Tenaris S.A. (NYSE and Mexico: TS and EXM Italy: TEN) (“Tenaris”)

today announced its results for the quarter ended September 30,

2024 in comparison with its results for the quarter ended September

30, 2023.

Summary of 2024 Third Quarter

Results(Comparison with second quarter of 2024 and third

quarter of 2023)

|

|

3Q 2024 |

2Q 2024 |

3Q 2023 |

|

Net sales ($ million) |

2,915 |

3,322 |

(12%) |

3,238 |

(10%) |

|

Operating income ($ million) |

537 |

512 |

5% |

868 |

(38%) |

|

Net income ($ million) |

459 |

348 |

32% |

547 |

(16%) |

|

Shareholders’ net income ($ million) |

448 |

335 |

34% |

537 |

(17%) |

|

Earnings per ADS ($) |

0.81 |

0.59 |

37% |

0.91 |

(11%) |

|

Earnings per share ($) |

0.40 |

0.29 |

37% |

0.46 |

(11%) |

|

EBITDA* ($ million) |

688 |

650 |

6% |

1,004 |

(31%) |

|

EBITDA margin (% of net sales) |

23.6% |

19.6% |

|

31.0% |

|

|

|

|

|

|

|

|

*EBITDA in 2Q 2024 includes a $171 million loss

from the provision for ongoing litigation related to the

acquisition of a participation in Usiminas. If this charge was not

included EBITDA would have amounted to $821 million, or 24.7% of

sales.

Net sales in the third quarter were affected by

lower prices in the Americas and lower demand in the USA, Mexico

and Saudi Arabia as well as lower line pipe shipments in Argentina.

Margins were relatively resilient with our EBITDA margin falling

1.1% quarter on quarter on a comparable basis while net income

recovered after the extraordinary provisions recorded by Tenaris

and its associate company Ternium in the last quarter.

During the quarter, our free cash flow amounted

to $373 million and, after spending $182 million on share buybacks,

our positive net cash position amounted to $4.0 billion at

September 30, 2024.

Interim Dividend Payment

Our board of directors approved the payment of

an interim dividend of $0.27 per share ($0.54 per ADS), or

approximately $300 million, according to the following

timetable:

- Payment date: November 20,

2024

- Record date:

November 19, 2024

- Ex-dividend for

securities listed in Europe: November 18, 2024

-

Ex-dividend for securities listed in the United States and Mexico:

November 19, 2024

Follow-on Share Buyback

Program

Tenaris’s Board of Directors approved a $700

million follow-on share buyback program under the authority granted

by the annual general meeting of shareholders held on June 2,

2020.

Under the previous $1.2 billion share buyback,

which ran from November 5, 2023 to August 2, 2024, the Company

purchased a total number of ordinary shares representing 6.07% of

its total issued share capital measured as at the launch of the

program. This follow-on share buyback program will cover up to $700

million (excluding customary transaction fees), subject to a

maximum of 46,373,915 ordinary shares representing the remainder

3.93% of the Company’s issued share capital (measured also as at

the launch of the original program) that may be repurchased under

the above-referred authority (which authorizes repurchases up to a

maximum of 10% of the share capital).

The decision and opportunity of launching this

follow-on buyback program is driven by the Company’s significant

cash flow generation and strong balance sheet.

The follow-on buyback program is expected to be

launched in the near future and finish by March 26, 2025. It will

be executed by a primary financial institution on the Milan Stock

Exchange, with the intention to cancel the ordinary shares acquired

through the program.

The buybacks may be ceased, paused and continued

at any time, subject to compliance with applicable laws and

regulations.

Tenaris will provide updates on the buyback

program via press releases and on the Investors section of its

corporate website. The buybacks will be carried out subject to

market conditions and in compliance with applicable laws and

regulations, including the Market Abuse Regulation 596/2014 and the

Commission Delegated Regulation (EU) 2016/1052.

Market Background and Outlook

Oil prices appear relatively stable and support

industry investment despite uncertainty about Asian demand growth

and geopolitical tensions.

The decline in OCTG prices in North America that

we have seen over the past two years has now come to an end as

drilling activity has stabilized and the level of US OCTG imports

has come down.

The new government in Mexico is implementing its

energy policy, drilling activity in the near term is subdued, while

next year we expect that it will recover. In Argentina, the

economic environment is improving, which should support investment

in pipeline infrastructure and drilling activity in the Vaca Muerta

shale.

