TIDMALSP

RNS Number : 2828N

Ace Liberty & Stone PLC

22 September 2023

Ace Liberty and Stone plc

("Ace" or "the Company")

FINAL RESULTS FOR THE YEARED 30 APRIL 2023

Well-positioned to deliver long-term value for shareholders

Ace Liberty and Stone Plc (AQSE: ALSP), the active property

investment company capitalising on commercial property investment

opportunities across the UK, is delighted to announce its results

for the year ended 30 April 2023.

Financial Highlights:

-- Value of investment property up 2.1% to GBP78,106,598 (FY 2022 GBP76,500,343)

-- Shareholders' funds up 1.3% to GBP34,426,901 (FY 2022 GBP33,988,485)

-- Cash resources of GBP6,228,032 following successful open

offer and refinancing (FY 2022 GBP2,245,873)

-- Revenue reduced 2.5% to GBP5,557,714 (FY 2022 GBP5,697,850)

largely due to disposals in the prior year

-- 98% of Group's income from Government and Major Industrial & Commercial companies

Ismail Ghandour, Chief Executive Officer, commented:

"In a challenging economic environment, Ace is well-positioned

with a healthy balance sheet and significant cash resources to

explore any opportunities that may arise"

-ends-

For further information, please contact:

Ace Liberty & Stone Plc Tel: +44 (0) 20 7201 8340

Laura Yates, Finance Director www.acelibertyandstone.com

Alfred Henry Corporate Finance Tel: +44 (0) 20 3772 0021

Ltd

AQSE Growth Market Corporate Adviser www.alfredhenry.com

Nick Michaels

SP Angel Corporate Finance LLP Tel: +44 (0)20 3470 0470

Broker www.spangel.co.uk

Vadim Alexandre / Rob Rees

Chairman's Statement

I am pleased to present my Chairman's Statement on the results

for the year ending 30 April 2023. The past year has been an active

year for the Company. During the year under review, the Company

successfully completed a GBP22 million refinancing with Coutts

& Co, who are now the sole bank lenders to the Group. In

addition, with the support of existing shareholders,

GBP3 million was raised following a successful Open Offer of

shares. Together, these transactions have strengthened the balance

sheet with over GBP6 million cash and cash equivalents available at

year end.

We have welcomed two new Board members during the year, Nick

Jones as Property Director and Laura Yates as Finance Director.

Ivan Minter has moved to a non-executive role focusing on corporate

governance, where his wealth of experience and expertise can assist

in driving the growth of the Company. Mark Thomas and Hikmat

El-Rousstom stepped down from the Board during the year to focus on

other endeavours and we wish them every success for the future.

Two properties have been acquired during the period and

subsequently, Loders service station in Dorchester and Egerton Park

service station in Melton Mowbray, further details of which can be

found in the strategic report. Completion of the acquisition of

Hunters Row, Stafford is expected in December 2023.

During the year, revenue reduced 2% to GBP5,557,714 largely due

to disposals in the prior year, partially offset by income from new

acquisitions. Administrative expenses have increased from

GBP1,291,943 to GBP1,875,448. The increase is driven in the most

part by void costs of approximately GBP235,000 related to a vacant

unit in Sunderland. The majority of this cost is historic and

non-recurring as mitigating actions have now been put in place. In

addition, staff costs have increased by approximately GBP182,000,

which is largely related to non-recurring costs incurred as a

result of changes to the Board. Dilapidations settlements in

respect of Fawcett House, Sunderland and Telephone House, Sheffield

resulted in one-off income totalling GBP277,954. Finance costs

increased from GBP2,792,045 to GBP3,382,440. This is a result of

increased bank debt following the drawdown of the Coutts facility

in September 2022 and increasing interest rates. Our loan to value

remains conservative at 54%. Fair value adjustments of GBP600,000

to investment property and GBP430,911 to the investment in Lebanon

have reduced profit, with the Group reporting a loss before tax of

GBP263,657.

The cash contribution to capital investment in Lebanon has been

further impaired during the year to recognise the risk associated

with remitting the funds to the UK due to current economic

conditions in Lebanon. However, it remains the Company's intention

to utilise the funds for investment, when circumstances allow.

The Company paid an interim dividend of 3.4p per share in

October 2022 which was intended to recompense shareholders for a

long gap in dividend payments. This dividend payment utilised a

large portion of the Company's distributable reserves and, as such,

no final dividend was declared for the year ended April 2023. The

Board remains committed to establishing regular distributions to

shareholders and dividend payments will recommence once adequate

reserves are available.

