Naspers Fiscal Year 2022 Revenue Rose on E-Commerce Gains; Launches Buyback Program -- Update

27 Junio 2022 - 2:15AM

Noticias Dow Jones

By Anthony O. Goriainoff

Naspers Ltd. and its Amsterdam-listed subsidiary Prosus NV said

Monday that revenue grew in fiscal 2022, bolstered by their

e-commerce segments, and that they are launching an open-ended

buyback program of both Naspers and Prosus shares.

South African investor Naspers--which owns a major stake in

Chinese tech giant Tencent Holdings Ltd. through Prosus--said

revenue for the year to March 31 was $7.94 billion, compared with

$5.93 billion a year earlier.

Naspers said e-commerce segment revenue rose 56% to $10.7

billion. E-commerce segment revenue for Prosus was $9.8 billion, up

58%, it said.

Naspers said core headline earnings per share were $7.18,

compared with $8.14.

Core headline earnings for Naspers fell 40% to $2.1 billion,

with Prosus reporting core headline earnings of $3.7 billion, a

drop of 23%. The group said this was due to the continuing

investment in the e-commerce portfolio and a period of slower

growth at Tencent, as it adapted to China's regulatory changes.

Group trading profit fell 10% to $5 billion, reflecting

investments to expand market opportunity for each segment in the

business, the group said.

The group said it had disposed of shares in JD.com Inc. for

proceeds of around $3.67 billion. Those proceeds will be retained

by the Prosus group for general corporate and liquidity purposes,

it said.

Prosus declared a dividend of 14 European cents (15 U.S. cents)

a share.

"Our solid financial footing positions us well for the

challenging operating environment and the execution of our

strategy," the company said.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

June 27, 2022 03:00 ET (07:00 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

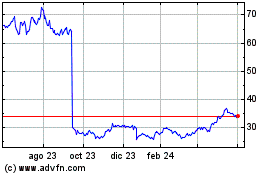

Prosus NV (EU:PRX)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

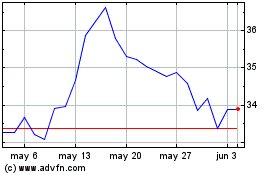

Prosus NV (EU:PRX)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024