TIDMALL

RNS Number : 4788U

Atlantic Lithium Limited

23 November 2023

23 November 2023

Quarterly Activities and Cash Flow Report

for the quarter ended 30 September 2023 - Updated

Atlantic Lithium Limited (AIM: ALL, ASX: A11, OTCQX: ALLIF,

"Atlantic Lithium" or the "Company"), the African-focused lithium

exploration and development company targeting to deliver Ghana's

first lithium mine, provides an update to the announcement

entitled, "Quarterly Activities and Cash Flow Report for the

quarter ended 30 September 2023", dated 31 October 2023.

Pursuant to ASX Listing Rule 5.3.5, the Company advises that

items 6.1 and 6.2 of Appendix 5B, which relate to payments of

salaries/fees (including superannuation) to Executive Directors,

which were erroneously omitted in the announcement dated 31 October

2023, have now been updated.

The updated Appendix 5B can be found below.

No other details in the announcement dated 31 October 2023 have

changed.

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Name of entity

=====================================================

ATLANTIC LITHIUM LIMITED

=====================================================

ABN Quarter ended ("current quarter")

=============== ==================================

17 127 215 132 30 September 2023

=============== ==================================

Consolidated statement of cash flows Current quarter Year to date (3 months)

$A'000 $A'000

1. Cash flows from operating activities

------ ---------------------------------------------------------------- ----------------- -------------------------

1.1 Receipts from customers - -

------ ---------------------------------------------------------------- ----------------- -------------------------

1.2 Payments for

(a) exploration & evaluation - -

(b) development - -

(c) production - -

(d) staff costs (389) (389)

(e) administration and corporate costs (1,645) (1,645)

1.3 Dividends received (see note 3) - -

------ ---------------------------------------------------------------- ----------------- -------------------------

1.4 Interest received - -

------ ---------------------------------------------------------------- ----------------- -------------------------

1.5 Interest and other costs of finance paid - -

------ ---------------------------------------------------------------- ----------------- -------------------------

1.6 Income taxes paid - -

------ ---------------------------------------------------------------- ----------------- -------------------------

1.7 Government grants and tax incentives - -

------ ---------------------------------------------------------------- ----------------- -------------------------

1.8 Other - -

------ ---------------------------------------------------------------- ----------------- -------------------------

1.9 Net cash from / (used in) operating activities (2,034) (2,034)

====== ================================================================ ================= =========================

2. Cash flows from investing activities

------ ----------------------------------------------------------------

2.1 Payments to acquire or for:

------ ----------------------------------------------------------------

(a) entities - -

(b) tenements - -

(c) property, plant and equipment (133) (133)

(d) exploration & evaluation (5,954) (5,954)

(e) investments - -

(f) other non-current assets - -

2.2 Proceeds from the disposal of:

------ ----------------------------------------------------------------

(a) entities -

(b) tenements -

(c) property, plant and equipment -

(d) investments 57 57

(e) other non-current assets -

2.3 Cash flows from loans to other entities -

------ ---------------------------------------------------------------- ----------------- -------------------------

2.4 Dividends received (see note 3) -

------ ---------------------------------------------------------------- ----------------- -------------------------

2.5 Other - Piedmont Contributions from farm-in arrangement 2,996 2,996

------ ---------------------------------------------------------------- ----------------- -------------------------

2.6 Net cash from / (used in) investing activities (3,034) (3,034)

====== ================================================================ ================= -------------------------

3. Cash flows from financing activities

------ ---------------------------------------------------------------- ----------------- -------------------------

3.1 Proceeds from issues of equity securities (excluding

convertible debt securities) -

------ ---------------------------------------------------------------- ----------------- -------------------------

3.2 Proceeds from issue of convertible debt securities -

------ ---------------------------------------------------------------- ----------------- -------------------------

3.3 Proceeds from exercise of options - -

------ ---------------------------------------------------------------- ----------------- -------------------------

3.4 Transaction costs related to issues of equity securities or - -

convertible debt securities

------ ---------------------------------------------------------------- ----------------- -------------------------

3.5 Proceeds from borrowings - -

------ ---------------------------------------------------------------- ----------------- -------------------------

3.6 Repayment of borrowings - -

------ ---------------------------------------------------------------- ----------------- -------------------------

