Amundi and Victory Capital announce plan to establish a strategic

partnership

Amundi and Victory Capital announce plan

to establish a strategic partnership:

- Amundi US to combine into Victory Capital

- Amundi to become a strategic shareholder of Victory

Capital

- Reciprocal 15-year exclusive distribution

agreements

Paris (France) & San Antonio (Texas,

United-States) 16 April 2024, Amundi and Victory Capital

(Nasdaq: VCTR) are announcing today that they have signed a

Memorandum of Understanding to combine Amundi US into Victory

Capital, for Amundi to become a strategic shareholder of Victory

Capital, and to establish long-term global distribution agreements.

The proposed transaction would create a broader US investment

platform for clients of both firms, provide Amundi with access to a

wider set of US-managed capabilities, and expand worldwide

distribution for Victory Capital.

The proposed transaction would benefit clients

of both firms with a broader range of asset classes including

actively managed fixed income, equity, and multi-asset investment

strategies offered through a variety of investment vehicles

including separately managed accounts, ETFs, mutual funds, UCITs,

collective investment trusts, and model portfolios.

Victory Capital is a fast growing, diversified

US-based asset management firm with $175bn of total client assets,

and a proven acquisition track record. The company’s differentiated

platform preserves the investment autonomy of a variety of

independent investment teams, all of whom leverage the benefits of

a fully integrated, centralized operating and distribution

platform.

Amundi US currently manages $104bn of assets

across a broad array of asset classes, including US and global

equity, fixed income and multi-asset investment capabilities for

individuals and institutions worldwide. Amundi US leverages

Amundi’s expansive international distribution footprint, managing a

significant amount of assets and portfolios on behalf of non-US

retail and institutional clients.

The addition of Amundi US as Victory Capital’s

largest Investment Franchise would meaningfully enhance Victory

Capital’s scale, expand its global client base, and further

diversify its investment capabilities, given Amundi US‘s broad

investment capabilities and strong long-term investment

performance.

Under the proposed transaction:

- Amundi US would

be combined into Victory Capital in exchange for a 26.1% economic

stake for Amundi in Victory Capital, with no cash payment involved.

Amundi would become a strategic shareholder of Victory Capital with

two of its representatives joining the Victory Capital Board of

Directors when the transaction closes.

- Both parties

would simultaneously enter into 15-year reciprocal distribution

agreements.

Under these proposed distribution

agreements:

- Amundi would be the distributor of

Victory Capital’s investment offering outside of the US. This would

allow Victory Capital to further expand its reach beyond the US

through Amundi’s global client base, which would benefit from

Victory Capital’s deep investment expertise and strong investment

performance track record across a wider range of US-manufactured

solutions.

- Victory Capital would become the

distributor of Amundi’s non-US manufactured products in the US. As

a result, Amundi would gain access to an expanded distribution

platform in the US, while providing Victory Capital’s clients with

its wide range of high-performing non-US investment

capabilities.

The proposed transaction would enable both

parties to further their respective strategic goals:

- It would allow Amundi to strengthen

its access to the US market via a larger US investment and

distribution platform, as well as to provide Amundi’s clients with

access to a broader and even more differentiated range of US

investment solutions;

- It would enable Victory Capital to

strategically extend its platform with the addition of its largest

Investment Franchise, which would meaningfully expand and diversify

its client base both in the US and outside the US. It also would

present Victory Capital with a unique opportunity to sell the

combined Victory Capital and Amundi US strategies to non-US clients

through Amundi’s entire global distribution network and joint

ventures. Victory Capital’s clients would benefit from expanded US

and non-US investment capabilities and products in complementary

asset classes.

As contemplated, the transaction is expected to

be accretive for the shareholders of both Victory Capital and

Amundi, increasing adjusted net income and earnings per share for

both companies.

The parties are working toward definitive

agreement, which is expected to be announced by the end of the

second quarter.

About this opportunity, Valérie Baudson,

Chief Executive Officer of Amundi, commented: “The

proposed transaction with Victory Capital is a unique opportunity

to strengthen our presence in the US, while becoming a strategic

shareholder in a reputable US based asset management firm with an

excellent track record of growth. It would expand our access to

top-performing US investment strategies for the benefit of our

clients globally. Additionally, Amundi would greatly benefit from

expanded distribution strength in the US market. The combination

would provide a significant catalyst for growth for Amundi.

Overall, this is a compelling proposition for our clients and our

employees; it would also be a value-creating deal for our

shareholders with significant prospects for both revenue growth and

synergies.”

David Brown, Chairman and Chief

Executive Officer of Victory Capital, added: “This

transaction would benefit the clients, employees, and shareholders

of both organizations. Strategically, bringing the Amundi U.S.

business on to our platform increases our size and scale, adds new

investment capabilities, and further strengthens our U.S.

distribution with the addition of new talent and relationships. At

the same time, the distribution agreement would immediately

position our products for success through Amundi’s extensive and

effective distribution channels throughout the world. Financially,

the transaction would create shareholder value, be accretive to

earnings, and increase our financial flexibility. Moreover, having

Amundi as a strategic shareholder in our firm would strengthen our

alignment on the distribution agreement and establish the

foundation for an enduring and mutually beneficial long-term

relationship.”

