Canadian Dollar Rises As Crude Oil Prices Advance

01 Octubre 2024 - 10:40PM

RTTF2

The Canadian dollar strengthened against other major currencies

in the Asian session on Wednesday, as the crude oil prices rose

amid the possibility of tight supplies due to an escalation in

tensions in the Middle East after Iran launched a missile attack on

Israel, aiming to avenge the killing of Hezbollah head Hassan

Nasrallah and other senior leaders of the group. West Texas

Intermediate Crude oil futures for November closed up $1.66 or

nearly 2.5 percent at $69.83 a barrel.

Brent crude futures settled at $73.56 a barrel, gaining $1.86 or

about 2.59%.

According to reports, Iran fired about 180 missiles toward

Israel. The Israel Defense Forces said most of the missiles were

intercepted.

"This attack will have consequences," said Israeli military

spokesman Daniel Hagari. A senior White House official told NBC

News earlier that the U.S. would help defend Israel and warned Iran

that an attack would "carry severe consequences."

Markets now await weekly oil reports from the American Petroleum

Institute (API) and U.S. Energy Information Administration (EIA).

The API's report is due later today, while EIA will release its

inventory data Wednesday morning.

Meanwhile, traders are cautious and concerned about the

escalation in tensions in the Middle East, after Iran launched a

missile attack on Israel. In the Asian trading today, the Canadian

dollar rose to a 1-month high of 1.4909 against the euro, from

yesterday's closing value of 1.4931. The loonie may test resistance

near the 1.47 region.

Against the U.S. dollar and the yen, the loonie advanced to

5-day highs of 1.3476 and 106.97 from Tuesday's closing quotes of

1.3490 and 106.41, respectively. If the loonie extends its uptrend,

it is likely to find resistance around 1.32 against the greenback

and 109.00 against the yen.

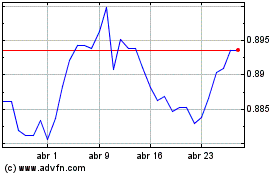

The loonie edged up to 0.9275 against the Australian dollar,

from yesterday's closing value of 0.9285. The next possible upside

target for the loonie is seen around the 0.90 region.

Looking ahead, Eurostat publishes euro area unemployment data

for August at 5:00 am ET in the European session. The jobless rate

is seen at 6.4 percent in August, unchanged from July.

In the New York session, U.S. MBA mortgage approvals data, U.S.

ADP employment data and U.S. EIA crude oil data are due to be

released.

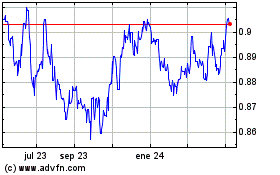

AUD vs CAD (FX:AUDCAD)

Gráfica de Divisa

De Sep 2024 a Oct 2024

AUD vs CAD (FX:AUDCAD)

Gráfica de Divisa

De Oct 2023 a Oct 2024