- Half-year sales of €3.3 million, exceeding 2023 full-year

sales

- 20 implants of the Aeson® artificial heart performed in the

first half of 2024

- 17% cash-burn1 reduction compared to the first half of

2023

- 2024 anticipated annual sales of €8 to €12 million

- Other 2024 operational objectives on track

- Active exploration of financing options to extend in the

near-term the Company's cash runway beyond the end of September

2024

Regulatory News:

CARMAT (FR0010907956, ALCAR), designer and developer of the

world’s most advanced total artificial heart, aiming to provide a

therapeutic alternative for people suffering from advanced

biventricular heart failure (the “Company” or

“CARMAT”), today announces its results for the first half

ending June 30, 20242, and provides an update on its progress and

prospects.

Stéphane Piat, Chief Executive Officer of CARMAT,

comments: “The outcome of the first half of 2024 is very positive.

With sales of €3.3 million, we have in just 6 months, exceeded our

2023 full-year sales. Achieving 20 Aeson® implants in the first

half of the year is a very encouraging indicator for such an

innovative device, which is still in its launch phase. In the

second quarter of 2024, we performed twice as many implants as in

the first quarter.

But beyond these numbers, the feedback and numerous spontaneous

testimonials from European physicians who have carried out Aeson®

implants, speak for themselves and give us confidence in the

progressive development of our truly unique therapy, which meets a

real need and literally “gives life back to patients”.

For the rest of the year, we anticipate a traction in implants,

both in the EFICAS study and commercially, which should enable us

to achieve annual sales of €8 to €12 million in 2024. In 2024, we

therefore plan to multiply our revenue by 3 or 4 versus 2023.

In addition, we anticipate several key catalysts in 2025,

including the publication of significant clinical results, which

should confirm these expert testimonials, and thus objectify the

safety and efficacy of our therapy. These results should play a key

role in accelerating our growth. Finally, in 2025, we also

anticipate resuming our PIVOTAL study in Europe, with patients not

eligible for heart transplant, with a view to eventually obtaining

the destination therapy indication that has always been and remains

CARMAT's ultimate goal.

The development of a breakthrough therapy such as ours is

necessarily an obstacle race. So far, we have overcome all hurdles,

not without difficulty, but successfully. We therefore look forward

to the next steps with confidence, resilience and the same winning

spirit.”

Abbreviated Income statement (in

millions of euros)

6 months

ended June 30, 2024

6 months

ended June 30, 2023

Revenue

3,3

0.6

Net operating expense

(25.4)

(25.9)

Net financial expense

(1.7)

(1.7)

Net non-recurring income

0.1

-

Research and innovation tax credit

0.8

1.0

Net loss

(26.2)

(26.7)

CARMAT generated €3.3 million in revenue in the first half of

2024, corresponding to the sale of seven artificial hearts for

commercial implants (in Germany, Italy and Poland) and 13 as part

of the EFICAS clinical study in France.

In the first six months of the year, CARMAT’s efforts and

resources were predominantly focused on:

- deploying and developing its business in

Europe; - stepping up its EFICAS clinical study in France; -

continuing discussions with the FDA with a view to starting up the

second cohort of its EFS (early feasibility study) in the United

States; - strengthening its financial structure.

The Company continued to keep tight control over its operating

expenses, enabling it to slightly reduce its net operating expense

to €25.4 million in the first half of 2024 (versus 2023).

After taking into account net financial expense of €1.7 million,

net non-recurring income of €0.1 million and €0.8 million in income

from the research tax credit, CARMAT ended the first half of 2024

with a net loss of €26.2 million (compared with a €26.7 million net

loss in the first six months of 2023).

- Cash and financial structure

Cash position and cash runway

At June 30, 2024, the Company had €11.4 million in cash and cash

equivalents, versus €8.0 million at December 31, 2023.

The variation over the first half 2024 can be analyzed as

follows:

(in millions of euros)

6 months

ended June 30, 2024

6 months

ended June 30, 2023

Net cash used in operating activities

(25.7)

(30.7)

Net cash used in investing activities

(1.1)

(1.6)

Net cash from financing activities

30.3

4.7

Cash and cash equivalents at end of

period

3.4

(27.6)

The cash burn used in operating and investing activities in the

first half of 2024 decreased by 17% compared with that of the first

half of 2023, in line with a planned trajectory that the Company is

determined to continue during the rest of 2024 and in the coming

years.

In the first half of 2024, CARMAT obtained the following

funds:

- an aggregate €32.5 million in proceeds from

two capital increases (€16.5 million in January and €16.0 million

in May); and - €0.3 million corresponding to the final tranche of

the total €1.4 million "CAP23" grant awarded to CARMAT as a winner

of the French government's "Industrial Recovery Plan - Strategic

Sectors" call for projects.

