Bitcoin Exchange Reserves Plunge To Multi-Year Lows: Will BTC Gain From Supply Crunch?

04 Diciembre 2024 - 1:30AM

NEWSBTC

According to data from CryptoQuant, Bitcoin (BTC) reserves on

cryptocurrency exchanges have dropped to a multi-year low. This

decline coincides with the ongoing bull market, which has pushed

the digital asset’s price closer to the $100,000 mark. This

significant decline could have major implications for the asset’s

supply-demand dynamics. Investor Confidence Increasing In Bitcoin?

During a bull market, Bitcoin reserves on exchanges increase as

long-term holders (LTH) and short-term holders (STH) transfer their

holdings to trading platforms to take profits. However, the current

bull market is breaking this trend, as BTC exchange reserves

dwindle. Related Reading: Bitcoin Set To Hit $140,000 Target In

December – Here’s Why Data from Cryptoquant indicates that over

171,000 BTC have been withdrawn from crypto exchanges since

pro-crypto Republican candidate Donald Trump won the November US

presidential election. The high amount of BTC being withdrawn from

exchanges suggests that holders are likely moving their holdings to

cold wallets, signaling long-term confidence in BTC. According to

the chart below, BTC exchange reserves witnessed a sharp decline

starting in November 2022 – falling from 3.33 million BTC on

November 5, to 2.93 million BTC on December 21. Another notable

drop began in February 2024, likely in anticipation of the Bitcoin

halving in April and the ensuing supply scarcity of the

digitally-programmed asset. During this period, reserves decreased

from 3.05 million BTC to 2.63 million BTC by October 30 – a decline

of 13.77% over eight months. Exchange reserves stand at just 2.46

million BTC, the lowest level in years. This ongoing decline hints

at a potential supply crunch for Bitcoin, which could propel its

price upward in the coming months. BTC Illiquid Supply Continues To

Grow Another data point that supports the long-term holding

hypothesis for BTC is Glassnode’s illiquid supply metric. The chart

shared below shows that the digital asset’s illiquid supply has

grown by 185,000 BTC in the past 30 days. Notably, the

illiquid supply now accounts for approximately 14.8 million BTC,

representing nearly three-fourths of the current circulating supply

of 19.8 million BTC. If this trend continues, Bitcoin’s price could

experience a significant surge due to supply scarcity. However,

this could also introduce heightened volatility. Related Reading:

Bitcoin Resets Open Interest, Targets $100,000 After Holding Key

Support – Details While the decline in exchange reserves and rising

illiquid supply are long-term bullish indicators for Bitcoin,

short-term price movements could see a brief correction. According

to crypto analyst Ali Martinez, BTC has formed a head-and-shoulder

pattern on the hourly chart, which may trigger a sell-off that can

push the asset’s price to $90,000. That said, another seasoned

crypto analyst, Rekt Capital, said that after briefly touching the

$98,000 price level, BTC has already entered the parabolic phase of

the rally. BTC trades at $94,968 at press time, down 1.4% in the

past 24 hours. Featured image from Unsplash, charts from

CryptoQuant, Glassnode, X and Tradingview.com

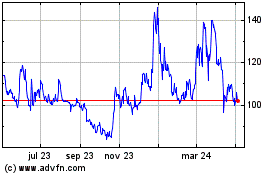

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

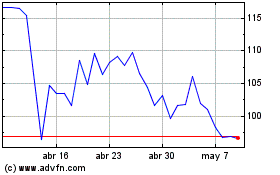

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024