Amundi: Q1 2023 Results

Amundi: First quarter 2023

results

A high net

income1,2

at €300 million

|

Results |

|

Adjusted net

income1,2

of €300 million, thanks to a

diversified profile and operational efficiency

- Resilient management

fees Q1/Q1 despite unfavourable market impacts

- Good cost control in

an inflationary environment

Cost/income ratio at

53.6%2 |

|

|

|

|

|

Activity |

|

Healthy inflows for Retail and the JVs in India and

Korea

-

Retail (excluding JV et Amundi BOC WM):

+€4.3 billion, including +4.2 in MLT

assets3, thanks to the success of the

offers adapted to the new context: structured products and Buy

& Watch bond funds

- SBI MF (India)

+€2.8 billion and NH-Amundi (Korea) +€1.6 billion

Total flows (-€11.1 billion) impacted by redemptions for

very-low-margin institutional assets |

|

|

|

|

|

Continued development

initiatives |

|

Amundi Technology: 4 new clients in Q1Fund

Channel: closing of the transaction with CACEIS, which

acquires 33.33% of FC’s capital to develop fund execution and offer

an integrated service to distributorsResponsible

investment: €822 billion in assets under management as at

31 March 2023, extension of the range of funds aligned to a Net

Zero trajectory4 |

Paris, 28 April 2023

The Amundi Board of Directors meeting of 27

April 2023, chaired by Yves Perrier, approved the financial

statements for Q1 2023.

CEO Valérie Baudson stated:

“Amundi delivered a good performance in the

first quarter of 2023, in an uncertain market environment.

Our adjusted net income remained stable at €300

million compared to the fourth quarter of 2022, thanks to the

resilience of our revenues and good cost control. The productivity

gains and continued synergies generated by the integration of Lyxor

have enabled us to absorb the effects of inflation while continuing

to invest.

I would also like to underline the healthy

inflows of our Retail activities over the quarter, whether for our

partner networks in France and abroad or for our third-party

distributors”.

* * *

A market context remaining

uncertain

Over one year, the equity and bond markets5 were

down -5% and -12% respectively. Despite a rebound during the first

quarter (+9% on average for the quarter compared to Q4 2022), the

equity markets remain volatile.

-

Results

A healthy financial performance for the

first quarter

Adjusted

data6

Adjusted net

income6 reached €300 million in

Q1 2023, essentially stable compared to Q4 2022, and down

-7.5% from Q1 2022, in line with the unfavourable evolution of the

market.

This strong performance is explained by the

diversification of Amundi's activities and its operational

efficiency, and is reflected in revenue resilience and good cost

control.

Net revenue5

amounted to €794 million, down -4.9% from Q1 2022 but

stable (+0.4%) relative to Q4 2022.

-

Net management fees were

sustained at a high level: €736 million, down -3.9%

year-on-year, to be compared to a -5.9% average drop in assets

under management excluding JVs over the same period, reflecting the

higher margins thanks to the mix effect; net management fees

increased by +2.3% compared to Q4 2022;

-

Revenue growth for Amundi

Technology was robust (+35% compared to

Q1 2022), at €13 million, confirming its development;

- Performance

fees (€28 million) were down significantly compared to the

high comparison base in Q1 and Q4 2022 (respectively €71 million

and €63 million);

- Finally,

net financial and other income

was positive (€16 million), thanks to both the return to positive

yields on the net cash and positive mark-to-market of the

investment portfolio in the quarter.

Operating

costs5 were well under control at €425

million, an increase of only +0.6% compared to Q1

2022, in a context of high inflation.

Inflation, development investments, and the

unfavourable exchange rate effect were largely absorbed by

productivity gains and the pursuit of synergies generated by the

integration of Lyxor.

In this context, the very moderate increase in

costs over one year, well below the inflation rates seen in most of

the countries where Amundi operates, reflects the agility Amundi’s

to adjust its cost base, delivering the best cost/income ratio in

the sector again this quarter: 53.6%6.

