use assets as of December 31, 2023 was $327,000 and $1,000, respectively.

The components of lease costs, which were included in operating expenses in the Company’s condensed consolidated statements of operations, were as follows:

| | | Three Months Ended December 31, | | | Nine Months Ended December 31, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | (in thousands) | | | (in thousands) | |

| Lease cost | | | | | | | | | | | | | | | | |

| Operating lease cost | | $ | 52 | | | $ | 60 | | | $ | 141 | | | $ | 185 | |

| | | | | | | | | | | | | | | | | |

| The supplemental cash flow information related to leases are as follows: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Cash paid for amounts included in the measurement of lease liabilities: | | | | | | | | | | | | | | | | |

| Operating cash flows from operating leases | | | 43 | | | | 62 | | | | 123 | | | | 187 | |

| | | | | | | | | | | | | | | | | |

| Right-of-use assets obtained in exchange for lease obligations: | | | | | | | | | | | | | | | | |

| Operating leases | | | — | | | | — | | | | 248 | | | | — | |

| Finance leases | | | — | | | | — | | | | — | | | | — | |

Information relating to the lease term and discount rate are as follows:

| Weighted average remaining lease term (in months) | | As of December 31, 2023 | | | As of December 31, 2022 | |

| Operating leases | | | 44.7 | | | | 18.8 | |

| Finance leases | | | 5.2 | | | | 17.2 | |

| | | | | | | | | |

| Weighted average discount rate | | | | | | | | |

| Operating leases | | | 9.58 | % | | | 7.50 | % |

| Finance leases | | | 7.50 | % | | | 7.50 | % |

As of December 31, 2023 the maturities of lease liabilities were as follows:

| (in thousands) | | Operating Leases | | | Finance Leases | |

| | | | | | | | | |

| 2024 | | $ | 52 | | | $ | 1 | |

| 2025 | | | 116 | | | | — | |

| 2026 | | | 54 | | | | — | |

| 2027 | | | 66 | | | | — | |

| Thereafter | | | 52 | | | | — | |

| Total lease payments | | $ | 340 | | | $ | 1 | |

| Less: Imputed interest | | | (4 | ) | | | — | |

| Total | | $ | 336 | | | $ | 1 | |

NOTE 10 — GOVERNMENTAL ASSISTANCE PROGRAMS

During the three month periods ended December 31, 2023 and December 31, 2022, the Company’s Hong Kong subsidiary recorded income of nil and $4,000, respectively, under the governmental program called the Employment Support Scheme (“ESS”). During the nine month periods ended December 31, 2023 and December 31, 2022, the Company’s Hong Kong subsidiary recorded income of nil and $34,000, respectively, under the ESS program. The proceeds were required to be used for payroll expenses and the Company was subject to government-appointed random reviews to verify the information submitted by the applicant.

The income realized from the amount granted under the ESS program is presented as Other Income under the description called “Income from governmental assistance programs” in the Consolidated Statements of Operations.

NOTE 11 — LEGAL PROCEEDINGS

On April 19, 2022, the U.S. District Court for the District of Delaware (the "District Court") granted judgment in favor of the Company in its trademark infringement lawsuit against air conditioning and heating products provider Emerson Quiet Kool and wholesaler Home Easy (the “Defendants”). Among other things, the District Court's order included an injunction prohibiting Defendants’ distribution, manufacturing, and sales of EMERSON QUIET KOOL branded products or use of that trademark and directed the U.S. Patent and Trademark Office to cancel Defendants’ trademark registration for the EMERSON QUIET KOOL trademark and prohibited Defendants from attempting to register that mark or any other confusingly similar mark in the future. The judgment also awards $6.5 million to the Company. The Defendants, through a third party, made certain payments to the Company, including certain advances towards a portion of their liability. Those amounts were previously reflected as advanced deposits in the Consolidated Balance Sheets. The aggregate amount of the payments is $4.1 million, which has been reduced by approximately $784,000 for legal fees incurred in fiscal 2023 and approximately $216,000 for legal fees incurred in fiscal 2024, in pursuit of the advanced deposits. Separately, on July 11, 2023, the U.S. Court of Appeals for the Third Circuit affirmed the District Court's judgment against the Defendants. On September 29, 2023, the District Court granted the Company’s request for final judgement including approximately $3.16 million in legal fees and $700,000 in enhanced damages, along with the prospect of additional damages due to Defendants’ alleged contempt of court. The Company is pursuing all available remedies against the Defendants and those acting in concert with them. There is no guarantee that the Company will be able to collect the entire judgment or that any negotiated resolution regarding these matters will ever be agreed among the parties or, if agreed, how soon the parties might be able to do so. Due to the legal judgement having been affirmed as stated above, the Company released the balance of the advanced deposits of approximately $3,100,000, to other income during the quarter ended September 30, 2023.

