Amundi: First Quarter 2024 Results

Amundi: First Quarter 2024

Results

Assets under management at an all-time

highHealthy inflows of +€17bn, net

income1,2

up +6% Q1/Q1

|

Net income Growth |

|

High level of adjusted net

income1,2

Q1 2024: €318m, +5.9% Q1/Q1

- Driven by the growth

of net management fees: +4.0% Q1/Q1

- Combined with cost

control

-

Cost-income ratio of 53.3%2, at

the best level in the industry

|

|

|

|

|

|

High & Diversified Net

inflows |

|

Record level assets under management: €2,116bn as

of 31 March 2024, +9.4% year-on-yearNet

inflows Q1 2024: +€16.6bn

-

Balanced by main client segments, expertise and

geographies

-

Positive in active management, driven by bond

solutions

|

|

|

|

|

|

Continuing Development |

|

Development in line with the priorities of the 2025

Strategic Ambitions plan:

- Third party

Distribution: net inflows +€7bn

- Passive

management: +€5.0bn of inflows in ETFs

- Asia:

AuM of €422bn, +6% over the quarter, very diversified inflows

between the main countries of the zone

-

Technology & services: Amundi Technology

revenue +36% Q1/Q1, 61 clients (+4 in Q1)

|

|

|

|

|

|

Two Value-creating

Operations |

|

Closing on 2 April, ahead of schedule, of the

acquisition of Alpha Associates, a specialist in

the multi-management of private assets (private debt,

infrastructures, private equity)Signing on April

15 of a strategic partnership memorandum of

understanding3 in the US with Victory

Capital |

Paris, 26 April 2024

The Board of Directors of Amundi met on

25 April 2024 under the chairmanship of Philippe Brassac and

approved the financial statements for the first quarter of

2024.

Valérie Baudson, Chief Executive

Officer, stated:

“We had a particularly intense start to the

year, both in terms of sales momentum and the development according

to our strategic priorities. We were able to combine organic and

external growth, in line with our 2025 Strategic Ambitions

plan.

Our net inflows, which reached +€17 billion, are

very balanced across the main client segments, expertise and

geographies. This shows the good positioning of our range of

solutions, which allows us to respond effectively to the needs of

our clients. Our assets under management reached their highest

level ever, at more than €2,100bn.

This activity is also reflected in our

profitability: the net income1,2 for the first quarter, at €318m,

is up +6% year-on-year, driven by the increase of our net

management fees and the control of our costs.

Finally, two external growth operations that are

significant for our future development mark the beginning of the

year. The acquisition of Alpha Associates is now finalised, three

months ahead of schedule. Starting in the second quarter, our

clients will therefore benefit from new high-performance solutions

in the multi-management of private assets. Secondly, the

partnership3 with the US manager Victory Capital will strengthen

our presence in the United States and our US asset management

expertise. It also brings strong value creation for our clients and

our shareholders.

These initiatives, combined with our sustained

organic investments, are promising for our future business and

results.”

Highlights of the First Quarter of

2024

Rising markets, but a European asset

management market that is still slowing down

Since the beginning of 2024, both

equity4 and

bond5 markets extended

their rally of the end of 2023. Year-on-year, they gained +14.5%

and +4.2% respectively in average value for Q1 2024, compared to

the same quarter last year.

However, investors remain strongly risk-averse

in the asset management market in Europe, which is

reflected by an idling of inflows in open-ended funds6, at +€90bn

in the first quarter, down slightly compared to Q4 2023 (+€104bn).

As in the previous quarter, net inflows were mainly driven by

treasury products (+€28bn) and passive management (+€68bn), while

net flows in medium-long term active management remained negative

(-€6bn).

Amundi continues its development, both

organic and through value-creating external operations

The beginning of the year was marked by two

important external operations:

- The acquisition of

Alpha Associates, announced7 at the publication of

the annual results in early February, was finalised on 2 April.

Alpha will be integrated starting in the second quarter, with

assets under management reaching €9 billion at the end of

March 2024; this operation strengthens our expertise and creates a

European leader in the field of multi-management of private assets,

whose solutions can be distributed to Amundi’s large institutional

client base and adapted to the needs of Retail clients. The

revenue synergies related to this acquisition are expected to

exceed €20 million in the fifth year; the operation should

generate a return on investment of more than 13% after 3

years.