In the Middle East, while gas drilling activity

remains at a stable level, we see some reduction in oil activity

and rationalization of inventories, including pipes, to protect

cash flow.

In the fourth quarter, our sales and EBITDA will

be lower than the third quarter, affected by lower sales in Mexico

and Saudi Arabia and the delayed impact of OCTG pricing in the

Americas. Overall, our 2024 second half results will be in line

with our investor day guidance in September. Going into 2025, we

expect our sales and EBITDA to recover with an increase in

shipments in North America and the Middle East and a rebound in

OCTG prices in North America.

Analysis of 2024 Third Quarter Results

Tubes

The following table indicates, for our Tubes business segment,

sales volumes of seamless and welded pipes for the periods

indicated below:

|

Tubes Sales volume (thousand metric tons) |

3Q 2024 |

2Q 2024 |

3Q 2023 |

|

Seamless |

746 |

805 |

(7%) |

744 |

0% |

|

Welded |

191 |

228 |

(16%) |

169 |

13% |

|

Total |

937 |

1,033 |

(9%) |

913 |

3% |

|

|

|

|

|

|

|

The following table indicates, for our Tubes

business segment, net sales by geographic region, operating income

and operating income as a percentage of net sales for the periods

indicated below. During this quarter, the coating service results

attributable to the coating business acquired from Mattr, which

were previously included in our Others segment, have been

reclassified to our Tubes segment and comparative amounts have been

reclassified accordingly.

|

Tubes |

3Q 2024 |

2Q 2024 |

3Q 2023 |

|

(Net sales - $ million) |

|

|

|

|

|

|

North America |

1,273 |

1,439 |

(12%) |

1,700 |

(25%) |

|

South America |

484 |

599 |

(19%) |

608 |

(20%) |

|

Europe |

280 |

269 |

4% |

231 |

21% |

|

Asia Pacific, Middle East and Africa |

754 |

823 |

(8%) |

556 |

36% |

|

Total net sales ($ million) |

2,790 |

3,130 |

(11%) |

3,095 |

(10%) |

|

Coating services to third parties included in Tubes ($

million) |

70 |

67 |

5% |

19 |

273% |

|

Operating income ($ million) |

527 |

459 |

15% |

841 |

(37%) |

|

Operating margin (% of sales) |

18.9% |

14.7% |

|

27.2% |

|

|

|

|

|

|

|

|

Net sales of tubular products and services

decreased 11% sequentially and 10% year on year. Sequentially,

volumes decreased 9% and average selling prices excluding the

coating services on third parties pipes decreased 2%. In North

America sales declined due to lower prices throughout the region

and lower activity in the United States and Mexico. In South

America we had lower pipeline sales in Argentina and lower

conductor sales in Brazil partially compensated by a start of

shipments to the Raia offshore line pipe project. In Europe sales

increased thanks to the continued shipments to the Sakarya offshore

line pipe project and higher sales of OCTG in Romania and Turkey

which more than compensated for lower sales in the North Sea. In

Asia Pacific, Middle East and Africa further sales in Saudi Arabia

under inventory replenishment program, stable sales to the United

Arab Emirates and a high level of shipments to Iraq, attenuated a

drop in sales in sub-Saharan Africa, China and the rest of the

Middle East.

Operating results from tubular products and

services amounted to a gain of $527 million in the third quarter of

2024 compared to a gain of $459 million in the previous quarter and

a gain of $841 million in the third quarter of 2023. In the second

quarter of 2024 our Tubes operating income included a $171 million

loss from the provision for ongoing litigation related to the

acquisition of a participation in Usiminas and a $14 million gain

from a positive legal claim resolution in Mexico. Excluding these

two effects Tubes operating income in the second quarter of 2024

would have amounted to $616 million and the current quarter would

have been 14% lower following the decline in prices and sales.

Others

The following table indicates, for our Others

business segment, net sales, operating income and operating income

as a percentage of net sales for the periods indicated below:

|

Others |

3Q 2024 |

2Q 2024 |

3Q 2023 |

|

Net sales ($ million) |

125 |

192 |

(35%) |

143 |

(13%) |

|

Operating income ($ million) |

10 |

52 |

(81%) |

27 |

(64%) |

|

Operating margin (% of sales) |

7.9% |

27.3% |

|

19.0% |

|

|

|

|

|

|

|

|

Net sales of other products and services

decreased 35% sequentially and decreased 13% year on year.

Sequentially, sales declined mainly due to lower sales of coiled

tubing, sucker rods and oil services in Argentina.

