Pound Rises As U.K. Inflation Slows Less-than-expected

21 Mayo 2024 - 10:24PM

RTTF2

The British pound strengthened against other major currencies in

the pre-European session on Wednesday, after data showed that U.K.

consumer price inflation slowed less than expected in April,

leaving a 50 percent chance of a June rate cut unchanged. Data from

the Office for National Statistics showed that the U.K. consumer

price inflation weakened to the lowest since July 2021. Consumer

prices rose 2.3 percent on a yearly basis in April, slower than the

3.2 percent increase in March. However, inflation was stronger than

economists' forecast of 2.1 percent.

The April inflation was the weakest since July 2021, when it was

2.0 percent.

Month-on-month, the consumer price index posted 0.3 percent

increase after rising 0.6 percent a month ago. Economists were

expecting a 0.2 percent gain.

Another report from the ONS showed that output price inflation

was the highest since May 2023. Output prices moved up 1.1 percent

after a 0.7 percent gain in March. Monthly inflation remained

unchanged at 0.2 percent.

Input prices declined for the eleventh consecutive month in

April. Input prices registered an annual fall of 1.6 percent

following a 2.5 percent drop in March. The monthly input PPI

inflation rate was 0.6 percent in April, following a revised 0.2

percent fall in March.

Also, the European shares traded higher, as investors await

highly anticipated earnings results from AI chip leader Nvidia, set

for release after the U.S. closing bell.

In economic releases, the minutes of the Fed's April 30-May 1

meeting as well as a report on U.S. existing home sales may garner

some attention.

The minutes may shed additional light on Fed officials' thinking

with regard to the outlook for rates.

The British sterling held steady against its major rivals in the

Asian trading today.

In the European trading now, the pound rose to nearly a

1-1/2-month high of 0.8512 against the euro and nearly a 2-year

high of 1.1645 against the Swiss franc, from yesterday's closing

quotes of 0.8543 and 1.1582, respectively. If the pound extends its

uptrend, it is likely to find resistance around 0.83 against the

euro and 1.17 against the franc.

Against the U.S. dollar and the yen, the pound advanced to a

2-month high of 1.2763 and nearly a 4-week high of 199.55 from

Tuesday's closing quotes of 1.2708 and 198.54, respectively. The

pound may test resistance around 1.29 against the greenback and

201.00 against the yen.

Looking ahead, U.S. MBA mortgage approvals data, U.S. existing

home sales data for April and U.S. EIA crude oil data are slated

for release in the New York session.

At 2:00 pm ET, the minutes of the U.S. Federal Reserve's latest

monetary policy meeting will be published.

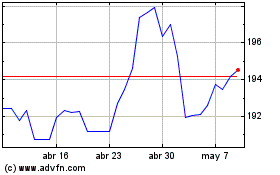

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De May 2024 a Jun 2024

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Jun 2023 a Jun 2024