Pound Rises As Traders' Await BoE Rate Decision

18 Diciembre 2024 - 10:52PM

RTTF2

The British pound strengthened against other major currencies in

the European session on Thursday, as investors braced for the Bank

of England's last meeting of the year later in the day.

The central bank is widely expected to hold rates at 4.75

percent after data showed a high rate of wage growth and inflation

above the bank's 2 percent target.

Meanwhile, the U.S. Federal Reserve on Wednesday cut the key

lending rate by 25 basis point as expected but revised its

projections to signal just two interest rate cuts next year

compared to the four previously forecast, citing stubbornly high

inflation.

Fed Chair Jerome Powell's explicit - and repeated - references

to the need for caution from here underscored investor concerns

that Trump's fiscal, trade and tariff policies may fuel inflation

and keep U.S. interest rates higher for longer.

The British sterling was trading slightly lower against its

major rivals in the Asian trading today.

In the European trading now, the pound rose to a 1-1/2-month

high of 198.73 against the yen and a 1-week high of 0.8228 against

the euro, from early lows of 194.33 and 0.8254, respectively. If

the pound extends its uptrend, it is likely to find resistance

around 200.00 against the yen and 0.81 against the euro.

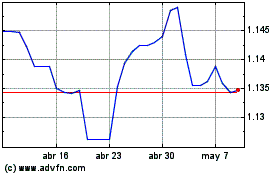

Against the Swiss franc and the U.S. dollar, the pound edged up

to 1.1360 and 1.2658 from early lows of 1.1320 and 1.2567,

respectively. The pound may test resistance around 1.14 against the

franc and 1.30 against the greenback.

Looking ahead, Canada average weekly earnings data for October,

U.S. weekly jobless claims data, U.S. Philadelphia Fed

manufacturing index for December, U.S. core PCE prices data for the

third quarter, existing home sales for November, U.S. Consumer

Board's leading index for November and U.S. Kansas Fed composite

index for December are slated for release in the New York

session.

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Nov 2024 a Dic 2024

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Dic 2023 a Dic 2024