Gross operating

income5 (GOI) amounted to €369

million, down -10.5% from Q1 2022 and -2.5% from Q4

2022.

The share of net income of

equity-accounted companies, reflecting

Amundi's share in the net income of minority JVs in India (SBI MF),

China (ABC-CA), South Korea (NH-Amundi), and Morocco (Wafa

Gestion), was up +11.2% relative to Q1 2022,

at €22 million.

Accounting data

Net accounting income (group share) was €285

million in the first quarter, including the amortisation of the

intangible assets (customer contracts related to the acquisition of

Lyxor and the distribution contracts related to previous

transactions), ie -€15m after tax in Q1 2023.

Accounting earnings per share

was €1.40.

-

Activity

Healthy Retail

inflows and favourable business mix

The assets managed by Amundi as of 31

March 2023 were down -4.3% over one year, but up +1.6%

compared to end-2022, at €1,934 billion.

Retail recorded satisfactory

inflows: +€4.3 billion excluding the Chinese

subsidiary Amundi BOC WM. As in 2022, inflows mainly came from

MLT assets, +€4.2 billion, driven

by all segments:

- The French

networks posted net inflows of +€2.7

billion, of which +€0.8 billion in

MLT assets and +€1.9 billion in

treasury products. MLT inflows were driven, as in H2 2022, by

structured products, at +€1.5 billion;

- Inflows from the

International networks (excluding Amundi BOC WM in

China) reached +€1.2 billion, entirely in

MLT assets; as for the French

networks, both structured products (+€0.5 billion) and bond

strategies continued their success achieved in the latter part of

2022; the performance was well-diversified by country and network,

with healthy inflows particularly in Italy with UniCredit, in the

Czech Republic with the Société Générale and UniCredit

subsidiaries, and in Spain with Sabadell.

- Third Party

Distribution experienced a reversal of the trend observed

in Q4 2022: in the first quarter, total inflows of +€0.4 billion

break down into a strong performance of +€2.2

billion in MLT assets, notably in ETFs, and conversely

outflows in treasury product; by geography, the good performance of

Asia should be noted for the quarter.

The strong performance for Retail is more than

offset, however, by MLT asset outflows in very low margin segments

or products, as well as outflows in China, where the asset

management market still shows net redemptions in MLT assets; this

latter factor also explains the net outflows at our JVs:

- Outflows for the

Institutional segment (-€11.7 billion, of which

-€13.7 billion in MLT assets) were largely limited to a few

very-low-margin insurance and institutional mandates, in particular

in the CA & SG Insurers segment, which experienced redemptions

in the traditional life (“euro”) contracts, and a large sovereign

client in index management;

- In

China, Amundi BOC WM recorded outflows of

-€2.8 billion, still related to maturing term funds, and the

ABC-CA JV was impacted by redemptions from large

institutions (outflows of -€5.0 billion).

Excluding the Chinese JV, inflows in the other

JVs were very satisfactory, particularly in India (+€2.8 billion)

and Korea (+€1.6 billion), both continuing to benefit from strong

activity, particularly in MLT assets.

Total net inflows for the quarter were negative

at -€11.1 billion.

-

Continuing development

initiatives

Several important milestones of the Ambitions

2025 development plan were reached during the first quarter:

- Amundi

Technology saw its earnings increase by +35% compared to

Q1 2022 and added 4 new customers, including 3 in Asia. Amundi

Technology and HSBC Securities Services in Asia have signed an

agreement for the use of the ALTO platform. This is a major new

client for the ALTO offering to asset servicers, which already

counts CACEIS, Société Générale Securities Services and Bank of NY

Mellon among its clients. BNY Mellon has successfully deployed ALTO

across 7 of its entities in EMEA;

- Amundi's fund

distribution platform Fund Channel is announcing

today the closing of its transaction with CACEIS. The latter is

acquiring 33.33% of the capital of Fund Channel, to develop fund

execution and offer integrated services to distributors.