Item 2. Management’s Discussion and Analysis of Results of Operations and Financial Condition.

The following discussion of the Company’s operations and financial condition should be read in conjunction with the Financial Statements and notes thereto included elsewhere in this Quarterly Report on Form 10-Q.

In the following discussions, most percentages and dollar amounts have been rounded to aid presentation. Accordingly, all amounts are approximations.

Forward-Looking Information

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Forward-looking statements include statements with respect to the Company’s beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions, and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond the Company’s control, and which may cause the Company’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements.

All statements other than statements of historical fact are statements that could be forward-looking statements. The reader can identify these forward-looking statements through the Company’s use of words such as “may,” “will,” “can,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “seek,” “estimate,” “continue,” “plan,” “project,” “predict,” “could,” “intend,” “target,” “potential,” and other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation:

| |

● |

the Company’s ability to generate sufficient revenue to achieve and maintain profitability; |

| |

● |

the Company’s ability to obtain new customers and retain key existing customers, including the Company’s ability to maintain purchase volumes of the Company’s products by its key customers; |

| |

● |

the Company’s ability to obtain new licensees and distribution relationships and maintain relationships with its existing licensees and distributors; |

| |

● |

the Company’s ability to resist price increases from its suppliers or pass through such increases to its customers; |

| |

● |

changes in consumer spending for retail products, such as the Company’s products, and in consumer practices, including sales over the Internet; |

| |

● |

the Company’s ability to maintain effective internal controls or compliance by its personnel with such internal controls; |

| |

● |

the Company’s ability to successfully manage its operating cash flows to fund its operations; |

| |

● |

the Company’s ability to anticipate market trends, enhance existing products or achieve market acceptance of new products; |

| |

● |

the Company’s ability to accurately forecast consumer demand and adequately manage inventory; |

| |

● |

the Company’s dependence on a limited number of suppliers for its components and raw materials; |

| |

● |

the Company’s dependence on third party manufacturers to manufacture and deliver its products; |

| |

● |

increases in shipping costs for the Company’s products or other service issues with the Company’s third-party shippers; |

| |

● |

the Company’s dependence on a third party logistics provider for the storage and distribution of its products in the United States; |

| |

● |

the ability of third party sales representatives to adequately promote, market and sell the Company’s products; |

| |

● |

the Company’s ability to maintain, protect and enhance its intellectual property; |

| |

● |

the effects of competition; |

| |

● |

the Company’s ability to distribute its products in a timely fashion, including the impact of labor disputes, public health threats and social unrest, if any; |

| |

● |

evolving cybersecurity threats to the Company’s information technology systems or those of its customers or suppliers; |

| |

● |

changes in foreign laws and regulations and changes in the political and economic conditions in the foreign countries in which the Company operates; |

| |

● |

changes in accounting policies, rules and practices; |

| |

● |

changes in tax rules and regulations or interpretations; |

| |

● |

changes in U.S. and foreign trade regulations and tariffs, including potential increases of tariffs on goods imported into the U.S., and uncertainty regarding the same; |

| |

● |

limited access to financing or increased cost of financing; |

| |

● |

the effects of currency fluctuations between the U.S. dollar and Chinese renminbi and increases in costs of production in China; and |

| |

● |

the other factors listed under “Risk Factors” in the Company’s Annual Report on Form 10-K, as amended, for the fiscal year ended March 31, 2023 and other filings with the SEC. |

All forward-looking statements are expressly qualified in their entirety by this cautionary notice. The reader is cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this report or the date of the document incorporated by reference into this report. The Company has no obligation, and expressly disclaims any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise. The Company has expressed its expectations, beliefs and projections in good faith and it believes it has a reasonable basis for them. However, the Company cannot assure the reader that its expectations, beliefs or projections will result or be achieved or accomplished.

