- This capital increase will be carried out through a public

offering without preferential subscription rights and with a 7

trading days priority period, on an irreducible and reducible

basis, for the benefit of CARMAT’s shareholders

- The initial amount of the capital increase may be increased

up to €11.8 million in case of full exercise of the extension

clause and up to €13.6 million in case of full exercise of the

extension clause and the over-allotment option

- Extension of CARMAT's cash runway until at least the end of

2024, in case of realization of the initial capital increase

(excluding extension clause and over-allotment option)

- Completion of the capital increase would enable CARMAT to

make further progress towards achieving several growth drivers in

2025

- Issue price of new shares at €1.60 per share

- After the Offering, the Company's 12-month financing needs,

i.e. up to the end of September 2025, will be of €36 to 38

million

NOT FOR DISTRIBUTION DIRECTLY OR INDIRECTLY IN

THE UNITED STATES OF AMERICA, CANADA, AUSTRALIA, SOUTH AFRICA OR

JAPAN.

Regulatory News:

CARMAT (FR0010907956, ALCAR), designer and developer of the

world’s most advanced total artificial heart, aiming to provide a

therapeutic alternative for people suffering from advanced

biventricular heart failure (the “Company” or

“CARMAT”), today announces the launch of a capital increase

with the removal of shareholders' preferential subscription rights

through a public offering (the "Public Offering") and with a

priority period, on an irreducible and reducible basis, for its

existing shareholders, and a global placement to institutional

investors in France and outside France, excluding, notably, the

United States of America, Canada, Japan, South Africa, and

Australia (the "Global Placement" and, together with the

priority period and the Public Offering, the "Offering"),

for an initial amount of 10.3 million euros. The Offering may be

increased up to a maximum of 13.6 million euros in case of full

exercise of the extension clause and the over-allotment option. The

main characteristics of this capital increase are as follows:

- Subscription price: 1.60 euros per share, representing a

discount of 24.5% compared to the average of the volume-weighted

average share prices of the last five trading sessions preceding

the setting of this subscription price (i.e., 2.12 euros) and a

discount of 21.18% compared to the closing price on September 16,

2024 (i.e., 2.03 euros);

- Subscription parity: 5 New Shares for every 28 existing shares

held on September 17, 2024;

- Subscription commitments and guarantee commitments amounting to

6.7 million euros, representing 65.2% of the initial amount of the

capital increase (including 4.5 million euros from historical

shareholders Sante Holdings SRL (Dr Antonino Ligresti) and Lohas

SARL (Pierre Bastid));

- Subscription period of the priority period and the Public

Offering: from September 18 to September 26, 2024, inclusive;

- Record date for the registration of CARMAT shares to benefit

from the priority subscription period: September 17, 2024;

- Global Placement period: from September 18 to September 28,

2024, inclusive.

Stéphane Piat, Chief Executive Officer of CARMAT,

comments: "Since the autumn of 2023, which marked the real start of

Aeson®’s commercial deployment, we have observed a very encouraging

momentum and continuous growth in implantations and sales. We are

progressively enhancing our commercial approach, notably building

on a deeper understanding of market access dynamics and the

specificities of each country. Feedback from European hospitals is

very positive and confirms the unique and differentiating features

of Aeson®.

Although marked by the inherent challenges of introducing a

disruptive innovation, this initial phase has allowed us to lay

solid foundations with more than 50 European centers trained and

ready to support our expansion. In addition, in view of recently

achieving half of the targeted recruitments in the EFICAS study in

France, we believe we are well-positioned to finalize the study

during next year and publish its results by the end of 2025. These

results should significantly accelerate Aeson’s adoption.

The capital increase with a priority period for shareholders

that we are launching today is crucial to strengthen our short-term

financial structure and provide us with the means to progress

towards the significant milestones which are ahead of us in 2025:

finalizing the EFICAS study, initiating the second cohort of

patients in the EFS study in the United States, and resuming the

European PIVOTAL study with patients not eligible for

transplantation, in order to ultimately target the destination

therapy. Achieving these milestones should represent a major step

towards our strategic objective of establishing Aeson® as one of

the reference therapies in the treatment of advanced heart failure,

to save and improve patients' lives worldwide."

