Amundi: Third Quarter & 9 Months 2023 Results

Amundi: Third Quarter & 9 Months 2023

Results

High net inflows of +€14bn and net

income2,3

up Q3/Q3 to €290m

|

High inflows & increase in assets

under management |

|

Q3 net inflows: +€13.7bn, in MLT

assets1, Treasury products and

JVs

- In

both client segments, Retail and Institutional

- Continued

success of new solutions adapted to the market backdrop:

structured products, fixed income (Buy & Watch) and Treasury

products

- Healthy net

inflows in active management fixed income funds:

+€6bn

Despite a risk-off environment: weak flows in the

European asset management market1 Assets under management

of €1,973bn at 30 September 2023, up

+4.1% YoY, up +0.6% QoQ |

|

|

|

|

|

Profitability maintained at a high level |

|

Q3 2023: Adjusted net

income2,3

of €290m, +3% Q3/Q3

- thanks to a

diversified profile and operational efficiency

- cost/income ratio of

54.4%3, despite inflation and the market environment

9M 2023: Adjusted net

income2,3

of €910m, +4.0% 9M/9M

-

cost/income ratio of 53.4%3 over nine months

|

|

|

|

|

|

Continued development in our strategic

priorities |

|

Passive management - Q3 inflows: +€10.8bn

Asia - Q3 inflows: +€3.4bn, with continued

development in India, stabilisation in China Responsible

Investment - extension of the range

- launch of an

infrastructure fund to invest in renewable energy production4

-

extended range of products aligned with a Net Zero trajectory, and

of Responsible Investment ETFs (32%5 as at 30 September 2023)

|

Paris, 27 October 2023

Amundi’s Board of Directors, chaired by Philippe

Brassac, convened on 26 October 2023 to review the financial

statements for the third quarter and first nine months of 2023.

Valérie Baudson, Chief Executive

Officer, said:

“Amundi posted a good performance in terms of

both business activity and financial results in the third quarter

of 2023.

Our solutions, adapted to the high-interest-rate

and high-inflation environment, continued to attract many clients

against a backdrop of uncertainty, still characterised by

significant risk aversion. Amundi generated high inflows of +€14bn,

driven by our two strategic development priorities, passive

management and Asia.

Net income was high, reflecting Amundi’s good

operational efficiency and diversified profile. Quarter after

quarter, these results confirm the Group's effective positioning on

long-term growth trends and the relevance of our strategic

plan.”

* * *

Continued risk aversion

Bond markets6

have been relatively stable since the beginning of the year.

However, they were down -4.5% quarter-on-quarter (on an average

basis), with long-term rates7 increasing by +120 basis points on

average between these two periods. The equity

markets8 experienced a sharp decline at

the end of the third quarter, breaking with the growth seen since

the fourth quarter of 2022; their rise was limited to +2.0% on

average in the third quarter of 2023 compared to the previous

quarter, and they have gained +13.6% year-on-year.

The market effect was virtually neutral in the

third quarter compared to the previous quarter, and positive

year-on-year. These fluctuations have not reduced the risk aversion

that has prevailed for several quarters now.

Investors remain cautious and this resulted in

low inflows on the asset management market in

Europe, with slightly positive inflows in open-ended

funds9 (+€36bn in the third quarter). It was higher than in the

previous quarter (+€23bn) but it remained mainly driven by treasury

products (+€47bn) and passive management (+€47bn), while

medium/long-term active management saw its outflows accelerate over

the quarter (-€59bn vs. -€24bn in the second quarter).

-

Business activity

High inflows, positive in

MLT10 assets, Treasury products

and JVs

Amundi’s assets under management at 30

September 2023 were up +4.1% year on year (compared with

end-September 2022) and up +0.6% this quarter (compared with the

end of June 2023), at €1,973bn. The market effect

was virtually neutral during the quarter (-€1.7bn) and positive

year-on-year (+€56.8bn).

Amundi generated high net inflows of

+€13.7bn, positive in both MLT assets10 and

treasury products, in the Retail, Institutional and JV

segments.

- +€7.8bn in

MLT assets10,11, thanks in particular to two institutional

mandates, and driven by passive management (+€10.8bn, including

+€3.6bn in ETFs); like in the European market as a whole, active

management recorded outflows (-€3.0bn), continuing the rotation of

previous quarters, with withdrawals from Multi-Asset and Equity

funds, partially offset by bond inflows;

- +€3.5bn in

treasury products11, driven mainly by the

return of Retail clients to this asset class (+€2.7bn), reflecting

risk aversion and the attractiveness of yields at the short end of

the yield curve;

- Lastly, the

JVs12 posted net inflows of

+€2.4bn, thanks to the continued development of the Indian

JV SBI MF (+€2.0bn, of which +€3.4bn in MLT assets10) and the

stabilisation of the Chinese JV ABC-CA (at breakeven overall, but

with inflows of +€0.3bn excluding the outflows in the Channel

Business, a low-margin activity that is in run-off); the other JVs

also posted positive net inflows (+€0.4bn).