- A memorandum

of3understanding7 was signed on 15 April with Victory

Capital, a US asset manager, to establish a strategic

partnership aimed at combining Amundi’s activities in the United

States into Victory Capital, in exchange for a 26.1% economic stake

for Amundi in Victory Capital and 15-year reciprocal international

distribution agreements ; the merger of Amundi US and Victory

Capital would create a larger US investment platform serving the

clients of both companies; Amundi would thus have a greater number

of US and global management expertise to offer its clients, while

Victory Capital would expand its capacities to distribute its

products outside the United States. The transaction is expected to

be accretive for Amundi shareholders, with an increase of the

adjusted net income and EPS.

These operations aim to accelerate the

Group’s organic development, which reached new milestones

in the first quarter:

- In

Asia, assets under management increased sharply, by +6% in

the quarter alone, reaching €422bn, with net inflows of

+€6.8bn from Asian JVs (+€4.4bn, in particular in

India and Korea), and also from the other countries where Amundi is

located (China, Hong Kong, Singapore, Japan) for +€2.4bn;

- Contrary to the

trend in the European fund market, Amundi’s active

management8 showed positive inflows in the first quarter,

at +€1.3bn, excluding JVs, thanks to a very good sales momentum in

bond strategies: +€12.0bn, excluding JVs, in particular on Target

Maturity funds (+€3.5bn);

- Passive

management recorded strong net inflows in ETFs

(+€5.0bn), bringing assets under management to €227bn at the end of

March 2024, with, once again, good net inflows in fixed income ETFs

(+€1.6bn);

- Third-party

Distribution recorded its highest level of activity in two

years, with net inflows of +€7.0bn, with assets under management

now reaching €345bn, i.e., more than 53% of the Retail segment;

- Amundi

Technology saw its revenues increase by +35.7%

year-on-year, with 61 clients at the end of March

2024 (+4 in Q1);

- Lastly, in

Responsible Investment, Amundi’s subsidiary CPR AM

launched the first thematic strategy on biodiversity with major

institutional players; this first fund will allow the roll-out in

2024 of new strategies on this theme for retail clients; Amundi

also launched, with IFC, a World Bank subsidiary, a fund for the

development of Sustainable Bonds markets in emerging countries:

nearly €0.5bn was mobilised with major institutional clients; this

initiative confirms Amundi’s position as one of the world’s leaders

in blended finance projects on post-project transition issues

carried out with supranational agencies, IFC, EIB or AIIB.

-

Activity

High and diversified inflows, by main

client segments, geographies and types of management

As of 31 March 2024,

assets managed by Amundi reached their highest

level ever, at €2.116 trillion, up +9.4%

year-on-year (compared with the end of March 2023) and up

+3.9% over the quarter. They are driven by market dynamics, a

positive foreign exchange effect, as well as net

inflows, which reached +€53.5bn over 12

months to the end of March 2024.

In Q1 2024, Amundi generated

high net inflows of +€16.6bn, balanced by

main client segments, by expertise and by geography, a

sign of the success of Amundi’s expertise across its whole range of

solutions.

By client segments, net inflows

reached +€6.5bn for Retail, +€5.6bn for the Institutional segment

and + €4.5bn for JVs.

- The Retail

segment benefits from the strong sales momentum of

Third-Party Distributors, at

+€7.0bn, including + €5.0bn in MLT Assets, driven

by ETFs and actively-managed bond solutions. The French

Networks also records positive net flows of +€1.5bn,

thanks to treasury products. Conversely, the net outflows in

International Retail Networks (-€1.9bn) are due to

withdrawals on the Italian networks, in line with market trends,

and despite good net inflows in Sabadell network in Spain.

- The

Institutional segment is also diversified: net

inflows are driven by treasury products (+€3.9bn), despite the

seasonal outflows of Corporates, and it is also positive for MLT

Assets (+€1.7bn). In this category, net inflows reached +€3.4bn for

the Institutionals & Sovereigns segment, despite the exit on a

low margin index mandate for -€5bn.

-

JVs continue to show a high level of overall net

inflows thanks to India (SBI MF, +€2.9bn), and South Korea

(NH-Amundi +€1.5bn). Our JV in China with ABC (ABC-CA -€0.1bn)

confirms its stabilisation and returns to balance.