3.7 Transaction costs related to loans and borrowings - -

------ ---------------------------------------------------------------- ----------------- -------------------------

3.8 Dividends paid - -

------ ---------------------------------------------------------------- ----------------- -------------------------

3.9 Other (provide details if material) - -

------ ---------------------------------------------------------------- ----------------- -------------------------

3.10 Net cash from / (used in) financing activities - -

====== ================================================================ ================= =========================

4. Net increase / (decrease) in cash and cash equivalents for the

period

------ ---------------------------------------------------------------- ----------------- -------------------------

4.1 Cash and cash equivalents at beginning of period 15,346 15,346

------ ---------------------------------------------------------------- ----------------- -------------------------

4.2 Net cash from / (used in) operating activities (item 1.9 above) (2,034) (2,034)

------ ---------------------------------------------------------------- ----------------- -------------------------

4.3 Net cash from / (used in) investing activities (item 2.6 above) (3,034) (3,034)

4.4 Net cash from / (used in) financing activities (item 3.10 - -

above)

------ ---------------------------------------------------------------- ----------------- -------------------------

4.5 Effect of movement in exchange rates on cash held 287 287

------ ---------------------------------------------------------------- ----------------- -------------------------

4.6 Cash and cash equivalents at end of period 10,565 10,565

====== ================================================================ ================= =========================

5. Reconciliation of cash and cash equivalents Current quarter Previous quarter

at the end of the quarter (as shown in the consolidated statement of cash $A'000 $A'000

flows) to the related

items in the accounts

---- --------------------------------------------------------------------------- ---------------- -----------------

5.1 Bank balances 10,561 15,327

---- --------------------------------------------------------------------------- ---------------- -----------------

5.2 Call deposits - -

---- --------------------------------------------------------------------------- ---------------- -----------------

5.3 Bank overdrafts - -

---- --------------------------------------------------------------------------- ---------------- -----------------

5.4 Other - Petty Cash 4 19

---- --------------------------------------------------------------------------- ---------------- -----------------

5.5 Cash and cash equivalents at end of quarter (should equal item 4.6 above) 10,565 15,346

==== =========================================================================== ================ =================

6. Payments to related parties of the entity and their associates Current quarter

$A'000

----- ----------------------------------------------------------------------------------------- ----------------

6.1 Aggregate amount of payments to related parties and their associates included in item 1 345

----- ----------------------------------------------------------------------------------------- ----------------

6.2 Aggregate amount of payments to related parties and their associates included in item 2 158

6.1 & 6.2 are payments of salaries/fees (including superannuation) to Executive Directors.

==================================================================================================================

7. Financing facilities Total facility amount at quarter end Amount drawn at quarter end

NOTE : the term "facility' includes all $A'000 $A'000

forms of financing arrangements available

to the

entity.

Add notes as necessary for an

understanding of the sources of finance

available to the entity.

---- ------------------------------------------- ------------------------------------- ----------------------------

7.1 Loan facilities - -

---- ------------------------------------------- ------------------------------------- ----------------------------

7.2 Credit standby arrangements - -

---- ------------------------------------------- ------------------------------------- ----------------------------

7.3 Other - -

---- ------------------------------------------- ------------------------------------- ----------------------------

7.4 Total financing facilities - -

---- ------------------------------------------- -------------------------------------

7.5 Unused financing facilities available at quarter end -

---- ----------------------------------------------------------------------------------

7.6 Include in the box below a description of each facility above, including the lender, interest

rate, maturity date and whether it is secured or unsecured. If any additional financing facilities

have been entered into or are proposed to be entered into after quarter end, include a note

providing details of those facilities as well.

====

8. Estimated cash available for future operating activities $A'000

----- --------------------------------------------------------------------------------------------- --------

8.1 Net cash from / (used in) operating activities (item 1.9) (2,034)

----- --------------------------------------------------------------------------------------------- --------

8.2 (Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) (5,954)

----- --------------------------------------------------------------------------------------------- --------

8.3 Total relevant outgoings (item 8.1 + item 8.2) (7,988)

----- --------------------------------------------------------------------------------------------- --------

8.4 Cash and cash equivalents at quarter end (item 4.6) 10,565

----- --------------------------------------------------------------------------------------------- --------

8.5 Unused finance facilities available at quarter end (item 7.5) -

----- --------------------------------------------------------------------------------------------- --------

8.6 Total available funding (item 8.4 + item 8.5) 10,565

----- --------------------------------------------------------------------------------------------- --------

8.7 Estimated quarters of funding available (item 8.6 divided by item 8.3) 1.3

-----

NOTE : if the entity has reported positive relevant outgoings (ie a net cash inflow) in item

8.3, answer item 8.7 as "N/A". Otherwise, a figure for the estimated quarters of funding available

must be included in item 8.7.