Reasons for the Offering

The main purpose of the issuance is to strengthen CARMAT's

shareholders’ equity and finance its short-term working capital

needs. Before the Offering (as defined below), the confirmed

financial resources available to the Company allow it to finance

its activities until the end of September 2024. The net proceeds of

the operation will enable CARMAT to carry on with its operations

beyond this horizon, particularly to continue the development of

its production and sales, as well as its EFICAS clinical trial in

France.

In the event of the Offering being completed between 75% and

100%, the Company will be able to finance its activities until

early December 2024 and until at least the end of 2024,

respectively. The funds to be raised as part of the Offering will

only partially finance the Company's needs. Given its financing

requirement of 45 million euros over the next 12 months (i.e.,

until the end of September 2025), the Company will still face a

12-month working capital shortfall of 36 to 38 million euros

depending on whether the Offering is completed at 75% or 100%.

The Company is working on a gradual extension of its 12-month

cash runway, in several stages, through various initiatives,

including one or more additional capital increases.

Structure of the Offering

In accordance with the tenth (10th) and thirteenth (13th)

resolutions of the mixed general meeting of the Company's

shareholders held on May 30, 2024 (the "General Meeting"),

and using the sub-delegation granted by the Board of Directors on

September 16, 2024, the Chief Executive Officer decided on

September 16, 2024, to launch a capital increase without

shareholders' preferential subscription rights through a public

offering and with a priority period, on an irreducible and

reducible basis, for Company’s shareholders, by issuing a maximum

of 6,414,516 new ordinary shares of the Company with a nominal

value of 0.04 euros each (the "New Shares"), which may be

increased by 962,177 additional New Shares in case of full exercise

of the extension clause (the "Extension Clause") and by

1,106,504 additional New Shares in case of full exercise of the

over-allotment option (the "Over-Allotment Option").

The New Shares not subscribed during the priority period, both

on an irreducible and reducible basis, will be subject to a global

offering (the "Offering") comprising:

- A public offering in France, mainly intended for individuals

(the "Public Offering");

- A global placement intended for institutional investors (the

"Global Placement") comprising:

- An offer in France to qualified investors; and

- An international offer to qualified investors in certain

countries outside the United States of America, in offshore

transactions pursuant to Regulation S of the Securities Act

("Regulation S") (except in Japan, Australia, South Africa,

and Canada).

The distribution of shares to the public in France will occur in

accordance with the applicable provisions of Euronext market

rules.

The subscription price of the New Shares will be 1.60 euros per

share.

The definitive number of New Shares to be issued will be

determined at the end of the Global Placement on September 28, 2024

(see the section "Structure of the

Offering and Indicative Timetable" below).

Invest Securities is acting as Global Coordinator and Bookrunner

in connection with the Offering (the "Global Coordinator and

Bookrunner"). The Offering is subject to a placement agreement

concluded on September 16, 2024, between the Company and Invest

Securities.

Guarantee and subscription commitments

The issuance is not covered by a guarantee or underwriting

within the meaning of Article L. 225-145 of the French Commercial

Code.

Under subscription commitments and subscription commitments by

way of guarantee, 9 investors have undertaken to subscribe to the

capital increase up to a total amount of 6.7 million euros,

representing 65,2% of the initial amount of the Offering The

subscription commitments by way of guarantee would be triggered if

the total subscription amount of the New Shares (subscriptions

received within the Offering) represents less than 100% of the

Offering (excluding the exercise of the Extension Clause and the

Over-Allotment Option).

All guarantors will be remunerated by a commission equal to 5%

of the amount of their subscription commitment by way of guarantee,

regardless of the number of shares allocated to them. The

guarantors will also receive a commission of 2% of the amount of

their subscription commitment by way of guarantee that is actually

called upon in the final allocation of the issued shares. In case

of partial exercise of these commitments, investors acting as a

guarantee will be allocated proportionally to their initial

commitment. It is specified that the shares potentially allocated

under these commitments are not subject to a lock-up

commitment.

