GAM Holding AG announces rights take-up and number of shares sold

in its rights offering

FOR RELEASE IN SWITZERLAND - THIS IS A RESTRICTED

COMMUNICATION AND YOU MUST NOT FORWARD IT OR ITS CONTENTS TO ANY

PERSON TO WHOM FORWARDING THIS COMMUNICATION IS PROHIBITED BY THE

LEGENDS CONTAINED HEREIN.

Not for release, publication or distribution, in whole

or in part, directly or indirectly, in the United States of

America, Canada, Japan or Australia or any other jurisdiction in

which the release, publication or distribution would be

unlawful.

Zurich, 13 November 2024

PRESS RELEASE

Ad hoc announcement pursuant to Art. 53 Listing Rules:

GAM Holding AG announces rights take-up and number of

shares sold in its rights offering

GAM Holding AG ("GAM") announces that in its

rights offering and placement of 904,464,247 newly issued

registered shares (the "Offered Shares") (the

"Offering"), 42% of the subscription rights have

been validly exercised by the end of the subscription period on

13 November 2024, at 12:00 CET. This includes the full pro

rata allocation of the newly issued Offered Shares to Rock

Investment SAS ("Rock"), a group company of GAM's

anchor shareholder NJJ Holding SAS, due to its indirect

participation in GAM through its majority controlled subsidiary

Newgame SA.

As previously announced, Rock has agreed to provide a backstop

commitment for the Offering in an amount of up to CHF 100

million (the "Rock Commitment"). Therefore, the

remaining 520,890,592 Offered Shares (excluding the full pro

rata allocation of Offered Shares to Rock) for which the

subscription rights were not validly exercised during the

subscription period were allocated to and purchased by Rock in

accordance with the Rock Commitment. As a result, Rock’s direct and

indirect shareholding rises to 774,332,093 shares representing 73%

of GAM’s issued share capital after settlement of the rights

issue.

The first trading day of the Offered Shares is expected to be

15 November 2024.

Delivery of the Offered Shares against payment of the Offer

Price is scheduled for 15 November 2024. The Offered Shares

will carry full voting rights, be eligible for dividends and other

distributions, if any, for the first time for the financial year

ending December 31, 2024, and rank pari passu in all respects

with the existing registered shares.

With the completion of the capital increase, GAM will receive

expected net proceeds of approximately CHF 98.2 million. These

proceeds will be used to repay amounts outstanding under the loan

facility granted by Rock and any residual amount will be used for

general corporate purposes.

-ends-

For further information please contact:

Investor

Relations

Magdalena

Czyzowska

T +44 (0) 207 917 2508

GAM Media Relations

Colin Bennett

T +44 (0) 20 73 938 544

Visit us: www.gam.com

Follow us: X and LinkedIn

Notes to editors

About GAM

GAM is an independent investment manager that is listed in

Switzerland. It is an active, independent global asset manager that

delivers distinctive and differentiated investment solutions for

its clients across its Investment and Wealth Management Businesses.

Its purpose is to protect and enhance its clients’ financial

future. It attracts and empowers the brightest minds to provide

investment leadership, innovation and a positive impact on society

and the environment. Total assets under management were CHF

19.0 billion as of 30 June 2024. GAM has global distribution with

offices in 14 countries and is geographically diverse with clients

in almost every continent. Headquartered in Zurich, GAM Investments

was founded in 1983 and its registered office is at Hardstrasse 201

Zurich, 8037 Switzerland. For more information about GAM

Investments, please visit https://www.gam.com/en/.

Other Important Information

This release contains or may contain statements that constitute

forward-looking statements. Words such as “anticipate”, “believe”,

“expect”, "estimate", "aim", “project”, “forecast”, "risk",

“likely”, “intend”, “outlook”, “should”, “could”, "would", “may”,

“might”, "will", "continue", "plan", "probability", "indicative",

"seek", “target”, “plan” and other similar expressions are intended

to or may identify forward-looking statements.