Selling, general and administrative

expenses, or SG&A, amounted to $454

million, or 15.6% of net sales, in the third quarter of 2024,

compared to $497 million, 15.0% in the previous quarter and $433

million, 13.4% in the third quarter of 2023. Sequentially, the

decline in SG&A is mainly due to lower shipment costs due to a

reduction in volumes shipped and a decrease in services and fees,

taxes and others.

Other operating results

amounted to a gain of $11 million in the third quarter of 2024,

compared to a loss of $170 million in the previous quarter and a

$36 million gain in the third quarter of 2023. In the second

quarter of 2024 we recorded a $171 million loss from provision for

ongoing litigation related to the acquisition of a participation in

Usiminas.

Financial results amounted to a

gain of $48 million in the third quarter of 2024, compared to a

gain of $57 million in the previous quarter and a gain of $67

million in the third quarter of 2023. Financial result of the

quarter is mainly attributable to a $50 million net finance income

from the net return of our portfolio investments offset by other

financial results.

Equity in earnings (losses) of

non-consolidated companies generated a gain of $8 million

in the third quarter of 2024, compared to a loss of $83 million in

the previous quarter and a loss of $110 million in the third

quarter of 2023. These results are mainly derived from our

participation in Ternium (NYSE:TX). The previous quarter included

an $83 million loss from the provision for ongoing litigation

related to the acquisition of a participation in Usiminas on our

investment in Ternium.

Income tax charge amounted to

$134 million in the third quarter of 2024, compared to $138 million

in the previous quarter and $278 million in the third quarter of

2023. With a similar income before equity earnings of

non-consolidated companies and income tax, the tax charge of the

quarter was sequentially lower mainly due to a lower impact of the

foreign exchange devaluation in Mexico on the fiscal values of

fixed assets and inventory.

Cash Flow and Liquidity of 2024 Third

Quarter

Net cash generated by operating activities

during the third quarter of 2024 was $552 million, compared to $935

million in the previous quarter and $1.3 billion in the third

quarter of 2023. During the third quarter of 2024 cash generated by

operating activities includes a net working capital reduction of

$48 million.

With capital expenditures of $179 million, our

free cash flow amounted to $373 million during the quarter. After

share buybacks of $182 million in the quarter, our net cash

position amounted to $4.0 billion at September 30, 2024.

Analysis of 2024 First Nine Months Results

|

|

9M 2024 |

9M 2023 |

Increase/(Decrease) |

|

Net sales ($ million) |

9,679 |

11,454 |

(15%) |

|

Operating income ($ million) |

1,860 |

3,497 |

(47%) |

|

Net income ($ million) |

1,558 |

2,812 |

(45%) |

|

Shareholders’ net income ($ million) |

1,520 |

2,789 |

(45%) |

|

Earnings per ADS ($) |

2.67 |

4.72 |

(43%) |

|

Earnings per share ($) |

1.34 |

2.36 |

(43%) |

|

EBITDA* ($ million) |

2,326 |

3,890 |

(40%) |

|

EBITDA margin (% of net sales) |

24.0% |

34.0% |

|

|

|

|

|

|

*EBITDA in 9M 2024 includes a $174 million loss

from the provision for ongoing litigation related to the

acquisition of a participation in Usiminas. If this charge was not

included EBITDA would have amounted to $2,499 million, or 25.8% of

sales.

Our sales in the first nine months of 2024

decreased 15% compared to the first nine months of 2023 as volumes

of tubular products shipped decreased 4%, tubes average selling

prices decreased 15% excluding the coating services on third

parties pipes, while sales in the Others segment remained flat.

Following the decrease in sales, mainly due to the tubes average

price decline, EBITDA margin declined from 34% to 24% and EBITDA

declined 40%. EBITDA in the first nine months of 2024 includes a

$174 million loss from the provision for ongoing litigation related

to the acquisition of a participation in Usiminas, included in

other operating expenses. Additionally, related to the same case,

net income includes an $86 million loss from our participation in

Ternium.

Cash flow provided by operating activities

amounted to $2.4 billion during the first nine months of 2024,

including a a reduction in working capital of $324 million. After

capital expenditures of $512 million, our free cash flow amounted

to $1.9 billion. Following a dividend payment of $459 million in

May 2024 and share buybacks for $985 million in the nine months,

our positive net cash position amounted to $4.0 billion at the end

of September 2024.