- Assets under

management in Responsible Investment reached €822

billion, compared to €800 billion at end-2022, thanks to a positive

market effect. As

part of its Net Zero commitment, on 17 April

Amundi announced the launch of a full range of funds across a wide

range of asset classes aligned to a Net Zero trajectory7, targeting

a reduction by 30% in carbon intensity in 2025 compared to 2019,

and by 60% in 2030.

***

Amundi's Annual General Meeting will take place

on 12 May at 10am CET. As announced on 8 February upon the

publication of the results for 2022, the Board of Directors will

propose to the General Meeting a cash dividend of €4.10 per share,

stable relative to the dividend paid for 2021. This dividend

represents a payout ratio of approximately 75% of net accounting

income (Group share) in 2022, excluding integration costs, and a

yield of 7% based on the closing share price on 25 April 2023.

Financial

disclosure schedule

- AGM for the 2022

financial year: Friday 12 May 2023

- Publication of H1

2023 results: 28 July 2023

- Publication of 9M

2023 results: 27 October 2023

Dividend schedule (€4.10 per share proposed

to the General Meeting of 12 May 2023)

- Ex-dividend date:

Monday 22 May 2023

- Payment: as from

Wednesday 24 May 2023

***

APPENDICES

Quarterly Statement of

income

|

(€M) |

|

Q1 2023 |

Q1 2022 |

% YoY ch. |

Q4 2022 |

% QoQ ch. |

| |

|

|

|

|

|

|

|

Net revenue - Adjusted |

|

794 |

835 |

-4.9% |

790 |

+0.4% |

|

Net management fees |

|

736 |

766 |

-3.9% |

720 |

+2.3% |

|

Performance fees |

|

28 |

71 |

-60.0% |

63 |

-55.0% |

|

Technology |

|

13 |

10 |

+35.0% |

15 |

-12.7% |

|

Net financial income & other net income |

|

16 |

(12) |

NM |

(7) |

NM |

|

Operating expenses

- Adjusted |

|

(425) |

(423) |

+0.6% |

(412) |

+3.2% |

|

Cost income ratio - Adjusted |

|

53.6% |

50.6% |

+2.9pp |

52.1% |

+1.4pp |

| |

|

|

|

|

|

|

|

Gross operating income

- Adjusted |

|

369 |

412 |

-10.5% |

378 |

-2.5% |

|

Cost of risk and others |

|

(1) |

(4) |

-85.0% |

(4) |

-87.2% |

|

Share of net income of equity accounted companies |

|

22 |

20 |

+11.2% |

24 |

-8.1% |

|

Income before

tax -

Adjusted |

|

390 |

428 |

-8.9% |

398 |

-2.0% |

|

Corporate tax - Adjusted |

|

(91) |

(103) |

-11.6% |

(96) |

-5.0% |

|

Non-controlling interests |

|

1 |

(1) |

NM |

0 |

+75.2% |

|

Net income group share - Adjusted |

|

300 |

324 |

-7.5% |

303 |

-1.0% |

|

Amortisation of intangible assets (net of tax) |

|

(15) |

(15) |

+0.2% |

(15) |

+0.2% |

|

Integration costs (net of tax) |

|

0 |

(8) |

NM |

(2) |

NM |

|

Net income group

share |