Lohas SàRL (Mr. Pierre Bastid), a shareholder holding 4,666,226

shares in the Company (i.e. 13.0% of the share capital), has

irrevocably undertaken to place an order for €1.95 million, on an

irreducible basis up to its share and within the framework of the

Public Offering for the balance.

Santé Holdings SRL (Dr. Antonino Ligresti), a shareholder

holding 4,237,616 shares in the Company (11.8% of the share

capital), has irrevocably undertaken to place an order for €2.55

million, on an irreducible basis up to the amount of its share and

within the framework of the Public Offering for the balance.

In aggregate, the subscription commitments described above

represent a total amount of €4.5 million, or 43.9% of the total

initial amount of the capital increase (38.1% of the maximum amount

of the capital increase in case of full exercise of the Extension

Clause, and 33.2% of the maximum amount of the capital increase in

case of full exercise of the Extension Clause and the

Over-Allotment Option).

Details of the commitments representing a total of 65.2% of the

Offering amount are as follows:

Investor’s Name

Amount of the subscription

order

Historical shareholders

Santé Holding Srl

€2.550.000

Lohas SàRL

€1.950.000

Sub-total historical

shareholders

€4.500.000

Guarantors

Market Wizards

€680.000

Friedland Gestion

€500.000

Hamilton Stuart Capital

€500.000

Gestys

€300.000

Giga società semplice

€30.000

Sully Patrimoine Gestion

€80.000

EB Finance

€100.000

Sub-total guarantors

€2.190.000

Total

€6.690.000

Main Terms of the Capital Increase

Amount of the issue and number of New

Shares to be issued

The capital increase amounts to an initial gross amount

(including issue premium) of €10.3 million, which may be increased

to a maximum amount of €11.8 million in case of full exercise of

the Extension Clause, and to a maximum amount of €13.6 million in

case of full exercise of the Extension Clause and the

Over-Allotment Option, representing a maximum of 115% and 132%

respectively of the initial amount of the Offering.

Structure of the Offering and indicative

timetable

Priority period

The capital increase will be carried out without shareholders'

preferential subscription rights, and with a priority period, on an

irreducible and reducible basis, of seven consecutive trading days,

from September 18 to 26, 2024 (inclusive) at 5:30 p.m., granted to

holders of existing shares recorded in their securities accounts at

the close of business on September 17, 2024, according to the

indicative timetable. This priority period is neither transferable

nor negotiable.

Within the priority period, each shareholder of the Company will

have the option of subscribing for New Shares to be issued in

connection with the Public Offering (i) on an irreducible basis, up

to the amount of his or her interest in the Company's share capital

on September 17, 2024, i.e. 5 New Shares for every 28 existing

shares held on September 17, 2024, and (ii) on a reducible basis,

up to the number of New Shares he/she would like to subscribe for

in addition to that to which he/she would be entitled if he/she

exercised his/her irreducible priority subscription right (within

the limits set out below), it being specified that orders to

subscribe for new shares on a reducible basis under the priority

subscription period will be given priority over orders to subscribe

for shares under the Public Offering and the Global Offering

(including with regard to New Shares issued in connection with the

possible exercise of the Extension Clause).

Any shareholder who, by application of this rule, would be

allocated the right to subscribe for less than one New Share will

have the right to subscribe for one New Share.

Shareholders wishing to subscribe for New Shares in addition to

those due under their irreducible priority right may place an order

either on a reducible basis within the priority period or within

the framework of the Public Offering or the Global Placement.

Orders placed by shareholders within the priority period on a

reducible basis will be served within the limits of their requests

and proportionally to the number of existing shares for which the

rights have been used to support their irreducible subscription,

without resulting in the allocation of fractions of New Shares. New

Shares potentially issued in the context of the exercise of the

Extension Clause will be allocated as a priority, according to the

same rules, to fulfill the reducible orders that were not fully

served. Orders placed by shareholders within the Public Offering or

the Global Placement will be treated without priority compared to

orders placed by any other investor within the Public Offering or

the Global Placement.