The following table shows our net sales by business segment for

the periods indicated below:

|

Net sales ($ million) |

9M 2024 |

9M 2023 |

Increase/(Decrease) |

|

Tubes |

9,212 |

95% |

10,987 |

96% |

(16%) |

|

Others |

467 |

5% |

467 |

4% |

(0%) |

|

Total |

9,679 |

|

11,454 |

|

(15%) |

|

|

|

|

|

|

|

Tubes

The following table indicates, for our Tubes

business segment, sales volumes of seamless and welded pipes for

the periods indicated below:

|

Tubes Sales volume (thousand metric tons) |

9M 2024 |

9M 2023 |

Increase/(Decrease) |

|

Seamless |

2,328 |

2,428 |

(4%) |

|

Welded |

687 |

707 |

(3%) |

|

Total |

3,016 |

3,136 |

(4%) |

|

|

|

|

|

The following table indicates, for our Tubes business segment,

net sales by geographic region, operating income and operating

income as a percentage of net sales for the periods indicated

below:

|

Tubes |

9M 2024 |

9M 2023 |

Increase/(Decrease) |

|

(Net sales - $ million) |

|

|

|

|

North America |

4,301 |

6,071 |

(29%) |

|

South America |

1,699 |

2,476 |

(31%) |

|

Europe |

802 |

754 |

6% |

|

Asia Pacific, Middle East and Africa |

2,410 |

1,687 |

43% |

|

Total net sales ($ million) |

9,212 |

10,987 |

(16%) |

|

Coating services to third parties included in Tubes ($

million) |

300 |

55 |

441% |

|

Operating income ($ million) |

1,772 |

3,403 |

(48%) |

|

Operating margin (% of sales) |

19.2% |

31.0% |

|

|

|

|

|

|

Net sales of tubular products and services

decreased 16% to $9,212 million in the first nine months of 2024,

compared to $10,987 million in the first nine months of 2023 due to

a 4% decrease in volumes and a 15% decrease in average selling

prices excluding the coating services on third parties pipes. Price

declines were concentrated in the Americas, more so in North

America, and were partially offset by increases in Europe and Asia

Pacific, Middle East and Africa.

Operating results from tubular products and

services amounted to a gain of $1,772 million in the first nine

months of 2024 compared to a gain of $3,403 million in the first

nine months of 2023. The decline in operating results is mainly due

to the decline in average selling prices and the corresponding

impact on margins. Additionally, in the first nine months of 2024

our Tubes operating income includes a charge of $174 million loss

from the provision for ongoing litigation related to the

acquisition of a participation in Usiminas, included in other

operating expenses. On the other hand, operating income in the

first nine months of 2024 includes gains amounting to $39 million

from positive legal claims resolutions in Mexico and Brazil.

Others

The following table indicates, for our Others

business segment, net sales, operating income and operating income

as a percentage of net sales for the periods indicated below:

|

Others |

9M 2024 |

9M 2023 |

Increase/(Decrease) |

|

Net sales ($ million) |

467 |

467 |

0% |

|

Operating income ($ million) |

88 |

94 |

(6%) |

|

Operating margin (% of sales) |

18.9% |

20.1% |

|

|

|

|

|

|

Net sales of other products and services which

amounted to $467 million in the first nine months of 2024 remained

flat in comparison to the the first nine months of 2023 as an

increase in sales of oilfield services in Argentina and coiled

tubing offset a decline in sales of sucker rods, excess raw

materials and energy.

Operating results from other products and

services amounted to a gain of $88 million in the first nine months

of 2024, compared to a gain of $94 million in the first nine months

of 2023. Results were mainly derived from our sucker rods business,

coiled tubing and our oilfield services business in Argentina.

Selling, general and administrative

expenses, or SG&A, amounted to $1,459 million in the

first nine months of 2024, representing 15.1% of sales, and $1,449

million in the first nine months of 2023, representing 12.6% of

sales. SG&A expenses increased as a percentage of sales due to

the 15% decline in revenues, mainly due to lower Tubes average

selling prices, and an increase of fixed costs partially offset by

a reduction in selling expenses.

Other operating results

amounted to a loss of $146 million in the first nine months of

2024, compared to a gain of $41 million in the same period of 2023.

In the first nine months of 2024 we recorded a $174 million loss

from provision for ongoing litigation related to the acquisition of

a participation in Usiminas. In the first nine months of 2023 other

operating income includes a non-recurring gain of $33 million

corresponding to the transfer of the awards related to the

Company’s Venezuelan nationalized assets.