By client segment,

Retail recorded positive net inflows of

+€2.0bn, characterised as in previous quarters by

a high level of risk aversion. It reflects strong inflows in

treasury products (+€2.7bn) and conversely limited outflows in MLT

assets10 (-€0.7bn), broken down by type of client:

- Third-Party

Distributors (+€2.1bn) recorded strong activity in

ETFs/index funds as well as treasury products;

- the Partner

Networks excluding Amundi BOC WM (+€0.3bn) continued to

capitalise on the success of structured products and recorded a

renewed interest in treasury products;

- in

China, Amundi BOC WM experienced outflows

(-€0.5bn), as the confirmed ramp-up of the new open-ended fund

offering was unable to offset the maturity of term funds this

quarter.

Lastly, the Institutionals

segment recorded strong net

inflows, at +€9.3bn, especially in MLT Assets10

(+€8.5bn), including two large, low-margin mandates with

institutional investors, one in equity index solutions and another

one in bond solutions. On the other hand, CA & SG Insurers

continued their redemptions (-€3.1bn), linked, as in previous

quarters, to the withdrawals of traditional life insurance policies

by their clients. Profit-taking in the Employee & Retirement

Savings business (net outflows of -€0.9bn) was also noteworthy, as

employees of issuers whose shares had risen significantly in

previous months sold their employee share ownership funds.

-

Results

Profitability maintained at a high level

in the third quarter

Adjusted

data13

In the third quarter of 2023, adjusted

net income13 reached

€290m, up +3.0% on the third quarter of 2022. This result

was achieved thanks to a further increase in revenues, in

particular due to the resilience of management fees despite the

risk-off environment, and operational efficiency, which enabled a

smaller annual increase in expenses than revenues, despite the

inflationary environment.

Adjusted net

revenues13 amounted to €780m, up

+2.9% compared to the third quarter of 2022.

- Net

management fees held up well over one year, at €737m, down

-1.4% compared to the third quarter of 2022, which had benefited

from non-recurring items;

- Performance

fees totalled €10m, compared to €13m in the third quarter

of 2022 and €51m in the second quarter of 2023. This was due to the

adoption of a prudent investment policy in uncertain markets; in

addition, the number of fund anniversary dates, and therefore

performance fee bookings, is traditionally lower in the third

quarter;

- Amundi

Technology’s revenues, at €14m, continued to grow: +13%

compared to the third quarter 2022;

- Finally,

net financial and other income amounted to €19m,

thanks to positive rates of return on the investment of net cash;

this compares to negative revenues in the third quarter of 2022

(-€13m), a quarter that was marked by still negative short-term

rates in the eurozone and a market environment that was

unfavourable to the investment portfolio (decline in the equity and

fixed income markets).

The very good control of operating

expenses13 (€424m) helped to contain the

increase in costs below that of revenues, at only

+2.3% compared to the third quarter of 2022. As in

previous quarters, the impact of inflation, which stands at 4.3%

year-on-year in the eurozone14, and development investments were

largely absorbed by productivity gains and synergies generated by

the integration of Lyxor, which have now been almost entirely

realised.

This good cost control, which was confirmed

again this quarter, reflects Amundi's agility in adjusting its cost

base, and the Group has the best cost/income

ratio13 in the sector at

54.4%, a slight improvement compared to the third quarter

of 2022 (54.7%).

Adjusted gross operating

income13 (GOI) came to

€356m, up +3.6% compared to the third

quarter of 2022.

Income from associates, which

reflects Amundi’s share of the net income of the minority JVs in

India (SBI MF), China (ABC-CA), South Korea (NH-Amundi) and Morocco

(Wafa Gestion), was up +2.0% compared to the third

quarter of 2022, at €24m, reflecting continued

strong growth in India and Korea, which was partially offset by

China, whose contribution remains positive but down compared to

previous quarters.

Adjusted net earnings per

share13 was €1.42 in the

third quarter of 2023.

Accounting data for third quarter

2023

Accounting net income Group share came to

€276m. This amount includes the amortisation of

intangible assets (client contracts linked to the acquisition of

Lyxor and distribution agreements related to previous

acquisitions), representing -€15m after tax. The end of the

integration costs relating to Lyxor were recognised in 2022, and

therefore had no effect on the 2023 accounts.

Accounting net earnings per

share stood at €1.35 for the third quarter of

2023.

Over the first nine months of

2023, adjusted net income amounted to

€910m, up +4.0%, reflecting the same trends as in the

third quarter:

- adjusted

net revenue13 increased by +2.2% compared

to the first nine months of 2022, to €2,397m, driven as in the

third quarter by net financial and other income (€49m vs. -€40m in

the first nine months of 2022) and Amundi Technology’s revenues

(+25.8% to €42m). Net management fees were down slightly but not as

much as average assets under management excluding JVs, at -1.3% vs.

-1.9%, reflecting resilient margins thanks to a favourable client

mix. Meanwhile, performance fees were down much more sharply, at

-17.2% (€89m vs. €108m), reflecting the prudent investment policy

in risky assets;

- adjusted

expenses15 remained under control, at

€1,280m, up +1.7% compared to the first nine months of 2022, a

slower growth than that of revenues, despite the inflationary

environment; the adjusted cost/income

ratio15 as 53.4%,

compared to 53.7% over the first nine months of 2022.