|

285 |

302 |

-5.6% |

286 |

-0.4% |

|

Earnings per share (€) |

|

1.40 |

1.49 |

-5.9% |

1.41 |

-0.4% |

Change in assets under management from

end-2019 to end-March 2023

|

(€bn) |

Assets under

management |

Net inflows |

Market &

Forex effects |

Scopeeffect |

|

% ch. In

AuM vs previous quarter |

|

As at 31/12/2019 |

1,653 |

|

|

|

|

+5.8% |

|

Q1 2020 |

|

-3.2 |

-122.7 |

|

/ |

|

|

As at 31/03/2020 |

1,527 |

|

|

|

/ |

-7.6% |

|

Q2 2020 |

|

-0.8 |

+64.9 |

|

/ |

|

|

As at 30/06/2020 |

1,592 |

|

|

|

/ |

+4.2% |

|

Q3 2020 |

|

+34.7 |

+15.2 |

|

+20.78 |

|

|

As at 30/09/2020 |

1,662 |

|

|

|

/ |

+4.4% |

|

Q4 2020 |

|

+14.4 |

+52.1 |

|

/ |

|

|

As at 31/12/2020 |

1,729 |

|

|

|

/ |

+4.0% |

|

Q1 2021 |

|

-12.7 |

+39.3 |

|

/ |

|

|

As at 31/03/2021 |

1,755 |

|

|

|

/ |

+1.5% |

|

Q2 2021 |

|

+7.2 |

+31.4 |

|

/ |

|

|

As at 30/06/2021 |

1,794 |

|

|

|

/ |

+2.2% |

|

Q3 2021 |

|

+0.2 |

+17.0 |

|

/ |

|

|

As at 30/09/2021 |

1,811 |

|

|

|

/ |

+1.0% |

|

Q4 2021 |

|

+65.6 |

+39.1 |

|

+1489 |

|

|

As at 31/12/2021 |

2,064 |

|

|

|

/ |

+14% |

|

Q1 2022 |

|

+3.2 |

-46.4 |

|

/ |

|

|

As at 31/03/2022 |

2,021 |

|

|

|

/ |

-2.1% |

|

Q2 2022 |

|

+1.8 |

-97.75 |

|

/ |

|

|

As at 30/06/2022 |

1,925 |

|

|

|

/ |

-4.8% |

|

Q3 2022 |

|

-12.9 |

-16.3 |

|

/ |

|

|

As at 30/09/2022 |

1,895 |

|

|

|

/ |

-1.6% |

|

Q4 2022 |

|

+15.0 |

-6.2 |

|

/ |

|

|

As at 31/12/2022 |

1,904 |

|

|

|

/ |

+0.5% |

|

Q1 2023 |

|

-11.1 |

+40.9 |

|

/ |

|

|

As at 31/03/2023 |

1,934 |

|

|

|

/ |

+1.6% |

| |

|

|

|

|

|

|

|

|

Total one year between 31 March 2022 and

31 March 2023: - 4.3%

- Net

inflows €7.3 bn

- Market & forex

effect -€79.3

bn

Breakdown of assets under management

& net inflows by client segment10

|

(Md€) |

|

|

AuM31.03.2023 |

AuM31.03.2022 |

% ch. /31.03.2022 |

Net inflows Q1

2023 |

Net inflows Q1

2022 |

|

French networks |

124 |

122 |

+1.7% |

+2.7 |

-1.3 |

|

International networks |

157 |

172 |

-8.6% |

-1.6 |

+3.5 |

|

o/w Amundi BOC WM |

4 |

13 |

-68.7% |

-2.8 |

+2.3 |

|

Third-party distributors |

296 |

322 |

-8.2% |

+0.4 |

+11.9 |

| |

|

|

|

|

|

|

|

|

Retail |

|

|

578 |

617 |

-6.4% |

+1.5 |

+14.1 |

|

Institutionals & Sovereigns (*) |

472 |

476 |

-0.8% |

+1.0 |

-3.0 |

|

Corporates |

96 |

95 |

+1.9% |

-7.9 |

-13.4 |

|

Employee savings |

79 |

75 |

+4.9% |

-0.6 |

-1.3 |

|

CA & SG Insurers |

416 |

462 |

-9.9% |

-4.3 |

-1.7 |

|

|

|

Institutionals |

|

1,064 |

1,108 |

-4.0% |

-11.7 |

-19.4 |

|

JVs |

|