Results of Operations

The following table summarizes certain financial information for the three and nine month periods ended December 31, 2023 (fiscal 2024) and December 31, 2022 (fiscal 2023) (in thousands):

| |

|

Three Months Ended December 31, |

|

|

Nine Months Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net product sales |

|

$ |

2,599 |

|

|

$ |

1,704 |

|

|

$ |

6,745 |

|

|

$ |

4,335 |

|

| Licensing revenue |

|

|

23 |

|

|

|

123 |

|

|

|

124 |

|

|

|

271 |

|

| Royalty income |

|

|

— |

|

|

|

105 |

|

|

|

— |

|

|

|

700 |

|

| Net revenues |

|

|

2,622 |

|

|

|

1,932 |

|

|

|

6,869 |

|

|

|

5,306 |

|

| Cost of sales |

|

|

2,144 |

|

|

|

1,361 |

|

|

|

5,654 |

|

|

|

3,549 |

|

| Selling, general and administrative expenses |

|

|

1,202 |

|

|

|

1,051 |

|

|

|

3,464 |

|

|

|

3,686 |

|

| Operating loss |

|

|

(724 |

) |

|

|

(480 |

) |

|

|

(2,249 |

) |

|

|

(1,929 |

) |

| Settlement of litigation |

|

|

— |

|

|

|

— |

|

|

|

3,100 |

|

|

|

— |

|

| Interest income, net |

|

|

289 |

|

|

|

235 |

|

|

|

872 |

|

|

|

424 |

|

| Income from governmental assistance programs |

|

|

— |

|

|

|

4 |

|

|

|

— |

|

|

|

34 |

|

| Income (loss) before income taxes |

|

|

(435 |

) |

|

|

(241 |

) |

|

|

1,723 |

|

|

|

(1,471 |

) |

| Provision for income taxes |

|

|

(14 |

) |

|

|

— |

|

|

|

74 |

|

|

|

— |

|

| Net income (loss) |

|

$ |

(421 |

) |

|

$ |

(241 |

) |

|

$ |

1,649 |

|

|

$ |

(1,471 |

) |

Net product sales — Net product sales for the three month period ended December 31, 2023 were $2.6 million as compared to $1.7 million for the three month period ended December 31, 2022, an increase of $0.9 million, or 52.5%. The Company’s sales during the three month periods ended December 31, 2023 and December 31, 2022 were highly concentrated among the Company’s two largest customers – Wal-Mart and Amazon – comprising in the aggregate approximately 85% and 95%, respectively, of the Company’s total net product sales for such periods.

Net product sales for the nine month period ended December 31, 2023 were $6.7 million as compared to $4.3 million for the nine month period ended December 31, 2022, an increase of $2.4 million, or 55.6%. The Company’s sales during the nine month periods ended December 31, 2023 and December 31, 2022 were highly concentrated among the Company’s three largest customers – Wal-Mart, Amazon and Fred Meyer – comprising in the aggregate approximately 91% of the Company’s total net product sales for both periods.

Net product sales are comprised primarily of the sales of houseware and audio products which bear the Emerson® brand name. Net product sales may be periodically impacted by adjustments made to the Company’s sales allowance and marketing support accrual to record unanticipated customer deductions from accounts receivable or to reduce the accrual by any amounts which were accrued in the past but not taken by customers through deductions from accounts receivable within a certain time period. In the aggregate, these adjustments had the effect of increasing net product sales and operating income by approximately $3,000 and $10,000 for the three month periods ended December 31, 2023 and December 31, 2022, respectively, and by approximately $9,000 and $15,000 for the nine month periods ended December 31, 2023 and December 31, 2022, respectively. The major elements which contributed to the overall increase in net product sales were as follows:

i) Houseware products: Net sales increased $0.4 million, or 313.4%, to $0.6 million for the three month period ended December 31, 2023 as compared to $0.2 million for the three month period ended December 31, 2022, driven by increased net sales of microwave ovens and refrigerators. Net sales increased $0.9 million, or 89.9%, to $2.0 million for the nine month period ended December 31, 2023 as compared to $1.1 million for the nine month period ended December 31, 2022, driven by increased net sales of microwave ovens and refrigerators.