In addition, on July 5, 2024, i.e., after the half-year close,

CARMAT set up a flexible equity financing line with Vester

Finance3, involving the issue of up to 3,500,000 shares

(corresponding to c. €8.2 million based on CARMAT’s share price of

€2.345 on June 30, 2024) over a 24-month period, with CARMAT

immediately receiving €2.2 million.

In view of all of these factors4, and based on its current

business plan, CARMAT’s confirmed financial resources should enable

it to fund its business until end-September 2024. The Company is

actively working on various financing options to secure in the very

short-term, the financial resources it requires to continue as a

going concern beyond that date5. The Company estimates its

financing requirements over the next 12 months to be c. €45

million.

Net debt

On March 22, 2024, the Company reached an agreement with all of

its lenders – the European Investment Bank (EIB), BNP Paribas

(BNPP) and Bpifrance (BPI) – on new repayment terms for its bank

loans6.

Taking into account this agreement, CARMAT’s net debt at June

30, 2024 was €47.1 million, breaking down as follows:

(in millions of euros)

June 30, 2024

+ Long-term financial liabilities (>12

months)

57.3

+ Short-term financial liabilities (<12

months)

1.2

- Cash and cash equivalents

(11.4)

(Net cash)/Net debt

47.1

Short-term financial liabilities comprise:

- €0.2 million in interest due on tranches 2

and 3 of the EIB loan; and - an aggregate €1.0 million in principal

and interest payments due on the government-guaranteed loans

("PGEs") taken out with BNPP and BPI.

- First-half 2024 highlights

Marked acceleration in Sales

Twenty Aeson® implants were performed in the first half of 2024,

versus respectively three and fourteen in the first half and in the

second half of 2023. The rate of Aeson® implants reached four per

month in the second quarter, doubling from two hearts per month in

the first quarter.

In the first six months of 2024, CARMAT generated €3.3 million

in revenue7, which means that it has already exceeded its full-year

revenue for 2023 (€2.8 million).

Sales were generated for the first time in Poland, bringing the

number of countries in which CARMAT has a commercial activity to

three (Germany, Italy and Poland). A total of nine hospitals

carried out their first Aeson® implants in the first half of 2024 –

four in Germany, three in France and two in Poland.

This very positive trend reflects the encouraging take-up of

CARMAT’s artificial heart therapy in Europe.

Very good momentum for the EFICAS clinical study

In the first six months of 2024, 13 Aeson® implants were

performed as part of the EFICAS clinical study in France,

corresponding to a rate of more than two implants per month.

This brought the total number of Aeson® implants performed under

this study to 24 at June 30, 2024, paving the way for the

completion, in the short-term, of half of the target number of

patient recruitments, which represents 52 patients in total.

All of the French centers taking part in the study8, a total of

10, had already referred patients, and nine of them had performed

at least one implant.

As a reminder, EFICAS is the largest clinical study ever

conducted by CARMAT and will allow the company to collect

additional data on safety and performance of its Aeson® heart, as

well as medico-economic data to support its value proposition. The

Company anticipates publishing the study results in the last

quarter of 2025.

This study is instrumental to report Aeson® clinical results

scientifically on a significant sample size of patients, and thus

facilitate the communication and dissemination of these results

across the medical community.

In view of this, the Company believes that the publication will

lead to a strong and sustained acceleration in the take-up of

Aeson® artificial hearts in Europe.

EFICAS is a key study both for securing social security

reimbursement of Aeson® in France and for supporting CARMAT’s

application for Premarket Approval (PMA) (marketing authorization

in the United States issued by the FDA – Food & Drug

Administration), which the Company expects to receive in 2027.

Continued international business development

Europe and Middle East

In the first half of 2024, CARMAT trained nine new hospitals to

perform Aeson® commercial implants, expanding its network to 42

centers in 14 different countries9. The Company is therefore well

on track to meet its target of 50 trained hospitals by the end of

2024.

Out of these 42 centers, three-quarters were active in

first-half 2024, i.e., they had already submitted patient files to

CARMAT to assess their eligibility for implantation.

In addition, five countries in Europe (Switzerland, Austria,

Slovenia, Croatia and Greece) and one in the Middle East (Israel)

were activated and therefore ready to perform implants. The Company

plans to activate more countries in Europe in the second half of

the year.

United States

Discussions with the FDA (the U.S. Food & Drug

Administration) continued during the period, with a view to

commencing the second cohort of seven patients in the EFS10.

Based on all of the information available, the Company expects

this to happen in Q1 2025, and still foresees the commercial launch

of Aeson® in the United States taking place during the second half

of 2027.

