Strong Q3 2024 at +5.8% organic

growth

Upgrading full year organic growth

guidance

despite challenging macro

October 17,

2024

-

Q3 2024 organic growth at +5.8%

-

Continuing to gain market share

-

Accelerating versus 4-year Q3 CAGR of +5.1%

-

#1 ranking in net new business1

in Q3 and 2024 YTD

-

M&A acceleration: acquisition of the world’s largest

influencer and commerce marketing companies for $1

billion

-

Expecting to maintain momentum in Q4: upgrading full year

2024 organic growth guidance floor to +5.5%, versus +5.0%

previously.

-

Confirming industry-high 2024 financial KPIs: operating

margin rate at 18.0% and free cash flow2

between €1.8bn-1.9bn

Q3 2024

9M 2024

Arthur Sadoun, Chairman and CEO of Publicis Groupe:

“Publicis had a very busy and very strong Q3,

with organic growth of +5.8%.

Once again, we were able to gain market share by

capturing a disproportionate amount of client demand for

personalization at scale, with our combined media and Epsilon

activities growing at almost +10%. All of our regions delivered

strongly, with the U.S. at +4%, Europe at +4.9% and APAC at +6.4%,

with China accelerating to +12.4%.

The strength of our model is also reflected in

our net new business performance. Not only have we topped new

business league table since the beginning of 2024, for the fifth

year in a row we also led the ranking in Q3 which was very active

quarter when it comes to pitch activity.

Despite an increasingly challenging

macroeconomic environment, we expect to sustain our momentum in Q4.

We are in a position to upgrade our organic growth guidance for the

full year. This means that we should outperform the industry by

close to 400 basis points on average in 2024.

Beyond our immediate results, in Q3 we also took

steps to continue to stay ahead of the industry thanks to our

model. We invested 1 billion dollars in acquiring Influential, the

world’s largest influencer marketing platform and Mars United

Commerce, the #1 independent commerce marketing company. We are now

clearly leading on 3 critical expertise for our clients:

addressable media, Creators and Commerce. We are then able to

directly link this expertise with Epsilon’s identities around the

world to create a connected media ecosystem that we can build

transparently within our clients’ owned environments.

Our ability to fuel this unique and breakthrough

connected ecosystem with intelligent content through our creative

and production capabilities, and power it with the technology of

Publicis Sapient, makes us confident in our ability to continue to

outperform the market in 2024, and in the years to come.

I’d like to take this opportunity to thank our

clients for their trust, and our people for their outstanding

efforts.”

* *

*

Q3 2024 NET REVENUE

Publicis Groupe's net revenue in Q3 2024 was 3,423 million

euros, up +5.6% compared to 3,241 million euros in Q3 2023.

Exchange rate variations had a 36 million euros negative impact.

Acquisitions, net of disposals, accounted for a positive impact of

33 million euros. Organic growth reached +5.8%.

Breakdown of Q3 2024 net revenue by

region

|

EUR million |

Net revenue |

Reported |

Organic |

|

|

Q3 2024 |

Q3 2023 |

growth |

growth |

|

North America |

2,105 |

1,999 |

+5.3% |

+4.7% |

| Europe |

812 |

769 |

+5.6% |

+4.9% |

| Asia

Pacific |

307 |

288 |

+6.6% |

+6.4% |

| Middle East

& Africa |

105 |

95 |

+10.5% |

+13.6% |

|

Latin America |

94 |

90 |

+4.4% |

+30.3% |

|

Total |

3,423 |

3,241 |

+5.6% |

+5.8% |

North America net revenue was

up +4.7% organically in Q3 2024. Taking into account a negative

impact of the US dollar to euro exchange rate and the contribution

of acquisitions completed over the last 12 months, reported growth

was at +5.3%. The U.S. posted a very solid quarter

with +4.0% organic growth, with Media and Epsilon combined

continuing to be accretive, confirming the strength of the Groupe’s

integrated offer in this geography where its model is the most

advanced. Publicis Sapient posted a slight decline in a context of

a continued “wait and see” attitude from clients. Finally, Creative

activities were up by a mid-single digit on the quarter.

