U.S. Dollar Appreciates After Hot PPI Data

12 Diciembre 2024 - 6:54AM

RTTF2

The U.S. dollar moved up against its most major counterparts in

the New York session on Thursday, as producer price inflation

increased more than expected in November, supporting expectations

that the U.S. central bank will cut rates by 25 basis points next

week.

Data from the Labor Department showed that the producer price

index for final demand climbed by 0.4 percent in November after

rising by an upwardly revised 0.3 percent in October.

Economists had expected producer prices to inch up by 0.2

percent, matching the uptick originally reported for the previous

month.

The report also said the annual rate of producer price growth

accelerated to 3.0 percent in November from an upwardly revised 2.6

percent in October.

The annual rate of producer price growth was expected to rise to

2.6 percent from the 2.4 percent originally reported for the

previous month.

While the data is not likely to significantly impact

expectations the Federal Reserve will lower interest rates next

week, it could reduce the chances the central bank continues to

lower rates early next year.

Separate data showed that first-time claims for U.S.

unemployment benefits unexpectedly increased in the week ended

December 7.

The report said initial jobless claims climbed to 242,000, an

increase of 17,000 from the previous week's revised level of

225,000.

Economists had expected jobless claims to dip to 220,000 from

the 224,000 originally reported for the previous week.

The greenback climbed to a 10-day high of 1.0463 against the

euro and more than a 2-week high of 0.8902 against the franc, off

its early lows of 1.0530 and 0.8816, respectively. The next

possible resistance for the currency is seen around 1.03 against

the euro and 0.91 against the franc.

The greenback touched a 4-1/2-year high of 1.4200 against the

loonie. The currency is likely to locate resistance around the 1.43

level.

The greenback rose to an 8-day high of 1.2670 against the pound,

from an early 3-day low of 1.2787. If the greenback rises further,

it is likely to test resistance around the 1.24 region.

The greenback recovered to 0.6367 against the aussie and 0.5771

against the kiwi, from its early 2-day lows of 0.6429 and 0.5817,

respectively. The currency is poised to challenge resistance around

0.62 against the aussie and 0.56 against the kiwi.

In contrast, the greenback declined to 151.79 against the yen.

The currency is seen finding support around the 149.00 level.

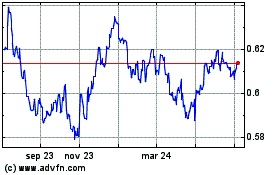

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Nov 2024 a Dic 2024

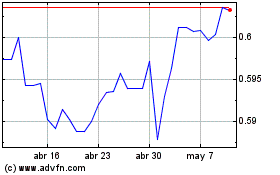

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Dic 2023 a Dic 2024