Production ramp-up

Thanks to its expanded production capacity, with a second

production facility coming on stream at its Bois-d'Arcy site at the

end of 2023, as well as its growing supplier base and the

experience it has built up over the last few years, the Company had

a continuous production output in the first half of 2024, enabling

it to meet demand without any difficulties, while keeping up an

inventory level of more than 20 Aeson® hearts.

CARMAT intends to continue to implement its industrial roadmap

aimed at continuously improving its production processes, securing

its supplies, gradually reducing the production cost for its

artificial heart, and aligning its capacity development with

demand.

Changes in the Company’s governance

On June 24, 2024, Pierre Bastid, having served on the Company’s

Board as a director since 2018, was appointed as Chairman of the

Board of Directors, replacing Alexandre Conroy, who resigned for

personal reasons.

A seasoned industrialist and entrepreneur, Pierre Bastid has

subscribed for shares in each of the capital increases carried out

by the Company since 2016 and holds 13.1% of CARMAT’s share

capital11 via the Lohas and Les Bastidons entities.

CARMAT’s Board has now 10 directors, including five independent

directors.

2024 Objectives

For the second half of 2024, the Company forecasts a sales trend

which would reach a yearly turnover within a range of €8 million to

€12 million, to be compared with revenue of around €14 million

previously communicated. This forecast reflects a better

understanding of the market access dynamics and seasonality, as

well as two summer months during which the level of surgical

activity remained limited across Europe.

Regarding the other key objectives for 2024, the Company

confirms it is on track to achieve them by the end of the year,

namely:

- a patient recruitment rate of around 75% in

the EFICAS clinical study, - c. fifty centers trained for

commercial implants, - a c. 20% reduction in cash burn (operations

and investments) versus 2023, - filing to resume the EFS study

(United States).

Key catalysts anticipated in 2025 to support short and

medium-term development

In 2025, the Company anticipates four key drivers to support its

short and medium-term development:

- Q1 2025: initiation of the second cohort of

patients in the EFS study in the United States, - H1 2025:

publication in a scientific journal of the Aeson® clinical results

for patients previously under “ECLS12“, - H2 2025: resumption of

the PIVOTAL study in Europe for a cohort of patients not eligible

for heart transplant, to target the “Destination Therapy”

indication, - Q4 2025: publication of the results of the EFICAS

study (52 patients).

In the short term, continued development

in Europe supported by scientific publications

With over 70 patients having received an implant since Aeson®

was created, CARMAT has built up substantial clinical experience.

This testifies to the technology's unique performance and safety

profile, particularly given that the Company tends to treat

patients at an increasingly severe stage of the disease.

In the coming months, the Company intends to carry-on with the

gradual spread of its therapy across Europe, in the

bridge-to-transplant indication for which Aeson® is currently

approved, by building on this clinical experience, but also on the

growing reputation of Aeson®, supported in particular by a ripple

effect between centers, and spontaneous positive communication by

physicians and hospitals performing implants.

Aeson® sales’ growth should then accelerate significantly

following the publication of Aeson® clinical results in patients

previously under ECLS, anticipated in Q1 2025, and EFICAS study

results in Q4 2025.

In the medium term, heading towards the US

market and the Destination Therapy

In the medium term, the Company continues to target access to

the US market, as well as the Destination Therapy (DT) indication

(or so called “permanent implant”), which would allow patients to

remain under Aeson® support with no subsequent heart transplant. In

terms of addressable market, the Destination Therapy represents one

of the biggest opportunities in cardiology.

The anticipated launch, in Q1 2025, of the second cohort of

patients in the US EFS study, and the expected resumption in H2

2025 of the European PIVOTAL study with a cohort of patients not

eligible for heart transplant, are important milestones to

ultimately get Aeson® approved for this strategic indication.

About CARMAT

CARMAT is a French MedTech that designs, manufactures and

markets the Aeson® artificial heart. The Company’s ambition is to

make Aeson® the first alternative to a heart transplant, and thus

provide a therapeutic solution to people suffering from end-stage

biventricular heart failure, who are facing a well-known shortfall

in available human grafts. The world’s first physiological

artificial heart that is highly hemocompatible, pulsatile and

self-regulated, Aeson® could save, every year, the lives of

thousands of patients waiting for a heart transplant. The device

offers patients quality of life and mobility thanks to its

ergonomic and portable external power supply system that is

continuously connected to the implanted prosthesis. Aeson® is

commercially available as a bridge to transplant in the European

Union and other countries that recognize CE marking. Aeson® is also

currently being assessed within the framework of an Early

Feasibility Study (EFS) in the United States. Founded in 2008,

CARMAT is based in the Paris region, with its head offices located

in Vélizy-Villacoublay and its production site in Bois-d’Arcy. The

Company can rely on the talent and expertise of a multidisciplinary

team of circa 200 highly specialized people. CARMAT is listed on

the Euronext Growth market in Paris (Ticker: ALCAR / ISIN code:

FR0010907956).