|

292 |

296 |

-1.1% |

-0.8 |

+8.4 |

|

TOTAL |

|

|

1,934 |

2,021 |

-4.3% |

-11.1 |

+3.2 |

(*) including funds of funds

Breakdown of assets under management

& net inflows by asset class10

|

(€bn) |

|

|

AuM31.03.2023 |

AuM31.03.2022 |

% ch. /31.03.2022 |

Net inflows Q1

2023 |

Net inflows Q1

2022 |

|

Equities |

|

|

425 |

435 |

-2.3% |

-2.9 |

+8.2 |

|

Multi-asset |

|

|

286 |

328 |

-12.9% |

-7.2 |

+10.9 |

|

Bonds |

|

|

616 |

661 |

-6.8% |

-3.2 |

+0.5 |

|

Real, alternative & Structured assets |

125 |

125 |

+0.6% |

+0.9 |

+1.4 |

| |

|

|

|

|

|

|

|

|

MLT ASSETS excl.

JVs |

1,453 |

1,549 |

-6.2% |

-12.4 |

+21.0 |

|

Treasury products

excl. JVs |

189 |

176 |

+7.4% |

+2.1 |

-26.3 |

| |

|

|

|

|

|

|

|

|

TOTAL ASSETS

excl. JVs |

1,642 |

1,725 |

-4.8% |

-10.3 |

-5.2 |

|

JVs |

|

|

292 |

296 |

-1.1% |

-0.8 |

+8.4 |

|

TOTAL |

|

|

1,934 |

2,021 |

-4.3% |

-11.1 |

+3.2 |

|

o/w MLT assets |

1,716 |

1,812 |

-5.3% |

-11.3 |

+30.2 |

|

o/w treasury

products |

218 |

209 |

+4.3% |

+0.3 |

-27.0 |

Breakdown of assets under management

& net inflows by geographic

area10

|

(€bn) |

|

|

Encours31.03.2023 |

Encours31.03.2022 |

% var. /31.03.2022 |

Net inflows Q1

2023 |

Net inflows Q1

2022 |

|

France |

|

|

903 |

948 |

-4.8% |

-2.4 |

-22.8 |

|

Italy |

|

|

197 |

209 |

-5.4% |

-0.7 |

+3.8 |

|

Europe outside France & Italy |

343 |

350 |

-2.0% |

+0.3 |

+8.7 |

|

Asia |

|

|

371 |

386 |

-4.0% |

-4.8 |

+14.2 |

|

Rest of the world |

120 |

128 |

-5.9% |

-3.4 |

-0.7 |

| |

|

|

|

|

|

|

|

|

TOTAL |

|

|

1,934 |

2,021 |

-4.3% |

-11.1 |

+3.2 |

|

TOTAL outside

France |

1,031 |

1,072 |

-3.8% |

-8.6 |

+26.0 |

Breakdown of assets under management

& net inflows by management type and asset

class11

|

(Md€) |

|

|

AuM31.03.2023 |

AuM31.03.2022 |

% ch. /31.03.2022 |

Net inflows T1

2023 |

Net inflows T1

2022 |

|

Active management |

1,027 |

1,117 |

-8.1% |

-13.1 |

+9.1 |

|

Equities |

|

|

183 |

183 |

-0.2% |

-1.3 |

-0.7 |

|

Multi-asset |

|

|

278 |

321 |

-13.5% |

-7.6 |

+11.0 |

|

Bonds |

|

|

566 |

612 |

-7.6% |

-4.2 |

-1.2 |

|

Structured products |

33 |

32 |

+6.0% |

+1.1 |

-1.2 |

|

Passive management |

301 |

307 |

-2.2% |

-0.2 |

+10.6 |

|

ETF & ETC |

181 |

190 |

-4.6% |

+1.9 |

+9.3 |

|

Index & Smart beta |

119 |

117 |

+1.6% |

-2.2 |

+1.2 |

|

Real assets &

Alternatives |

92 |

93 |

-1.2% |

-0.1 |

+2.6 |

|

Real assets |

66 |

66 |

-0.4% |

-0,1 |

+2,2 |

|

Alternatives |

26 |

27 |

-3.4% |

-0.0 |

+0,4 |

| |

|

|

|

|

|

|

|

|

MLT ASSETS excl.