Adjusted gross operating

income15 came to

€1,117m, up +2.7% compared to the first nine

months of 2022.

Income from equity-accounted

companies, at €73m, was up sharply by

+13.8% compared to the first nine months of 2022,

mainly driven by the JV in India.

Adjusted net earnings per

share15 were €4.46 for

the first nine months of 2023.

Accounting data for the first nine

months of 2023

Accounting net income, Group share came to

€866m. This amount includes the amortisation of

intangible assets (client contracts linked to the acquisition of

Lyxor and distribution agreements related to previous

acquisitions), representing -€44m after tax for the first nine

months of 2023. No integration costs were recorded for Lyxor during

the year.

Accounting net earnings per share for

the first nine months 2023 reached

€4.25.

-

Continued growth initiatives

Amundi is continuing its Ambitions 2025

strategic plan:

- Passive

management recorded strong inflows this quarter of

+€10.8bn, in index/smart beta products (+€7.2bn) and in ETFs

(+€3.6bn);

- In

Asia, inflows reached +€3.4bn, driven by the JV in India,

the start of stabilisation of JVs in China and strong activity in

Singapore (+€0.7bn), Japan (+€0.6bn) and Taiwan (+€0.3bn);

- In

Responsible Investment, Amundi Transition

Energétique16, in association with several Crédit Agricole Regional

banks, launched in September a new infrastructure fund to finance

local production and consumption of renewable energies in the

French regions; it is the third fund of this type in the Alba 2

investment programme. In addition, the range of funds that are part

of the Net Zero trajectory17 now covers five asset classes and

includes new funds this quarter, the objective being to achieve a

full range by 2025Finally, the share of ETFs tracking responsible

invertment indices has reached 32% of the range18, compared with

27% at the end of 2022 and on track to reach the target of 40% by

2025.

-

A solid financial structure

Tangible equity19 amounted to €4.1bn at 30

September 2023, up slightly compared to end-2022 (+€0.2bn) due to

the net income since the beginning of 2023 (+€0.9bn), and the

payment of dividends (-€0.8bn) last May for 2022.

On 19 September, FitchRatings confirmed

Amundi’s long-term rating of A+ with a stable outlook, which is the

best in the sector.