Financial results amounted to a

gain of $81 million in the first nine months of 2024, compared to a

gain of $128 million in the first nine months of 2023. While net

finance income increased due to a higher net financial position,

other financial results were negatively affected by a cumulative

result of the U.S. dollar denominated Argentine bond previously

recognized in other comprehensive income, while foreign exchange

results decreased in the first nine months of 2024 in respect to

the same period of 2023.

Equity in (losses) earnings of

non-consolidated companies generated a loss of $27 million

in the first nine months of 2024, compared to a gain of $39 million

in the first nine months of 2023. These results were mainly derived

from our equity investment in Ternium (NYSE:TX) and in the first

nine months of 2024 were negatively affected by an $86 million loss

from the provision for ongoing litigation related to the

acquisition of a participation in Usiminas on our Ternium

investment.

Income tax amounted to a charge

of $357 million in the first nine months of 2024, compared to $852

million in the first nine months of 2023. The lower income tax

charge reflects mainly the reduction in results at several

subsidiaries.

Cash Flow and Liquidity of 2024 First Nine

Months

Net cash provided by operating activities during

the first nine months of 2024 amounted to $2.4 billion (including a

reduction in working capital of $324 million), compared to cash

provided by operations of $3.6 billion (net of a reduction in

working capital of $248 million) in the first nine months of

2023.

Capital expenditures amounted to $512 million in

the first nine months of 2024, compared to $453 million in the

first nine months of 2023. Free cash flow amounted to $1.9 billion

in the first nine months of 2024, compared to $3.1 billion in the

first nine months of 2023.

Following a dividend payment of $459 million in

May 2024 and share buybacks of $985 million in the nine months, our

positive net cash position amounted to $4.0 billion at the end of

September 2024.

Conference call

Tenaris will hold a conference call to discuss

the above reported results, on November 7, 2024, at 08:00 a.m.

(Eastern Time). Following a brief summary, the conference call will

be opened to questions.

To listen to the conference please join through

one of the following options:

ir.tenaris.com/events-and-presentations or

https://edge.media-server.com/mmc/p/z7cmogvw/

If you wish to participate in the Q&A session please

register at the following link:

https://register.vevent.com/register/BIf7b93fbc38f245839de51051af91f592

Please connect 10 minutes before the scheduled start time.