For more information, please go to www.carmatsa.com and follow

us on LinkedIn.

Name: CARMAT ISIN code:

FR0010907956 Ticker: ALCAR

Disclaimer

This press release and the information it contains do not

constitute an offer to sell or subscribe, or the solicitation of an

order to buy or subscribe, CARMAT shares in any country.

This press release may contain forward-looking statements about

the Company's objectives and prospects. These forward-looking

statements are based on the current estimates and expectations of

the Company's management, and are subject to risk factors and

uncertainties, including those described in its universal

registration document filed with the Autorité des Marchés

Financiers (AMF) under number D.24-0374 and available on CARMAT's

website, as updated in the Company's 2024 half-year financial

report published today.

Readers' attention is particularly drawn to the fact that the

Company's current financing horizon is limited to the end of

September 2024 and that, given its financing requirements and

outstanding dilutive instruments, the Company's shareholders are

likely to experience significant dilution of their stake in the

Company in the short term. The Company is also subject to other

risks and uncertainties, such as the Company's ability to implement

its strategy, the pace of development of CARMAT's production and

sales, the pace and results of ongoing or planned clinical trials,

changes in technology and the competitive environment, regulatory

developments, industrial risks and all risks associated with

managing the Company's growth. The forward-looking statements

contained in this press release may not be achieved due to these or

other unknown risk factors and uncertainties, or factors which the

Company does not currently consider material and specific.

Aeson® is an active implantable medical device commercially

available in the European Union and other CE-marked countries. The

Aeson® total artificial heart is intended to replace the ventricles

of the native heart and is indicated as a bridge to transplantation

in patients with end-stage biventricular heart failure (Intermacs

classes 1-4) who cannot benefit from maximal medical therapy or a

left ventricular assist device (LVAD), and who are likely to

benefit from heart transplantation within 180 days of implantation.

The implant decision and surgical procedure must be carried out by

healthcare professionals trained by the manufacturer. The

documentation (clinician's manual, patient's manual and alarm

booklet) must be read carefully to learn about the characteristics

of Aeson® and the information required for patient selection and

proper use (contraindications, precautions, side effects) of

Aeson®. In the United States, Aeson® is currently available

exclusively as part of a feasibility clinical trial approved by the

Food & Drug Administration (FDA).

________________________________ 1 Cash flow from operating and

investing activities 2 The interim financial statements were

approved by the Board of Directors on September 5, 2024; The

statutory auditor's limited review procedures are currently in

progress. The 2024 half-year financial report is published today

and can be consulted on the Company's website. 3 See the press

release published by the Company on July 5, 2024 about this equity

financing. 4 Including the €2.2 million received in early July 2024

in connection with the Vester Finance equity financing line. 5 See

Section 4.2.1 for the factors underlying the going concern

principle used by the Board of Directors. 6 See the press release

on the agreement published by the Company on March 22, 2024. 7

Including €1.1m in the first quarter and €2.2m in the second

quarter. 8 AP-HP GHU Pitié Salpêtrière, Hôpital Européen Georges

Pompidou, CHU de Rennes, CHU de Strasbourg, Hospices Civils de

Lyon, CHRU de Lille, Hôpital Marie-Lannelongue, CHU de Montpellier,

CHU de Nantes and CHU de Dijon. 9 Germany, Italy, Poland,

Switzerland, Israel, Slovenia, Saudi Arabia, Serbia, Croatia,

Austria, Denmark, Netherlands, Czech Republic and Greece. 10 The

first cohort of seven patients was finalized in the second half of

2021. 11 At June 30, 2024. 12 ECLS = Extra-Corporal Life

Support

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240905480690/en/

CARMAT Stéphane Piat Chief Executive Officer

Pascale d’Arbonneau Chief Financial Officer Tel.: +33 1 39

45 64 50 contact@carmatsas.com Alize RP Press Relations

Caroline Carmagnol Tel.: +33 6 64 18 99 59

carmat@alizerp.com NewCap Financial Communication &

Investor Relations Dusan Oresansky Jérémy Digel Tel.:

+33 1 44 71 94 92 carmat@newcap.eu

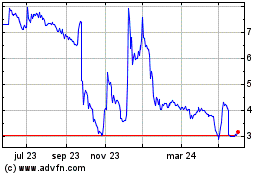

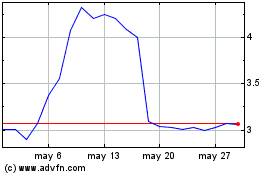

Carmat (EU:ALCAR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Carmat (EU:ALCAR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024