Airbus in Talks to Buy Atos Cybersecurity Unit for Up to $2 Billion -- 2nd Update

03 Enero 2024 - 3:15AM

Noticias Dow Jones

By Adria Calatayud

Airbus is in talks to buy Atos's cybersecurity unit, with an

indicative offer that values the business at up to 1.8 billion

euros ($1.97 billion) including debt.

Facing fresh financial constraints, French IT group Atos is

revisiting its asset-sale plans nearly a year after the European

plane maker's failed bid to take a minority stake in the Atos

division that houses the cybersecurity unit.

Atos said Wednesday that it is in preliminary discussions with

Airbus over a potential sale of its big-data and security business,

or BDS, and that it will now open a due diligence phase. Airbus's

indicative offer is for an enterprise value of between EUR1.5

billion and EUR1.8 billion, Atos said.

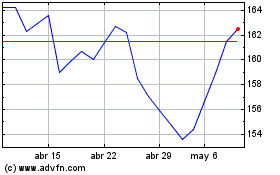

At 0826 GMT, Atos shares rose 2.6% to EUR7.17, having jumped as

much as 12% in earlier trade, but have lost about a third of their

value over the last year. Airbus shares traded 0.4% lower at

EUR140.78, but were still up 24% compared with a year ago.

Airbus confirmed it submitted a nonbinding proposal in relation

to a potential acquisition of Atos's BDS. Discussions remain

subject to due diligence and there can be no certainty that they

will result in a transaction, the company said.

The France-headquartered plane maker, which is also a large

defense contractor, said the acquisition of BDS could enhance its

defense and security portfolio with strong capabilities in

cybersecurity, advanced computing and artificial intelligence.

Airbus said a potential deal for BDS would align with its

ambitions in the aerospace, defence and cybersecurity segment, a

long-running aspiration for the company. Chief Executive Guillaume

Faury said during an earnings call in November that recent

geopolitical conflicts have reinforced the need for innovative

defense, space and cyber capabilities.

In February last year, Airbus made an offer to buy a 29.9% stake

in Evidian--as Atos's Eviden business was previously called--but

pulled out in March, saying it would continue to discuss other

potential options with Atos.

Since then, financial pressures on Atos have grown and the

company said it has adjusted its strategy as a result to ensure the

repayment and refinancing of its debts. As part of this process,

Atos is widening its asset-sale program beyond the EUR400 million

in divestments it indicated in late July, with BDS as a key

lever.

Atos said it received two letters indicating nonbinding interest

in BDS, one of which relates only to part of the unit's

operations.

The company is considering additional asset sales after changing

market conditions forced it to reduce the size of a planned capital

increase for Eviden, the division that includes BDS. In October,

Atos said it planned a capital increase of EUR900 million for

Eviden to strengthen the division's finances.

Atos said it is continuing talks to sell its Tech Foundations

division to EP Equity Investment, an investment company steered by

Czech billionaire Daniel Kretinsky, but that there is no certainty

an agreement will be reached.

The company said it doesn't rule out the sale of additional

assets, particularly if the transaction with EPEI doesn't go

ahead.

In parallel to negotiations for asset sales, Atos said it will

enter into talks with its banks, seeking to maintain funding and

provide refinancings to avoid uncertainties about the company's

long-term outlook.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

January 03, 2024 04:00 ET (09:00 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

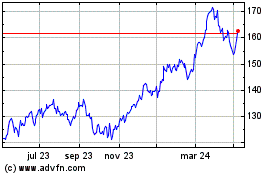

Airbus (EU:AIR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Airbus (EU:AIR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024