JVs |

1,453 |

1,549 |

-6.2% |

-12.4 |

+21.0 |

|

Treasury products

excl. JVs |

189 |

176 |

+7.4% |

+2.1 |

-26.3 |

| |

|

|

|

|

|

|

|

|

TOTAL ASSETS

excl. JVs |

1,642 |

1,725 |

-4.8% |

-10.3 |

-5.2 |

|

JVs |

|

|

292 |

296 |

-1.1% |

-0.8 |

+8.4 |

|

TOTAL |

|

|

1,934 |

2,021 |

-4.3% |

-11.1 |

+3.2 |

|

o/w MLT assets |

|

1,716 |

1,812 |

-5.3% |

-11.3 |

+30.2 |

|

o/w treasury

products |

218 |

209 |

+4.3% |

+0.3 |

-27.0 |

Methodology & Alternative Performance

Measures (APM)

Accounting and adjusted

data

- Accounting

data: in 2022 and Q1

2023, accounting data include the amortisation of intangible

assets. In 2022, they also include Lyxor integration costs.

- Adjusted

data: the following adjustments were made

to present the most economically accurate income statement:

restatement of the amortisation of distribution contracts with

Bawag, UniCredit, and Banco Sabadell, and the intangible assets

representing the Lyxor’s client contracts recorded as deduction

from net income; costs of the Lyxor consolidation in 2022

In the accounting data, amortisation of

distribution contracts:

- Q1

2022: -€20 m before tax and -€15 m after tax

- Q4

2022: -€20 m before tax and -€15 m after tax

- Q1

2023: -€20 m before tax and -€15 m after tax

Acquisition de

Lyxor

- In accordance with

IFRS 3, recognition on Amundi’s balance sheet as of 31/12/2021 of:

- goodwill in the amount

of €652 m;

- an intangible asset

(representing client contracts), of -€40 m before tax (-€30 m after

tax), which will be amortised on a straight-line basis over 3

years;

- In the Group income

statement, the above-mentioned intangible asset will be amortised

on a straight-line basis over 3 years starting in 2022; the

full-year impact of this amortisation will be -€10 m net of tax

(i.e. -€13 m before tax). This amortisation will be recognised as a

deduction from net income and will be added to the existing

amortisation of distribution agreements.For Q1 2022, Q4 2022, and

Q1 2023 the amortisation expense for this intangible asset was

respectively -€2 m (-€3 m before tax).

- €10 m in

integration costs before tax were recorded for Q1

2022 and €2 m for Q4 2022. Integration costs were fully recorded in

2021 and 2022, for a total of €77 m before tax (including €16 m in

Q4 2021 and €57 m after tax including €12 m in Q4 2021).

Alternative Performance

Measures12

To present the most economically accurate income

statement, Amundi publishes adjusted data which excludes

amortisation of intangible assets and the impact of Affrancamento

(see above).

These adjusted and normalised data are

reconciled with accounting data as follows:

