Pound Drops On Tariff Concerns

02 Diciembre 2024 - 7:44AM

RTTF2

The pound declined against its major counterparts in the New

York session on Monday, as the U.S. dollar strengthened after

President-elect Donald Trump threatened to impose a 100 percent

tariff on BRICS nations if they moved away from the U.S.

currency.

Trump warned BRICS countries to not create a new currency or

back any other currency to replace the US dollar, pledging 100

percent tariffs for non-compliance.

Investors looked ahead to key economic data and comments from

Federal Reserve officials, including Chair Jerome Powell, for

additional clues about the outlook for interest rates.

The UK manufacturing sector deteriorated at the steepest pace in

nine months in November, as output and new orders declined amid

concerns surrounding the economic outlook, high costs, and weak

demand, final survey data released by S&P Global showed.

The manufacturing purchasing managers' index dropped to 48.0 in

November from 49.9 in October. Any reading below 50 indicates

contraction. The flash reading was also 48.6.

The pound fell to a 5-day low of 1.2616 against the greenback

and a 2-1/2-month low of 188.47 against the yen, off its early

highs of 1.2735 and 191.29, respectively. The next possible support

for the currency is seen around 1.24 against the greenback and

185.00 against the yen.

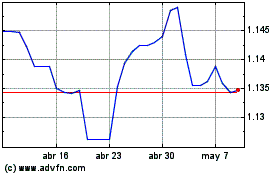

The pound retreated to 1.1200 against the franc and 0.8300

against the euro, from an early more than 2-week high of 1.1262 and

a 10-day high of 0.8270, respectively. The currency is seen finding

support around 1.10 against the franc and 0.86 against the

euro.

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Nov 2024 a Dic 2024

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Dic 2023 a Dic 2024