By major asset classes and excluding

JVs, treasury products (+€8.7bn) benefit

from the attraction of high short-term interest rates. MLT

Assets9 (+€3.4bn) also

experienced a good level of inflows, balanced by types of

management:

- Passive

management (+€2.5bn) benefited from the good momentum on

ETFs (+€5.0bn); inflows in index and smart beta products were also

satisfactory, but recorded a negative quarter due to the exit on

the index mandate mentioned above;

- Active

management, structured products, real and alternative assets

(+€0.9bn) resisted well, in a European open-ended fund

market showing net outflows; as in previous quarters, fixed income

expertise (+€12.0bn) and structured products (+€0.6bn) were

favoured by investors, while equities, multi-assets, real estate

and liquid alternative funds registered net outflows.

Finally, by geography, Europe

collected net inflows of +€12.8bn, Asia +€6.8bn and the Americas

+€1.0bn.

-

First Quarter 2024 Results

Net

Income10,,11

up +6% Q1/Q1 to €318m

Profitability at a high level in

Q1

Adjusted

data11

In Q1 2024, the adjusted net

income11 reached €318m, up +5.9% compared

to Q1 2023. This growth was fuelled by a significant

increase in revenues, up +3.8% compared to Q1 2023, to

€824m:

- Net

management fees experienced a high growth of +4.0%

compared to Q1 2023, driven by the increase in average assets under

management (excluding JVs) of +5.9%, in a context of market

appreciation; net inflows were nevertheless concentrated on less

risky products;

- Performance

fees went down to €18m;

- Technology

revenues, up +35.7% to

€18m, benefited from the addition of new clients over the past

year (+10), and the increase in license fees;

- finally,

net financial income rose very

strongly, by +43.1% to €23m, driven by the

increase in short term rates, which gained +130bp12 between Q1 2023

and Q1 2024.

Operating

expenses11 (€439m) remained controlled,

at +3.3% compared to Q1 2024, below the growth in revenues over the

same period (+3.8%), thus giving rise to a positive jaws effect.

The continuous productivity efforts have absorbed the acceleration

in investments for the development of Amundi Technology.

This jaws effect results in an improvement in

the cost-income ratio, at the best level in the sector at

53.3%11.

It also translates into an acceleration in the

growth of Adjusted Gross Operating

Income11 (GOI), up

+4.4% compared to Q1 2023, to

€385m.

Income from equity-accounted companies,

at €29m, also increased, by +30.2%

compared to Q1 2023, mainly thanks to the continued strong growth

of our JV in India.

Adjusted Net Earnings per

Share11 reached €1.55 in

Q1 2024.

Accounting data for Q1 2024

Net income, Group share, amounted to

€303m and included the amortisation of intangible

assets (client contracts related to the Lyxor acquisition and

distribution contracts related to previous operations), i.e. -€15m

after tax.

Accounting Net Earnings per Share in Q1

2024 reached €1.47.