***

Financial disclosure schedule

- Investor &

Analyst Fixed income workshop in London: 15 December 2023

- Publication of Q4

and 2023 results: 7 February 2024

- Publication of Q1

2024 results: 26 April 2024

- General Meeting: 24

May 2024

- Publication of Q2

and H1 2024 results: 26 July 2024

- Publication of Q3

and 9M 2024 results: 30 October 2024

***

APPENDICES

Change in assets under management from

end-2019 to end-September 202320

|

(€bn) |

Assets under management |

Net inflows |

Market and forex effect |

Scope effect |

|

Change in AuM vs. previous quarter |

|

At 31/12/2019 |

1,653 |

|

|

|

|

+5.8% |

|

Q1 2020 |

|

-3.2 |

-122.7 |

|

/ |

|

|

At 31/03/2020 |

1,527 |

|

|

|

/ |

-7.6% |

|

Q2 2020 |

|

-0.8 |

+64.9 |

|

/ |

|

|

At 30/06/2020 |

1,592 |

|

|

|

/ |

+4.2% |

|

Q3 2020 |

|

+34.7 |

+15.2 |

|

+20.721 |

|

|

At 30/09/2020 |

1,662 |

|

|

|

/ |

+4.4% |

|

Q4 2020 |

|

+14.4 |

+52.1 |

|

/ |

|

|

At 31/12/2020 |

1,729 |

|

|

|

/ |

+4.0% |

|

Q1 2021 |

|

-12.7 |

+39.3 |

|

/ |

|

|

At 31/03/2021 |

1,755 |

|

|

|

/ |

+1.5% |

|

Q2 2021 |

|

+7.2 |

+31.4 |

|

/ |

|

|

At 30/06/2021 |

1,794 |

|

|

|

/ |

+2.2% |

|

Q3 2021 |

|

+0.2 |

+17.0 |

|

/ |

|

|

At 30/09/2021 |

1,811 |

|

|

|

/ |

+1.0% |

|

Q4 2021 |

|

+65.6 |

+39.1 |

|

+14822 |

|

|

At 31/12/2021 |

2,064 |

|

|

|

/ |

+14% |

|

Q1 2022 |

|

+3.2 |

-46.4 |

|

/ |

|

|

At 31/03/2022 |

2,021 |

|

|

|

/ |

-2.1% |

|

Q2 2022 |

|

+1.8 |

-97.75 |

|

/ |

|

|

At 30/06/2022 |

1,925 |

|

|

|

/ |

-4.8% |

|

Q3 2022 |

|

-12.9 |

-16.3 |

|

/ |

|

|

At 30/09/2022 |

1,895 |

|

|

|

/ |

-1.6% |

|

Q4 2022 |

|

+15.0 |

-6.2 |

|

/ |

|

|

At 31/12/2022 |

1,904 |

|

|

|

/ |

+0.5% |

|

Q1 2023 |

|

-11.1 |

+40.9 |

|

/ |

|

|

At 31/03/2023 |

1,934 |

|

|

|

/ |

+1.6% |

|

Q2 2023 |

|

+3.7 |

+23.8 |

|

/ |

|

|

At 30/06/2023 |

1,961 |

|

|

|

/ |

+1.4% |

|

Q3 2023 |

|

+13.7 |

-1.7 |

|

/ |

|

|

At 30/09/2023 |

1,973 |

|

|

|

/ |

+0.6% |

Total, one year, between 30 September 2022

and 30 September 2023: +4.1%

- Net inflows

+€22.2bn

- Market and foreign exchange

effects +€57.0bn

Breakdown of AuM and net inflows by

client segment23

|

(€bn)

|

AuM 30/09/2023 |

AuM 30/09/2022 |

% change vs. 30/09/2022 |

Q3 2023Inflows |

Q3 2022Inflows |

9M 2023Inflows |

9M 2022Inflows |

|

French networks |

126 |

114 |

+10.8% |

+0.9 |

+0.9 |

+4.6 |

-1.8 |

|

International networks |

156 |

156 |

-0.1% |

-1.0 |

-0.3 |

-3.2 |

+1.3 |

|

o/w Amundi BOC WM |

4 |

10 |

-63.8% |

-0.5 |

-1.8 |

-3.3 |

-1.5 |

|

Third-party distributors |

305 |

292 |

+4.3% |

+2.1 |

-3.3 |

+4.1 |

+9.6 |

| |

|

|

|

|

|

|

|

|

Retail |

587 |

562 |

+4.4% |

+2.0 |

-2.8 |

+5.6 |

+9.1 |

|

Institutional & Sovereigns (*) |

489 |

438 |

+11.6% |

+17.9 |

-4.7 |

+14.4 |

-15.5 |

|

Corporates |

97 |

84 |

+15.5% |

-3.8 |

-1.7 |

-7.4 |

-20.6 |

|

Employee savings plans |

84 |

71 |

+17.5% |

-0.9 |

-0.2 |

+2.6 |

+1.8 |

|

CA & SG insurers |

406 |

420 |

-3.1% |

-3.9 |

-2.2 |

-9.6 |

-3.0 |

| |

|

|

|

|

|

|

|

|

Institutionals |

1,076 |

1,013 |

+6.3% |

+9.3 |

-8.8 |

+0.0 |

-37.2 |

|

JVs |

310 |

319 |

-3.0% |

+2.4 |

-1.3 |

+0.7 |

+20.2 |

|

Total |

1,973 |

1,895 |

+4.1% |

+13.7 |

-12.9 |

+6.3 |

-8.0 |

(*) Including funds of funds.

Breakdown of AuM and net inflows by

asset class23

|

(€bn)

|

AuM 30/09/2023 |

AuM 30/09/2022 |

% change vs. 30/09/2022 |

Q3 2023Inflows |

Q3 2022Inflows |

9M 2023Inflows |

9M 2022Inflows |

|

Equities |

443 |

387 |

+14.6% |

+7.0 |

-2.3 |

+2.0 |

+9.0 |

|

Multi-assets |

274 |

287 |

-4.6% |

-5.9 |

-4.2 |

-17.0 |

+0.6 |

|

Bonds |

624 |

612 |

+2.1% |

+7.7 |

+3.7 |

+10.1 |

-1.4 |

|

Real, alternative and structured |

124 |

126 |

-1.1% |

-1.1 |

-0.8 |

+2.4 |

-0.8 |

| |

|

|

|

|

|

|

|

|

MLT ASSETS excl. JVs |

1,465 |

1,411 |

+3.8% |

+7.8 |

-3.5 |

-2.4 |

+7.5 |

|

Treasury Products excl. JVs |

198 |

165 |

+20.3% |

+3.5 |

-8.1 |

+8.0 |

-35.6 |

| |

|

|

|

|

|

|

|

|

Assets excl. JVs |

1,663 |

1,576 |

+5.6% |

+11.3 |

-11.6 |

+5.6 |

-28.2 |

|

JVs |

310 |

319 |

-3.0% |

+2.4 |

-1.3 |

+0.7 |

+20.2 |

|

TOTAL |

1,973 |

1,895 |

+4.1% |

+13.7 |

-12.9 |

+6.3 |

-8.0 |

|

o/w MLT assets |

1,745 |

1,698 |

+2.7% |

+11.3 |

-1.4 |

-0.7 |

+30.2 |

|

o/w Treasury products |

229 |

197 |

+16.1% |

+2.5 |

-11.6 |

+7.1 |

-38.2 |

Breakdown of AuM and net inflows by

geographic area24

|

(€bn)

