Clarion Funding plc Publication of Half Year Accounts

16 Diciembre 2024 - 8:31AM

RNS Regulatory News

RNS Number : 2715Q

Clarion Funding plc

16 December 2024

Clarion Funding

plc

16 December

2024

CLARION HOUSING GROUP PUBLISHES HALF

YEAR ACCOUNTS

Clarion Housing Group today publishes its

accounts for the half year ending 30 September 2024. http://www.rns-pdf.londonstockexchange.com/rns/2715Q_1-2024-12-16.pdf

The accounts show a strong and resilient

financial performance. With turnover at £542 million (H1 2023/24:

£486 million) and an operating surplus of £138 million (H1 2023/24:

£109 million), both show an improved performance compared to the

first six months of the previous year. This is also reflected

in the net surplus increasing to £68 million (H1 2023/24: £35

million). The year-on-year gain is predominantly due to increased

rental income and increased surplus on disposal, which more than

offset higher operating costs.

The Group remains committed to both improving

its existing properties and delivering more new social

housing. This is demonstrated with the investment of £220

million in new and existing homes in the first half of the year,

over three times the net surplus for the period. The Group has

completed 792 properties (up from 606 in the first half of 2023/24)

- of which 78% were for affordable tenures.

During the period, £7 million was invested in

the important work of the Group's charitable foundation, Clarion

Futures. Over the first six months of 2024/25, Clarion Futures has

supported 793 people into jobs, 2,412 into training and 35 people

have been helped to set up their own business.

Mark Hattersley, Chief Financial Officer, said:

"I am proud of what we have achieved by the mid-point of the year,

and while we are heading into what can be the more challenging

winter period, we are well placed to continue to deliver for our

residents and retain a financially robust position.

Alongside the strong financial performance, we

have delivered an increased number of new homes and continue to

invest significantly in our homes and in our communities. We

couldn't achieve all of this without the ongoing support of our

investors, which was demonstrated by our successful return to the

capital markets in May with a new £250 million 33-year

sustainability bond. From opening a brand-new community centre in

Ealing to publishing our first Nature Recovery Strategy, we

continue to focus on our purpose of 'making a

difference'."

Ends

For more information, please contact Lucy Pond,

lucy.pond@clarionhg.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

DOCQKABBQBDDBBD

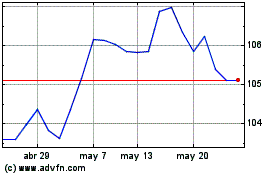

Affinity Sut.38 (LSE:51GC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

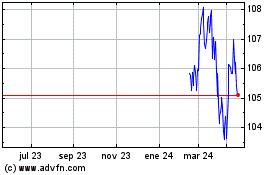

Affinity Sut.38 (LSE:51GC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024