Why Did Bitcoin Just Jump 10%? Blockchain Firm Weighs In

18 Mayo 2024 - 8:00AM

NEWSBTC

The cryptocurrency market has been on a hot streak in the past few

days, with several large-cap assets posting significant gains in

the past week. Most notably, the Bitcoin price bounced back from

around $61,000 to above $67,000 for the first time in nearly a

month. As expected, this latest price movement has sparked a lot of

speculation and discussion around the premier cryptocurrency.

Popular blockchain analytics firm CryptoQuant has shared on-chain

insights into the recent Bitcoin price rally and its future

trajectory. How Did Bitcoin Price Reach $67,000? In a recent

report, CryptoQuant revealed the catalyst and on-chain

manifestations behind BTC’s latest rally to above $67,000.

According to the analytics firm, the price of Bitcoin rode to its

new highs on the back of the news of lower-than-expected inflation

in the United States. Related Reading: Is Dogecoin About to Take

Off? Indicators Suggest Upward Momentum Ahead The inflation data

released on Wednesday, May 15 showed that the Consumer Price Index

(CPI) rose by 0.3% in April – lower than the expected 0.4%. This

revelation suggested that inflation might be on a downward slope in

the US, making risky assets like Bitcoin more attractive. In its

report, CryptoQuant revealed that there has been a decreased

selling pressure in the BTC market, as short-term holders are

selling at low or negative profits. Meanwhile, Bitcoin balances at

over-the-counter (OTC) desks have steadied, implying that fewer

coins are entering the open market. What’s more, the analytics

platform highlighted a particular on-chain signal that might have

predicted the recent Bitcoin price rally. According to CryptoQuant,

BTC miners have been extremely underpaid over the past few weeks,

which often correlates with price bottoms. The Catalysts For

Sustained BTC Rally? CryptoQuant, in its report, identified

potential catalysts for a continued rally for the Bitcoin price.

According to the on-chain data company, demand from permanent

holders and largest investors is on the rise but it needs to climb

rapidly to push the price of BTC even higher. Related Reading:

Solana Takes The Crown: CoinGecko Ranks It The Best, Leaving

Ethereum Behind In Key Metric Furthermore, the latest data shows

that Bitcoin ETF (exchange-traded funds) purchases have dwindled to

nearly zero daily, while stablecoin liquidity growth is also on a

decline. CryptoQuant noted that these two metrics need a jolt,

which might be critical for a sustained Bitcoin rally. As of this

writing, the Bitcoin price continues to hover around $67,000,

reflecting a 2.5% increase in the past 24 hours. According to

CoinGecko data, the premier cryptocurrency is up by a significant

10% in the past week. Featured image from iStock, chart from

TradingView

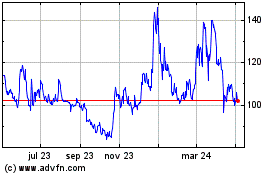

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

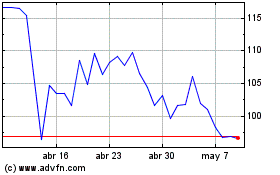

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024