U.S. Dollar Climbs Amid Risk Aversion

20 Septiembre 2024 - 8:08AM

RTTF2

The U.S. dollar advanced against its major counterparts in the

New York session on Friday, amid higher treasury yields and a

pullback in U.S. stocks.

U.S. stocks fell amid profit taking, as traders cash in on some

of the strong gains posted during Thursday's session.

Treasury yields rose as recent strong economic data indicated

continued strength in the economy.

Although the Fed has already signaled plans to continue lowering

rates in the coming months, incoming data could still impact market

sentiment.

Reports on durable goods orders, new home sales and consumer

confidence are likely to attract attention next week along with a

report on personal income and spending that includes the Fed's

preferred inflation gauge.

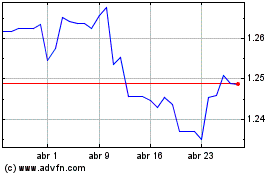

The greenback climbed to 1.1136 against the euro and 1.3267

against the pound, from an early 2-day low of 1.1181 and a

2-1/2-year low of 1.3340, respectively. The currency is seen

finding resistance around 1.06 against the euro and 1.27 against

the pound.

The greenback appreciated to a 1-week high of 0.8517 against the

franc and more than a 2-week high of 144.49 against the yen, off

its early lows of 0.8451 and 141.73, respectively. The currency is

likely to locate resistance around 0.92 against the franc and

147.00 against the yen.

The greenback edged up to 1.3589 against the loonie, 0.6782

against the aussie and 0.6210 against the kiwi, from its early lows

of 1.3542, 0.6828 and 0.6260, respectively. Immediate resistance

for the currency is seen around 1.38 against the loonie, 0.63

against the aussie and 0.60 against the kiwi.

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Oct 2024 a Nov 2024

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Nov 2023 a Nov 2024