Binance’s BUSD Reserves Steady At $13 Billion, Represents 18% Of All Assets

14 Febrero 2023 - 3:15AM

NEWSBTC

BUSD, a stablecoin issued by Paxos, a blockchain infrastructure

platform in New York, is still one of the most dominant assets on

Binance, the world’s largest cryptocurrency exchange by client

count and trading volume. BUSD Remains Dominant DeFiLlama data on

February 14 shows that BUSD makes up over 18% of all assets locked

and managed in Binance. It is the third largest asset, with

stablecoins worth more than $13.3 billion locked when writing. BUSD

comes third only after BNB, the native currency of the Binance

ecosystem, and USDT, a competing stablecoin issued by Tether

Holdings. There is $17.61 billion worth of BNB managed by Binance,

while users have deposited $15.01 billion of USDT in the exchange.

Related Reading: Binance Integrates Binance-Pegged BUSD On Optimism

Network Binance manages over $70 billion of various assets, with

tokens from Ethereum being the most popular. There are also tokens

from the BNB Smart Chain (BSC), Tron, Avalanche, and other

blockchains. Binance currently manages $10.62 billion of BTC, up

from around $8 billion in early January 2023. When BNB is

excluded, Binance has more than $53 billion of assets under

management. Binance is the world’s largest exchange by the

number of assets it manages. The second is OKX, an exchange with a

TVL of over $7.6 billion, excluding the value of its native token,

OKB. Paxos Ordered To Halt BUSD Minting, USDT Trading Volumes Surge

On February 13, Paxos stated that it had received a Wells

notice from the United States Securities and Exchange Commission

(SEC). The agency, Paxos said, had concluded that BUSD is a

security and was considering enforcement action. This action is

likely a lawsuit. Paxos is supposed to respond in writing,

explaining why the SEC’s assessment is incorrect. Related Reading:

Breaking: New York Regulator Orders Paxos To Stop Issuing Binance’s

BUSD Paxos asserts that BUSD is not a security under the United

States federal laws. They will “engage with the SEC staff on this

issue and are prepared to vigorously litigate if necessary.” In an

update, Binance CEO, Changpeng Zhao, said Paxos had received an

order from New York regulators to halt the new minting of

BUSD. #BUSD. A thread. 1/8 In summary, BUSD is issued and

redeemed by Paxos. And funds are #SAFU! — CZ 🔶 Binance

(@cz_binance) February 13, 2023 Paxos were allowed to handle

redemption requests from users. Following this announcement,

USDT’s trading volumes spiked as users redeemed BUSD for other

stablecoins, mainly USDT. Remember when journalists were

lining up to write every time #Tether would trade couple of bps

< 1$?I'm sure they will write as much now…

pic.twitter.com/XVo22HaWoF — Paolo Ardoino 🍐 (@paoloardoino)

February 13, 2023 By early February 14, DeFiLlama

data showed that $547.41 million of USDT had been

transferred into Binance, up from $86.43 million users moved to the

exchange on February 13. Feature image from Binance, Chart from

TradingView

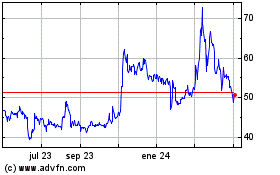

OKB (COIN:OKBUSD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

OKB (COIN:OKBUSD)

Gráfica de Acción Histórica

De May 2023 a May 2024