A2Dominion Housing Group Ltd Half Yearly Results

01 Noviembre 2018 - 11:45AM

RNS Non-Regulatory

TIDM54XE

A2Dominion Housing Group Ltd

01 November 2018

A2Dominion Housing Group's Half Yearly Performance Update

covering the period to 30 September 2018

A2Dominion Housing Group announces the following update for the

period to 30 September 2018.

Financial Performance

The Group has delivered a strong financial performance compared

to budget expectation for the period. The Group is expected to

sustain this level of performance through to the end of the

financial year.

Management Accounts Consolidated Statement of Comprehensive

Income

6 Months to 6 Months to

30-Sep-18 30-Sep-17

GBPm GBPm

------------------------------------ -------- ---------------------- ------------------------

Turnover 197.8 133.2

------------------------------------- -------- ---------------------- ------------------------

Rent 111.2 109.2

Sales 73.9 11.6

Social Housing Grant Amortisation 8.3 7.9

Other Income 4.4 4.5

------------------------------------- -------- ---------------------- ------------------------

Operating Surplus 52.2 56.3

Operating Margin 26.4% 42.3%

Share of Joint Venture Surplus 2.4 16.7

Interest (23.5) (26.0)

----------------------------------------------- ---------------------- ------------------------

Surplus for the Period 31.1 47.0

---------------------- ------------------------

Management Accounts Consolidated Statement of

Financial Position

30-Sep-18 31-Mar-18

GBPm GBPm

------------------------------------ ---- --- ---------------------- ------------------------

Fixed Assets 3,243.0 3,174.6

Current Assets 652.1 568.2

Creditors (2,925.4) (2,803.5)

----------------------------------------------- ---------------------- ------------------------

Net Assets 969.7 939.3

--- ---------------------- ------------------------

Revenue Reserves 962.6 932.6

Other Reserves 7.1 6.7

--- ---------------------- ------------------------

Net Equity 969.7 939.3

--- ---------------------- ------------------------

Year on year the Group achieved a lower operating margin

compared to the same period last year. This is a consequence of two

large developments with lower margins, which generated nearly

GBP50m of turnover during the 6 months to September 2018. Social

housing income operating margin remains strong at 35.7% (2017:

38.7%).

The Statement of Financial Position shows a net asset increase

of GBP30.4m which highlights the Group's continued commitment to

invest our surpluses and obtain funding to deliver our housing

development programme.

Operational Performance

-- Customer: The Group has performed well over the first half of

the year showing improved results in our customer contact

performance and maintaining a high level of customer satisfaction

(81%). Arrears levels have also remained steady for the year to

date. Overall satisfaction with responsive repairs services (89%)

and planned maintenance services (99%) are above target.

-- Development: The number of homes built to the end of September 2018 is 338.

Treasury

As at 30 September, the Group's loan facilities and borrowings

are summarised as follows:

Arranged Drawn

GBPm GBPm

A2Dominion Housing Group Limited (1.3) (1.3)

A2Dominion Homes Limited 932.0 635.6

A2Dominion South Limited 797.7 632.4

A2Dominion Residential Limited 280.5 280.5

A2Dominion Housing Options 26.0 26.0

A2Dominon Development Limited ____47.3 ___47.3

2,082.2 1,620.5

________ _______

In addition to the GBP461.7m of undrawn facilities, the Group

had GBP212.0m of cash invested with a variety of counterparties, in

line with our Treasury Policy.

As at 30 September, the Group's overall fixed rate ratio was

84.3% (compared to 91.4% as at the end of March 2018) and the

average borrowing rate remains unchanged at 4.38%.

Since April 2018, the Group has entered into two new revolving

credit facilities of GBP50m each. The Group has also issued a

Floating Rate Note of GBP60m, and has signed a new uncommitted

facility for a future notes issue of $100m. Over the next 2 years,

GBP170m of existing loan facilities will be lost through scheduled

loan facility amortisation and we are planning to replace these

lost facilities in the near future. The annual update of our EMTN

programme documentation was carried out during September, so that

the Group is able make use of this over the next 12 months.

Investor Update

An Investor Update presentation is available on our website

link: https://www.a2dominiongroup.co.uk/content/doclib/68.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NRADMMGMNMMGRZM

(END) Dow Jones Newswires

November 01, 2018 13:45 ET (17:45 GMT)

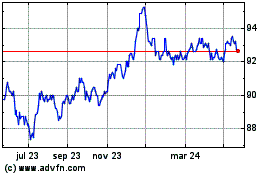

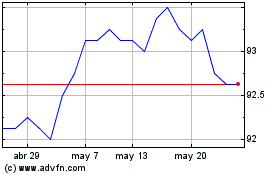

A2dominion 28 (LSE:54XE)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

A2dominion 28 (LSE:54XE)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024