By way of illustration, a shareholder holding 3,592 shares, i.e.

0.01% of the capital, may subscribe on an irreducible basis to a

maximum number of 640 New Shares, corresponding to a maximum

subscription amount of 1,024 euros, with the certainty of being

served in full, whether the capital increase is carried out at 75%,

100% or 115% of the amount initially targeted.

Public Offering

The Public Offering will be open only in France, from September

18, 2024 to September 26, 2024 (inclusive) at 5:30 pm (Paris time)

for over-the-counter subscriptions and, if given this option by

their financial intermediary, for online subscriptions. Funds

received in support of subscriptions will be centralized by

Uptevia, which will be responsible for drawing up the certificate

of deposit of funds recording the completion of the capital

increase.

Global Placement

The Global Placement will take place from September 18, 2024, to

September 28, 2024 (inclusive) at 5:00 pm. To be considered, orders

must be received by the Global Coordinator and Bookrunner no later

than September 28, 2024, before 5:00 pm (Paris time) (indicative

date).

Allocation Procedure

The allocation of New Shares will proceed as follows:

- Priority is given to existing shareholders registered as of

September 17, 2024, who can exercise their rights as

described;

- New Shares not subscribed within this priority period will be

allocated based on the nature and volume of demand between the

Public Offering and the Global Placement;

- Subscriptions in the Global Placement will be allocated based

on the order of arrival and/or the quality of different investor

categories;

- Subscription commitments by way of guarantee will be allocated

if the total allocated subscriptions do not reach the initial

Offering amount (a proportional reduction will occur in case of

partial guarantee call).

Gross and net amount of the Offering

The proceeds from the issuance received by the Company would be

approximately:

(in millions of euros)

Offering at 75%

Offering at 100% (excluding Extension

Clause)

Offering at 115% (after full exercise

of Extension Clause)

Offering after full exercise of

Extension Clause and Over-Allotment Option

Gross proceeds

7.70

10.26

11.80

13.57

Estimated expenses*

0.74

0.90

0.95

1.06

Net proceeds

6.95

9.36

10.85

12.51

* Including the remuneration of financial

intermediaries, legal, administrative and communication costs, as

well as the amount of the remuneration relating to subscription

commitments by way of guarantee in the event of a full call by the

guarantors (i.e. €153,000 = 7% x €2.2 million), and other costs

relating to the issue.

Indicative timetable

September 16, 2024

Decision of the Board of Directors

approving the principle of the Offering and sub-delegating the

Chief Executive Officer the powers to implement it

Decision of the Chief Executive Officer to

launch the Offering and set the Offering price

September 17, 2024

Approval of the Prospectus by the AMF

Signature of the Placing Agreement

Record date for registering shares in the

Company to benefit from the priority subscription period

September 18, 2024

Press release announcing the launch of the

Offering (before market opening)

Availability of the Prospectus

Publication of the Euronext Paris notice

of the Opening of the Offering

Opening of the priority period, the Public

Offering and the Global Offering

September 26, 2024

Closing of priority period and Public

Offering (at 5:30 pm)

September 28, 2024

Closing of the Global Offering (5:00

pm)

Setting of the final terms of the Offering

(including the exercise of the Extension Clause, if applicable)

September 30, 2024

Press release announcing the result of the

Offering (before market opening)

Publication by Euronext of the notice of

result of the Public Offering

October 2, 2024

Issuance of the New Shares - Settlement

and delivery of the New Shares

Admission of the New Shares to trading on

Euronext

Opening of the stabilization period

October 27, 2024

Deadline for exercising the Over-Allotment

Option

End of the stabilization period, if

any

Company's lock-up commitment

Until October 31, 2024, the Company has granted the Global

Coordinator and Bookrunner a lock-up commitment in respect of the

issue of equity securities of the Company, including shares that

may be issued upon exercise of the Vester warrants (bons de

souscription d’actions), but excluding certain customary exceptions

and shares that may be issued upon exercise of the warrants issued

in connection with the “equitization” of the loan granted by the

European Investment Bank.