Europe net revenue was up +4.9%

on an organic basis (+5.6% reported). Organic growth in

France and Germany accelerated

this quarter, mainly led by double-digit growth in Media in both

countries. The U.K. was impacted by a high

comparable base last year, with Media and Creative activities

together going up single digit after three years at double digits,

while Publicis Sapient remained impacted by delays in digital

business transformation projects. Central & Eastern

Europe was very strong organically, with double-digit

growth in most countries, led by both Media and Creative.

Net revenue in Asia Pacific

recorded +6.6% growth on reported basis and +6.4% on an organic

basis. China accelerated to +12.4% organic growth

after +10.5% in Q2 2024, benefitting from new business wins in

Media. South-East Asia grew by a low-single digit,

on top of a double-digit growth in Q3 2023.

Australia and New Zealand were up

by a low-single digit this quarter.

Net revenue in the Middle East and

Africa region was up +13.6% organically (+10.5% on a

reported basis), largely driven by double-digit growth in Media and

at Publicis Sapient.

In Latin America, net revenue

was up +30.3% organically led by both Media and Creative, notably

in Brazil, Colombia and Mexico. Reported growth was +4.4% due to

the depreciation of the Argentinian peso relative to the euro.

Breakdown of net revenue for Q3 2024 by

sector

|

Client sectors |

% Net revenue |

| Healthcare |

17% |

| Automotive |

14% |

| Financial |

13% |

| Food &

beverage |

13% |

| TMT |

13% |

| Non-food

consumer products |

10% |

| Retail |

9% |

| Leisure &

travel |

4% |

| Public sector

& others |

4% |

|

Energy & manufacturing |

3% |

Based on 3,397 main clients representing 91% of

the Groupe’s net revenue.

2024 NET REVENUE AT END SEPTEMBER 2024

Publicis Groupe's net revenue in the first nine

months of 2024 was 10,111 million euros up +5.8% compared to 9,559

million euros in the first nine months of 2023. Exchange rate

variations had a 52 million euros negative impact. Acquisitions,

net of disposals, accounted for a positive impact of 76 million

euros. Organic growth reached +5.6%.

Breakdown of net revenue for the first 9

months of 2024 by region

|

EUR million |

Net revenue |

Reported |

Organic |

|

|

9M 2024 |

9M 2023 |

growth |

growth |

|

North America |

6,217 |

5,892 |

+5.5% |

+4.9% |

| Europe |

2,461 |

2,321 |

+6.0% |

+5.0% |

| Asia

Pacific |

879 |

838 |

+4.9% |

+6.8% |

| Middle East

& Africa |

295 |

274 |

+7.7% |

+9.0% |

|

Latin America |

259 |

234 |

+10.7% |

+19.7% |

|

Total |

10,111 |

9,559 |

+5.8% |

+5.6% |

NET DEBT

Net financial debt amounted to 1,710 million

euros as of September 30, 2024, compared to a net debt of 99

million euros as of June 30, 2024, and to a net debt of 714 million

euros at the end of September 2023. The Groupe’s last twelve months

average net debt amounted to 406 million euros as of September 30,

2024, down from 451 million euros as of September 30, 2023.

ACQUISITIONS

On January 18, 2024, Publicis

Groupe Singapore announced the acquisition of AKA

Asia, one of Singapore's leading integrated communications

agencies. Founded in 2009, AKA is a highly respected player in the

South-East Asian market, known for delivering award-winning and

innovative communication campaigns. The acquisition expands and

diversifies Publicis Groupe's capabilities in the region, while

bolstering the Groupe's strategic communications, PR and influence

offering. AKA has joined the Groupe's regional Influence

practice.

On March 12, 2024, Publicis

Sapient announced the acquisition of Spinnaker

SCA, a leading supply chain services firm that provides

end-to-end supply chain strategy, planning and execution consulting

services. Founded in 2002 and based in Boulder in the U.S.,

Spinnaker SCA has become part of Publicis Sapient and brings core

capabilities and skill sets including advanced AI and ML analytics,

supply chain digital twins, warehouse and transportation management

and expanded digital services. Spinnaker SCA further enables

Publicis Sapient to offer solutions for clients to optimize their

agile supply chains as part of their digital business

transformation.

