Ace Liberty & Stone PLC Open Offer Amendment (8923F)

09 Noviembre 2022 - 11:18AM

UK Regulatory

TIDMALSP

RNS Number : 8923F

Ace Liberty & Stone PLC

09 November 2022

THE INFORMATION CONTAINED IN THIS ANNOUNCEMENT IS INSIDE

INFORMATION FOR

THE PURPOSES OF ARTICLE 7 OF REGULATION 596/2014

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT IS

RESTRICTED AND IT

IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY

OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, JAPAN, THE

REPUBLIC OF

SOUTH AFRICA OR AUSTRALIA OR ANY OTHER STATE OR JURISDICTION IN

WHICH SUCH

RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL

Ace Liberty and Stone plc

("Ace" or "the Company")

Proposed Open Offer of up to 18,238,835 New Ordinary Shares at

25 pence per share

Ace Liberty and Stone Plc (AQSE: ALSP), the active property

investment company capitalising on commercial property investment

opportunities across the UK, announced on the 21 October 2022 that

it will raise up to GBP4,559,708.75 (before fees and expenses)

through an Open Offer by way of the issue of New Ordinary Shares at

an Issue Price of 25 pence per New Ordinary Share. Following

shareholders' requests, the timetable for the Open Offer has been

amended and the new timetable is set out below. All other aspects

of the Open Offer remain unchanged and details can be found on the

company website www.acelibertyandstone.com .

Revised Timetable of Events

Record Date for entitlement to participate 6.00 p.m. on 20 October

in the Open Offer 2022

Announcement of the General Meeting and

Open Offer and dispatch of the Circular 21 October 2022

and the Application Form

Expected ex-entitlement date for the 8.00 a.m. on 21 October

Open Offer 2022

Basic Entitlements and Excess Open Offer 8.00 a.m. on 24 October

Entitlements credited to Stock Accounts 2022

in CREST of Qualifying CREST Shareholders

Latest time and date for receipt of completed 11.00 a.m. on 14 November

Forms of Proxy or receipt of CREST Proxy 2022

Instructions for the General Meeting

General Meeting 11.00 a.m. on 16 November

2022

Recommended latest time for requesting 4.30 p.m. on 24 November

withdrawal of Basic Entitlements and 2022

Excess Open Offer Entitlements from CREST

Latest time for depositing Basic Entitlements 3.00 p.m. on 25 November

and Excess Open Offer Entitlements into 2022

CREST

Latest time and date for splitting Application

Forms 3.00 p.m. on 28 November

(to satisfy bona fide market claims only) 2022

Latest time and date for receipt of completed

Application Forms 11.00 a.m. on 30 November

and payment in full under the Open Offer 2022

or settlement of relevant CREST instructions

(as appropriate)

Allotment of New Ordinary Shares 8.00 a.m. on 14 December

2022

Admission of the New Ordinary Shares

to trading on 8.00 a.m. on 14 December

AQSE Growth Market 2022

Expected date of dispatch of definitive

share certificates for the by 21 December 2022

New Ordinary Shares in certificated form

(certificated holders only)

Admission, Settlement and dealings

The result of the Open Offer is expected to be announced on 14

December 2022. Admission to trading of the New Ordinary Shares on

the AQSE Growth Market will take place automatically following an

announcement by the Company confirming completion of the Open

Offer. It is expected that Admission will become effective and that

dealings in the Open Offer Shares, fully paid, will commence at

8.00 a.m. on 14 December 2022.

Ismail Ghandour, Chief Executive Officer, commented:

"The Directors have taken into account shareholder requests to

allow more time for completion of applications and, in particular,

to allow overseas investors adequate time to remit funds to the UK.

The Open Offer will provide Ace with the flexibility to take

advantage of opportunities that provide long-term benefits for our

shareholders and we look forward to announcing the result of the

Open Offer in December."

-ends-

For further information, please contact:

Ace Liberty & Stone Plc

Ivan Minter, Financial Director Tel: +44 (0) 20 7201 8340

http://acelibertyandstone.com

Alfred Henry Corporate Finance

Ltd,

AQSE Growth Market Corporate Adviser

Jon Isaacs / Nick Michaels Tel: +44 (0) 20 3772 0021

www.alfredhenry.com

SP Angel Corporate Finance LLP

Broker

Vadim Alexandre / Rob Rees Tel: +44 (0)20 3470 0470

www.spangel.co.uk

- ends -

The Directors accept responsibility for this announcement.

Notes to Editors

Ace Liberty & Stone Plc is a property investment company

with a diverse portfolio of properties located across the UK,

predominantly in the midlands and north of England, which are now

the focus of Government incentives. The Company locates commercial

properties which have creditworthy tenants, several years' rental

income and the potential for an increase in value through creative

asset management activity, such as change of tenancy, change of use

or new lease negotiation. Ace has maintained a track record of

generating strong profits at disposal of properties and achieving

better-than average returns on capital. With strong support from

shareholders and mortgage lenders, the Company is currently seeking

to deploy its strong balance sheet and is seeking further

investment opportunities in the UK to create value for existing and

new investors.

Ace is run by a board with extensive property experience, an

excellent network of contacts and relevant professional

qualifications. This sector expertise has allowed the Board to

identify opportunities and act promptly to secure investments.

For more information on the Company please visit

www.acelibertyandstone.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXBLBRTMTBMBIT

(END) Dow Jones Newswires

November 09, 2022 12:18 ET (17:18 GMT)

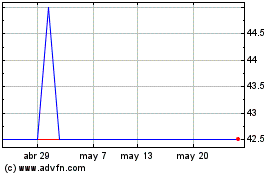

Ace Liberty & Stone (AQSE:ALSP)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

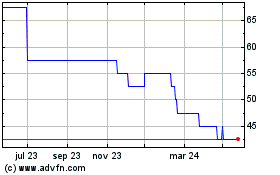

Ace Liberty & Stone (AQSE:ALSP)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024