Euro Rises; US Inflation Report In Focus

12 Diciembre 2023 - 12:42AM

RTTF2

The euro recovered from its early lows against other major

currencies in the European session on Tuesday, as investors awaited

cues from U.S. inflation data later in the day and the Fed's

monetary policy announcement on Wednesday.

U.S. CPI data for November may show inflation still cooling but

staying well above the Fed's 2 percent annual target.

The Federal Reserve is widely expected to hold rates on

Wednesday, with the spotlight squarely on the central bank's dot

plot and summary economic projections as well as comments from

Chair Jerome Powell during his press conference.

In economic news, data from the think tank ZEW showed that

Germany's investor confidence strengthened to a nine-month high in

December despite the current budget crisis. The ZEW Indicator of

Economic Sentiment rose to 12.8 in December from 9.8 in November.

This was the highest score since March and also came in above

forecast of 8.8.

Investor confidence in the euro area also strengthened in

December, the survey showed. At 23.0 points, the economic sentiment

index gained 9.2 points from November.

The European currency traded lower against its major

counterparts in the Asian session today.

In the European trading now, the euro rose to nearly a 2-week

high of 0.8598 against the pound and a 5-day high of 1.0808 against

the U.S. dollar, from early lows of 0.8558 and 1.0761,

respectively. If the euro extends its uptrend, it is likely to find

resistance around 0.87 against the pound and 1.09 against the

greenback.

Moving away from an early 4-day low of 0.9435 against the Swiss

franc, the euro advanced to 0.9480. The euro may test resistance

near the 0.96 region.

The euro edged up to 157.30 against the yen, from an early low

of 156.50. On the upside, 161.00 is seen as the next resistance

level for the euro.

Against the Australia and the New Zealand dollars, the euro

edged up to 1.6402 and 1.7589 from early 4-day lows of 1.6322 and

1.7485, respectively. The next possible upside target levels for

the euro are seen around 1.66 against the aussie and 1.80 against

the kiwi.

The euro climbed to a 4-day high of 1.4664 against the Canadian

dollar, from an early low of 1.4593. The euro is seen finding

resistance around the 1.49 region.

Looking ahead, U.S. inflation data for November, U.S. Redbook

report and U.S. Federal budget statement for November are slated

for release in the New York session.

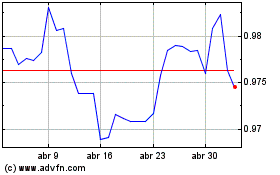

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Jun 2024 a Jul 2024

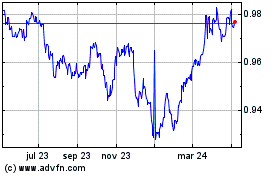

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Jul 2023 a Jul 2024