A replay of the conference call will also be available on our

webpage at: ir.tenaris.com/events-and-presentations

Some of the statements contained in this press

release are “forward-looking statements”. Forward-looking

statements are based on management’s current views and assumptions

and involve known and unknown risks that could cause actual

results, performance or events to differ materially from those

expressed or implied by those statements. These risks include but

are not limited to risks arising from uncertainties as to future

oil and gas prices and their impact on investment programs by oil

and gas companies.Consolidated Condensed Interim Income

Statement

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended September 30, |

Nine-month period ended September 30, |

|

|

2024 |

2023 |

2024 |

2023 |

|

|

Unaudited |

Unaudited |

|

Net sales |

2,915,487 |

3,237,836 |

9,678,708 |

11,453,930 |

|

Cost of sales |

(1,935,560) |

(1,973,381) |

(6,213,226) |

(6,548,324) |

|

Gross profit |

979,927 |

1,264,455 |

3,465,482 |

4,905,606 |

|

Selling, general and administrative expenses |

(454,020) |

(432,682) |

(1,458,840) |

(1,448,765) |

|

Other operating income |

16,682 |

39,219 |

42,167 |

51,575 |

|

Other operating expenses |

(5,490) |

(3,091) |

(188,337) |

(10,971) |

|

Operating income |

537,099 |

867,901 |

1,860,472 |

3,497,445 |

|

Finance Income |

65,815 |

56,100 |

190,988 |

149,853 |

|

Finance Cost |

(15,979) |

(19,179) |

(52,284) |

(87,103) |

|

Other financial results, net |

(1,381) |

30,565 |

(57,828) |

65,116 |

|

Income before equity in earnings of non-consolidated

companies and income tax |

585,554 |

935,387 |

1,941,348 |

3,625,311 |

|

Equity in earnings (losses) of non-consolidated companies |

7,605 |

(110,382) |

(26,735) |

38,545 |

|

Income before income tax |

593,159 |

825,005 |

1,914,613 |

3,663,856 |

|

Income tax |

(133,968) |

(278,200) |

(356,971) |

(851,804) |

|

Income for the period |

459,191 |

546,805 |

1,557,642 |

2,812,052 |

|

|

|

|

|

|

|

Attributable to: |

|

|

|

|

|

Shareholders' equity |

448,066 |

537,311 |

1,520,232 |

2,788,967 |

|

Non-controlling interests |

11,125 |

9,494 |

37,410 |

23,085 |

|

|

459,191 |

546,805 |

1,557,642 |

2,812,052 |

Consolidated Condensed Interim Statement of Financial

Position

| (all amounts in thousands of

U.S. dollars) |

At September 30, 2024 |

|

At December 31, 2023 |

|

|

Unaudited |

|

|

|

ASSETS |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

Property, plant and equipment, net |

6,150,671 |

|

|

6,078,179 |

|

|

Intangible assets, net |

1,355,801 |

|

|

1,377,110 |

|

|

Right-of-use assets, net |

149,808 |

|

|

132,138 |

|

|

Investments in non-consolidated companies |

1,550,676 |

|

|

1,608,804 |

|

|

Other investments |

1,020,808 |

|

|

405,631 |

|

|

Deferred tax assets |

790,907 |

|

|

789,615 |

|

|

Receivables, net |

199,459 |

11,218,130 |

|

185,959 |

10,577,436 |

|

Current assets |

|

|

|

|

|

|

Inventories, net |

3,762,705 |

|

|

3,921,097 |

|

|

Receivables and prepayments, net |

249,754 |

|

|

228,819 |

|

|

Current tax assets |

307,459 |

|

|

256,401 |

|

|

Trade receivables, net |

2,079,600 |

|

|

2,480,889 |

|

|

Derivative financial instruments |

8,727 |

|

|

9,801 |

|

|

Other investments |

2,798,807 |

|

|

1,969,631 |

|

|

Cash and cash equivalents |

715,028 |

9,922,080 |

|

1,637,821 |

10,504,459 |

|

Total assets |

|

21,140,210 |

|

|

21,081,895 |

|

EQUITY |

|

|

|

|

|

|

Shareholders' equity |

|

17,200,408 |

|

|

16,842,972 |

|

Non-controlling interests |

|

219,167 |

|

|

187,465 |

|

Total equity |

|

17,419,575 |

|

|

17,030,437 |

|

LIABILITIES |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

Borrowings |

14,405 |

|

|

48,304 |

|

|

Lease liabilities |

103,121 |

|

|

96,598 |

|

|

Derivative financial instruments |

- |

|

|

255 |

|

|

Deferred tax liabilities |

479,187 |

|

|

631,605 |

|

|

Other liabilities |

318,498 |

|

|

271,268 |

|

|

Provisions |

87,363 |

1,002,574 |

|

101,453 |

1,149,483 |

|

Current liabilities |

|

|

|

|

|

|

Borrowings |

485,996 |

|

|

535,133 |

|

|

Lease liabilities |

48,616 |

|

|

37,835 |

|

|

Derivative financial instruments |

3,230 |

|

|

10,895 |

|

|

Current tax liabilities |

291,032 |

|

|

488,277 |

|

|

Other liabilities |

380,577 |

|

|

422,645 |

|

|

Provisions |

221,870 |

|

|

35,959 |

|

|

Customer advances |

324,382 |

|

|

263,664 |

|

|

Trade payables |

962,358 |

2,718,061 |

|

1,107,567 |

2,901,975 |

|

Total liabilities |

|

3,720,635 |

|

|

4,051,458 |

|

Total equity and liabilities |

|

21,140,210 |

|

|

21,081,895 |

Consolidated Condensed Interim Statement of Cash

Flows

| (all amounts in

thousands of U.S. dollars) |

Three-month period ended September 30, |

Nine-month period ended September 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| |

|

Unaudited |

Unaudited |

| Cash flows

from operating activities |

|

|

|

| Income for the

period |

|

459,191 |

|

546,805 |

|

1,557,642 |

|

2,812,052 |

|

| Adjustments for: |

|

|

|

|

|

| Depreciation and

amortization |

|

151,122 |

|

136,129 |

|

465,073 |

|

392,163 |

|

| Bargain purchase gain |

|

- |

|

(3,162) |

|

(2,211) |

|

(3,162) |

|

| Provision for the

ongoing litigation related to the acquisition of participation in

Usiminas |

6,736 |

|

- |

|

177,346 |

|

- |

|

| Income tax accruals less

payments |

|

(108,788) |

|

76,994 |

|

(222,350) |

|

134,168 |

|

| Equity in (losses)