On June 5, 2024, Publicis

Groupe in France announced the acquisition of Downtown

Paris, a creation and production house specialized in

leading brands in the beauty and luxury business. Founded in 2016,

the agency has strengthened the production vertical of Publicis

France and is working with the Groupe's various luxury

entities.

On July 25, 2024, Publicis

Groupe announced the acquisition of Influential,

the world’s preeminent influencer marketing company and platform,

creating the world’s leading influencer marketing solution.

Influential’s proprietary AI-powered technology platform with over

100 billion data points, coupled with its network of over 3.5

million creators, including access to and data on 90% of global

influencers with more than 1 million followers, currently serves

more than 300 brands around the world. By combining these

capabilities with the unique data and identity assets of Epsilon,

Publicis Groupe is putting the leadership of ID-driven influencer

marketing in the hands of all of its clients through a premium

creator network, revolutionized influencer planning and maximized

cross-channel outcomes.

On September 19, 2024, Publicis

Groupe announced the acquisition of Mars United

Commerce, the largest independent commerce marketing

company in the world. With over 1,000 employees based in 14 hubs

worldwide, Mars leverages its proprietary suite of commerce

solutions to drive growth for more than 100 of the world’s top

brands. The combined forces of Publicis Groupe and Mars has created

the industry-leading connected commerce solution, allowing clients

to influence the complete commerce journey for billions of global

shoppers through an offering that begins with the industry’s

deepest and richest database of consumer behavior and ends at the

digital and physical shelves of the world’s leading online and

offline retailers.

OUTLOOK

After delivering a very strong third quarter of

2024, which continued to demonstrate the strength of the Groupe’s

model and its ability to win market share and outperform the

industry, the Groupe raises the floor of its organic growth

guidance for the full year 2024.

The floor is now expected at +5.5%

organic growth for the full year compared to a floor of

+5.0% previously, despite a macroeconomic environment that became

more challenging over the quarter. This guidance takes into account

the current macroeconomic uncertainties, which affect client spend,

continue to weigh on Publicis Sapient like other IT consulting

firms and would impact clients’ end-of-year budget adjustments.

The Groupe also confirms its 2024

guidance on financial ratios, which will be maintained at

the industry-leading levels of 18% operating margin rate and

between 1.8 and 1.9 billion euros free cash flow before change in

working capital, while sustaining its industry-high bonus pool and

including the Groupe’s opex investment of 100 million euros for its

AI plan.

Disclaimer

Certain information contained in this document,

other than historical information, may constitute forward-looking

statements or unaudited financial forecasts. These

forward-looking statements and forecasts are subject to risks and

uncertainties that could cause actual results to differ materially

from those projected. These forward-looking statements and

forecasts are presented at the date of this document and, other

than as required by applicable law, Publicis Groupe does not assume

any obligation to update them to reflect new information or events

or for any other reason. Publicis Groupe urges you to carefully

consider the risk factors that may affect its business, as set out

in the Universal Registration Document filed with the French

Autorité des Marchés Financiers (AMF) and which is available on the

website of Publicis Groupe (www.publicisgroupe.com), including an

unfavorable economic climate, a highly competitive industry,

risks associated with the confidentiality of personal data, the

Groupe’s business dependence on its management and employees, risks

associated with mergers and acquisitions, risks of IT system

failures and cybercrime, the possibility that our clients could

seek to terminate their contracts with us on short notice, risks

associated with the reorganization of the Groupe, risks of

litigation, governmental, legal and arbitration proceedings, risks

associated with the Groupe’s financial rating and exposure to

liquidity risks.

About Publicis Groupe - The Power of One

Publicis Groupe [Euronext Paris FR0000130577,

CAC 40] is a global leader in communication. The Groupe is

positioned at every step of the value chain, from consulting to

execution, combining marketing transformation and digital business

transformation. Publicis Groupe is a privileged partner in its

clients’ transformation to enhance personalization at scale. The

Groupe relies on ten expertise concentrated within four main

activities: Communication, Media, Data and Technology. Through a

unified and fluid organization, its clients have a facilitated

access to all its expertise in every market. Present in over 100

countries, Publicis Groupe employs around 103,000 professionals.

www.publicisgroupe.com | Twitter: @PublicisGroupe | Facebook |

LinkedIn | YouTube | Viva la Difference!

