Is The Tide Turning For Bitcoin? Recent Reserves And Netflows Indicate Market Reversal

28 Diciembre 2024 - 12:00AM

NEWSBTC

Analysts from the market intelligence company CryptoQuant note that

current patterns in Bitcoin (BTC) metrics indicate possible changes

in market dynamics. Bitcoin Price Faces Short-Term Volatility

After a period of steady decline, spot exchange reserves have

experienced a notable uptick, reflecting an inflow of 20,000 BTC.

This increase suggests that more Bitcoin is being deposited into

exchanges, which often indicates an intention to trade or

sell. This type of behavior may add further selling pressure

to the Bitcoin price, which has declined almost 7% over the last

two weeks, signaling a potential early sign of short-term

volatility. Related Reading: Cardano (ADA) Struggles to Hold

Ground: Another Drop Incoming? Simultaneously, netflows across all

exchanges have turned positive, with a net increase of 15,800 BTC.

This reversal from the predominantly negative trend seen in recent

weeks implies that inflows to exchanges are now exceeding

outflows. When combined with rising reserves, this shift

strengthens the likelihood of increased trading activity or

profit-taking by investors, according to CryptoQuant’s

analysis. While the broader trend in the market has favored

accumulation and self-custody, these recent changes may reflect a

growing caution among investors, who might be preparing for

profit-taking or bracing for a potential price correction.

Furthermore, a report by Bloomberg highlights a key metric gauging

investor interest in Bitcoin from South Korea, which has risen to a

four-month high amid ongoing political turmoil in the East Asian

country. Trading Volumes Surge As Political Crisis Unfolds

Known as the “Kimchi Premium,” this metric measures the price gap

between Bitcoin on South Korean exchange Upbit and Coinbase.

Recently, this premium surged to the range of 3-5%, indicating

heightened demand from South Korean investors. Per the

report, the political landscape in South Korea has been tumultuous,

particularly following President Yoon Suk Yeol’s brief and

controversial declaration of martial law earlier this month, which

lasted only six hours before being rescinded. Subsequently,

the National Assembly impeached Yoon on December 14, suspending his

powers and elevating Prime Minister Han Duck-soo to the role of

acting president. In a further development, the parliament voted to

impeach Han as well, marking a historic first for an acting

president in South Korea. These political upheavals have

rattled financial markets, coinciding with growing economic

challenges and increasing nuclear threats from North Korea. The

South Korean won has also seen a decline of 0.35% against the US

dollar. Related Reading: Ethereum Price Setting For a Big Move –

Breakout Or Downturn? According to Bloomberg, South Korea remains

one of the most active retail markets for cryptocurrencies, with

trading volumes on Korea-based exchanges often surpassing those on

traditional stock exchanges. Ki Young Ju, founder and CEO of

CryptoQuant, pointed out that corporate accounts are not permitted

on Korean crypto exchanges, meaning that the vast majority of

crypto activity in the country is driven by retail investors.

The Kimchi Premium has become a well-known metric for measuring

retail interest in cryptocurrency, and factors such as strict

currency controls and anti-money laundering (AML) regulations have

contributed to this phenomenon. At the time of writing, BTC is

priced at $93,938, experiencing a 2.5% decrease over the last 24

hours, with its closest support level at $92,000 serving to halt

additional declines for the top cryptocurrency in the market.

Featured image from DALL-E, chart from TradingView.com

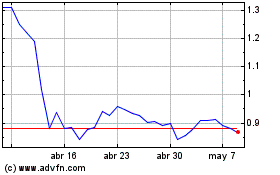

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024