Bitcoin Whales Lose Interest, Is This A Precursor For A Crash To $50,000?

09 Mayo 2024 - 6:30AM

NEWSBTC

Movement and accumulation from crypto whales are two of the

catalysts for Bitcoin price increases. Although major whales are

still buying the dip, on-chain data indicates a general waning

accumulation momentum which suggests their conviction might

actually be waning. According to IntoTheBlock, an on-chain

analytics firm, Bitcoin whale accumulation volumes have declined

substantially in each buying cycle over the past month. This

decline in whale accumulation could be worrying for investors,

especially as the price of Bitcoin is now trying to hold above

$60,000. Whale Appetite For Bitcoin Dips According To On-Chain Data

Whales, or large investors holding over 1,000 BTC, have accumulated

strongly since the beginning of the year, especially during market

dips. This accumulation has largely helped to keep Bitcoin in

bullish sentiment and prevented huge price declines. However,

IntoTheBlock recently revealed an interesting pattern between these

whale wallets in each accumulation phase. Related Reading:

Cardano Entry Of A Lifetime: Analyst Predicts 5,600% Rally To $25

The largest accumulation occurred between March 5 and March 7, when

these wallets acquired over 120,000 BTC. Every succeeding price dip

has, however, seen less accumulation than the one before it.

Particularly, Bitcoin’s recent dip to $56,000 failed to attract

notable whale accumulation. This drop in buying and selling

activity indicates whales may have lost some interest or appetite

for accumulating more Bitcoin in the short term. Whales are buying

the dip, but is their conviction dwindling? 🛍️Addresses holding

over 1000 BTC have accumulated strongly in recent months,

especially during dips. 📈Prices have increased shortly following

every accumulation. However, note that each spike in accumulation

by… pic.twitter.com/OkbekJr5NC — IntoTheBlock (@intotheblock) May

6, 2024 Precursor For A Crash To $50,000? The waning conviction

among Bitcoin whales has raised the question of whether Bitcoin

could reverse back into a full bearish momentum. These concerns are

particularly valid, considering some analysts are of the notion

that Bitcoin might’ve reached its peak in this cycle. As

IntoTheBlock noted, prices have increased shortly following every

accumulation this year. While the lower whale buying activity could

stall price increases in the short term, it is not a sure sign that

Bitcoin is headed for a major price crash. However, if the trend

continues for several more months, it could signal lower demand and

a weakening bull market. Related Reading: Crypto Analyst Predicts

350% Surge For Shiba Inu – Here’s The Target According to the

“In/Out Of Money Metric”, there is still a strong resistance volume

between $59,000 and $61,000. A drop below this range again would

push 552,220 addresses into losses. In fact, while a drop to his

level would be painful for many holders, most crypto analysts

remain optimistic about Bitcoin’s long-term prospects. At the

time of writing, Bitcoin is trading at $61,488. The crypto recently

rebounded around $57,500 and is up by 7.4% in the past seven days.

According to analyst Marco Johanning, $57,000 is an important

support level for Bitcoin. He noted that while a break below

$57,000 could lead to further declines into $52,000, the crypto

market is still very bullish for Bitcoin. BTC price struggles to

hold $61,000 support | Source: BTCUSD on Tradingview.com Featured

image from FameEX, chart from Tradingview.com

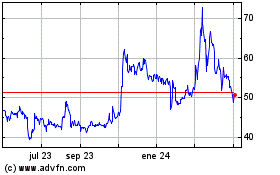

OKB (COIN:OKBUSD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

OKB (COIN:OKBUSD)

Gráfica de Acción Histórica

De May 2023 a May 2024