Please find the presse release here

|

ContactsPublicis Groupe

|

|

Amy Hadfield |

Corporate Communications |

+ 33 1 44 43 70 75 |

amy.hadfield@publicisgroupe.com |

|

Jean-Michel Bonamy |

Investor Relations |

+ 33 1 44 43 74 88 |

jean-michel.bonamy@publicisgroupe.com |

|

Lorène Fleury |

Investor Relations |

+ 33 1 44 43 57 24 |

lorene.fleury@publicisgroupe.com |

|

Maxine Miller |

Investor Relations |

+ 33 1 44 43 74 21 |

maxine.miller@publicisgroupe.com |

Appendices

Net revenue: organic growth

calculation

|

(million euro) |

Q1 |

Q2 |

Q3 |

9 months |

|

Impact of currencyat end Sep.

2024(million euro) |

|

2023 net revenue |

3,079 |

3,239 |

3,241 |

9,559 |

|

GBP (2) |

20 |

|

Currency impact (2) |

(29) |

13 |

(36) |

(52) |

|

USD (2) |

(19) |

|

2023 net revenue at 2024 exchange rates (a) |

3,050 |

3,252 |

3,205 |

9,507 |

|

Others |

(53) |

|

2024 net revenue before acquisition impact (b) |

3,212 |

3,433 |

3,390 |

10,035 |

|

Total |

(52) |

|

Net revenue from acquisitions (1) |

18 |

25 |

33 |

76 |

|

|

|

|

2024 net revenue |

3,230 |

3,458 |

3,423 |

10,111 |

|

|

|

|

Organic growth (b/a) |

+5.3% |

+5.6% |

+5.8% |

+5.6% |

|

|

|

| |

(1) |

|

Acquisitions (Spinnaker SCA, Practia, Mars United Commerce,

Corra, Influential, AKA Asia, ARBH, Downtown Paris), net of

disposals. |

| |

|

|

|

| |

(2) |

|

EUR = USD 1.0871 on average in 9M 2024 vs. USD 1.0835 on

average in 9M 2023 |

| |

|

|

EUR = GBP 0.8514 on average in 9M 2024 vs. GBP 0.8710 on

average in 9M 2023 |

Definitions

Net revenue or Revenue less pass-through

costs: Pass-through costs mainly concern production and

media activities, as well as various expenses incumbent on clients.

These items that can be re-billed to clients do not come within the

scope of assessment of operations, net revenue is a more relevant

indicator to measure the operational performance of the Groupe’s

activities.

Organic growth: Change in net

revenue excluding the impact of acquisitions, disposals and

currencies.

4Y CAGR organic growth:

Calculated as: ( [1 + organic growth (n-4)]*[1 + organic growth

(n-3)]*[1 + organic growth (n-2)]*[1 + organic growth (n-1)]

)^(1/4) - 1.

Operating margin: Revenue after

personnel costs, other operating expenses (excl. non-current income

and expense) and depreciation (excl. amortization of intangibles

arising on acquisitions).

Operating margin rate:

Operating margin as a percentage of net revenue.

Free cash flow before changes in working

capital requirements: Net cash flow from operating

activities less interests paid & received, repayment of lease

liabilities & related interests and before changes in WCR

linked to operating activities.

Free cash flow: Net cash flow

from operating activities less interests paid & received,

repayment of lease liabilities & related interests.

Net debt (or financial net

debt): Sum of long and short financial debt and associated

derivatives, net of treasury and cash equivalents, excluding lease

liability since 1st January 2018.

Average net debt: Last 12-month

average of monthly net debt at end of each month.

1 JP Morgan new business ranking (published

October 10, 2024)

2 Before change in working capital

requirements

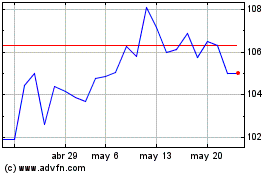

Publicis Groupe (EU:PUB)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

Publicis Groupe (EU:PUB)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025