|

AuM 30/09/2023 |

AuM 30/09/2022 |

% change vs. 30/09/2022 |

Q3 2023Inflows |

Q3 2022Inflows |

9M 2023Inflows |

9M 2022Inflows |

|

France |

903 |

858 |

+5.2% |

+4.1 |

-7.2 |

-1.2 |

-30.0 |

|

Italy |

197 |

190 |

+3.3% |

-1.5 |

+1.6 |

-2.2 |

+6.3 |

|

Europe excl. France & Italy |

353 |

319 |

+10.6% |

-0.8 |

-2.7 |

+6.0 |

-1.3 |

|

Asia |

391 |

403 |

-3.0% |

+3.4 |

-2.6 |

-0.4 |

+23.4 |

|

Rest of the world |

130 |

125 |

+4.1% |

+8.5 |

-2.1 |

+4.1 |

-6.4 |

| |

|

|

|

|

|

|

|

|

TOTAL |

1,973 |

1,895 |

+4.1% |

+13.7 |

-12.9 |

+6.3 |

-8.0 |

|

TOTAL outside France |

1,070 |

1,037 |

+3.2% |

-9.6 |

-5.7 |

+7.5 |

+22.0 |

Breakdown of AuM and net inflows by type

of management and asset class24

|

(€bn) |

AuM 30/09/2023 |

AuM 30/09/2022 |

% change vs. 30/09/2022 |

Q3 2023Inflows |

Q3 2022Inflows |

9M 2023Inflows |

9M 2022Inflows |

|

Active management |

1,022 |

1,011 |

+1.1% |

-1.9 |

+1.1 |

-15.6 |

+0.7 |

|

Equities |

187 |

167 |

+11.6% |

-1.6 |

+2.0 |

-2.5 |

+4.9 |

|

Multi-assets |

265 |

280 |

-5.4% |

-6.3 |

-4.3 |

-18.2 |

+0.5 |

|

Bonds |

570 |

563 |

+1.3% |

+6.1 |

+3.4 |

+5.1 |

-4.8 |

| |

|

|

|

|

|

|

|

|

Structured products |

35 |

28 |

+27.6% |

-0.2 |

+0.0 |

+2.9 |

-2.8 |

|

Passive management |

319 |

275 |

+16.1% |

+10.8 |

-3.8 |

+10.8 |

+7.5 |

|

ETF & ETC |

192 |

167 |

+14.7% |

+3.6 |

-4.8 |

+8.0 |

+4.6 |

|

Index & Smart Beta |

127 |

107 |

+18.4% |

+7.2 |

+1.0 |

+2.8 |

+2.9 |

| |

|

|

|

|

|

|

|

|

Real and Alternative assets |

89 |

98 |

-9.3% |

-0.9 |

-0.8 |

-0.5 |

+2.1 |

|

Real assets |

63 |

66 |

-4.2% |

-0.3 |

+0.3 |

+0.2 |

+3.0 |

|

Alternative assets |

25 |

32 |

-19.8% |

-0.6 |

-1.1 |

-0.7 |

-1.0 |

| |

|

|

|

|

|

|

|

|

MLT ASSETS excl. JVs |

1,465 |

1,411 |

+3.8% |

+7.8 |

-3.5 |

-2.4 |

+7.5 |

|

Treasury Products excl. JVs |

198 |

165 |

+20.3% |

+3.5 |

-8.1 |

+8.0 |

-35.6 |

| |

|

|

|

|

|

|

|

|

TOTAL ASSETS excl. JVs |

1,663 |

1,576 |

+5.6% |

+11.3 |

-11.6 |

+5.6 |

-28.2 |

|

JVs |

310 |

319 |

-3.0% |

+2.4 |

-1.3 |

+0.7 |

+20.2 |

|

TOTAL |

1,973 |

1,895 |

+4.1% |

+13.7 |

-12.9 |

+6.3 |

-8.0 |

|

o/w MLT assets |

1,745 |

1,698 |

+2.7% |

+11.3 |

-1.4 |

-0.7 |

+30.2 |

|

o/w Treasury products |

229 |

197 |

+16.1% |

+2.5 |

-11.6 |

+7.1 |

-38.2 |

Income statement for the first nine

months of the year

|

(€M) |

|

9M 2023 |

9M 2022 |

% chg.9M/9M |

| |

|

|

|

|

|

Net revenues - Adjusted |

|

2,397 |

2,347 |

+2.2% |

|

Management fees |

|

2,217 |

2,245 |

-1.3% |

|

Performance fees |

|

89 |

108 |

-17.2% |

|

Technology |

|

42 |

34 |

+25.8% |

|

Net financial & other income |

|

49 |

(40) |

NM |

|

Operating expenses - Adjusted |

|

(1,280) |

(1,259) |

+1.7% |

|

Cost/income ratio - Adjusted (%) |

|

53.4% |

53.7% |

-0.3pp |

| |

|

|

|

|

|

Gross operating income - Adjusted |

|

1,117 |

1,088 |

+2.7% |

|

Cost of risk & other |

|

(5) |

(4) |

+35.9% |

|

Equity-accounted companies |

|

73 |

64 |

+13.8% |

|

Pre-tax income - Adjusted |

|

1,185 |

1,148 |

+3.2% |

|

Corporate tax |

|

(277) |

(272) |

+2.0% |

|

Non-controlling interests |

|

3 |

(1) |

NM |

|

Net income Group share - Adjusted |

|

910 |

875 |

+4.0% |

|

Earnings per share - Adjusted (€) |

|

4.46 |

4.31 |

+3.6% |

Third-quarter income

statement

|

(€M) |

|

Q3 2023 |