It should be noted that no lock-up commitment has been requested

in the context of the Offering, either from existing shareholders

of the Company or from investors who have committed to subscribe to

the Offering.

Impact of the Offering on the shareholder's situation

For information purposes, assuming that the Offering is carried

out at 100% and the full allocation of the aforementioned

subscription and commitments by way of guarantee, and on the basis

of the number of shares outstanding and the breakdown of the

Company's shareholder on the date hereof, the breakdown of the

Company's shareholder base would, to the best of its knowledge, be

as follows:

Shareholders

Excluding exercise of the

Extension Clause

After full exercise of the

Extension Clause

After full exercise of the

Extension Clause and Over-allotment Option

Number of shares

% of capital

% of voting rights (1)

Number of shares

% of capital

% of voting rights (1)

Number of shares

% of capital

% of voting rights (1)

Lohas SARL (Pierre Bastid)

4,541,643

10.7%

9.7%

4,541,643

10.5%

9.5%

4,541,643

10.2%

9.3%

Les Bastidons (Pierre Bastid)

1,343,333

3.2%

2.9%

1,343,333

3.1%

2.8%

1,343,333

3.0%

2.7%

Sante Holdings SRL (Dr Antonino

Ligresti)

5,831,366

13.8%

15.9%

5,831,366

13.5%

15.6%

5,831,366

13.1%

15.3%

Matra Défense SAS (Airbus Group)

2,670,640

6.3%

7.8%

2,670,640

6.2%

7.6%

2,670,640

6.0%

7.5%

Corely Belgium SPRL (Gaspard family)

880,000

2.1%

3.6%

880,000

2.0%

3.5%

880,000

2.0%

3.4%

Therabel Invest

741,706

1.8%

1.6%

741,706

1.7%

1.6%

741,706

1.7%

1.5%

Pr. Alain Carpentier & Family

491,583

1.2%

2.1%

491,583

1.1%

2.1%

491,583

1.1%

2.0%

Association Recherche Scientifique

Fondation A. Carpentier

115,000

0.3%

0.5%

115,000

0.3%

0.5%

115,000

0.3%

0.5%

Cornovum

458,715

1.1%

1.0%

458,715

1.1%

1.0%

458,715

1.0%

0.9%

Stéphane Piat (Chief Executive

Officer)

553,402

1.3%

1.4%

553,402

1.3%

1.4%

553,402

1.2%

1.4%

Treasury shares*

14,281

0.0%

0.0%

14,281

0.0%

0.0%

14,281

0.0%

0.0%

Free float

24,694,141

58.3%

53.5%

25,656,318

59.3%

54.5%

26,762,822

60.3%

55.5%

TOTAL

42,335,810

100.0%

100.0%

43,297,987

100.0%

100.0%

44,404,491

100.0%

100.0%

* Liquidity contract (situation at

31/8/2024)

Amount and percentage of dilution resulting immediately from

the Offering

As an indication, the impact of the Offer on the shareholding of

a shareholder holding 1% of the Company's share capital prior to

the Offer and not subscribing to it, and on the proportion of the

Company's shareholders' equity per share is as follows (based on a

number of 35,921,294 shares currently in issue and unaudited

shareholders' equity equal to -€37.6 million on the date

hereof):

Portion of capital

Portion of shareholders’

equity per share

Non-diluted basis

Diluted basis*

Non-diluted basis

Diluted basis*

Before the Offering

1.00%

0.75%

-1.0462

-0.3973

After the issuance of 4,810,887 New Shares

(should the Offering be reduced to 75%)

0.88%

0.68%

-0.7337

-0.2160

After the issuance of 6,414,516 New Shares

resulting from this capital increase (excluding the Extension

Clause)

0.85%

0.66%

-0.6453

-0.1627

After the issuance of all New Shares

(including full exercise of the Extension Clause but excluding the

Over-allotment Option)

