Amundi and Victory Capital sign a definitive agreement to become

strategic partners

Amundi and Victory Capital sign a

definitive agreement

to become strategic partners

Paris, 9 July 2024 - Amundi

today announces that it has reached a definitive agreement with

Victory Capital for their previously announced transaction.

The agreement is in line with the Memorandum of

Understanding announced on April 16, 20241:

- Amundi US will be combined with

Victory Capital;

- Amundi will become a strategic

shareholder of Victory Capital with a 26.1% economic stake in

Victory Capital;

- Both parties have entered into

15-year distribution and services agreements, which will be

effective upon the closing of the transaction.

Under these distribution and services

agreements, Amundi will be the distributor of Victory Capital’s

US-manufactured active asset management products outside of the US.

Additionally, Amundi will become the supplier of non-US

manufactured products for Victory’s distribution in the US.

Valérie Baudson, Chief Executive Officer of

Amundi, commented: “The transaction will allow Amundi to

strengthen its presence in the US via a larger US investment and

distribution platform. It will also provide Amundi’s clients

worldwide with access to a broader range of high-performing US

investment solutions. Thanks to this transaction, Amundi will

become a strategic shareholder in a US-based asset management firm

with a consistent track record of development. This is a compelling

proposition for our clients and our employees. It is also a

value-creating deal for our shareholders.”

Amundi expects this transaction, which does not

include any cash consideration, to result in a material increase in

the contribution from US operations to its results, leading to a

low single-digit accretion of the adjusted net income and EPS of

Amundi.

The transaction is subject to customary closing

conditions2, and is expected to be completed late in the

4th quarter of 2024 or early 2025.

Ardea Partners is acting as financial advisor

and Cleary Gottlieb Steen & Hamilton LLP and Dechert LLP are

providing legal counsel to Amundi in connection with this

transaction.

Press contacts:

Natacha Andermahr

Tel. +33 1 76 37 86 05

natacha.andermahr@amundi.com

Corentin Henry

Tel. +33 1 76 36 26 96

corentin.henry@amundi.com

Geoff Smith, Amundi US

Tel. +1 617 422 4758

Geoff.Smith@amundi.com

Investor contacts:

Cyril Meilland, CFA

Tel. +33 1 76 32 62 67

cyril.meilland@amundi.com

Thomas Lapeyre

Tel. +33 1 76 33 70 54

thomas.lapeyre@amundi.com

Annabelle Wiriath

Tel. + 33 1 76 32 43 92

annabelle.wiriath@amundi.com

Forward-looking statements

This document may contain forward-looking statements within the

meaning of applicable U.S. federal and non-U.S. securities laws.

These statements may include, without limitation, any statements

preceded by, followed by or including words such as “target,”

“believe,” “expect,” “aim,” “intend,” “may,” “anticipate,”

“assume,” “budget,” “continue,” “estimate,” “future,” “objective,”

“outlook,” “plan,” “potential,” “predict,” “project,” “will,” “can

have,” “likely,” “should,” “would,” “could” and other words and

terms of similar meaning or the negative thereof and include, but

are not limited to, statements regarding the proposed transaction

and the outlook for Victory Capital’s or Amundi’s future business

and financial performance.

Such forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Victory

Capital’s and Amundi’s control and could cause Victory Capital’s

and Amundi’s actual results, performance or achievements to be

materially different from the expected results, performance or

achievements expressed or implied by such forward-looking

statements.

Although it is not possible to identify all such risks and factors,

they include, among others, the following: risks that conditions to

closing will fail to be satisfied and that the transaction will

fail to close on the anticipated timeline, if at all; risks

associated with the expected benefits, or impact on Victory

Capital’s and Amundi’s respective businesses, of the proposed

transaction, including the ability to achieve any expected

synergies; and other risks and factors relating to Victory’s and

Amundi’s respective businesses contained in their respective public

filings. These factors may include changes in the economic and

commercial situation, regulations and the risk factors described in

Amundi's Registration Document (section 5.2) registered with the

AMF under number D.23-0257 on 7 April 2023.

Important Additional Information and

Where to Find It

This communication is being issued in connection

with the proposed acquisition of Amundi Holdings US, Inc. (“Amundi

US”) by Victory Capital. In connection with the transaction,

Victory Capital intends to file a proxy statement and certain other

documents regarding the transaction with the SEC. The definitive

version of the proxy statement (if and when available) will be

mailed to Victory Capital’s stockholders.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ

THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE

FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE TRANSACTIONS CONTEMPLATED BY THE CONTRIBUTION AGREEMENT

AND RELATED MATTERS.

Investors and security holders may obtain, free

of charge, copies of the proxy statement (when it is available) and

other documents that are filed or will be filed with the SEC by

Victory Capital through the website maintained by the SEC

at www.sec.gov or the Investor Relations portion of Victory

Capital’s website at https://ir.vcm.com.

Participants in the

Solicitation

Amundi and certain of its directors, executive

officers and other employees may be deemed to be “participants” in

the solicitation of proxies from Victory Capital’s stockholders

with respect to the special meeting of stockholders that will be

held to consider and vote upon the approval of the share issuance

in connection with the proposed acquisition of Amundi US by Victory

Capital. Additional information regarding the identity of the

participants, and their respective direct and indirect interests in

the transaction, by security holdings or otherwise, will be set

forth in the proxy statement and other materials to be filed with

the SEC in connection with the transaction (if and when they become

available). Investors and security holders may obtain free copies

of these documents using the sources indicated above.

About Amundi

Amundi, the leading European asset manager,

ranking among the top 10 global players1, offers its 100

million clients - retail, institutional and corporate - a complete

range of savings and investment solutions in active and passive

management, in traditional or real assets. This offering is

enhanced with IT tools and services to cover the entire savings

value chain. A subsidiary of the Crédit Agricole group and listed

on the stock exchange, Amundi currently manages more than €2.1

trillion of assets2.

With its six international investment

hubs3, financial and extra-financial research

capabilities and long-standing commitment to responsible

investment, Amundi is a key player in the asset management

landscape.

Amundi clients benefit from the expertise and

advice of 5,500 employees in 35 countries.

Amundi, a trusted partner, working every day in the

interest of its clients and society

www.amundi.com

1 Source: IPE “Top 500 Asset Managers”

published in June 2023, based on assets under

management as at 31/12/2022

2 Amundi data as at

31/03/2024

3 Boston, Dublin, London, Milan, Paris and

Tokyo

- PR Amundi and Victory Capital sign a definitive agreement to

become strategic partners

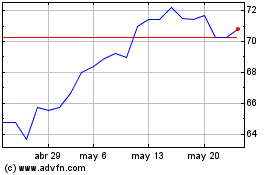

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

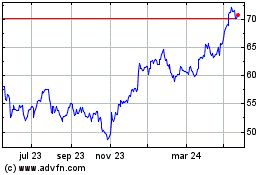

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024