earnings of non-consolidated companies |

(7,605) |

|

110,382 |

|

26,735 |

|

(38,545) |

|

| Interest accruals

less payments, net |

(5,678) |

|

(22,986) |

|

(8,313) |

|

(44,926) |

|

| Changes in provisions |

|

(615) |

|

(17,998) |

|

(5,347) |

|

21,935 |

|

| Changes in working

capital |

|

48,003 |

|

414,887 |

|

323,521 |

|

248,125 |

|

| Others, including

net foreign exchange |

9,446 |

|

55,883 |

|

61,894 |

|

37,528 |

|

| Net cash

provided by operating activities |

551,812 |

|

1,296,934 |

|

2,373,990 |

|

3,559,338 |

|

| |

|

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

|

| Capital expenditures |

|

(178,671) |

|

(170,376) |

|

(512,086) |

|

(452,625) |

|

| Changes in

advances to suppliers of property, plant and equipment |

(4,968) |

|

(1,342) |

|

(15,483) |

|

902 |

|

| Acquisition of

subsidiaries, net of cash acquired |

5,500 |

|

(100,311) |

|

31,446 |

|

(104,419) |

|

| Additions to

associated companies |

- |

|

(22,661) |

|

- |

|

(22,661) |

|

| Loan to joint ventures |

|

(1,392) |

|

(1,427) |

|

(4,137) |

|

(2,662) |

|

| Proceeds from

disposal of property, plant and equipment and intangible

assets |

13,182 |

|

648 |

|

19,317 |

|

9,023 |

|

| Dividends received

from non-consolidated companies |

- |

|

- |

|

53,136 |

|

43,513 |

|

| Changes in

investments in securities |

(243,133) |

|

(809,796) |

|

(1,279,885) |

|

(2,597,425) |

|

| Net cash

used in investing activities |

(409,482) |

|

(1,105,265) |

|

(1,707,692) |

|

(3,126,354) |

|

| |

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

| Dividends paid |

|

- |

|

- |

|

(458,556) |

|

(401,383) |

|

| Dividends paid to

non-controlling interest in subsidiaries |

(5,862) |

|

(1,530) |

|

(5,862) |

|

(18,967) |

|

| Changes in

non-controlling interests |

- |

|

2,033 |

|

1,115 |

|

3,772 |

|

| Acquisition of treasury

shares |

|

(181,741) |

|

- |

|

(985,127) |

|

- |

|

| Payments of lease

liabilities |

|

(17,944) |

|

(12,199) |

|

(51,326) |

|

(35,968) |

|

| Proceeds from borrowings |

|

331,348 |

|

326,185 |

|

1,526,444 |

|

1,358,223 |

|

| Repayments of borrowings |

|

(444,172) |

|

(381,886) |

|

(1,616,771) |

|

(1,524,973) |

|

| Net cash

used in financing activities |

(318,371) |

|

(67,397) |

|

(1,590,083) |

|

(619,296) |

|

| |

|

|

|

|

|

|

(Decrease) increase in cash and cash

equivalents |

(176,041) |

|

124,272 |

|

(923,785) |

|

(186,312) |

|

| |

|

|

|

|

|

| Movement

in cash and cash equivalents |

|

|

| At the beginning of the

period |

|

848,695 |

|

755,271 |

|

1,616,597 |

|

1,091,433 |

|

| Effect of exchange rate

changes |

|

8,652 |

|

(15,531) |

|

(11,506) |

|

(41,109) |

|

| (Decrease)

increase in cash and cash equivalents |

(176,041) |

|

124,272 |

|

(923,785) |

|

(186,312) |

|

| |

|

681,306 |

|

864,012 |

|

681,306 |

|

864,012 |

|

Exhibit I – Alternative performance

measures

Alternative performance measures should be

considered in addition to, not as substitute for or superior to,

other measures of financial performance prepared in accordance with

IFRS.

EBITDA, Earnings before interest, tax, depreciation and

amortization.

EBITDA provides an analysis of the operating

results excluding depreciation and amortization and impairments, as

they are recurring non-cash variables which can vary substantially

from company to company depending on accounting policies and the

accounting value of the assets. EBITDA is an approximation to

pre-tax operating cash flow and reflects cash generation before

working capital variation. EBITDA is widely used by investors when

evaluating businesses (multiples valuation), as well as by rating

agencies and creditors to evaluate the level of debt, comparing

EBITDA with net debt.

EBITDA is calculated in the following manner:

EBITDA = Net income for the period + Income tax

charges +/- Equity in Earnings (losses) of non-consolidated

companies +/- Financial results + Depreciation and amortization +/-

Impairment charges/(reversals).