0.83%

0.65%

-0.5954

-0.1322

After the issuance of all New Shares

(including full exercise of both the Extension Clause and the

Over-allotment Option)

0.81%

0.63%

-0.5407

-0.0984

* On the date of the Prospectus,

12,281,688 new shares are likely to be issued by the Company on

exercise or acquisition of dilutive instruments, including (i)

1,259,891 shares (ordinary and preferred) in respect of bonus

shares granted to Mr. Stéphane Piat (CARMAT's Chief Executive

Officer), of which 218,136 shares will become available on June 24,

2027 and a maximum of 436. 300 shares, that might become available

on that same date, assuming that the associated performance

criteria are all met on that date, (ii) 2,422,204 shares in respect

of the free shares allocated to the Company's employees, (iii)

66,000 warrants for the benefit of the Company's directors and

consultants, (iv) 3,005,000 shares on exercise of the 3,500,000

Vester warrants currently outstanding, and (v) 5,528,593 shares on

exercise of the 6,000,000 EIB warrants currently outstanding. The

Company will very probably be required to issue additional

equitization warrants in the future, to enable it to pay off its

debt to the European Investment Bank in full (i.e. around €47

million for all three tranches of the loan), it being specified

however that the total number of shares likely to be issued in-fine

in respect of this repayment cannot be determined precisely, as it

depends in particular on the future trend in the CARMAT share

price.

Eligible for PEA / PEA-PME schemes and for reinvestment as

part of a transfer of assets (provision 150-O B ter of the French

General Tax Code).

CARMAT shares are fully eligible for inclusion in share savings

plans (PEA) and PEA-PME accounts, which benefit from the same tax

advantages as the classic PEA.

The company is also eligible for the 150-O B ter scheme of the

French General Tax Code, which enables people who have sold

contributed shares within three years of the contribution to

maintain the tax deferral on cash subscriptions.

The persons concerned are invited to seek advice from their

usual tax advisor on the tax treatment applicable to their

particular case, notably in respect of the subscription,

acquisition, holding and disposal of CARMAT shares.

Prospectus availability

The Public Offering is the subject of a prospectus approved by

the French Financial Markets Authority (Autorité des marchés

financiers - the “AMF”) on September 17, 2024, under number

24-403, comprising the Company's 2023 Universal Registration

Document filed with the AMF on April 30, 2024 under number D.

24-0374, as updated by an amendment to the 2023 Universal

Registration Document filed with the AMF on September 17, 2024,

under number 24-0374-A01 (together the “2023 Universal

Registration Document”), and securities note (note

d’opération), including a summary of the prospectus (the “Note

d’Opération”), copies of which are available free of charge

from Carmat (36, avenue de l'Europe - Immeuble l'Étendard - Energy

III - 78140 Vélizy-Villacoublay), as well as on the Carmat

(www.carmatsa.com/fr/) and AMF (www.amf-france.org) websites.

Carmat draws the public's attention to Section 2 “Risk Factors”

of the 2023 Universal Registration Document, as updated by its

amendment, and to Chapter 2 “Risk Factors” of the Note

d’Opération.

About CARMAT

CARMAT is a French MedTech that designs, manufactures and

markets the Aeson® artificial heart. The Company’s ambition is to

make Aeson® the first alternative to a heart transplant, and thus

provide a therapeutic solution to people suffering from end-stage

biventricular heart failure, who are facing a well-known shortfall

in available human grafts. The world’s first physiological

artificial heart that is highly hemocompatible, pulsatile and

self-regulated, Aeson® could save, every year, the lives of

thousands of patients waiting for a heart transplant. The device

offers patients quality of life and mobility thanks to its

ergonomic and portable external power supply system that is

continuously connected to the implanted prosthesis. Aeson® is

commercially available as a bridge to transplant in the European

Union and other countries that recognize CE marking. Aeson® is also

currently being assessed within the framework of an Early

Feasibility Study (EFS) in the United States. Founded in 2008,

CARMAT is based in the Paris region, with its head offices located

in Vélizy-Villacoublay and its production site in Bois-d’Arcy. The

Company can rely on the talent and expertise of a multidisciplinary

team of circa 200 highly specialized people. CARMAT is listed on

the Euronext Growth market in Paris (Ticker: ALCAR / ISIN code:

FR0010907956).

