Beyond Ethereum: Getting Started With Cross-Chain Trading

02 Noviembre 2021 - 11:54AM

NEWSBTC

Despite its prominence as the most well-established smart contract

platform and decentralized finance (DeFi) ecosystem, Ethereum is

gradually seeing an exodus of users to other platforms — largely

due to its often gut-wrenchingly high transaction fees and

congestion. This is particularly the case among

cryptocurrency traders, who are moving away from Ethereum en-masse

to platforms like Avalanche and Binance Smart Chain. This is owed

to their dramatically lower fees and improved speed over Ethereum,

as well as the rapid development of their token ecosystems — and

the opportunities this brings. Decentralized exchanges (DEXs)

have emerged as the simplest way to gain exposure to these new

ecosystems, allowing traders to access the most promising tokens at

an early stage without waiting for centralized exchange

listings. Here, we take a look at three of the most promising

cross-chain ecosystems, and the DEXs that act as their primary

entry points. Avalanche: Pangolin In development since

mid-2020, Avalanche is one of the most well-known Ethereum

competitors and has grown into a thriving ecosystem of powerful

DApps and projects. Today, the Avalanche landscape is filled

with a wide variety of popular platforms, ranging from DeFi tools

to play-to-earn games, NFT marketplaces, and more. Pangolin

currently sits at the very center of this rapidly blossoming

ecosystem. As a decentralized exchange platform Pangolin provides a

permissionless, trustless way to exchange Avalanche (AVAX) coins

and a massive variety of Avalanche-based tokens while keeping fees

down to a minimum. With Pangolin, trades are completed in

just seconds, making it perfectly suited to professional and

high-frequency traders. It’s also simple to use, ensuring even

inexperienced traders can use it without any hurdles.

https://twitter.com/pangolindex/status/1454094600696516614 Since

Pangolin is an automated market maker, users are free to allocate

their tokens as liquidity to the protocol and earn a passive yield

as a liquidity provider. But more than this, it also includes

a variety of additional tools that make it the ideal entry route

into the Avalanche landscape. This includes a wide range of yield

farms, which users can use to earn boost the yield they earn on

their liquidity provider (LP) tokens, as well as Wyre integration —

allowing users to purchase AVAX using their debit or credit

card. As Avalanche’s most popular DeFi app and arguably its

most powerful DEX, Pangolin is an essential component of any

Avalanche user’s toolkit. Velas: WagyuSwap Billed as the

first AI-powered blockchain, Velas leverages a unique solution

known as “artificial intuition” to rapidly and automatically adjust

its operating parameters based on network conditions to maximize

performance. As a fork of Solana, Velas inherits all of its

capabilities, including massive scalability, extreme security, and

industry-leading throughput (with support for up to 75,000

transactions per second). But more than this, it also supports the

Ethereum Virtual Machine, providing a simple development

environment. WagyuSwap is the first DEX on Velas Chain and

the primary source of liquidity for Velas-based tokens. As an AMM,

it features permissionless liquidity provision, limitless

liquidity, and algorithmic asset pricing.

https://twitter.com/WagyuSwap_app/status/1435610670297387009 It’s

designed to act as a hub for users and developers operating on

Velas. It’s building the tools and services necessary to bootstrap

the Velas ecosystem and bring it up to par with competing

blockchains. In line with this, WagyuSwap will also include

its own staking solution, a variety of yield farms, and a

decentralized lottery feature. In time, WagyuSwap hopes to become

the cornerstone of DeFi on Velas and plans to expand its services

in line with market demand. If you’re looking to dive into a

new ecosystem right at its very inception, then Velas is certainly

worth exploring. Binance Smart Chain: PancakeSwap Right

now, Binance Smart Chain is undeniably Ethereum’s biggest

competitor. In terms of sheer size and development, Binance Smart

Chain is second only to Ethereum — having a complete ecosystem of

DApps and DeFi tools. The platform is essentially a faster,

cheaper version of Ethereum. It achieves this by leveraging a

highly efficient consensus system known as Proof of Staked

Authority (PoSA) in addition to a faster block time to dramatically

increase throughput and keep fees down to a minimum. As with

most DeFi-capable blockchains, a DEX lies at the heart of DeFi on

Binance Smart Chain. In this case, PancakeSwap is not only by far

the most popular DEX on BSC, but also its most popular DApp in

general.

https://twitter.com/pancakeswap/status/1443493779084759040 Like the

other options in this list, PancakeSwap falls under the AMM class

of DEXs and has its own permissionless liquidity pools for a huge

range of BEP-20 assets. More than this, it also features a huge

number of yield farms, prediction markets, a lottery tool, an NFT

marketplace, and its own NFT collections. The platform is governed

by holders of its native utility and governance token, known as

$CAKE. PancakeSwap is an entire ecosystem unto itself and is

one of the most frequently updated DApps on BSC — with new features

and improvements being added regularly. If you’re looking to get

started with BSC, PancakeSwap is almost certain to be your first

port of call.

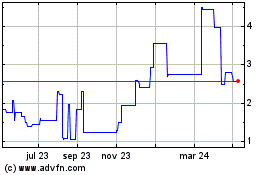

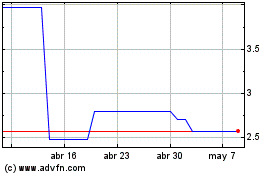

PancakeSwap Token (COIN:CAKEUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

PancakeSwap Token (COIN:CAKEUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024