***

APPENDICES

Change in assets under management from

the end of 2020 to the end of December

202313

|

(€bn) |

Assets under management |

NetInflows |

Market and foreign

exchangeeffect |

Scope effect |

|

Variation in AuM vs previous quarter |

|

As of 31/12/2020 |

1,729 |

|

|

|

/ |

+4.0% |

|

Q1 2021 |

|

-12.7 |

+39.3 |

|

/ |

|

|

As of 31/03/2021 |

1,755 |

|

|

|

/ |

+1.5% |

|

Q2 2021 |

|

+7.2 |

+31.4 |

|

/ |

|

|

As of 30/06/2021 |

1,794 |

|

|

|

/ |

+2.2% |

|

Q3 2021 |

|

+0.2 |

+17.0 |

|

/ |

|

|

As of 30/09/2021 |

1,811 |

|

|

|

/ |

+1.0% |

|

Q4 2021 |

|

+65.6 |

+39.1 |

|

+14814 |

|

|

As of 31/12/2021 |

2,064 |

|

|

|

/ |

+14% |

|

Q1 2022 |

|

+3.2 |

-46.4 |

|

/ |

|

|

As of 31/03/2022 |

2,021 |

|

|

|

/ |

-2.1% |

|

Q2 2022 |

|

+1.8 |

-97.75 |

|

/ |

|

|

As of 30/06/2022 |

1,925 |

|

|

|

/ |

-4.8% |

|

Q3 2022 |

|

-12.9 |

-16.3 |

|

/ |

|

|

As of 30/09/2022 |

1,895 |

|

|

|

/ |

-1.6% |

|

Q4 2022 |

|

+15.0 |

-6.2 |

|

/ |

|

|

As of 31/12/2022 |

1,904 |

|

|

|

/ |

+0.5% |

|

Q1 2023 |

|

-11.1 |

+40.9 |

|

/ |

|

|

As of 31/03/2023 |

1,934 |

|

|

|

/ |

+1.6% |

|

Q2 2023 |

|

+3.7 |

+23.8 |

|

/ |

|

|

As of 30/06/2023 |

1,961 |

|

|

|

/ |

+1.4% |

|

Q3 2023 |

|

+13.7 |

-1.7 |

|

/ |

|

|

As of 30/09/2023 |

1,973 |

|

|

|

/ |

+0.6% |

|

Q4 2023 |

|

+19.5 |

+63.8 |

|

-20.0 |

|

|

As of 31/12/2023 |

2,037 |

|

|

|

/ |

+3.2% |

|

Q1 2024 |

|

+16.6 |

+63.0 |

|

/ |

|

|

As of 31/03/2024 |

2,116 |

|

|

|

/ |

+3.9% |

Total one year between 31 March 2023 and 31

March 2024: +9.4%

- Net

inflows +€53.5bn

- Market & foreign exchange

effects

+€148.8 bn

- Scope

effect -€20.0bn

(sale of Lyxor Inc)

Breakdown of AuM & net inflows by

client segments15

|

(€bn) |

AuM as of 31/03/2024 |

AuM as of 31/03/2023 |

% var./ 31/03/2023 |

Inflows Q1 2024 |

Inflows Q1 2023 |

|

French networks |

137 |

124 |

+10.1% |

+1.5 |

+2.7 |

|

International networks |

165 |

157 |

+4.8% |

-2.0 |

-1.6 |

|

o/w Amundi BOC WM |

3 |

4 |

-29.6% |

-0.2 |

-2.8 |

|

Third-party distributors |

345 |

296 |

+16.5% |

+7.0 |

+0.4 |

| |

|

|

|

|

|

|

Retail |

647 |

578 |

+11.9% |

+6.5 |

+1.5 |

|

Institutional & Sovereigns (*) |

511 |

472 |

+8.2% |

+9.7 |

+1.0 |

|

Corporates |

108 |

96 |

+12.4% |

-4.2 |

-7.9 |

|

Employee savings plans |

90 |

79 |

+14.2% |

-0.9 |

-0.6 |

|

CA & SG insurers |

427 |

416 |

+2.7% |

+1.0 |

-4.3 |

| |

|

|

|

|

|

|

Institutional investors |

1,137 |

1,064 |

+6.9% |

+5.6 |

-11.7 |

|

JVs |

332 |

292 |

+13.7% |

+4.5 |

-0.8 |

|

Total |

2,116 |

1,934 |

+9.4% |

+16.6 |

-11.1 |

(*) Including funds of funds

Breakdown of assets & net inflows by

asset classes15

|

(€bn) |

AuM as of 31/03/2024 |

AuM as of 31/03/2023 |

% var./ 31/03/2023 |

Inflows Q1 2024 |

Inflows Q1 2023 |

|

Equities |

505 |

425 |

+18.7% |

-2.6 |

-2.9 |

|

Multi-assets |

280 |

286 |

-2.2% |

-7.6 |

-7.2 |

|

Bonds16 |

700 |

616 |

+13.6% |

+13.9 |

-3.2 |

|

Real, alternative, and structured assets |

107 |

125 |

-15.1% |

-0.3 |

+0.9 |

| |

|

|

|

|

|

|

MLT ASSETS excl. JVs |

1,591 |

1,453 |

+9.5% |

+3.4 |

-12.4 |

|

Treasury products excl.