For more information, please go to www.carmatsa.com and follow

us on LinkedIn.

Name: CARMAT ISIN code:

FR0010907956 Ticker: ALCAR

Disclaimer

With respect to Member States of the European Economic Area

other than France, no action has been taken or will be taken to

permit a public offering of the securities referred to in this

press release requiring the publication of a prospectus in any such

Member State. Therefore, such securities will only be offered in

any such Member State (i) to qualified investors as defined in

Regulation (EU) 2017/1129 of the European Parliament and European

Council of 14 June 2017, as amended (the “Prospectus

Regulation”) or (ii) in accordance with the other exemptions of

Article 1(4) of Prospectus Regulation.

In France, the offer of Carmat shares described above will be

made in the context of a share capital increase without

preferential subscription rights through a public offering in

France and with a priority subscription right, on a irreducible and

reducible basis, to the benefit of shareholders, and a global

placement for institutional investors in France and outside of

France, but excluding, in particular, the United States of America,

Canada, Japan, South Africa and Australia.

This press release and the information it contains are being

distributed to and are only intended for persons who are (x)

outside the United Kingdom or (y) in the United Kingdom who are

qualified investors (as defined in the Prospectus Regulation as it

forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018) and are (i) investment professionals falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended (the “Order”),

(ii) high net worth entities and other such persons falling within

Article 49(2)(a) to (d) of the Order (“high net worth companies”,

“unincorporated associations”, etc.) or (iii) other persons to whom

an invitation or inducement to participate in investment activity

(within the meaning of Section 21 of the Financial Services and

Market Act 2000) may otherwise lawfully be communicated or caused

to be communicated (all such persons in (y)(i), (y)(ii) and

(y)(iii) together being referred to as “Relevant Persons”).

Any invitation, offer or agreement to subscribe, purchase or

otherwise acquire securities to which this press release relates

will only be engaged with Relevant Persons. Any person who is not a

Relevant Person should not act or rely on this press release or any

of its contents.

This press release may not be distributed, directly or

indirectly, in or into the United States. This press release and

the information contained therein does not, and will not,

constitute an offer of securities for sale, nor the solicitation of

an offer to purchase, securities in the United States or any other

jurisdiction where restrictions may apply. Securities may not be

offered or sold in the United States absent registration or an

exemption from registration under the U.S. Securities Act of 1933,

as amended (the “Securities Act”). The securities of Carmat

have not been and will not be registered under the Securities Act,

and Carmat does not intend to conduct a public offering in the

United States.

The distribution of this press release may be subject to legal

or regulatory restrictions in certain jurisdictions. Any person who

comes into possession of this press release must inform him or

herself of and comply with any such restrictions.

Any decision to subscribe for or purchase the shares or other

securities of Carmat must be made solely based on information

publicly available about Carmat. Such information is not the

responsibility of Invest Securities and has not been independently

verified by Invest Securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240917895328/en/

CARMAT Stéphane Piat Chief Executive Officer

Pascale d’Arbonneau Chief Financial Officer Tel.: +33 1 39

45 64 50 contact@carmatsas.com Alize RP Press Relations

Caroline Carmagnol Tel.: +33 6 64 18 99 59

carmat@alizerp.com NewCap Financial Communication &

Investor Relations Dusan Oresansky Jérémy Digel Tel.:

+33 1 44 71 94 92 carmat@newcap.eu

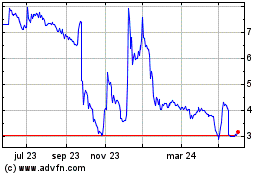

Carmat (EU:ALCAR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

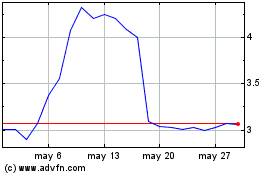

Carmat (EU:ALCAR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024