TIDM54XE

RNS Number : 3546M

A2Dominion Housing Group Ltd

14 September 2023

A2Dominion reports significant rise in costs and investment into

existing homes in 2022/23

A2Dominion Housing Group Limited has published its Annual Report

& Accounts for 2022/23, recording a turnover of GBP389.1m

(2022: GBP465.8m) and a net deficit of GBP12.8m (2022: GBP40.4m

surplus). This follows the Group's increased investment into its

existing homes to ensure they are safe and comply with new

regulations, as well as significant increases in its operational

costs, and planned fall in sales income.

A significant part of the housing association's reduced

operating margin and operating surplus (GBP50.3m) comes as a result

of the economic conditions the organisation and sector is now

facing. This includes GBP16.9m of impairments of active development

schemes, GBP7.9m of abortive costs for schemes deemed no longer

viable, and a further GBP7.6m of scheme write-downs within cost of

sales. Combined, these GBP32.4m of costs have contributed towards

the Group's reduced operating margin of 11.2% (2022: 20.1%), which

would otherwise have been 19.5%.

The Group also saw a planned reduction in its sales and

development programme which, coupled with construction delays, led

to a fall in sales income of GBP40.6m. It also increased its

investment into maintaining and improving its homes from GBP39.6m

in 2022 to GBP54.7m.

Notwithstanding, A2Dominion's balance sheet remains strong, with

GBP1.04bn of net assets and over GBP350m of available undrawn

facilities, demonstrating its ability to weather the current and

future challenges the economic environment presents.

Moving forward the Group will invest even greater resources into

redevelopment and service improvements. It has taken stock of its

operational and financial performance, continued investment to

address safety and building quality issues, and the needs of its

customers.

Ian Wardle, A2Dominion's Chief Executive Officer who joined the

housing association in September 2022, said:

"A2Dominion hasn't been immune to the tough economic challenges.

This year's financial performance has felt the full impact with

rising inflation, interest rates, and energy costs, alongside

tougher market conditions for construction and a reduced sales and

development programme.

"We've also chosen to continue significant investments into

remediating our tall and complex buildings and improving core

landlord services.

"All these factors have contributed towards significant rises in

our operational costs and pressures on our profitability. Work is

already underway to reduce our operating expenses, borrowings and

interest costs, which will help ensure our continued financial

sustainability and resilience over the medium to longer term.

"Overall, we continue to be a financially strong organisation,

with many of our services performing well. However we also

recognise that there are some important areas where we need to

improve and we are committed to putting this right."

Key highlights from the report:

-- 86.3% customer satisfaction with responsive repairs services

-- 85,000+ responsive repairs

-- New Damp & Mould and Enhanced Housing Management teams

-- GBP11.2 million generated in social value

-- Supporting 2,200+ customers to claim over GBP7 million in financial support

-- 745 new homes completed

-- 340 homes started on site

-- 1,748 homes to be built in our two-year development pipeline

-- Fitch A credit rating

-- 82% employee engagement score.

The full audited financial statements can be found in the

following location:

https://www.a2dominiongroup.co.uk/about/reports-and-accounts

Summary Financial Performance

GROUP STATEMENT OF COMPREHENSIVE 2023 2022

INCOME AND EXPENDITURE restated

GBPM GBPM

Turnover 389.1 465.8

Cost of sales (96.1) (181.6)

Operating costs (270.7) (213.0)

Surplus on sale of fixed assets 14.4 13.3

Share of jointly controlled entity

operating profit 6.7 9.2

Operating surplus 43.4 93.7

Operating margin 11.2% 20.1%

Net interest charges (66.9) (65.5)

Change in fair value of investments (0.8) 8.4

Movement in fair value of financial

instruments 4.7 2.7

Movement in fair value of investment

properties 0.6 9.0

Taxation 7.1 (6.4)

Non-controlling interest (0.9) (1.5)

Net (deficit)/surplus for the

year (12.8) 40.4

GROUP STATEMENT OF FINANCIAL 2023 2022

POSITION restated

GBPM GBPM

Tangible fixed assets and investments 3,600.2 3,624.0

Current assets 275.3 420.9

Creditors including loans and

borrowings (1,783.5) (1,952.6)

Deferred capital grant (1,050.8) (1,070.8)

Non-controlling interest (1.4) (1.7)

Total reserves 1,039.8 1,019.8

A copy of the Annual Financial Statements has also been

submitted to the National Storage Mechanism and will

shortly be available for inspection: https://data.fca.org.uk/#/nsm/nationalstoragemechanism

ENDS

Investor Contact

For further information, please contact Giedre Mickute, Head of

Treasury:

Tel: 07977 040 259

Email: giedre.mickute@a2dominion.co.uk

Media Contact

For media enquiries, please contact Sarah Ashton, Senior

Corporate Communications Manager:

Tel: 07823 532 199

Email: sarah.ashton@a2dominion.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSMZGMLDFVGFZM

(END) Dow Jones Newswires

September 14, 2023 05:30 ET (09:30 GMT)

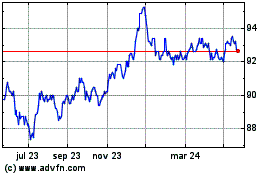

A2dominion 28 (LSE:54XE)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

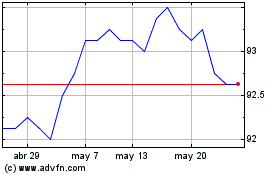

A2dominion 28 (LSE:54XE)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025