Q3 2022 |

% chg.Q3/Q3 |

|

Q2 2023 |

% chg.Q3/Q2 |

| |

|

|

|

|

|

|

|

|

Net revenues - Adjusted |

|

780 |

758 |

+2.9% |

|

823 |

-5.3% |

|

Management fees |

|

737 |

747 |

-1.4% |

|

744 |

-1.1% |

|

Performance fees |

|

10 |

13 |

-18.7% |

|

51 |

-79.6% |

|

Technology |

|

14 |

12 |

+13.0% |

|

16 |

-12.3% |

|

Net financial & other income |

|

19 |

(13) |

NM |

|

13 |

+52.0% |

|

Operating expenses - Adjusted |

|

(424) |

(415) |

+2.3% |

|

(430) |

-1.4% |

|

Cost/income ratio - Adjusted (%) |

|

54.4% |

54.7% |

-0.3pp |

|

52.3% |

+2.1pp |

| |

|

|

|

|

|

|

|

|

Gross operating income - Adjusted |

|

356 |

343 |

+3.6% |

|

393 |

-9.5% |

|

Cost of risk & other |

|

(3) |

(0) |

NM |

|

(2) |

+30.1% |

|

Equity-accounted companies |

|

24 |

24 |

+2.0% |

|

27 |

-12.0% |

|

Pre-tax income - Adjusted |

|

377 |

366 |

+2.8% |

|

418 |

-9.9% |

|

Corporate tax |

|

(88) |

(85) |

+2.8% |

|

(99) |

-11.5% |

|

Non-controlling interests |

|

1 |

0 |

NM |

|

1 |

+26.5% |

|

Net income Group share - Adjusted |

|

290 |

282 |

+3.0% |

|

320 |

-9.3% |

|

Earnings per share - Adjusted (€) |

|

1.42 |

1.38 |

+2.6% |

|

1.57 |

-9.6% |

Methodology appendix

Accounting and adjusted

data

- Accounting

data – this includes amortisation of intangible assets

and, in 2022, Lyxor integration costs.

- Adjusted

data – in order to present an income statement closer to

economic reality, the following adjustments are made: restatement

of the amortisation of distribution agreements with Bawag,

UniCredit and Banco Sabadell and the intangible asset representing

Lyxor's client contracts, recognised as a deduction from net

revenues, and restatement of Lyxor's integration costs in

2022.

The amortisation of distribution

agreements and intangible assets representing Lyxor's client

contracts had the following impact on accounting data:

- Q3 2022: -€20m

before tax and -€15m after tax

- 9M 2022: -€61m

before tax and -€44m after tax

- Q2 2023: -€20m

before tax and -€15m after tax

- Q3 2023: -€20m

before tax and -€15m after tax

- 9M 2023: -€61m

before tax and -€44m after tax

Acquisition of Lyxor

- In accordance with

IFRS 3, recognition in Amundi’s balance sheet as of 31/12/2021:

- of goodwill

amounting to €652m;

- of an intangible

asset (representing client contracts) of -€40m before tax (-€30m

after tax), which will be amortised on a straight-line basis over 3

years;

- In the Group’s

income statement, the net tax impact of this amortisation of the

intangible asset is -€10m over a full year (i.e. -€13m before

tax). This

amortisation is recognised as a deduction from net revenues and is

added to the existing amortisation of distribution

agreements. In Q3

2022, Q2 and Q3 2023, the amortisation expense for this intangible

asset after tax was -€2m (i.e. -€3m before tax); in 9M 2022 and 9M

2023 it was -€6m (i.e. -€8m before tax).

- Integration

costs were fully recognised in 2022 and 2021, for a total

of €77m before tax and €57m after tax, o/w €40m before tax (€30m

after tax) in Q3 2022 and €51m before tax (€37m after tax) in 9M

2022. No integration costs were recognised in 2023.

Alternative performance

indicators25

In order to present an income statement that is

closer to economic reality, Amundi publishes adjusted data

excluding the amortisation of intangible assets.Adjusted,

standardised data reconciles with accounting data as follows:

