Bitcoin NVT Golden Cross Signals ‘Local Bottom’ — What’s Next?

16 Noviembre 2024 - 9:00AM

NEWSBTC

According to the latest on-chain data, the Bitcoin Network Value to

Transactions (NVT) Golden Cross has fallen into a crucial region.

What could this mean for the price of the premier cryptocurrency?

What Does The Falling NVT Golden Cross Mean For Price? In a recent

Quicktake post on the CryptoQuant platform, an analyst with the

pseudonym Burakkesmeci revealed that the price of Bitcoin might

have reached a “local bottom.” This exciting prognosis is based on

the latest movement by the “NVT Golden Cross” metric. For context,

the “Network Value to Transactions” ratio is an on-chain indicator

that estimates the difference between the Bitcoin market

capitalization and transaction volume. Typically, a high NVT value

signals that an asset’s price is high compared to the network’s

transaction volume, suggesting that the coin is overvalued. Related

Reading: BNB Price Poised for Takeoff: Will It Be The Next to

Rally? Conversely, when the value of the NVT metric is low, it

implies that the coin’s market value is small relative to the

transaction volume. Usually, this indicates that the asset is

undervalued and its price could still have room for upside

movement. Now, the Golden Cross indicator is a modified iteration

of the NVT ratio, and it helps to mark gradual buy and sell zones

in short-term trends. According to Burakkesmeci explained that when

the NVT GC exceeds 2.2 (the red zone), it means that the price in a

short-term trend is overheating (and the formation of a potential

local top). On the other hand, the NVT Golden Cross dipping below

-1.6 suggests that the price decline is wearing out, signaling a

potential bottom. Burakkesmeci noted that these local tops and

bottoms are regions rather than just precise levels. As shown in

the chart above, the NVT Golden Cross has crossed beneath -1.6 and

is currently around -3.3, suggesting that the Bitcoin price is at a

local bottom. According to the CryptoQuant analyst, this could

represent a “gradual buying opportunity” for investors looking to

get into the market. Bitcoin Market In Extreme Greed Investors will

want to proceed with caution especially as the Bitcoin market seems

to be overheating in the long term. According to another

CryptoQuant analyst, the Fear & Greed Index has flagged extreme

greed for the premier cryptocurrency. Typically, when the Fear

& Greed Index moves toward one end, there is a potential for

market reversal depending on the sentiment. In this case, where the

market is in extreme greed, the Bitcoin price may be about to

witness a correction. Related Reading: XRP Price Rockets Upward:

Bulls Poised for More Gains As of this writing, the price of BTC

sits just beneath $91,000, reflecting a 3% increase in the past

day. According to CoinGecko data, the market leader is up by an

impressive 19% in the last seven days. Featured image from iStock,

chart from TradingView

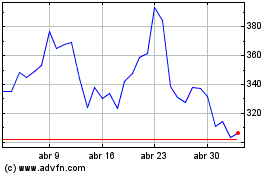

Gnosis (COIN:GNOUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Gnosis (COIN:GNOUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024