|

(€m) |

|

T1 2023 |

|

T1 2022 |

|

%Var. T1/T1 |

|

T4 2022 |

|

%Var. T1/T4 |

| |

|

|

|

|

|

|

|

|

|

|

|

Net revenue (a) |

|

773 |

|

814 |

|

-5.0% |

|

770 |

|

+0.5% |

|

- Amortisation of intangible assets (bef. Tax) |

|

-20 |

|

-20 |

|

+0% |

|

-20 |

|

+0.0% |

|

Net revenue - Adjusted

(b) |

|

794 |

|

835 |

|

-4.9% |

|

790 |

|

+0.5% |

| |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

(c) |

|

-425 |

|

-433 |

|

-1.7% |

|

-414 |

|

+2.6% |

|

- Integration costs (before tax) |

|

0 |

|

-10 |

|

/ |

|

-2 |

|

/ |

|

Operating expenses

- Adjusted

(d) |

|

-425 |

|

-423 |

|

+0.6% |

|

-412 |

|

+3.2% |

| |

|

|

|

|

|

|

|

|

|

|

|

Gross operating income

(e) = (a) + (c) |

|

348 |

|

382 |

|

-8.7% |

|

356 |

|

-2.0% |

| |

|

|

|

|

|

|

|

|

|

|

|

Gross operating income - Adjusted (f) = (b) +

(d) |

|

369 |

|

412 |

|

-10.5% |

|

378 |

|

-2.5% |

|

Cost income ratio (%) (c) / (a) |

|

55.0% |

|

53.1% |

|

+1.8pp |

|

53.8% |

|

+1.2pp |

|

Cost income ratio - Adjusted (d)

/ (b) |

|

53.6% |

|

50.6% |

|

+1.4pp |

|

52.1% |

|

+1.4pp |

|

Cost of risk & others (g) |

|

-1 |

|

-4 |

|

-85% |

|

-4 |

|

-87.2% |

|

Share of net income of equity accounted companies (h) |

|

22 |

|

20 |

|

+11.2% |

|

24 |

|

-8.1% |

|

Income before

tax (i) = (e) + (g) + (h) |

|

370 |

|

398 |

|

-7.1% |

|

375 |

|

-1.5% |

| |

|

|

|

|

|

|

|

|

|

|

|

Income before tax - Adjusted (j) = (f) + (g) +

(h) |

|

390 |

|

428 |

|

-8.9% |

|

398 |

|

-2.0% |

| |

|

|

|

|

|

|

|

|

|

|

|

Corporate tax (k) |

|

-85 |

|

-94 |

|

-9.8% |

|

-89 |

|

-4.6% |

|

Corporate tax - Adjusted (l) |

|

-91 |

|

-103 |

|

-11.6% |

|

-96 |

|

-5.0% |

|

Non-controlling interests (m) |

|

1 |

|

-1 |

|

/ |

|

0 |

|

/ |

|

Net income group share (o) =

(i)+(k)+(m) |

|

285 |

|

302 |

|

-5.6% |

|

286 |

|

-0.4% |

| |

|

|

|

|

|

|

|

|

|

|

|

Net income group share - Adjusted (p) =

(j)+(l)+(m) |

|

300 |

|

324 |

|

-7.5% |

|

303 |

|

-1.0% |

Shareholder structure

|

|

31 December

2021 |

31 December

2022 |

31 March 2023 |

|

|

|

|

|

|

|

Number of shares |

% capital |

Number of shares |

% capital |

Number of shares |

% capital |

|

Crédit Agricole Group |

141,057,399 |

69.46 % |

141,057,399 |

69.19 % |

141,057,399 |

69.19 % |

|

Employees |

1,527,064 |

0.75 % |

2,279,907 |

1.12 % |

2,238,508 |

1.10 % |

|

Treasury shares |

255,745 |

0.13 % |

1,343,479 |

0.66 % |

1,331,680 |

0.65 % |

|

Free float |

60,234,443 |

29.66 % |

59,179,346 |

29.03 % |

59,232,544 |

29.06 % |

|

Number of shares at end of period |

203,074,651 |

100.0 % |

203,860,131 |

100.0 % |

203,860,131 |

100.0 % |

|

Average number of shares for the period |

202,793,482 |

202,793,482 |

203,414,667 |

/ |

203,860,131 |

/ |

- Average number of

shares on a pro-rata basis

- The capital

increase reserved for employees took place on 26/07/2022. 0.5

million shares were created, bringing the portion of capital owned

by employees to 1.10% on 31/03/2023.