|

(€m) |

|

9M 2023 |

9M 2022 |

|

Q3 2023 |

Q3 2022 |

|

Q2 2023 |

| |

|

|

|

|

|

|

|

|

|

Net revenues (a) |

|

2,336 |

2,286 |

|

760 |

738 |

|

803 |

|

- Amortisation of intangible assets before tax |

|

(61) |

(61) |

|

(20) |

(20) |

|

(20) |

|

Net revenues - Adjusted (b) |

|

2,397 |

2,347 |

|

780 |

758 |

|

823 |

| |

|

|

|

|

|

|

|

|

|

Operating expenses (c) |

|

(1,280) |

(1.318) |

|

(424) |

(423) |

|

(430) |

|

Integration costs before tax |

|

0 |

(59) |

|

0 |

(9) |

|

0 |

|

Operating expenses - Adjusted (d) |

|

(1,280) |

(1,259) |

|

(424) |

(415) |

|

(430) |

| |

|

|

|

|

|

|

|

|

|

Gross operating income (e) = (a) + (c) |

|

1,056 |

967 |

|

335 |

314 |

|

373 |

|

Gross operating income - Adjusted (f) = (b) +

(d) |

|

1,117 |

1,088 |

|

356 |

343 |

|

393 |

| |

|

|

|

|

|

|

|

|

|

Cost/income ratio (%) – (a)/(c) |

|

54.8% |

57.7% |

|

55.9% |

57.4% |

|

53.6% |

|

Cost/income ratio - Adjusted (%) – (d)/(b) |

|

53.4% |

53.7% |

|

54.4% |

54.7% |

|

52.3% |

| |

|

|

|

|

|

|

|

|

|

Cost of risk & other (g) |

|

(5) |

(4) |

|

(3) |

(0) |

|

(2) |

|

Equity-accounted companies (h) |

|

73 |

64 |

|

24 |

24 |

|

27 |

|

Pre-tax income (i) = (e) + (g) + (h) |

|

1,124 |

1,027 |

|

356 |

337 |

|

398 |

|

Pre-tax income - Adjusted (j) = (f) + (g) +

(h) |

|

1,185 |

1,148 |

|

377 |

366 |

|

418 |

|

Income tax (k) |

|

(260) |

(239) |

|

(82) |

(77) |

|

(93) |

|

Income tax charge - Adjusted (l) |

|

(277) |

(272) |

|

(88) |

(85) |

|

(99) |

|

Non-controlling interests (m) |

|

3 |

(1) |

|

1 |

0 |

|

1 |

|

Net income, Group share (n)= (i)+(k)+(m) |

|

866 |

787 |

|

276 |

261 |

|

305 |

|

Adjusted net income, Group share (o) =

(j)+(l)+(m) |

|

910 |

875 |

|

290 |

282 |

|

320 |

| |

|

|

|

|

|

|

|

|

|

Earnings per share (€) |

|

4.25 |

3.87 |

|

1.35 |

1.28 |

|

1.50 |

|

Earnings per share - Adjusted (€) |

|

4.46 |

4.31 |

|

1.42 |

1.38 |

|

1.57 |

Shareholder structure

|

|

30 September 2022 |

31 December 2022 |

30 June 2023 |

30 September 2023 |

|

|

|

|

|

|

|

|

Number of shares |

% of share capital |

Number of shares |

% of share capital |

Number of shares |

% of share capital |

Number of shares |

% of share capital |

|

Crédit Agricole Group |

141,057,399 |

69.19% |

141,057,399 |

69.19% |

141,057,399 |

69.19% |

141,057,399 |

68.93% |

|

Employees |

2,353,097 |

1.15% |

2,279,907 |

1.12% |

2,314,287 |

1.14% |

3,018,388 |

1.47% |

|

Treasury shares |

1,399,468 |

0.69% |

1,343,479 |

0.66% |

1,315,690 |

0.65% |

1,297,231 |

0.63% |

|

Free float |

59,050,167 |

28.97% |

59,179,346 |

29.03% |

59,172,755 |

29.03% |

59,274,616 |

29.15% |

|

Number of shares at end of period |

203,860,131 |

100.0% |

203,860,131 |

100.0% |

203,860,131 |

100.0% |

204,647,634 |

100.0% |

|

Average number of shares year-to-date |

203,264,547 |

- |

203,414,667 |

- |

203,860,131 |

- |

204,050,516 |

- |

|

Average number of shares quarter-to-date |

203,638,148 |

- |

203,860,131 |

- |

203,860,131 |

- |

204,425,079 |

- |

- Average number of

shares on a pro-rata basis.

- The capital

increase reserved for employees took place on 27 July 2023. 787,503

shares (~0.4% of the capital before the transaction) were created,

bringing the portion of capital owned by employees to 1.47%,

compared to 1.14% before the transaction.

- The average number

of shares increased by 0.3% between Q2 and Q3 2023, by 0.4% between

Q3 2022 and Q3 2023 and by 0.4% between the first nine months of

2022 and the first nine months of 2023.

About Amundi

Amundi, the leading European asset manager,

ranking among the top 10 global players26, offers its 100 million

clients - retail, institutional and corporate - a complete range of

savings and investment solutions in active and passive management,

in traditional or real assets. This offering is enhanced with IT

tools and services to cover the entire savings value chain. A

subsidiary of the Crédit Agricole group and listed on the stock

exchange, Amundi currently manages more than €1.95 trillion of

assets27.

With its six international investment hubs28,

financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape.

Amundi clients benefit from the expertise and

advice of 5,400 employees in 35 countries.

Amundi, a trusted partner, working every

day in the interest of its clients and society.

www.amundi.com

Press contacts:

Natacha

Andermahr Tel. +33 1 76 37 86

05natacha.andermahr@amundi.com

Corentin HenryTel. +33 1 76 36 26

96corentin.henry@amundi.com

Investor contacts:Cyril Meilland,

CFATel. +33 1 76 32 62

67cyril.meilland@amundi.com

Thomas LapeyreTel. +33 1 76 33 70

54thomas.lapeyre@amundi.com

DISCLAIMER:

This press release may contain forward-looking

information concerning Amundi's financial position and results.

