Associated British Foods PLC Third Quarter Trading Update (8108D)

26 Junio 2023 - 1:00AM

UK Regulatory

TIDMABF

RNS Number : 8108D

Associated British Foods PLC

26 June 2023

26 JUNE 2023

Third Quarter trading update

Associated British Foods plc today issues a trading update for

the 12 weeks to 27 May 2023 summarising the significant trading

developments since the last market update.

Trading performance

The following table sets out revenues by business segment for

the third quarter of the financial year and for year to date.

Third quarter Change at Year to Change

GBPm constant date at constant

currency GBPm currency

============ ============= ========= ======= ============

Grocery 1,058 +13% 3,163 +11%

Sugar 665 +51% 1,854 +35%

Agriculture 458 +4% 1,408 +11%

Ingredients 547 +10% 1,635 +20%

Total Food 2,728 +18% 8,060 +18%

Retail 1,998 +13% 6,226 +15%

Group 4,726 +16% 14,286 +17%

============ ============= ========= ======= ============

References to growth in the following commentary are based on

constant currency except where stated.

Food

Trading across our Food businesses has continued to be good,

following the trends seen in our second quarter. In particular, we

have seen strong constant currency sales growth in Grocery and

Ingredients largely driven by the necessary pricing actions taken

earlier in the year to offset input cost increases.

In Sugar, trading has continued to be strong across its key

African markets. As previously announced, British Sugar has had to

secure alternative sources of supply as a consequence of the

production shortfall from the 2022/23 campaign. After delayed

planting, the 2023 UK beet sugar crop is now progressing well.

Retail

Primark has continued to trade in line with our expectations,

with summer ranges performing well as the season started in our

markets. Sales grew by 13% in the quarter, with like-for-like sales

growth of 7%, supported by higher average selling prices.

Like-for-like sales growth for the year to date is now 9%. Like-

for-like sales growth in the quarter was 6% in the UK and 7% in

Europe excluding the UK. As well as seasonal clothing and

accessories, sales in health and beauty products were particularly

strong. Sales in our flagship city centre stores have continued to

be good.

The deployment of Primark's much-improved website continued,

launching in Germany, Spain, Italy, and the US in the period and in

France shortly after the period ended. The remaining markets will

follow over the summer.

The contribution from new and extended stores continues to be

strong. Our exciting store expansion plan remains on track. We

opened four stores in the period: Venice, Italy; Walden Galleria,

Buffalo, NY; Toledo, Spain; and Bratislava, Slovakia, our first in

that country which becomes our 16(th) market. In the US, we have

now signed the lease for our first store in Texas.

Overall

The Group continues to trade well . Based on current trading

conditions, we now expect the Group's adjusted operating profit for

the full year to be moderately ahead of last year. Adjusted EPS

will also benefit from a Group Effective Tax Rate that is now

expected to be below that seen in the first half of the year.

As at the close of trading 23(rd) June we have completed GBP319m

of the GBP500m share buyback programme

For further information please contact:

Associated British Foods:

Tel: 020 7399 6545

Eoin Tonge, Finance Director

Ian Mace, Investor Relations

Citigate Dewe Rogerson:

Tel: 020 7638 9571

Holly Gillis Tel: 07940 797560

Angharad Tel: 07507 643004

Couch

Notes:

- Definitions of the alternative performance measures referred

to in this announcement can be found in note 30 of our Annual

Report and Accounts 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPUMCQUPWGMA

(END) Dow Jones Newswires

June 26, 2023 02:00 ET (06:00 GMT)

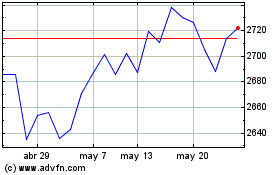

Associated British Foods (LSE:ABF)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

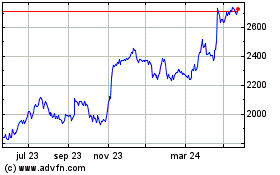

Associated British Foods (LSE:ABF)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024