BNB Token Burn: $1 Billion Of Tokens Sent To ‘Black Hole’ Address — Impact On Price?

02 Noviembre 2024 - 4:30AM

NEWSBTC

On Friday, November 1, the BNB Foundation announced the successful

completion of the 29th quarterly burn by the BNB Chain. This latest

event of the routine token burn reiterates the project’s commitment

to a deflationary approach in order to ensure growth. A total of

1,772,712.363 BNB tokens (worth approximately $1.07 billion) were

automatically burned in this quarter’s event. According to the

foundation’s blog post, this quarter’s burning was (and subsequent

token burning events will be) performed directly on Binance Smart

Chain (BSC), with the burn amount sent to a “black hole” address.

Can The Latest Burn Event Propel BNB’s Price To $600? Token

burning, a process in which tokens or coins are purposely and

permanently removed from circulation, is carried out to trigger an

increase in a token’s value. Similarly, the quarterly token burn

can have a significant impact on BNB’s price by decreasing the

total supply, thereby creating a deflationary effect. Related

Reading: Dogecoin Bollinger Bands Squeezes Tighter Than It Was

Before 2021 Rally, What This Means Moreover, the consistency of the

quarterly BNB burns shows the dedication of the foundation to the

long-term growth and success of the token. This positive trend

could favorably impact general market sentiment, as it strengthens

investors’ trust in BNB’s potential as a stable investment.

However, it is worth looking at the impact of previous quarterly

burns on the BNB price to be able to gauge the potential effect of

the latest event. Notably, the 28th token burn, which was completed

on July 22, 2024, didn’t exactly have a bullish impact on the value

of the fourth-largest cryptocurrency. According to data from

CoinGecko, the price of the BNB token sat just above $600 as of

July 22. Unexpectedly, the token’s price fell more than 22% to a

low of $464 about two weeks after the burn event. BNB’s value

seemed to have crumbled under the bearish climate of the general

market. The BNB token has mostly been in a consolidation range over

the past few months, mirroring the state of Bitcoin and the general

crypto market. Fortunately, the premier cryptocurrency seems to be

back in the bullish zone after returning to $70,000 for the first

time since June. If the strong positive correlation between BNB and

Bitcoin plays out, it means that investors could see Binance’s

native token resume its upward trend. Hence, BNB seems to have a

positive outlook and could soon reclaim $600, especially if the

flagship cryptocurrency remains bullish. BNB Price At A Glance As

of this writing, the value of BNB stands around $571.8, reflecting

a 0.6% price dip in the past 24 hours. Related Reading: Analyst

Exposes Ethereum Ascending Support At $2,400 – Best Chance To

Accumulate ETH? Featured image from Shutterstock, chart from

TradingView

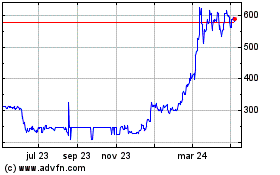

Binance Coin (COIN:BNBUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

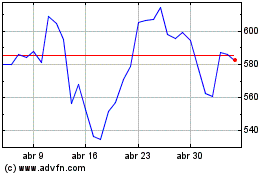

Binance Coin (COIN:BNBUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024