JVs16 |

193 |

189 |

+2.3% |

+8.7 |

+2.1 |

| |

|

|

|

|

|

|

Assets excl. JVs |

1,784 |

1,642 |

+8.7% |

+12.1 |

-10.3 |

|

JVs |

332 |

292 |

+13.7% |

+4.5 |

-0.8 |

|

TOTAL |

2,116 |

1,934 |

+9.4% |

+16.6 |

-11.1 |

|

o/w MLT assets |

1,892 |

1,716 |

+10.2% |

+7.7 |

-11.3 |

|

o/w Treasury products |

224 |

218 |

+3.2% |

+8.9 |

+0.3 |

Breakdown of AuM & net inflows by

type of management and asset

classes17

|

(€bn) |

AuM as of 31/03/2024 |

AuM as of 31/03/2023 |

% var./ 31/03/2023 |

Inflows Q1 2024 |

Inflows Q1 2023 |

|

Active management |

1,117 |

1,027 |

+ 8.7% |

+1.3 |

-13.1 |

|

Equities |

209 |

183 |

+13.9% |

-2.8 |

-1.3 |

|

Multi-assets |

270 |

278 |

-3.1% |

-8.0 |

-7.6 |

|

Bonds18 |

639 |

566 |

+12.8% |

+12.0 |

-4.2 |

| |

|

|

|

|

|

|

Structured products |

41 |

33 |

+22.0% |

+0.6 |

+1.1 |

|

Passive management |

368 |

301 |

+22.4% |

+2.5 |

-0.2 |

|

ETF & ETC |

227 |

181 |

+25.5% |

+5.0 |

+1.9 |

|

Index & Smart beta |

140 |

119 |

+17.6% |

-2.5 |

-2.2 |

| |

|

|

|

|

|

|

Real and Alternative assets |

66 |

92 |

-28.6% |

-0.9 |

-0.1 |

|

Real assets |

61 |

66 |

-7.3% |

-0.2 |

-0.1 |

|

Alternative assets |

4 |

26 |

-82.7% |

-0.7 |

-0.0 |

| |

|

|

|

|

|

|

MLT ASSETS excl. JVs |

1,591 |

1,453 |

+9.5% |

+3.4 |

-12.4 |

|

Treasury products excl.