The Memorandum of Understanding is non-binding

on the parties. As with any negotiation, there is no certainty that

these negotiations will result in a definitive agreement. The

ultimate completion of a transaction would remain subject to

conditions, including regulatory approvals.

FORWARD-LOOKING

STATEMENTS

This press release may contain forward-looking

statements within the meaning of applicable U.S. federal and

non-U.S. securities laws. These statements may include, without

limitation, any statements preceded by, followed by or including

words such as “target,” “believe,” “expect,” “aim,” “intend,”

“may,” “anticipate,” “assume,” “budget,” “continue,” “estimate,”

“future,” “objective,” “outlook,” “plan,” “potential,” “predict,”

“project,” “will,” “can have,” “likely,” “should,” “would,” “could”

and other words and terms of similar meaning or the negative

thereof and include, but are not limited to, statements regarding

the proposed transaction and the outlook for Victory Capital’s or

Amundi’s future business and financial performance. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Victory

Capital’s and Amundi’s control and could cause Victory Capital’s

and Amundi’s actual results, performance or achievements to be

materially different from the expected results, performance or

achievements expressed or implied by such forward-looking

statements.

Although it is not possible to identify all such

risks and factors, they include, among others, the following: the

fact that the Memorandum of Understanding is non-binding and there

is no certainty that the negotiations will result in definitive

agreements on the anticipated timeline, if at all, or that the

currently contemplated terms will not change; risks that conditions

to closing will fail to be satisfied and that the transaction will

fail to close on the anticipated timeline, if at all; risks

associated with the expected benefits, or impact on the Victory

Capital’s and Amundi’s respective businesses, of the proposed

transaction, including the ability to achieve any expected

synergies; and other risks and factors relating to Victory

Capital’s and Amundi’s respective businesses contained in their

respective public filings

About AmundiAmundi, the leading

European asset manager, ranking among the top 10 global players1,

offers its 100 million clients - retail, institutional and

corporate - a complete range of savings and investment solutions in

active and passive management, in traditional or real assets. This

offering is enhanced with IT tools and services to cover the entire

savings value chain. A subsidiary of the Crédit Agricole group and

listed on the stock exchange, Amundi currently manages more than €2

trillion of assets2.

With its six international investment hubs3,

financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape.

Amundi clients benefit from the expertise and advice of 5,400

employees in 35 countries.

Amundi, a trusted partner, working every day in the

interest of its clients and society.

www.amundi.com

About Victory Capital

Victory Capital is a diversified global asset management firm

with total assets under management of $170.3 billion, and $175.5

billion in total client assets, as of March 31, 2024. The Company

employs a next-generation business strategy that combines boutique

investment qualities with the benefits of a fully integrated,

centralized operating and distribution platform.

Victory Capital provides specialized investment strategies to

institutions, intermediaries, retirement platforms and individual

investors. With 11 autonomous Investment Franchises and a Solutions

Business, Victory Capital offers a wide array of investment

products and services, including mutual funds, ETFs, separately

managed accounts, alternative investments, third-party ETF model

strategies, collective investment trusts, private funds, a 529

Education Savings Plan, and brokerage services.

Victory Capital is headquartered in San Antonio, Texas, with

offices and investment professionals in the U.S. and around the

world. To learn more please visit www.vcm.com or follow Victory

Capital on Facebook, Twitter, and LinkedIn.

Amundi

Press contacts:

Natacha

Andermahr Tel. +33 1 76 37 86

05natacha.andermahr@amundi.com

Corentin HenryTel. +33 1 76 36 26

96corentin.henry@amundi.comGeoff Smith

Amundi USTel. +1 617 422

4758Geoff.Smith@amundi.com

Investor contacts:Cyril Meilland,

CFATel. +33 1 76 32 62

67cyril.meilland@amundi.com

Thomas LapeyreTel. +33 1 76 33 70

54thomas.lapeyre@amundi.com

Victory Capital

Press contact: Jessica

DavilaTel. +1 210-694-9693Jessica_davila@vcm.com

Investor contact:Matthew Dennis,

CFATel. +1 216-898-2412mdennis@vcm.com

* * *

1 Source: IPE “Top 500 Asset Managers” published

in June 2023, based on assets under management as at 31/12/20222

Amundi data as at 31/12/20233 Boston, Dublin, London, Milan, Paris

and Tokyo

- Press Release Amundi and Victory Capital announce plan to

establish a strategic partnership

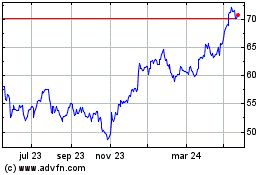

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

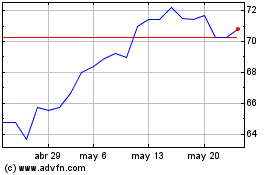

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024