These data do not represent forecasts within the meaning of

Delegated Regulation (EU) 2019/980.

This forward-looking information includes

projections and financial estimates derived from scenarios based on

a number of economic assumptions in a given competitive and

regulatory environment, project considerations, objectives and

expectations related to future events and operations, products and

services, and assumptions in terms of future performance and

synergies. These assumptions are, by nature, subject to random

factors liable to result in the failure to achieve the

forward-looking statements. Consequently, no guarantee can be given

as to the achievement of these projections and estimates, and

Amundi's financial position and results may differ significantly

from those projected or included in the forward-looking information

contained in this press release. Under no circumstances does Amundi

undertake to publish any changes or updates to this forward-looking

information, which is given as of the date of this press release.

More detailed information on the risks likely to affect Amundi's

financial position and results can be found in the "Risk Factors"

section of our Universal Registration Document filed with the

Autorité des Marchés Financiers. Readers should consider all of

these uncertainty and risk factors before making their own

decisions.

The figures presented have been prepared in

accordance with IFRS as adopted by the European Union and

applicable at that date, and with prudential regulations currently

in force. This financial information does not constitute a set of

financial statements for an interim period as defined by IAS 34

“Interim Financial Reporting” and has not been audited.

Unless otherwise stated, the sources of rankings

and market positions are internal. The information contained in

this press release, to the extent that it relates to parties other

than Amundi, or is derived from external sources, has not been

reviewed by a supervisory authority or has not been subject to

independent verification more generally, and no representation or

warranty has been expressed as to, nor should any reliance be

placed on, the fairness, accuracy, precision or completeness of the

information or opinions contained in this press release. Neither

Amundi nor its representatives may be held liable for any decision

taken or negligence or for any losses that may result from the use

of this press release or its content, or anything relating to them,

or any document or information to which it may refer.

The sum of the values presented in the tables

and analyses may differ slightly from the total reported due to

rounding.

1 Medium/Long-Term

Assets, excluding

JVs2 Net income,

Group

share3 Adjusted

data: excluding the amortisation of intangible assets and Lyxor

integration costs in 2022 (see Note on p. 8).4

As part of the Alba

2 investment programme5

In number of ETFs6

Quarterly averages,

Bloomberg Euro Aggregate for bond markets7

Quarterly averages,

10-year OAT yield8

Quarterly averages,

composite index 50% MSCI World + 50% Eurostoxx 600 for equity

markets9 Sources:

Morningstar FundFile, ETFGI. European open-ended & cross-border

funds (excluding mandates and dedicated funds). Data as of end of

June 2023.10

Medium/Long-Term

Assets11 Excluding

JVs12 Net inflows

include assets under advisory, marketed assets and funds of funds,

including 100% of the net inflows of the Asian JVs; for Wafa

Gestion in Morocco, net inflows are reported for Amundi’s share in

the JV’s

capital.13 Adjusted

data: excluding the amortisation of intangible assets and Lyxor

integration costs in 2022 (see Note on p. 8).14

Source:

Eurostat.15 Adjusted

data: excluding the amortisation of intangible assets and Lyxor

integration costs in 2022 (see Note on p. 8).16

Filiale à 100%

d’Amundi17 All

passively managed Net Zero Ambition funds comply with EU CTB/PAB

requirements.18 As a

percentage of the number of ETFs

managed.19 Shareholders’

equity less goodwill and intangible

assets.20 Assets

under management and net inflows including advised assets and

marketed assets and including 100% of the net inflows and assets

under management of the joint-ventures in Asia; for Wafa Gestion in

Morocco, assets under management and inflows are reported in

proportion to Amundi’s holding.21

Sabadell AM22

Lyxor, integrated

on

31/12/202123 Assets

under management and net inflows including advised assets and

marketed assets and including 100% of the net inflows and assets

under management of the joint-ventures in Asia; for Wafa Gestion in

Morocco, assets under management and inflows are reported in

proportion to Amundi’s

holding.24 Assets

under management and net inflows including advised assets and

marketed assets and including 100% of the net inflows and assets

under management of the joint-ventures in Asia; for Wafa Gestion in

Morocco, assets under management and inflows are reported in

proportion to Amundi’s

holding.25 See also

section 4.3 of Amundi Group’s 2022 Universal Registration Document

filed with the AMF on 7 April

2023.26 Source: IPE

"Top 500 Asset Managers" published in June 2023 based on assets

under management at 31/12/202227

Amundi data as at

30/09/202328

Boston, Dublin,

London, Milan, Paris and Tokyo

- Amundi PR results Q3&9M 2023_EN

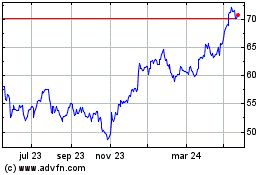

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

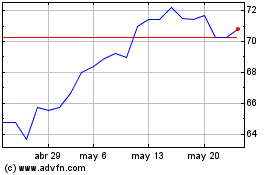

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024