JVs18 |

193 |

189 |

+2.3% |

+8.7 |

-2.1 |

| |

|

|

|

|

|

|

TOTAL ASSETS excluding JVs |

1,784 |

1,642 |

+8.7% |

+12.1 |

-10.3 |

|

JVs |

332 |

292 |

+13.7% |

+4.5 |

-0.8 |

|

TOTAL |

2,116 |

1,934 |

+9.4% |

+16.6 |

-11.1 |

|

o/w MLT assets |

1,892 |

1,716 |

+10.2% |

+7.7 |

-11.3 |

|

o/w Treasury products |

224 |

218 |

+3.2% |

+8.9 |

+0.3 |

Breakdown of AuM & net inflows by

geographic areas17

|

(€bn) |

AuM as of 31/03/2024 |

AuM as of 31/03/2023 |

% var./ 31/03/2023 |

Inflows Q1 2024 |

Inflows Q1 2023 |

|

France |

978 |

903 |

+8.3% |

+10.0 |

-2.4 |

|

Italy |

208 |

197 |

+5.1% |

-1.1 |

-0.7 |

|

Europe excl. France & Italy |

391 |

343 |

+14.2% |

+4.0 |

+0.3 |

|

Asia |

422 |

371 |

+13.8% |

+6.8 |

-4.8 |

|

Rest of world |

117 |

120 |

-2.3% |

-3.0 |

-3.4 |

| |

|

|

|

|

|

|

TOTAL |

2,116 |

1,934 |

+9.4% |

+16.6 |

-11.1 |

|

TOTAL excl. France |

1,138 |

1,031 |

+10.4% |

+6.6 |

-8.6 |

Adjusted income

statement19 for the First Quarter

2024

|

(€M) |

|

Q1 2024 |

Q1 2023 |

% var.Q1/Q1 |

|

Q4 2023 |

% var.Q1/Q4 |

| |

|

|

|

|

|

|

|

|

Adjusted net revenues |

|

824 |

794 |

+3.8% |

|

806 |

+2.2% |

|

Net management fees |

|

766 |

736 |

+4.0% |

|

723 |

+5.9% |

|

Performance fees |

|

18 |

28 |

-38.3% |

|

34 |

-48.7% |

|

Technology |

|

18 |

13 |

+35.7% |

|

18 |

-0.1% |

|

Financial income & other income |

|

23 |

16 |

+43.1% |

|

32 |

-27.2% |

|

Adjusted operating expenses |

|

(439) |

(425) |

+3.3% |

|

(426) |

+3.1% |

|

Adjusted cost-income ratio (%) |

|

53.3% |

53.6% |

-0.3pp |

|

52.8% |

+0.5pp |

|

Adjusted gross operating income |

|

385 |

369 |

+4.4% |

|

381 |

+1.1% |

|

Cost of risk & others |

|

(0) |

(1) |

-75.8% |

|

(2) |

-93.9% |

|

Equity-accounted companies |

|

29 |

22 |

+30.2% |

|

29 |

-0.9% |

|

Adjusted income before tax |

|

413 |

390 |

+5.9% |

|

407 |

+1.5% |

|

Corporate tax |

|

(97) |

(91) |

+6.2% |

|

(96) |

+0.1% |

|

Non-controlling interests |

|

1 |

1 |

+20.4% |

|

2 |

-65.0% |

|

Adjusted Net Income Group Share |

|

318 |

300 |

+5.9% |

|

313 |

+1.4% |

|

Adjusted earnings per share (€) |

|

1.55 |

1.47 |

+5.5% |

|

1.53 |

+1.4% |

Methodology Appendix

Accounting and adjusted

data

- Accounting

data - this includes the amortisation of intangible

assets.

- Adjusted

data - in order to present a profit and loss account

closer to the economic reality, the following adjustments are made:

restatement of the amortisation of the distribution contracts with

Bawag, UniCredit and Banco Sabadell, and of the intangible asset

representing Lyxor’s client contracts, recorded as a deduction from

net income.

In the accounting data, amortisation of

distribution contracts and intangible assets representing Lyxor’s

client contracts:

- Q1 2023: -€20m

before tax and -€15m after tax

- Q4 2023: -€20m

before tax and -€15m after tax

- 2023: -€82m before

tax and -€59m after tax

- Q1 2024: -€20m

before tax and -€15m after tax

Alternative Performance

Indicators20

In order to present a profit and loss account

closer to the economic reality, Amundi publishes adjusted data that

excludes the amortisation of intangible assets.The adjusted,

normalised data is reconciled with the accounting data as

follows:

|

(€m) |

|

Q1 2024 |

Q1 2023 |

|

Q4 2023 |

| |

|

|

|

|

|

|

Net revenues (a) |

|

804 |

773 |

|

786 |

|

- Amortisation of intangible assets before tax |

|

(20) |

(20) |

|

(20) |

|

Adjusted net revenues (b) |

|

824 |

794 |

|

806 |

| |

|

|

|

|

|

|

Operating expenses (c) |

|

(439) |

(425) |

|

(426) |

|

- Pre-tax integration costs |

|

0 |

0 |

|

0 |

|

Adjusted operating expenses (d) |

|

(439) |

(425) |

|

(426) |

| |

|

|

|

|

|

|

Gross Operating income (e) = (a) + (c) |

|

364 |

348 |

|

360 |

|

Adjusted gross operating income (f) = (b) +

(d) |

|

385 |

369 |

|

381 |

| |

|

|

|

|

|

|

Cost-income ratio (%) -(a)/(c) |

|

54.6% |

55.0% |

|

54.2% |

|

Adjusted cost-income ratio (%) -(d)/(b) |

|

53.3% |

53.6% |

|

52.8% |

| |

|

|

|

|

|

|

Cost of risk & others (g) |

|

(0) |

(1) |

|

(2) |

|

Equity-accounted companies (h) |

|

29 |

22 |

|

29 |

|

Income before tax (i) = (e) + (g) +

(h) |

|

393 |

370 |

|

387 |

|

Adjusted income before tax (j) = (f) + (g) +

(h) |

|

413 |

390 |

|

407 |

|

Income tax (k) |

|

(91) |

(85) |

|

(91) |

|

Adjusted income tax (l) |

|

(97) |

(91) |

|

(96) |

|

Non-controlling interests (m) |

|

1 |

1 |

|

2 |

|

Net income Group share (n) = (i)+(k)+(m) |

|

303 |

285 |

|

299 |

|

Adjusted net income Group Share (o) =

(i)+(k)+(m) |

|

318 |

300 |

|

313 |

| |

|

|

|

|

|

|

Earnings per share (€) |

|

1.48 |

1.40 |

|

1.46 |

|

Adjusted earnings per share (€) |

|

1.55 |

1.47 |

|

1.53 |

Shareholder structure

|

|

31/12/2022 |

31/03/2023 |

31/12/2023 |

31/03/2024 |

|

|

Number of shares |

% of capital |

Number of shares |

% of capital |

Number of shares |

% of capital |

Number of shares |

% of capital |

|

Crédit Agricole Group |

141,057,399 |

69.19% |

141,057,399 |

69.19% |

141,057,399 |

68.93% |

141,057,399 |

68.93% |

|

Employees |

2,279,907 |

1.12% |

2,238,508 |

1.10% |

2,918,391 |

1.43% |

2,869,026 |

1.40% |

|

Treasury shares |

1,343,479 |

0.66% |

1,331,680 |

0.65% |

1,247,998 |

0.61% |

1,259,079 |

0.62% |

|

Free float |

59,179,346 |

29.03% |

59,232,544 |

29.06% |

59,423,846 |

29.04% |

59,462,130 |

29.06% |

|

Number of shares at end of period |

203,860,131 |

100.0% |

203,860,131 |

100.0% |

204,647,634 |

100.0% |

204,647,634 |

100.0% |

|

Average number of shares since the beginning of the year |

203,414,667 |

- |

203,860,131 |

- |

204,201,023 |

- |

204,647,634 |

- |

|

Average number of shares since the beginning of the quarter |

203,860,131 |

- |

203,860,131 |

- |

204,647,634 |

- |

204,647,634 |

- |

Average number of shares prorata temporis.

- The capital

increase reserved for employees in 2023 was carried out on 27 July

2023. 787,503 securities (approximately 0.4% of the capital before

the operation) were created, bringing the employee share of the

capital to 1.47%, compared to 1.14% before the operation. As of 31

March 2024, this share is 1.40%.

- The average number

of shares was unchanged between Q4 2023 and Q1 2024 and increased

by +0.4% between Q1 2023 and Q1 2024.

***

Financial Communication

Schedule

- General Meeting:

24/05/2024

- Publication of Q2

and first half-year results for 2024: 26 July 2024

- Publication of Q3

and first nine-month results for 2024: 30 October 2024

Dividend Schedule

- Ex-date: Monday, 3

June 2024

- Payment date: from

Wednesday, 5 June 2024.

***

About Amundi

Amundi, the leading European asset manager,

ranking among the top 10 global players21, offers its 100 million

clients - retail, institutional and corporate - a complete range of

savings and investment solutions in active and passive management,

in traditional or real assets. This offering is enhanced with IT

tools and services to cover the entire savings value chain. A

subsidiary of the Crédit Agricole group and listed on the stock

exchange, Amundi currently manages more than €2.1 trillion in

assets22.

With its six international investment hubs23,

financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape.

Amundi clients benefit from the expertise and

advice of 5,500 employees in 35 countries.

Amundi, a trusted partner, working every

day in the interest of its clients and society.

www.amundi.com

Press contacts:

Natacha

Andermahr Tel. +33 1 76 37 86

05natacha.andermahr@amundi.com

Corentin HenryTel. +33 1 76 36 26

96corentin.henry@amundi.com

Investor contacts:Cyril Meilland,

CFATel. +33 1 76 32 62

67cyril.meilland@amundi.com

Thomas LapeyreTel. +33 1 76 33 70

54thomas.lapeyre@amundi.com

Annabelle Wiriath

Tel. + 33 1 76 32 43 92

annabelle.wiriath@amundi.com

DISCLAIMER:

This document may contain forward-looking

information concerning Amundi's financial situation and results.

The figures provided do not constitute a “forecast” as defined in

Commission Delegated Regulation (EU) 2019/980. This forward-looking

information includes projections, and financial estimates are based

on scenarios that employ a number of economic assumptions in a

given competitive and regulatory context, evaluations relating to

plans, objectives and expectations in line with future events,

transactions (including the proposed transaction between Amundi and

Victory Capital), products and services and assumptions in terms of

future performances and synergies. As such, the forward-looking

aspects indicated may not necessarily come to pass due to

unforeseeable circumstances and known and unknown risks, including,

as it relates to the proposed transaction between Amundi and

Victory Capital, the fact that the Memorandum of Understanding is

non-binding and there is no certainty that the negotiations will

result in definitive agreements on the anticipated timeline, if at

all, or that the currently contemplated terms will not change;

risks that conditions to closing will fail to be satisfied and that

the transaction will fail to close on the anticipated timeline, if

at all; risks associated with the expected benefits, or impact on

the Victory Capital’s and Amundi’s respective businesses, of the

proposed transaction, including the ability to achieve any expected

synergies; and other risks and factors relating to Victory’s and

Amundi’s respective businesses contained in their respective public

filings. As a result, no guarantees can be made with regard to

whether or not these projections or estimates will come to

fruition, and Amundi's financial situation and results may differ

significantly from those projected or implied in the

forward-looking information contained in this document. Amundi is

not required, under any circumstances, to publish amendments or

updates to such forward-looking information provided on the date of

this document.