-------------------------------------------------------------------------------------------------------------

8.8 If item 8.7 is less than 2 quarters, please provide answers to the following questions:

8.8.1 Does the entity expect that it will continue to have the current level of net operating

cash flows for the time being and, if not, why not?

Answer: Yes

8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further

cash to fund its operations and, if so, what are those steps and how likely does it believe

that they will be successful?

Answer:

* Atlantic Lithium Ltd has been funded under a

co-development agreement with Piedmont Lithium Inc.

Exploration and feasibility activities are 50% funded

by Piedmont and US$70.0m towards mine capex for the

Ewoyaa Lithium Project. Any additional expenditure

for the development of the Project will be shared

equally between the Company and Piedmont.

* Owing by Piedmont at end of September 2023 is US$2m.

* Atlantic Lithium has agreed non-binding Heads of

Terms with the Minerals Income Investment Fund of

Ghana ("MIIF") to invest a total of US$32.9m in the

Company and the Ghana subsidiaries. The proposed

investment will support the development of the

Project and the broader Cape Coast Lithium Portfolio

in Ghana. Under the terms of the non-binding

agreement, MIIF intend to invest an initial US$27.9m

to acquire a 6% contributing interest in the

Company's Ghana Portfolio and will make ongoing

contributions through monthly cash calls as the

Project develops. MIIF also intend to subscribe for

19,245,574 shares in Atlantic for a total value of

US$5m.

8.8.3 Does the entity expect to be able to continue its operations and to meet its business

objectives and, if so, on what basis?

Answer: Yes. The company has funding available (see 8.8.2).

NOTE : where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above

must be answered.

=============================================================================================================

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 31 October 2023

Authorised by: Authorised by the Board of Atlantic Lithium Limited

Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 6: Exploration for and Evaluation of

Mineral Resources and AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

For any further information, please contact:

Atlantic Lithium Limited

Neil Herbert (Executive Chairman)

Amanda Harsas (Finance Director and Company Secretary)

www.atlanticlithium.com.au

IR@atlanticlithium.com.au

Tel: +61 2 8072 0640

SP Angel Corporate Finance Yellow Jersey PR Limited Canaccord Genuity Limited

LLP Charles Goodwin Financial Adviser:

Nominated Adviser Bessie Elliot Raj Khatri (UK) /

Jeff Keating atlantic@yellowjerseypr.com Duncan St John, Christian

Charlie Bouverat Tel: +44 (0)20 3004 Calabrese (Australia)

Tel: +44 (0)20 3470 9512

0470 Corporate Broking:

James Asensio

Tel: +44 (0) 20 7523

4500

============================== ============================= =============================

Notes to Editors:

About Atlantic Lithium

www.atlanticlithium.com.au

Atlantic Lithium is an AIM and ASX-listed lithium company

advancing a portfolio of lithium projects in Ghana and Côte

d'Ivoire through to production.

The Company's flagship project, the Ewoyaa Project in Ghana, is

a significant lithium spodumene pegmatite discovery on track to

become Ghana's first lithium-producing mine.

The Definitive Feasibility Study for the Project indicates the

production of 3.6Mt of spodumene concentrate over a 12-year mine

life, making it one of the top 10 largest spodumene concentrate

mines in the world.

The Project, which was awarded a Mining Lease in October 2023,

is being developed under a funding agreement with Piedmont Lithium

Inc.

Atlantic Lithium holds 509km(2) and 774km(2) of tenure across

Ghana and Côte d'Ivoire respectively, comprising significantly

under-explored, highly prospective licences.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBJBLTMTJTMRJ

(END) Dow Jones Newswires

November 23, 2023 04:39 ET (09:39 GMT)

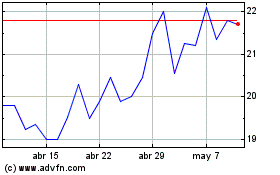

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025