A2Dominion Housing Group Ltd Replacement: Half Yearly Performance Update

21 Noviembre 2017 - 4:10AM

RNS Non-Regulatory

TIDM54XE

A2Dominion Housing Group Ltd

21 November 2017

The following amendments have been made to the 'Half Yearly

Performance Update' announcement released on 16/11/2017 at 09:00

under RNS No 6320W.

The Management Accounts Consolidated Statement of Comprehensive

Income (unaudited) section has been corrected.

All other details remain unchanged. The full amended text is

shown below.

A2Dominion Housing Group's Half Yearly Performance Update

covering the period to 30 September 2017

A2Dominion Housing Group announces the following update for the

period to 30 September 2017.

The Group has delivered a strong financial and operational

performance for the period. The Group is on track to continue at

this level of performance through to the end of the financial

year.

Financial Performance

Management Accounts Consolidated Statement of Comprehensive

Income (unaudited)

6 Months

to 6 Months to

30-Sep-17 30-Sep-16

GBPm GBPm

------------------------ ---------- ------------

Turnover 149.9 187.2

Operating Surplus 73.0 60.4

Operating Margin 48.7% 32.3%

Interest -26.0 -23.1

Surplus for the Period 47.0 37.3

------------------------- ---------- ------------

Management Accounts Consolidated Statement of Financial Position

(unaudited)

Sep-17 Sep-16

GBPm GBPm

------------------ --------- ---------

Fixed Assets 3,101.1 3,060.7

Current Assets 573.0 578.1

Creditors -2,788.9 -2,802.5

Net Assets 885.2 836.3

------------------- --------- ---------

Revenue Reserves 882.3 833.8

Other Reserves 2.8 2.5

Net Equity 885.2 836.3

------------------- --------- ---------

Our first six months' results deliver a strong operating margin

compared to the same period last year. A significant contributor to

this is the surplus being delivered from our share of joint venture

profits. This impacts turnover, as the joint venture sales are

netted off with cost of sales and accounted for net in

turnover.

Operational Performance

Customer: The Group has performed well over the first half of

the year showing continued improvement on our customer contact

focussed KPIs. Our customer service centre achieved its best ever

customer satisfaction result in September with 88.0% with the year

to date figure standing at 83.4%.

Arrears levels across the board have remained steady with the

majority of areas showing a slight year to date improvement.

Development: We are currently forecasting to complete 1,014

units by the year end against a target of 900 units with actual

handovers at 339 at the end of September 2017. Our current

committed pipeline totals 5,277 units being delivered between 2018

and 2023.

Treasury: As at 30 September, the Group's overall borrowings and

arranged facilities were virtually unchanged from the year end

position. Loan facilities at the half-year can be summarised as

follows:

Arranged Drawn

GBPm GBPm

---------------------------------- ----------- ---------

A2Dominion Housing Group Limited -1.4 -1.4

A2Dominion Homes Limited 897.4 677.9

A2Dominion South Limited 784 648.3

A2Dominion Residential Limited 217.3 217.3

Total Loans 1,897.3 1,542.1

----------------------------------- ----------- ---------

In addition to the GBP355.2m of undrawn facilities, the Group

had GBP165m of cash invested with a variety of counterparties, in

line with our Treasury policy.

As at 30 September, the Group's overall fixed rate ratio was 91%

(compared to 93% as at the end of March 2017) and the average

borrowing rate remains unchanged at 4.7%.

There have been no changes to the Group's borrowing structure

during the year to date and no new funding was raised or

refinancing carried out. Over the next 2 years, GBP150m of existing

loans will be lost through scheduled capital repayments and we are

planning to replace these lost facilities in the near future. The

annual update of our EMTN programme documentation was carried out

during October, so that the Group is able make use of this over the

next 12 months.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRAUARRRBSAAUAA

(END) Dow Jones Newswires

November 21, 2017 05:10 ET (10:10 GMT)

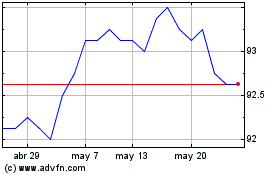

A2dominion 28 (LSE:54XE)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

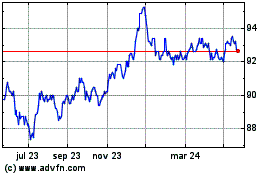

A2dominion 28 (LSE:54XE)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024