About Amundi

Amundi, the leading European asset manager,

ranking among the top 10 global players13, offers its 100 million

clients - retail, institutional and corporate - a complete range of

savings and investment solutions in active and passive management,

in traditional or real assets. This offering is enhanced with IT

tools and services to cover the entire savings value chain. A

subsidiary of the Crédit Agricole group and listed on the stock

exchange, Amundi currently manages more than €1.9 trillion of

assets14.

With its six international investment hubs15,

financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape.

Amundi clients benefit from the expertise and

advice of 5,400 employees in 35 countries.

Amundi, a trusted partner, working every

day in the interest of its clients and society.

Press contact:

Natacha

Andermahr Tel. +33 1 76 37 86

05natacha.andermahr@amundi.com

Investor contacts:Cyril Meilland,

CFATel. +33 1 76 32 62

67cyril.meilland@amundi.com

Thomas LapeyreTel. +33 1 76 33 70

54thomas.lapeyre@amundi.com

DISCLAIMER:

This document may contain projections concerning

Amundi's financial situation and results. The figures provided do

not constitute a “forecast” as defined in Commission Delegated

Regulation (EU) 2019/980.

This information is based on scenarios that

employ a number of economic assumptions in a given competitive and

regulatory context. As such, the projections and results indicated

may not necessarily come to pass due to unforeseeable

circumstances. The reader should take all of these uncertainties

and risks into consideration before forming their own opinion.

The figures presented were prepared in

accordance with IFRS guidelines as adopted by the European Union.

Data including Lyxor in 2021, before the integration in the

accounts as from 1 January 2022, (with assumptions about the

restatement of certain activities retained by SG).

The information contained in this presentation,

to the extent that it relates to parties other than Amundi or comes

from external sources, has not been verified by a supervisory

authority, and no representation or warranty has been expressed as

to, nor should any reliance be placed on, the fairness, accuracy,

correctness or completeness of the information or opinions

contained herein. Neither Amundi nor its representatives can be

held liable for any decision made, negligence or loss that may

result from the use of this presentation or its contents, or

anything related to them, or any document or information to which

the presentation may refer.

1 Attributable net income2 Adjusted data:

excludes amortisation of intangible assets, and in 2022 Lyxor

integration costs (see note p. 8)3 MLT: Medium/Long Term4 All Net

Zero Ambition passive management funds comply with the EU’s CTB/PAB

criteria5 Quarterly averages, Bloomberg Global Aggregate for bonds

and 50% MSCI World + 50% Eurostoxx 600 composite index for

equities6 Adjusted data: excludes amortisation of intangible assets

and in 2022 Lyxor integration costs (see note p. 8)7 All Net Zero

Ambition passive management funds comply with the EU’s CTB/PAB

criteria8 Sabadell AM9 Lyxor, consolidated on 31/12/202110 Assets

under management and net inflows, including assets under advisory

and marketed assets, and comprising 100% of net inflows and the

assets managed by the Asian JVs. For Wafa Portfolio Management in

Morocco, assets under management and inflows are reported on a

proportional consolidation basis11 Assets under management and net

inflows, including assets under advisory and marketed assets, and

comprising 100% of net inflows and the assets managed by the Asian

JVs. For Wafa Portfolio Management in Morocco, assets under

management and inflows are reported on a proportional consolidation

basis12 See also Section 4.3 of the 2022 Universal Registration

Document filed with the AMF on 7 April 202313 Source: IPE “Top 500

Asset Managers” published in June 2022, based on assets under

management as at 31/12/202114 Amundi data as at 31/03/202315

Boston, Dublin, London, Milan, Paris and Tokyo

- Amundi PR Q1-2023 results_vdef

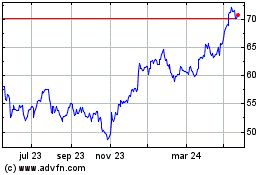

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

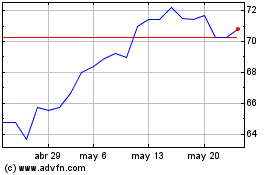

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024