More detailed information on risks that may

affect Amundi's financial situation and results can be reviewed in

the “Risk factors” chapter of our Universal Registration Document

filed with the French Autorité des Marchés Financiers. The reader

should take all of these uncertainties and risks into consideration

before forming their own opinion.

The figures presented were prepared in

accordance with IFRS guidelines as adopted by the European Union

and applicable at that date, and with the applicable prudential

regulations in force. Unless otherwise mentioned, the sources for

rankings and market positions are internal. The information

contained in this document, to the extent that it relates to

parties other than Amundi or comes from external sources, has not

been verified by a supervisory authority or, more generally, been

subject to independent verification, and no representation or

warranty has been expressed as to, nor should any reliance be

placed on, the fairness, accuracy, correctness or completeness of

the information or opinions contained herein. Neither Amundi nor

its representatives can be held liable for any decision made,

negligence or loss that may result from the use of this document or

its contents, or anything related to them, or any document or

information to which the document may refer.

The sum of the values appearing in the tables

and analyses may differ slightly from the total reported as a

result of rounding.

1

Net income (Group

share)2 Adjusted

data: excluding amortisation of intangible assets (see note p. 8)3

Non-binding

Memorandum of Understanding at this stage, subject to due diligence

and negotiation of final agreements. Final agreements will be

subject to the usual finalisation conditions and regulatory

approvals. There is no guarantee that the parties will reach an

agreement on the final documents and, if they are concluded, that

the transactions will be carried out.4

Composite Index:

50% MSCI World + 50% Eurostoxx 600 for Equity Markets5

Bloomberg Euro

Aggregate for Bond Markets6

Sources:

Morningstar FundFile, ETFGI. European & cross-border open-ended

funds (excluding mandates and dedicated funds). Data as of end of

March 2024.7 For

more details on these operations, please refer to the press

releases and the presentations to investors, available on the

website www.about.amundi.com8

Excluding

structured products, real and alternative assets9

Medium/Long-Term

Assets10 Net income

(Group share)11

Adjusted data:

excluding amortisation of intangible assets (see note p. 8)12

3-month Euribor13

Assets under

management and net inflows, including assets under advisory,

marketed assets and funds of funds, and taking into account 100% of

the net inflows and assets under management of the JVs in Asia; for

Wafa Gestion in Morocco, assets under management and inflows are

reported in proportion to Amundi’s holding in its capital.14

Lyxor, integrated

as of 31/12/202115

Assets under

management and net inflows, including assets under advisory,

marketed assets and funds of funds, and taking into account 100% of

the net inflows and assets under management of the JV in Asia; for

Wafa Gestion in Morocco, assets under management and inflows are

reported in proportion to Amundi’s holding in its

capital.16 As of

01/01/2024, reclassification into Bonds of short-term bond

strategies (€30bn in AuM) previously classified as Treasury

products until 31/12/2023; the assets and net flows up to that date

have not been reclassified in this table.17

Assets under

management and net inflows, including assets under advisory,

marketed assets and funds of funds, and taking into account 100% of

the net inflows and assets under management of the JV in Asia; for

Wafa Gestion in Morocco, assets under management and inflows are

reported in proportion to Amundi’s holding in its

capital.18 As of

01/01/2024, reclassification into Bonds of short-term bond

strategies (€30bn in AuM) previously classified as Treasury

products until 31/12/2023; the assets and net flows up to that date

have not been reclassified in this table.19

Adjusted data:

excluding amortisation of intangible assets, see Methodology

Appendix below20

See also section

4.3 of the 2023 Universal Registration Document filed with the

French Financial Markets Authority on 18 April 202421

Source: IPE “Top

500 Asset Managers,” published in June 2023, based on assets under

management as of

31/12/202222 Amundi

data as of 31/12/202323

Boston, Dublin,

London, Milan, Paris and Tokyo

- Amundi PR results Q1 2024

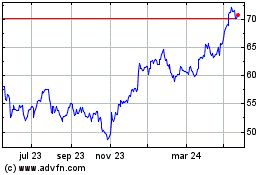

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

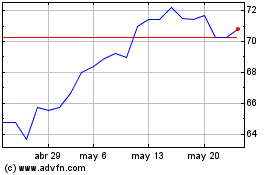

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024