MicroStrategy’s Bankruptcy Risk: CEO Warns Bitcoin Must Drop To $16,500 To Trigger Collapse

18 Diciembre 2024 - 3:30AM

NEWSBTC

MicroStrategy, the business intelligence firm co-founded by Bitcoin

bull Michael Saylor, has significantly ramped up its Bitcoin

acquisition strategy, surpassing 400,000 BTC in holdings.

However, concerns about the company’s financial stability tied to

the Bitcoin price have emerged, particularly from Ki Young Ju, CEO

of CryptoQuant. Ju cautioned that while the prospect of

MicroStrategy facing bankruptcy is not impossible, it would require

an event as unlikely as “an asteroid hitting Earth.”

MicroStrategy’s Financial Risks As Bitcoin Price Floor Holds At

$30,000 In a recent post on X (formerly Twitter), Ju elaborated on

the matter by stating that BTC has maintained a consistent price

floor, never dropping below the long-term cost basis of major

holders, which currently stands at $30,000. He noted:

MicroStrategy’s debt is $7 billion, while its Bitcoin holdings are

valued at $46 billion. Based solely on Bitcoin, the liquidation

price would be around $16,500. The last cycle’s bottom was at

$16,000. Talking about a drop to that level now feels as improbable

as predicting $3,000 when Bitcoin was at $60,000. Related Reading:

Ethereum Reaches $4,100 For The First Time In Over Three Years,

Aiming For $5,000 Next In the context of current price movements,

CryptoQuant noted that the price surge toward BTC’s new all-time

high above $108,000 on Tuesday was fueled by short liquidations

totaling approximately $151 million over the past 12 hours, The

firm disclosed that the Bitcoin-to-gold ratio also reached an

all-time high during this surge, reinforcing Bitcoin’s reputation

as “digital gold” and affirming its role as a preferred store of

value compared to traditional gold assets. Additionally,

MicroStrategy’s recent inclusion in the Nasdaq 100 has bolstered

market sentiment. Saylor hinted at further Bitcoin purchases, even

with spot prices exceeding $100,000. CryptoQuant asserts that

this inclusion could lead to passive fund inflows into

MicroStrategy shares, providing the company with greater access to

capital for its Bitcoin acquisitions. BTC Purchases For Sixth

Consecutive Weeks Saylor stated on Monday that Microstrategy has

purchased the market’s leading crypto for the sixth week in a row.

This transaction adds to the firm’s considerable Bitcoin portfolio,

which currently stands at 439,000 BTC, acquired for around $27.1

billion at an average price of $61,725 per coin.

Additionally, Saylor revealed that the firm’s Bitcoin assets have

produced significant gains, with a 46.4% increase quarter-to-date

(QTD) and a 72.4% gain year-to-date (YTD). Related Reading: Solana

Monthly Chart ‘Looks Ready For A Monster Run’ – Details CryptoQuant

also noted that this week’s central bank meetings appear to be

secondary to market sentiment surrounding Bitcoin. While it

remains highly unlikely, an “extremely dovish stance” from the

Federal Reserve and Chairman Jerome Powell could provide the

necessary momentum for BTC to rise even further. At the time of

writing, BTC is trading at $104,140, down 2.6% on the 24-hour time

frame but still up 6.5% on the week. Featured image from DALL-E,

chart from TradingView.com

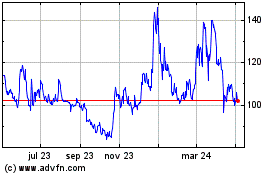

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

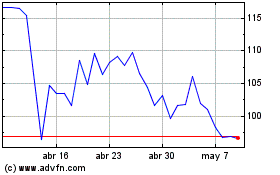

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024