Pound Rises As Flash U.K. Private Sector Expands Steadily

16 Diciembre 2024 - 1:13AM

RTTF2

The British pound strengthened against other major currencies in

the European session on Monday, after data showed that the U.K.

private sector activity advanced at a steady pace in December.

Data from S&P Global showed that the U.K. Purchasing

Managers' Index (PMI) posted 50.5, unchanged from November. The

economists had expected the index to improve to 50.7 in

December.

The Manufacturing activity declined at a faster pace with the

index falling to 47.3 from 48.0 in November. Economists expected

the index to have improved to 48.1.

The service sector activity also expanded at a faster pace. The

corresponding index rose to 51.4 from 50.4.

Traders await the outcome of the Bank of England meeting to be

held later this week, with analysts predicting no change in

interest rates at 4.75%.

Investors will also pay close attention to BoE Governor Andrew

Bailey's press conference for fresh interest rate guidance for

2025. Traders see the BoE reducing interest rates three times next

year.

In the European trading today, the pound rose to a 4-day high of

194.76 against the yen, from an early low of 193.65. The pound may

test resistance around the 198.00 region.

Against the euro and the Swiss franc, the pound advanced to

0.8926 and 1.1286 from an early more than a 2-week low of 0.8328

and a 5-day low of 1.1250, respectively. If the pound extends its

uptrend, it is likely to find resistance 0.81 against the euro and

1.14 against the franc.

The pound edged up to 1.2671 against the U.S. dollar, from an

early low of 1.2627. On the upside, 1.28 is seen as the next

resistance level for the pound.

Looking ahead, Canada housing starts for November, U.S. New York

Empire State manufacturing index for December and U.S. S&P

Global flash PMI results for December are set to be released in the

New York session.

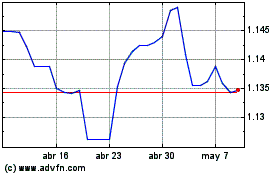

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Nov 2024 a Dic 2024

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Dic 2023 a Dic 2024