Any such statements in this release speak only as of the date

hereof and are based on assumptions and contingencies subject to

change without notice, as are statements about market and industry

trends, projections, guidance, and estimates. Any forward-looking

statements in this release are not indications, guarantees,

assurances or predictions of future performance and involve known

and unknown risks, uncertainties and other factors, many of which

are beyond the control of the person making such statements, its

affiliates and its and their directors, officers, employees, agents

and advisors and may involve significant elements of subjective

judgement and assumptions as to future events which may or may not

be correct and may cause actual results to differ materially from

those expressed or implied in any such statements. You are strongly

cautioned not to place undue reliance on forward-looking statements

and no person accepts or assumes any liability in connection

therewith.

This release is not a financial product or investment advice, a

recommendation to acquire, exchange or dispose of securities or

accounting, legal or tax advice. It has been prepared without

taking into account the objectives, legal, financial or tax

situation and needs of individuals. Before making an investment

decision, individuals should consider the appropriateness of the

information having regard to their own objectives, legal, financial

and tax situation and needs and seek legal, tax and other advice as

appropriate for their individual needs and jurisdiction.

Disclaimer

This document is not an offer to sell or a

solicitation of offers to purchase or subscribe for shares. This

document is not a prospectus within the meaning of the Swiss

Financial Services Act and not a prospectus under any other

applicable laws. Copies of this document may not be sent to,

distributed in or sent from jurisdictions in which this is barred

or prohibited by law. The information contained herein shall not

constitute an offer to sell or the solicitation of an offer to buy,

in any jurisdiction in which such offer or solicitation would be

unlawful prior to registration, exemption from registration or

qualification under the securities laws of any jurisdiction. The

offer and listing of new securities was made solely by means of,

and on the basis of, the prospectus published by GAM Holding AG for

such purpose. Copies of such prospectus (and any supplements

thereto) are available free of charge from at GAM Holding AG,

Investor Relations, Hardstrasse 201, 8005 Zürich, Switzerland

(email: investorrelations@gam.com).

This document is not for publication or

distribution in the United States of America (including its

territories and possessions, any State of the United States and the

District of Columbia), Canada, Japan or Australia or any other

jurisdiction into which the same would be unlawful. This document

does not constitute an offer or invitation to subscribe for or

purchase any securities in such countries or in any other

jurisdiction into which the same would be unlawful. In particular,

the document and the information contained herein should not be

distributed or otherwise transmitted into the United States of

America or to publications with a general circulation in the United

States of America. The securities referred to herein have not been

and will not be registered under the U.S. Securities Act of 1933,

as amended (the "Securities Act"), or the laws of

any state and may not be offered or sold in the United States of

America absent registration under or an exemption from registration

under the Securities Act. There will be no public offering of the

securities in the United States of America.

The information contained herein does not

constitute an offer of securities to the public in the United

Kingdom. No prospectus offering securities to the public will be

published in the United Kingdom. In the United Kingdom this

document is only directed at persons who (i) are qualified

investors and who are also (ii) investment professionals falling

within article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (the "FSMA Order"); (iii) persons

falling within Articles 49(2)(a) to (d), "high net worth companies,

unincorporated associations, etc." of the FSMA Order and (iv)

persons to whom an invitation or inducement to engage in investment

activity within the meaning of Section 21 of the Financial Services

and Markets Act 2000 may otherwise be lawfully communicated or

caused to be communicated (all such persons together being referred

to as "relevant persons"). The securities are only available to,

and any invitation, offer or agreement to subscribe, purchase or

otherwise acquire such securities will be engaged in only with,

relevant persons. Any person who is not a relevant person should

not act or rely on this document or any of its contents.

In any member state of the European Economic

Area (each a "Relevant State") this document is only addressed to

qualified investors in that Relevant State within the meaning of

the Prospectus Regulation.

- GAM Holding AG announces rights take-up and number of shares

sold in its rights offering

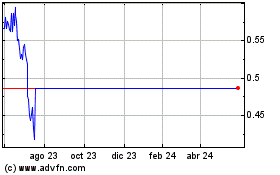

Gam (LSE:0QN3)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

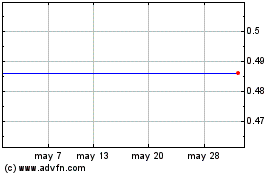

Gam (LSE:0QN3)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025