The past number of years have been challenging for the UK

economy with the unprecedented impact of the Covid-19 pandemic and

the uncertainty caused by Brexit. Ace's robust portfolio withstood

the many challenges during this period but new challenges are upon

us. The ongoing Ukraine conflict, together with rising interest

rates and inflation, which accelerated following the mini budget in

September 2022, leave the economy in a very different place

compared to 12 months ago. The volatility in the interest rate

market has had a particular impact on property valuations and the

real estate market.

In spite of the challenging economic conditions facing the

Company, the Directors are confident in the long-term strength of

Ace. The Board has focused on developing a portfolio of

geographically diverse, low-risk assets with a secure tenant base.

Together with significant cash reserves at year end, the portfolio

is in a strong position to perform well against this backdrop of

economic turmoil.

Dr Tony Ghorayeb

Chairman

Date: 19 September 2023

Consolidated Statement of Comprehensive Income for the year

ended 30 April 2023

2023 2022

GBP GBP

Revenue 5,557,714 5,697,850

Gain / (Loss) on disposal of investment

property (29,442) 917,203

Administrative expenses (1,875,448) (1,291,943)

Fair value gain / (loss) on investment

property (600,000) 193,704

Fair value loss on investments (430,911) (797,576)

Fair value loss on assets held for

sale - (200,000)

Loss on disposal of subsidiaries - (412,382)

Dilapidations settlement 277,954 -

Finance cost (3,382,440) (2,792,045)

Finance income 218,916 751,421

------------------------------------------ ------------ ------------

Profit / (Loss) before taxation (263,657) 2,066,232

------------------------------------------ ------------ ------------

Taxation (41,885) (769,427)

------------------------------------------ ------------ ------------

Profit / (Loss) after taxation (305,542) 1,296,805

------------------------------------------ ------------ ------------

Other comprehensive income - release

of equity proportion of CLNs - 202,302

------------------------------------------ ------------ ------------

Total comprehensive income for the

period (305,542) 1,499,107

------------------------------------------ ------------ ------------

Attributable to:

------------------------------------------ ------------ ------------

Owners of the parent (305,542) 1,499,107

------------------------------------------ ------------ ------------

Earnings per share on continuing Pence Pence

activities

Basic earnings per share attributable

to equity owners of the parent (0.48) 2.55

Diluted earnings per share attributable

to equity owners of the parent (0.48) 2.03

Consolidated Statement of Financial position at 30 April

2023

2023 2022

GBP GBP

ASSETS

Non-current assets

Investment property 78,106,598 76,500,343

Investments 3,810,015 4,240,851

Deferred tax 298,237 186,738

Derivative financial

instrument 509,292 326,651

--------------------------------------------------------- ----------- -----------

82,724,142 81,254,583

---------------------------------------------------------- ----------- -----------

Current assets

Assets held for

sale - 850,000

Trade and other

receivables 1,251,468 533,079

Cash and cash equivalents 6,228,032 2,245,873

-----------

7,479,500 3,628,952

---------------------------------------------------------- ----------- -----------

TOTAL ASSETS 90,203,642 84,883,535

--------------------------------------------------------- ----------- -----------

EQUITY AND LIABILITIES

Current liabilities

Trade and other

payables 2,421,557 3,072,567

Taxation 320,341 953,280

Borrowings 29,886,011 17,644,125

--------------------------------------------------------- ----------- -----------

32,627,909 21,669,972

---------------------------------------------------------- ----------- -----------

Non-current liabilities

Borrowings 23,148,832 29,225,078

--------------------------------------------------------- ----------- -----------

23,148,832 29,255,078

---------------------------------------------------------- ----------- -----------

Share capital 17,806,741 14,711,713

Share premium 17,010,240 16,975,362

Other reserve 208,600 208,600

Treasury shares (880,620) (480,620)

Retained earnings 281,940 2,573,430

--------------------------------------------------------- ----------- -----------

Total equity 34,426,901 33,988,485

--------------------------------------------------------- ----------- -----------

TOTAL EQUITY AND LIABILITIES 90,203,642 84,883,535

----------------------------------- ----------------------- ----------- -----------

Consolidated Cash Flow Statement for the year ended 30 April

2023

2023 2022

GBP GBP

Profit / (Loss) before

tax (263,657) 2,066,232

Cash flow from operating

activities

Adjustments for:

Finance income (218,916) (751,421)

Finance costs 3,382,440 2,792,045

(Gain) / Loss on disposal

of investment property 29,442 (917,203)

Fair value adjustment 1,030,911 803,872

Loss on disposal of

subsidiaries - 412,382

(Decrease) / Increase

in receivables (762,949) 200,258

Decrease in payables (839,915) (1,789,890)

