U.S. Dollar Drops Against Majors

26 Septiembre 2024 - 7:11AM

RTTF2

Erasing gains, the U.S. dollar fell against its most major

counterparts in the New York session on Thursday.

The currency rebounded earlier following the release of strong

economic data, including weekly jobless claims and GDP data for the

second quarter.

Data from the Labor Department showed that first-time claims for

U.S. unemployment benefits unexpectedly edged lower in the week

ended September 21.

The Labor Department said initial jobless claims slipped to

218,000, a decrease of 4,000 from the previous week's revised level

of 222,000.

The dip surprised economists, who had expected jobless claims to

rise to 225,000 from the 219,000 originally reported for the

previous week.

Final data from the Commerce Department showed that second

quarter GDP growth matched both expected and previous figures.

GDP increased 3.0 percent in the second quarter, unchanged from

the previous reading, but higher than the 1.4 percent jump reported

in the first quarter.

The greenback fell to 1.1178 against the euro and 1.3418 against

the pound, off its early highs of 1.1125 and 1.3312, respectively.

The currency is seen finding support around 1.13 against the euro

and 1.36 against the pound.

The greenback retreated to 0.6895 against the aussie, 1.3466

against the loonie and 0.6322 against the kiwi, from an early high

of 0.6818, 2-day high of 1.3489 and a 3-day high of 0.6252,

respectively. The currency is likely to challenge support around

0.70 against the aussie, 1.33 against the loonie and 0.645 against

the kiwi.

The greenback was trading at 0.8467 against the franc, down from

an early 3-day high of 0.8516. The currency is poised to challenge

support around the 0.83 level.

In contrast, the greenback appreciated to a fresh 3-week high of

145.21 against the yen. Immediate resistance for the currency is

seen around the 147.00 level.

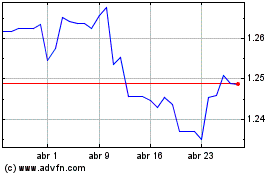

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Feb 2025 a Mar 2025

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Mar 2024 a Mar 2025