U.S. Dollar Drops Amid Dovish Comments From Fed's Goolsbee

23 Septiembre 2024 - 8:22AM

RTTF2

The U.S. dollar fell against its major counterparts in the New

York session on Monday, as Chicago Fed President Austan Goolsbee

hinted at significant rate cuts over the next year.

Many more rate cuts are likely needed over the next 12 months as

labor market deterioration happens fast, Goolsbee said at the

National Association of State Treasurers Annual Conference.

"We have a long way to come down" on the Fed policy rate, which

was reduced to the 4.75%-5.00% range last week.

"If we want a soft landing, we can't be behind the curve,"

Goolsbee added.

Reports on durable goods orders, new home sales and consumer

confidence are due this week along with a report on personal income

and spending that includes the Fed's preferred inflation gauge.

The greenback retreated to 0.8464 against franc and 1.1143

against the euro, from an early nearly 2-week high of 0.8518 and a

4-day high of 1.1083, respectively. The currency is seen finding

support around 0.83 against the franc and 1.12 against the

euro.

The greenback touched a 2-1/2-year low of 1.3359 against pound,

off an early 4-day high of 1.3248. The currency is likely to

challenge support around the 1.35 level.

The greenback weakened to more than a 2-week low of 1.3490

against the loonie, near 9-month low of 0.6853 against the aussie

and more than a 3-week low of 0.6273 against the kiwi, off its

early highs of 1.3582, 0.6793 and 0.6225, respectively. Immediate

support for the currency is seen around 1.32 against the loonie,

0.69 against the aussie and 0.63 against the kiwi.

The greenback eased against the yen and was trading at 143.41.

The currency is poised to challenge support around the 134.00

level.

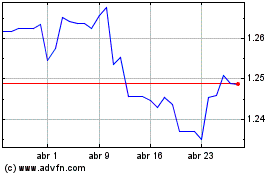

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Oct 2024 a Nov 2024

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Nov 2023 a Nov 2024