EBITDA is a non-IFRS alternative performance measure.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended September 30, |

Nine-month period ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| Income for the period |

459,191 |

|

546,805 |

|

1,557,642 |

|

2,812,052 |

|

| Income tax charge |

133,968 |

|

278,200 |

|

356,971 |

|

851,804 |

|

| Equity in earnings (losses) of

non-consolidated companies |

(7,605) |

|

110,382 |

|

26,735 |

|

(38,545) |

|

| Financial Results |

(48,455) |

|

(67,486) |

|

(80,876) |

|

(127,866) |

|

| Depreciation and

amortization |

151,122 |

|

136,129 |

|

465,073 |

|

392,163 |

|

| EBITDA |

688,221 |

|

1,004,030 |

|

2,325,545 |

|

3,889,608 |

|

| |

|

|

|

|

|

|

|

|

Free Cash Flow

Free cash flow is a measure of financial performance, calculated

as operating cash flow less capital expenditures. FCF represents

the cash that a company is able to generate after spending the

money required to maintain or expand its asset base.

Free cash flow is calculated in the following manner:

Free cash flow = Net cash (used in) provided by operating

activities - Capital expenditures.

Free cash flow is a non-IFRS alternative performance

measure.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended September 30, |

Nine-month period ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| Net cash provided by operating

activities |

551,812 |

|

1,296,934 |

|

2,373,990 |

|

3,559,338 |

|

| Capital expenditures |

(178,671) |

|

(170,376) |

|

(512,086) |

|

(452,625) |

|

| Free cash

flow |

373,141 |

|

1,126,558 |

|

1,861,904 |

|

3,106,713 |

|

| |

|

|

|

|

|

|

|

|

Net Cash / (Debt)

This is the net balance of cash and cash

equivalents, other current investments and fixed income investments

held to maturity less total borrowings. It provides a summary of

the financial solvency and liquidity of the company. Net cash /

(debt) is widely used by investors and rating agencies and

creditors to assess the company’s leverage, financial strength,

flexibility and risks.

Net cash/ debt is calculated in the following manner:

Net cash = Cash and cash equivalents + Other investments

(Current and Non-Current)+/- Derivatives hedging borrowings and

investments - Borrowings (Current and Non-Current).

Net cash/debt is a non-IFRS alternative performance measure.

|

(all amounts in thousands of U.S. dollars) |

At September 30, |

|

|

2024 |

|

2023 |

|

| Cash and cash equivalents |

715,028 |

|

864,043 |

|

| Other current investments |

2,798,807 |

|

2,496,747 |

|

| Non-current investments |

1,013,474 |

|

560,489 |

|

| Derivatives hedging borrowings

and investments |

- |

|

766 |

|

| Current borrowings |

(485,996) |

|

(597,493) |

|

| Non-current borrowings |

(14,405) |

|

(25,248) |

|

| Net cash /

(debt) |

4,026,908 |

|

3,299,304 |

|

| |

|

|

|

|

Operating working capital days

Operating working capital is the difference

between the main operating components of current assets and current

liabilities. Operating working capital is a measure of a company’s

operational efficiency, and short-term financial health.

Operating working capital days is calculated in

the following manner:

Operating working capital days = [(Inventories +

Trade receivables – Trade payables – Customer advances) /

Annualized quarterly sales ] x 365.

Operating working capital days is a non-IFRS alternative

performance measure.

| (all amounts in thousands of

U.S. dollars) |

At September 30, |

|

|

2024 |

|

2023 |

|

| Inventories |

3,762,705 |

|

3,884,882 |

|

| Trade receivables |

2,079,600 |

|

2,169,293 |

|

| Customer advances |

(324,382) |

|

(160,533) |

|

| Trade payables |

(962,358) |

|

(999,209) |

|

| Operating working

capital |

4,555,565 |

|

4,894,433 |

|

| Annualized quarterly

sales |

11,661,948 |

|

12,951,344 |

|

| Operating working capital

days |

143 |

|

138 |

|

Giovanni

Sardagna Tenaris

1-888-300-5432www.tenaris.com

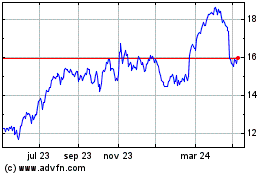

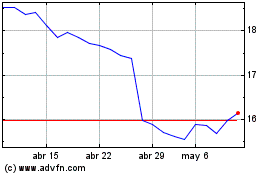

Tenaris (BIT:TEN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Tenaris (BIT:TEN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025