Tax paid (791,055) (189,720)

Interest paid (2,735,433) (2,050,999)

Other finance costs

paid (455,715) (39,469)

Share issue costs 126,022 -

----------------------------------------------------------------------- ------------- -------------

Net cash (used) / generated by operating

activities (1,498,825) 536,087

-------------------------------------------------------- ------------ ------------- -------------

Cash flows from investing

activities

Interest received 4,986 825

Purchase of investment -

properties (2,206,255)

Sale of investment properties 820,558 4,317,203

Sale of subsidiaries - 5,067,061

Investment into LiBank - (37,747)

------------------------------------- ----------------------------- ------------- -------------

Net cash (used) / generated by investing

activities (1,380,711) 9,347,342

-------------------------------------------------------- ------------ ------------- -------------

Cash flows from financing

activities

Share issue, net of issue -

costs 2,980,484

Purchase of treasury shares (400,000) -

Long-term loans advanced 23,227,500 -

Long-term loans repaid (1,093,450) (761,950)

Short-term loans repaid (15,890,751) (9,788,969)

Equity dividend paid (1,962,088) -

----------------------------------------------------------------------- ------------- -------------

Net cash generated / (used)

by financing activities 6,861,695 (10,550,919)

------------------------------------------- ------------------------ ------------- -------------

Net increase / (decrease) in cash

and cash equivalents 3,982,159 (667,490)

-------------------------------------------------------- ------------ ------------- -------------

Cash and cash equivalents at the beginning

of the period 2,245,873 2,913,363

Cash and cash equivalents at the end

of the period 6,228,032 2,245,873

-------------------------------------------------------- ------------ ------------- -------------

NOTES TO PRELIMINARY RESULTS FOR THE PERIODED 30 APRIL 2023

1. The financial information set out above does not constitute

statutory accounts for the purpose of Section 434 of the Companies

Act 2006. The financial information has been extracted from the

statutory accounts of Ace Liberty & Stone Plc and is presented

using the same accounting policies, which have not yet been filed

with the Registrar of companies, but on which the auditors gave an

unqualified report on 19 September 2023.

The preliminary announcement of the results for the year ended

30 April 2023 was approved by the board of directors on 19

September 2023.

2. Earnings per Share

The calculations of earnings per share are based on the following

earnings and numbers of shares.

--------------------------------------------------------------------------

Profit / (Loss) for the period

attributable to equity owners (305,542) 1,499,107

--------------------------------------------- ------------- ------------

Weighted average number of shares shares shares

of 25p of 25p

For basic earnings per share 63,997,280 58,780,517

Dilutive effect of share options 14,568,122 14,940,383

--------------------------------------------- ------------- ------------

For diluted earnings per share 78,595,402 73,720,900

--------------------------------------------- ------------- ------------

Earnings per share pence pence

Basic (0.48) 2.55

Diluted (0.48) 2.03

GBP GBP

Dividends declared during the 0.034 -

year - per share of 25p

Dividends declared during the 2,001,588 -

year - total

.

- ends -

The Directors accept responsibility for this announcement.

Notes to Editors

Ace Liberty & Stone Plc is a property investment company

with a diverse portfolio of properties located across the UK,

predominantly in the midlands and north of England, which are now

the focus of Government incentives. The Company locates commercial

properties which have creditworthy tenants, several years' rental

income and the potential for an increase in value through creative

asset management activity, such as change of tenancy, change of use

or new lease negotiation. Ace has maintained a track record of

generating strong profits at disposal of properties and achieving

better-than average returns on capital. With strong support from

shareholders and mortgage lenders, the Company is currently seeking

to deploy its strong balance sheet and is seeking further

investment opportunities in the UK to create value for existing and

new investors.

Ace is run by a board with extensive property experience, an

excellent network of contacts and relevant professional

qualifications. This sector expertise has allowed the Board to

identify opportunities and act promptly to secure investments.

For more information on the Company please visit

www.acelibertyandstone.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXNKDBBOBKDDCB

(END) Dow Jones Newswires

September 22, 2023 02:00 ET (06:00 GMT)

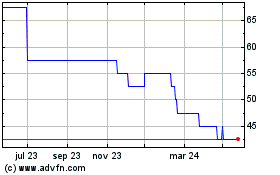

Ace Liberty & Stone (AQSE:ALSP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

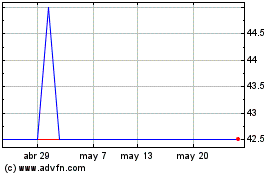

Ace Liberty & Stone (AQSE:ALSP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024