ii) Audio products: Net sales increased $0.4 million, or 27.4%, to $2.0 million for the three month period ended December 31, 2023 as compared to $1.6 million for the three month period ended December 31, 2022, resulting from increased net sales of clock radios. Net sales increased $1.4 million, or 44.4%, to $4.7 million for the nine month period ended December 31, 2023 as compared to $3.3 million for the nine month period ended December 31, 2022, resulting from increased net sales of clock radios.

Business operations — The Company expects to continue to expand its existing distribution channels and to develop and promote new products with retailers in the U.S. The Company is also continuing to invest in products and marketing activities to expand its sales through internet and ecommerce channels. These efforts require investments in appropriate human resources, media marketing and development of products in various categories in addition to the traditional home appliances and audio products on which the Company has historically focused. The Company also is continuing its efforts to identify strategic courses of action related to its licensing activities, including seeking new licensing relationships. The Company has engaged each of Leveraged Marketing Corporation of America and Global Licensing Services Pte Limited as an agent to assist in identifying and procuring potential licensees.

Emerson’s success is dependent on its ability to anticipate and respond to changing consumer demands and trends in a timely manner, as well as expanding into new markets and sourcing new products that are profitable to the Company. Geo-political factors may also affect the Company’s operations and demand for the Company’s products, which are subject to customs requirements and to tariffs and quotas set by governments through mutual agreements and bilateral actions. The Company expects that U.S. tariffs on categories of products that the Company imports from China, and China’s retaliatory tariffs on certain goods imported from the United States, as well as modifications to international trade policy, will continue to affect its product costs going forward. If no mitigation steps are taken, or the mitigation is unsuccessful, the combination of tariffs will result in significantly increased annualized costs to the Company as all of the Company’s products are currently manufactured by suppliers in China. Although the Company is monitoring the trade and political environment and working to mitigate the possible effect of tariffs with its suppliers as well as its customers through pricing and sourcing strategies, the Company cannot be certain how its customers and competitors will react to the actions taken. In addition, heightened tensions between the United States and China over Hong Kong and any resulting retaliatory policies may affect our operations in Hong Kong. At this time, the Company is unable to quantify possible effects on its costs arising from the new tariffs, which are expected to increase the Company’s inventory costs and associated costs of sales as tariffs are incurred, and some costs may be passed through to the Company’s customers as product price increases in the future. However, if the Company is unable to successfully pass through the additional costs or otherwise mitigate the effects of these tariffs, or if the higher prices reduce demand for the Company’s products, it will have a negative effect on the Company’s product sales and gross margins.

Starting in the fourth quarter of fiscal 2020, the global COVID-19 pandemic has presented significant challenges and impacted the Company’s business and operating results, and the operations and production capabilities of the Company’s suppliers in China. The pandemic has directly and indirectly disrupted certain sales and supply chain activities. Global component shortages, in particular semiconductor chips, arising from changes in consumer demand and reduced manufacturing capacity related to the COVID-19 pandemic may cause price fluctuations and longer lead times in the supply of these components. Although the Company is seeking alternate suppliers for these components, developing alternate sources of supply will be time consuming, difficult and costly, and may require the re-tooling of products to accommodate components from different suppliers. In addition to increasing cost trends, the Company’s suppliers are not equipped to hold meaningful amounts of inventory and could pause manufacturing, which could ultimately impact the Company’s ability to fulfill customer orders on a timely basis. These impacts on the Company’s supply chain may continue to impact the Company’s ability to meet product demand, which could result in additional costs, customer dissatisfaction in the event of inventory shortages or may otherwise adversely impact the Company’s business and results of operations.