Bitcoin 30-Day Trader Profits Back In ‘Healthy’ Range, Is BTC Ready For $100,000?

05 Diciembre 2024 - 8:00AM

NEWSBTC

On-chain data shows the unrealized gains of the 30-day Bitcoin

investors are now back inside the historical ‘healthy’ zone, a sign

that could be bullish for BTC. Bitcoin MVRV Ratio For 30-Day

Traders Has Declined Recently In a new post on X, the on-chain

analytics firm Santiment has discussed about the trend in the

Bitcoin Market Value to Realized Value (MVRV) Ratio. The MVRV Ratio

here refers to an indicator that keeps track of how the value held

by the BTC investors (that is, the market cap) compares against the

value that they initially put in (the realized cap). Related

Reading: XRP, Bitcoin See Lack Of Euphoria: Why This Is Bullish

When the value of this metric is greater than 1, it means the

market as a whole is in a state of net unrealized profit. On the

other hand, it being under the threshold implies the dominance of

loss among the investors. In the context of the current topic, the

MVRV Ratio for the entire market isn’t of interest, but rather that

of two specific holding ranges: 30-day and 365-day. The indicator

corresponding to these ranges provides insight into the profit-loss

breakdown of the monthly and yearly buyers of the asset. Now, here

is the chart shared by the analytics firm that shows the trend in

the Bitcoin MVRV Ratio for the 30-day and 365-day traders over the

last few months: As displayed in the above graph, the Bitcoin MVRV

Ratio for the 30-day investors had shot up to significant levels

last month as the asset’s all-time high (ATH) exploration had taken

place. Since the cryptocurrency has fallen to its consolidation

phase, though, the metric has observed a cooldown. In the chart,

Santiment has highlighted three zones for the indicator based on

the historical trend. It would appear that the earlier increase had

seen the metric surge into the ‘danger’ region, but with this

decline, it’s now back inside the ‘healthy’ range. More

specifically, the indicator has a value of 4.2% now, which is just

inside the +5% to -5% range of the healthy zone. From the chart,

it’s visible that the metric was last at this level on 26 November,

just after which BTC observed a rebound. Generally, the tendency of

the investors to sell goes up the higher amount of profits that

they own, so high values of the MVRV Ratio can be a bad sign for

the asset’s price. This is why the indicator being higher than 5%

corresponds to the danger zone. Related Reading: Strong Bitcoin

Rise “Expected Within 1-2 Months,” Quant Explains Why With the MVRV

Ratio of the 30-day traders making a return into the healthy range,

it’s possible that Bitcoin may be able to see a resumption of its

rally or at least, avoid a further drop. The indicator for those

who bought within the past year sits at more than 37%, but usually,

investors who have been holding for so long don’t tend to sell

easily, so these high profits may not be an immediate threat to

BTC. BTC Price At the time of writing, Bitcoin is trading around

$94,900, down 1% over the last week. Featured image from Dall-E,

Santiment.net, chart from TradingView.com

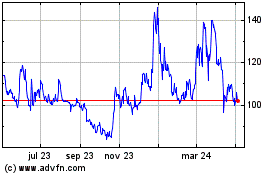

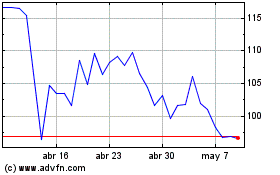

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024