KPN successfully issues € 500m Green Hybrid Bond

11 Junio 2024 - 10:45AM

KPN successfully issues € 500m Green Hybrid Bond

NOT FOR DISTRIBUTION TO ANY U.S. PERSON OR ANY

PERSON LOCATED OR RESIDENT IN THE UNITED STATES OF AMERICA OR IN

ANY JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS

ANNOUNCEMENT

Today, Koninklijke KPN N.V. (“KPN”) has

successfully issued a Green € 500m perpetual non-call 5.25 year

subordinated bond to finance projects that support KPN’s

sustainability ambitions and have a positive environmental impact

(the “Green Hybrid Bond”). With this issuance, KPN further

demonstrates its commitment to its sustainability ambitions through

financing arrangements. The Green Hybrid Bond issuance has been

well received by institutional investors with a final orderbook in

excess of € 1.9bn and a broad diversified investor base.

The Green Hybrid Bond was priced with a coupon

of 4.875% per annum until the first reset date on 18 September 2029

and is first callable in June 2029. The Green Hybrid Bond will be

treated for 50% as equity and 50% as debt by the credit rating

agencies and will be accounted for as equity under IFRS. The Green

Hybrid Bond is expected to be rated BB+ by both S&P and Fitch

and will be listed on the Global Exchange Market of Euronext

Dublin.

The Green Hybrid Bond is issued under KPN’s

Green Finance Framework and with its proceeds, KPN will finance or

refinance projects with positive environmental impact in three

areas: Energy Efficiency (network transformation including roll-out

of fiber and modernization of KPN’s mobile network), Circular

Economy (investments that extend product life and reduce waste) and

Clean Transportation (reducing emissions by shifting to electric

vehicles). The Green Hybrid Bond reinforces KPN’s environmental

efforts and supports its ambition to become “Net Zero” by 2040.

Sustainalytics, a leading ESG research agency,

has provided an updated second-party opinion on KPN’s Green Finance

Framework which it considers credible and impactful and in

alignment with the core components of the Green Bond Principles.

The documentation related to the Green Finance Framework and this

bond issue is available on KPN’s website.

ING, Goldman Sachs, ABN Amro, BNP Paribas, and

Intesa Sanpaolo acted as Joint Lead Managers for the Green Hybrid

Bond offering.

Disclaimer

These materials are not for release, distribution or

publication, whether directly or indirectly and whether in whole or

in part, to U.S. persons or into or in the United States,

Australia, Canada or Japan or any (other) jurisdiction where to do

so would constitute a violation of the relevant laws of such

jurisdiction. This press release is not an offer of the Bonds for

sale in the United States, Australia, Canada or Japan or any

(other) jurisdiction where to do so would constitute a violation of

the relevant laws of such jurisdiction.The Bonds are not and will

not be registered under the US Securities Act of 1933, as amended

(the “US Securities Act”) and will also not be registered with any

authority competent with respect to securities in any state or

other jurisdiction of the United States of America. The Bonds may

not be offered or sold in the United States of America without

either registration of the Bonds or an exemption from registration

under the US Securities Act being applicable. There will not be a

public offering of the Bonds in the United States of America.

Formal disclosures:

Royal KPN N.V. Head of IR: Matthijs van Leijenhorst Inside

information: Yes Topic: KPN successfully issues € 500m Green Hybrid

Bond11/06/2024; 17:45hKPN-N

- KPN successfully issues € 500m Green Hybrid Bond

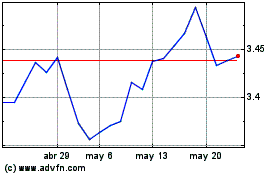

Koninklijke KPN NV (EU:KPN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Koninklijke KPN NV (EU:KPN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024